The Bears Are Here

Oh Brother!

I suppose I picked the wrong month to try out this whole sobriety thing. The market is getting pummeled. If you've been trying to catch the falling knife, I pray for your hands. If you've been bearish this entire time, I envy your PnL. Regardless of what side you're on, plenty of opportunities are on the horizon.

Last week brought to light a few significant developments. From a macroeconomic perspective, the reported GDP exceeded expectations, and the PCE (inflation) report met predictions. Various Fed members made numerous public statements. Most of them, including Chair Powell, continued to emphasize rates will be 'higher for longer.' I believe they are wholeheartedly committed to this stance given the current state of inflation, demand, and consumer sentiment.

The precarious nature of inflation is enough to prompt volatility. However, when it rains, it pours. We are in the middle of Earnings Season. Microsoft, Amazon, and Intel all posted a solid beat. Google reported disappointing numbers. Meta (Facebook) reported solid earnings that were quickly forgotten due to concerning guidance. The party will continue this upcoming week with Apple—fingers crossed.

The following includes the major economic reports, key earnings, and the price levels across the market for the upcoming week I consider to be pivotal. Enjoy!

Your Brother,

Matt

Market Events

Monday, Oct. 30th

09:30 PM ET China Manufacturing PMI (Oct)

Tuesday, Oct. 31st

06:00 AM ET Europe CPI (YoY) (Oct)

10:00 AM ET CB consumer Confidence (Oct)

Wednesday, Nov. 1st

08:15 AM ET ADP Nonfarm Employment Change (Oct)

10:00 AM ET ISM Manufacturing PMI (Oct)

10:00 AM ET ISM Manufacturing Prices (Oct)

10:00 AM ET JOLTs Job Openings (Sept)

02:00 PM ET FOMC Interest Rate Decision -- STREAMING THIS!

Thursday, Nov. 2nd

08:30 AM ET Initial Jobless Claims

Friday, Nov. 3rd

08:30 AM ET Unemployment Rate (Oct)

08:30 AM ET Nonfarm Payrolls (Oct)

08:30 AM ET Average Hourl Earnings (MoM) (Oct)

09:45 AM ET S&P Global Services PMI (Oct)

10:00 AM ET ISM Non-Manufacturing PMI (Oct)

10:00 AM ET ISM Non-Manufacturing Prices (Oct)

Upcoming Earnings

Monday

AM: McDonalds & SoFi

PM: Pinterest & Public Storage

Tuesday

AM: BP, Caterpillar, JetBlue, Marathon & Pfizer

PM: AMD

Wednesday

AM: CVS, Norwegian & Wayfair

PM: Airbnb, Etsy Paypal, Roku & Qualcomm

Thursday

AM: Crocs, Moderna, Palantir & Shopify

PM: Apple, Carvana, Cloudflare, Coinbase, Draft Kings & Starbucks

Friday

AM: CBOE & Fubo

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

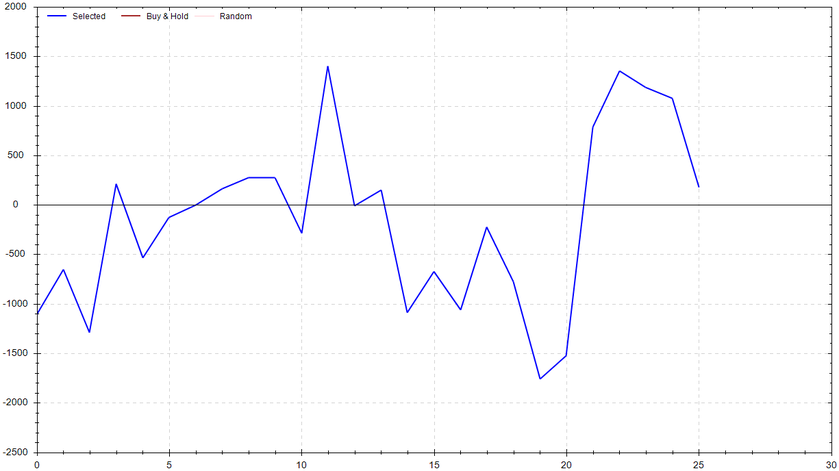

S&P 500 Seasonal Bias (Monday, Oct. 30th)

- Bull Win Percentage: 57.7%

- Profit Factor: 1.11

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Tuesday, Oct. 31st)

