Ready To Rally?!

Key Weekly Performance Stats:

- S&P 500: +1.07%

- Nasdaq 100: +1.13%

- Russel 2000: +0.62%

- Bitcoin: -1.20%

- Gold: +1.31%

- Silver: +9.45%

Last week, after the market was closed Monday for Washington’s Birthday, traders came back Tuesday ready to move. Stocks grinded higher through the shortened week, with the Nasdaq leading and the S&P 500 not far behind. The tone felt cautiously optimistic as investors balanced sticky inflation with signs the economy is cooling, but not cracking. Dip buyers were active, especially in tech, and volatility stayed relatively contained.

On the data front, the January Fed minutes reminded everyone that rate cuts are not a done deal. Policymakers flagged inflation risks and made it clear they want more progress before easing. We also got fresh reads on housing and manufacturing, which painted a mixed picture. Activity is slowing in some pockets, but nothing is flashing recession alarms. The overall vibe remains soft landing with a side of patience.

Looking ahead to next week, the calendar picks up. Consumer Confidence hits Tuesday, New Home Sales lands Wednesday, and we will also get updated factory and housing data throughout the week. None of it is necessarily blockbuster on its own, but taken together it will help shape expectations for the Fed’s next move. As always, rates and inflation headlines will likely matter more than anything else. It's also important to note the Nvidia will be reporting it's earnings after market close on Wednesday. As always stick to your trading plan and respect your risk. Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, Feb 23rd

Evening: Hims & Hers

Tuesday, Feb 24th

Morning: Home Depot

Evening: AMC, Cava & HP

Wednesday, Feb 25th

Morning: Hut 8

Evening: Nvidia

Thursday, Feb 26th

Morning: D Wave

Evening: Dell

Friday, Feb 27th

None

Market Events

Monday, Feb 23rd

None

Tuesday, Feb 24th

10:00 AM ET Consumer Confidence (Feb)

Wednesday, Feb 25th

05:00 AM ET Eurozone CPI MoM & YoY (Jan)

Thursday, Feb 26th

08:30 AM ET Initial Jobless Claims

Friday, Feb 27th

08:30 AM ET PPI MoM & YoY (Jan)

09:45 AM ET Chicago PMI (Feb)

Seasonality Update

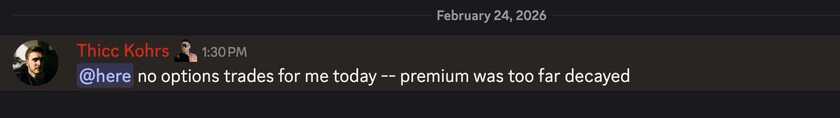

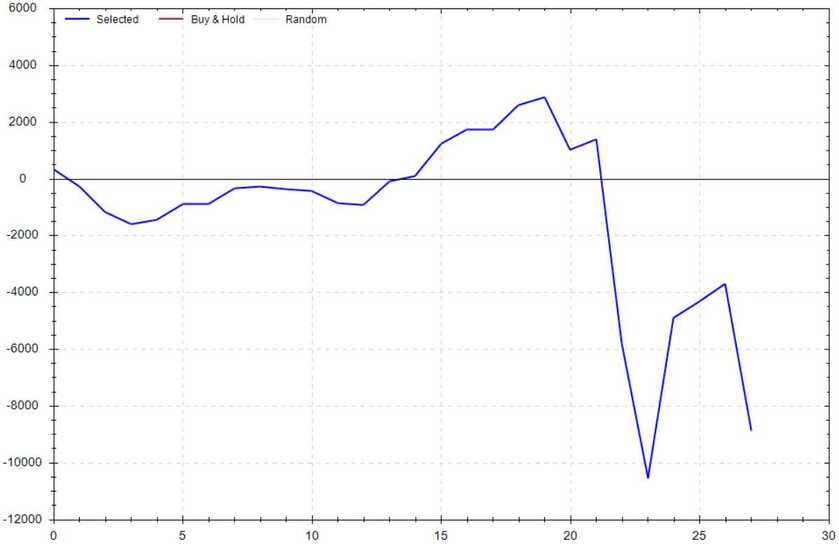

S&P 500 Seasonal Bias (Monday, Feb 23rd)

