Moon Bound?!

Howdy Astronauts,

Once again, another round of applause for the bullish degens reading this!

Most of the week was choppy -- A little up, a little down -- but that all changed on Friday. The bull camp showed up ready to party. Later in the newsletter, you can find the key upside price targets I'll be watching with any continuation. For now, all you really need to know is that the bulls posted a textbook consolidation breakout, especially in the tech sector.

So, what went down?

For most of the week, not much. There were a handful of earnings and announcements, but nothing to run home and tell Mom about. The most exciting thing was when the Fed Chair told his colleagues to "close the fucking door" on climate protesters. I should also note that his actual speech had more of a hawkish tone. This slightly harsher-than-expected stance partially explains why the market took a hit on Thursday. The other reason was a disastrous Treasury bond auction. Not even 50% of the tendered 30-year bonds were sold—no bueno, mi amigo.

Enough with the past. Let's focus on the future!

For this upcoming week, the name of the game is inflation reports. All specific reports, and their associated release times, are posted below. These updates will be particularly pivotal to the current situation. If inflation continues to drop, the market could easily continue its explosion to the upside. If the cost of life is still too damn high, it would most likely be time for some downward mean reversion to play out.

Warm Regards,

Matthew

P.S. The official Goonie Discord is live and poppin' off!

Join here --> https://bit.ly/GoonieGroup

Market Events

Monday, Nov. 13th

10:30 AM ET Crude Oil Inventories

Tuesday, Nov. 14th

08:30 AM ET Core CPI (MoM) (Oct)

08:30 AM ET CPI (MoM) (Oct)

08:30 AM ET CPI (YoY) (Oct)

Wednesday, Nov. 15th

08:30 AM ET Core Retail Sales (MoM) (Oct)

08:30 AM ET PPI (MoM) (Oct)

08:30 AM ET Retail Sales (MoM) (Oct)

08:30 AM ET Crude Oil Inventories

Thursday, Nov. 16th

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Fed Manufacturing Index (Nov)

Friday, Nov. 17th

05:00 AM ET CPI (YoY) (Oct)

08:30 AM ET Building Permits (Oct)

Upcoming Earnings

Monday

PM: Fisker & Rumble

Tuesday

AM: Home Depot

Wednesday

AM: Advanced Auto Parts, JD, Target & TJX

Thursday

AM: Alibaba, Macy's & Walmart

PM: Dolby, Ross & Gap

Friday

AM: BJ's (lol)

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

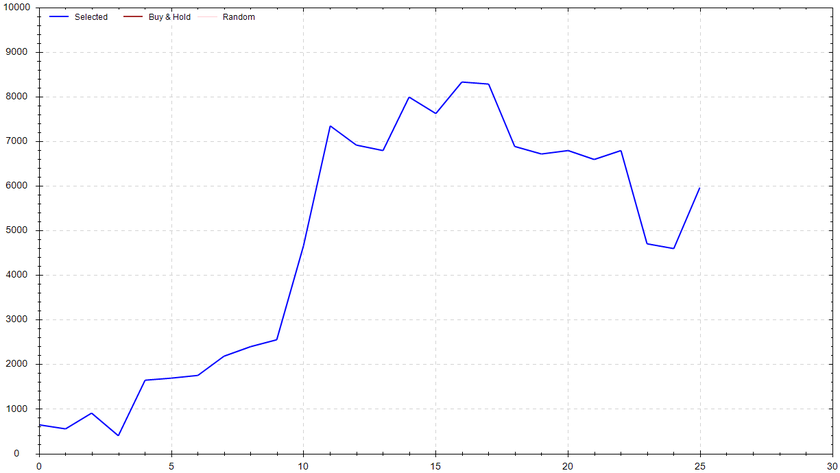

S&P 500 Seasonal Bias (Monday, Nov. 13th)

