TGIF!!!

If you're curious about what I trade & how I trade, join the Goonie Trading Discord. You can be a premium member for 1 month free of charge. It's a riskless opportunity for you to become a Goonie today!

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

Piper's Picks

PIPER'S RETURN: +$16 (+100%)

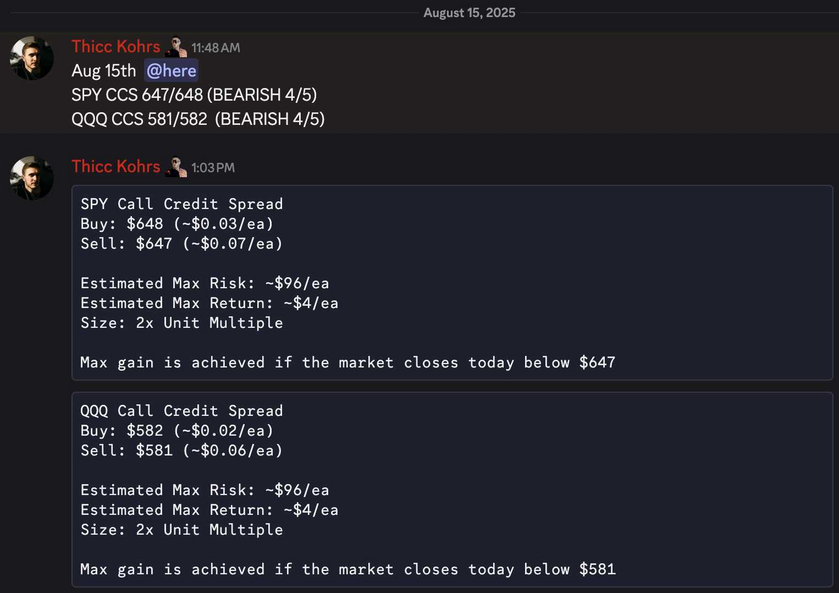

A BEARISH signal, 4/5 strength, was generated around 11:50am ET by Piper. The signal was used with various advanced options strategies to score (don't worry, I'll teach you every aspect of the strategy). Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units!

SPY Return: +$8 (+100%) per $192 signal capital requirement

QQQ Return: +$8 (+100%) per $192 signal capital requirement

Total Return: +$16 (+100%) per $384 signal capital requirement

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 4 total units!

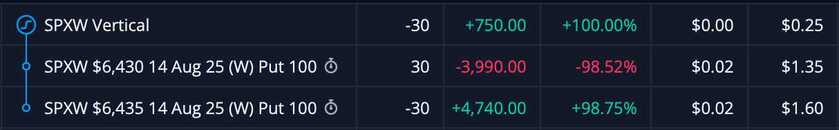

Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.25/ea and expired worthless -- THIS MEANS MY REALIZED GAIN WAS $750!

These PCS's were sold at $0.25/ea and expired worthless -- THIS MEANS MY REALIZED GAIN WAS $750!