- Bull Win Percentage: 46%

- Profit Factor: 0.79

- Bias: Leaning Bearish

Equity Curve -->

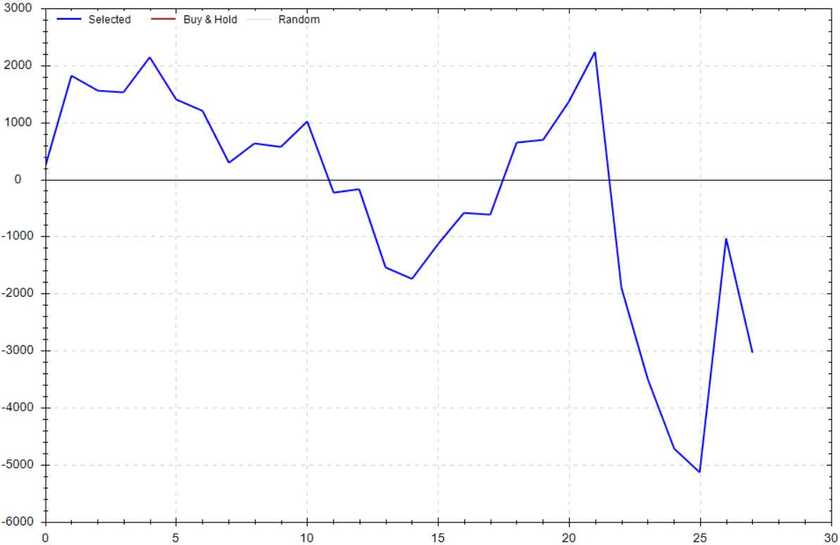

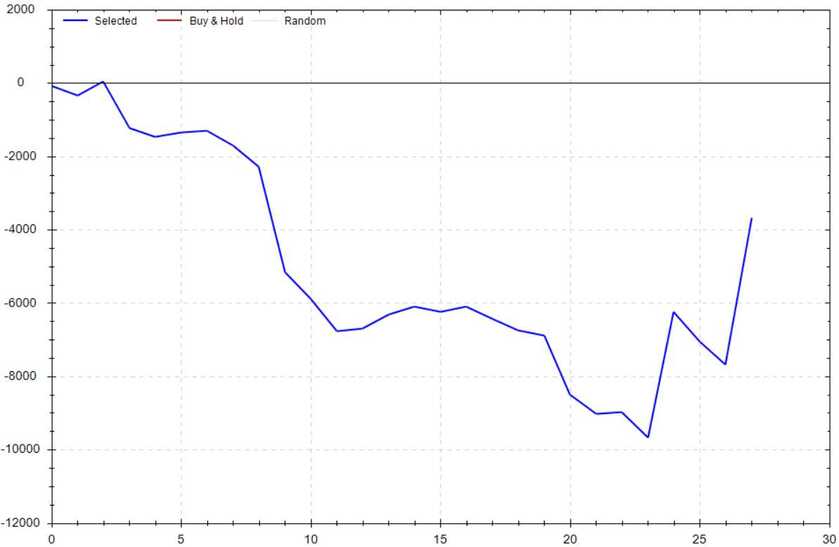

S&P 500 Seasonal Bias (Tuesday, Feb 24th)

- Bull Win Percentage: 50%

- Profit Factor: 0.51

- Bias: Bearish

Equity Curve -->

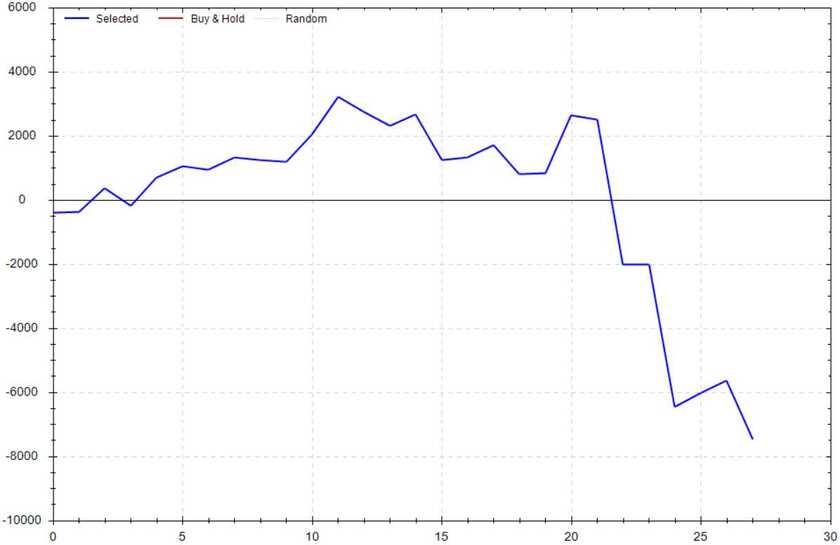

S&P 500 Seasonal Bias (Wednesday, Feb 25th)

- Bull Win Percentage: 50%

- Profit Factor: 1.44

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, Feb 26th)

- Bull Win Percentage: 54%

- Profit Factor: 0.59

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Feb 27th)