- Bull Win Percentage: 50%

- Profit Factor: 1.02

- Bias: Neutral

Equity Curve -->

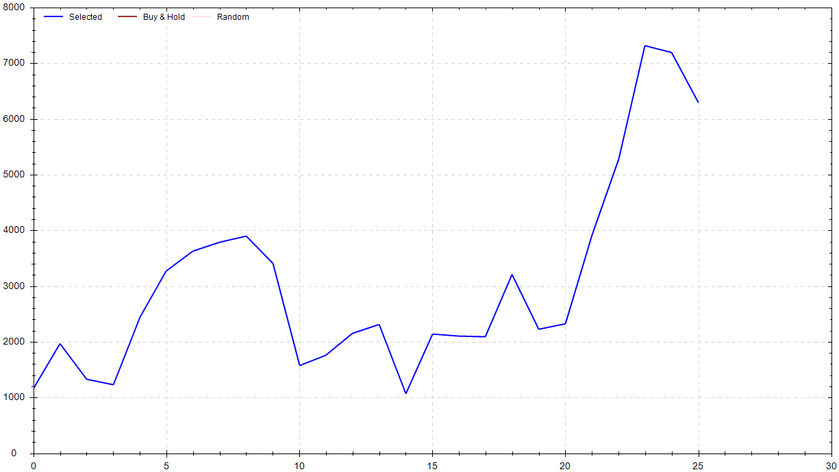

S&P 500 Seasonal Bias (Wednesday, Nov. 1st)

- Bull Win Percentage: 61.5%

- Profit Factor: 1.99

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, Nov. 2nd)

- Bull Win Percentage: 61.5%

- Profit Factor: 1.26

- Bias: Leaning Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Nov. 3rd)

- Bull Win Percentage: 69.2%

- Profit Factor: 2.08

- Bias: Bullish

Equity Curve -->

Options Strategy Update

The 0 DTE signal went 10 out of 10 (~100% accuracy).

I'm starting to think that this trading strategy will be taking my title of Best Trader on This Side of The Mississippi. After batting 1000 last week, the 0 DTE has once again showcased perfection this week. There are only two questions that remain. Will the streak continue? Second, will I grow the balls to put serious money behind that strategy?

Monday Oct. 23rd

SPY PUT Credit Spread ($418 / $417) 🟢

QQQ PUT Credit Spread ($351 / $350) 🟢

Tuesday Oct. 24th

SPY PUT Credit Spread ($422 / $421) 🟢

QQQ PUT Credit Spread ($356 / $355) 🟢

Wednesday Oct. 25th

SPY CALL Credit Spread ($422 / $423) 🟢

QQQ CALL Credit Spread ($357 / $358) 🟢

Thursday Oct 26th

SPY CALL Credit Spread ($418 / $419) 🟢

QQQ CALL Credit Spread ($351 / $352) 🟢

Friday Oct 27th

SPY CALL Credit Spread ($416 / $417) 🟢

QQQ CALL Credit Spread ($349 / $350) 🟢

Charts of Interest

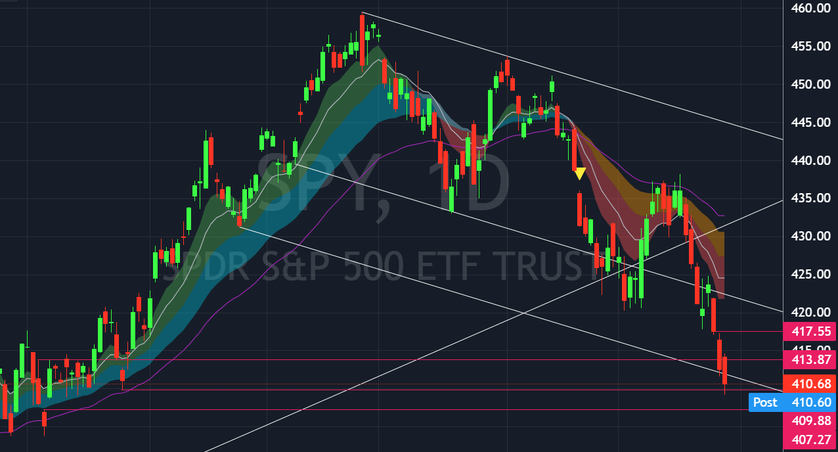

The overall market is getting crushed. Over the past two weeks, there have three major technical breakdowns. The $428 and $424 was sliced back-to-back in mid-October. Last week, the bears pushed & closed the market below the key $411ish level. My next bearish target is the gap fill at $407. If this were to snap, I'd then be watching $404. On the other hand, if the bull camp wakes up and mean reversion plays out, I'd be focusing on $414, $417.50, and then $420. I'd argue both situations are equally likely. Yes, the bears are in clear control, but price is getting overextended to the downside according to various indicators.