- Bull Win Percentage: 36%

- Profit Factor: 0.71

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

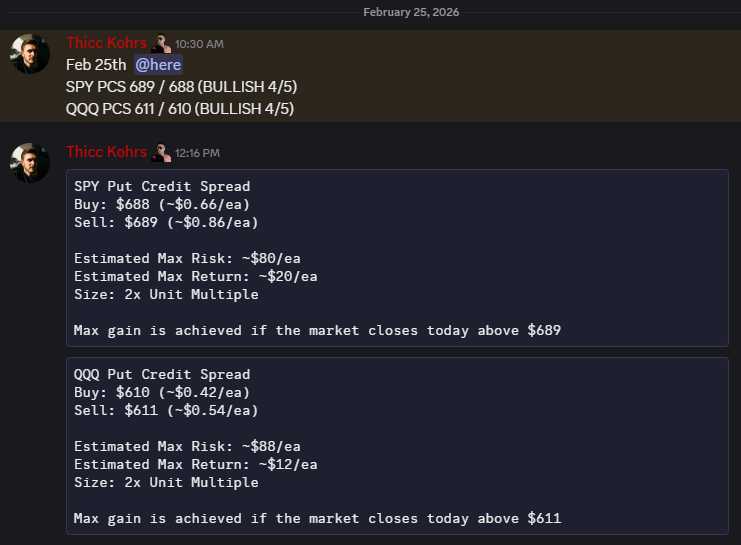

Options Strategy Update

The 0 DTE signal hit 8 for 8 times (14 for 14 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 14 Trades

February Record: 50/54 Units

Monday, Feb 16th

No Signal Produced (Market Holiday)

Tuesday, Feb 17th

SPY Call Credit Spread (2x Multiple @ $683 / $684) 🟢

QQQ Call Credit Spread (2x Multiple @ $603 / $604) 🟢

Wednesday, Feb 18th

SPY Put Credit Spread (2x Multiple @ $682 / $681) 🟢

QQQ Put Credit Spread (2x Multiple @ $600 / $599) 🟢

Thursday, Feb 19th

SPY Call Credit Spread (1x Multiple @ $687 / $686) 🟢

QQQ Call Credit Spread (1x Multiple @ $606 / $607) 🟢

Friday, Feb 20th

SPY Put Credit Spread (2x Multiple @ $681 / $680) 🟢

QQQ Put Credit Spread (2x Multiple @ $599 / $598) 🟢

How Many Boxes I Still Have To Unpack

14 Million *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

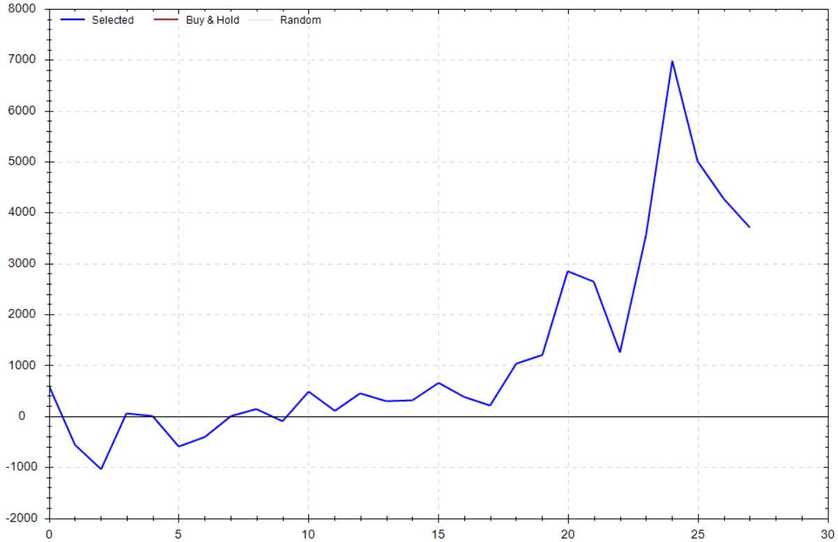

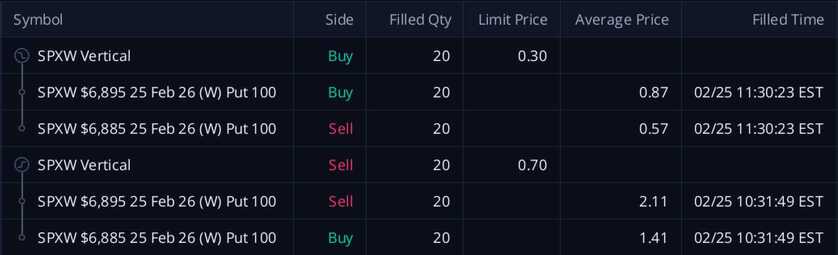

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!

These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!