The QQQs, aka the tech sector, is also getting hammered. As of now, the Nasdaq is holding onto support by the skin of its teeth. If this bull channel ends up officially failing, the next levels of support in my book would be $341 follow by $339. The bottom trendline serves as support and price starts to bounce, I'd want to see a retest of $351 then $353.

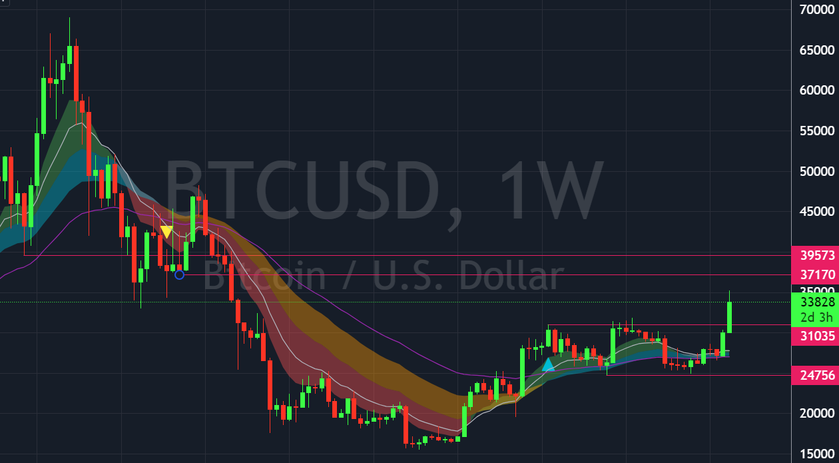

Bitcoin, digital gold, the currency your parents still don't understand, is continuing its bullish trip upward. The excitement surrounding the potential approval of a spot ETF has once again put this "internet money" back into the mainstream. If $31k can hold, I'd be confident in the bulls testing $37k and then $39.5k.

Tesla is seemingly making up its mind about what direction the next major leg should be. As the consolidation above $200 continues to play out, I suggest patience. It doesn't pay to be early or late. You want to be right on time. If $202 doesn't hold, $195 and $178 would be up next. Above $212, would setup $222 followed by $230.

Tesla is seemingly making up its mind about what direction the next major leg should be. As the consolidation above $200 continues to play out, I suggest patience. It doesn't pay to be early or late. You want to be right on time. If $202 doesn't hold, $195 and $178 would be up next. Above $212, would setup $222 followed by $230.

I fear Nvidia is starting to show some serious warning signs. Beyond the clear technical breakdown of the trendline, the neckline on a major head & shoulders is in danger of being snapped. If the key level of $400 doesn't hold, I'll be watching for a retest of $366. I'm not saying this will happen soon, but don't forget about the downside gap fill to $306 (this would slaughter the tech sector). A recapture of $440 would suggest that the recent price action is a good ole fashion bear trap.

I fear Nvidia is starting to show some serious warning signs. Beyond the clear technical breakdown of the trendline, the neckline on a major head & shoulders is in danger of being snapped. If the key level of $400 doesn't hold, I'll be watching for a retest of $366. I'm not saying this will happen soon, but don't forget about the downside gap fill to $306 (this would slaughter the tech sector). A recapture of $440 would suggest that the recent price action is a good ole fashion bear trap.

Apple is still working to fill out its bearish wedge. I've decided to include this chart because of the impending earnings. Bottom side support is $164 imo. If $172 is recaptured, a $174 breakout could setup $178.

Apple is still working to fill out its bearish wedge. I've decided to include this chart because of the impending earnings. Bottom side support is $164 imo. If $172 is recaptured, a $174 breakout could setup $178.

No special notes, but orange juice is still squeezing.

No special notes, but orange juice is still squeezing.

Times I Cried In The Shower

69 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!