- Bull Win Percentage: 57.7%

- Profit Factor: 2.07

- Bias: Bullish

Equity Curve -->

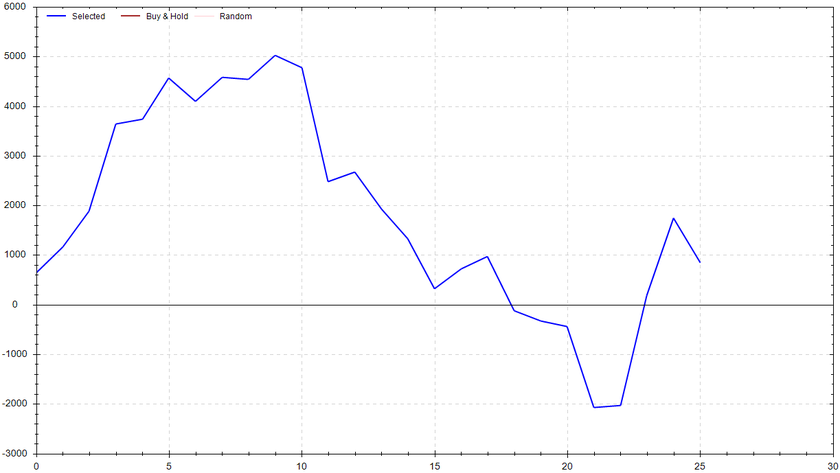

S&P 500 Seasonal Bias (Tuesday, Nov. 14th)

- Bull Win Percentage: 53.8%

- Profit Factor: 1.09

- Bias: Neutral

Equity Curve -->

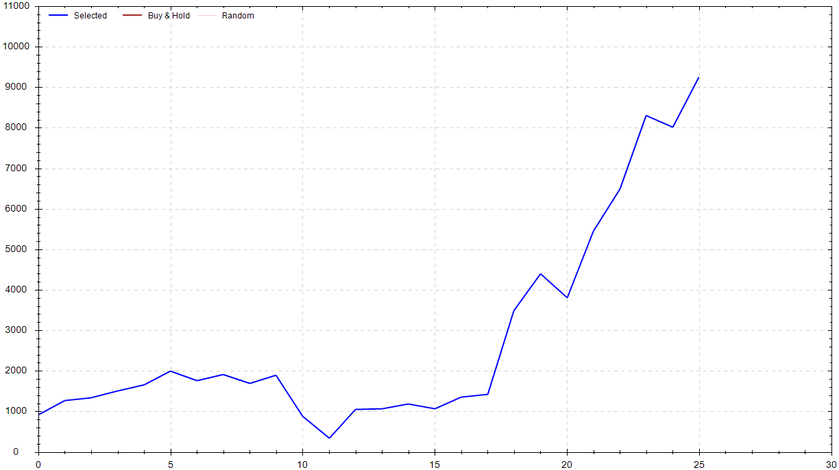

S&P 500 Seasonal Bias (Wednesday, Nov. 15th)

- Bull Win Percentage: 73.1%

- Profit Factor: 4.08

- Bias: Very Bullish

Equity Curve -->

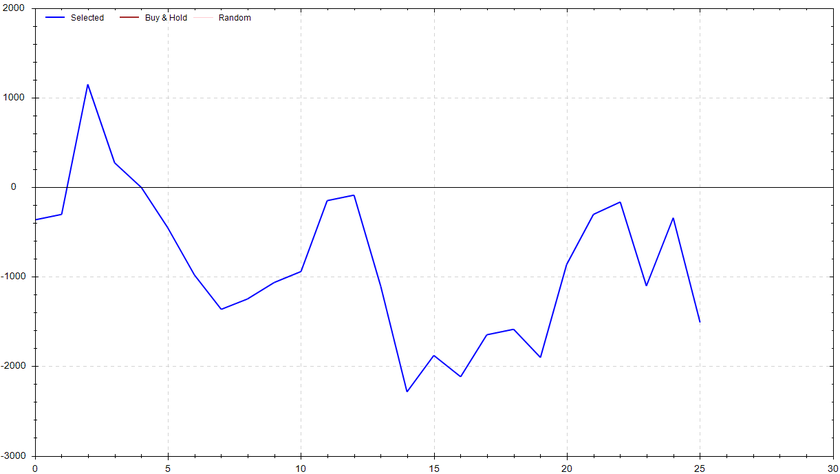

S&P 500 Seasonal Bias (Thursday, Nov. 16th)

- Bull Win Percentage: 53.8%

- Profit Factor: 0.80

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Nov. 17th)

- Bull Win Percentage: 46.2%

- Profit Factor: 0.49

- Bias: Bearish

Equity Curve -->

Options Strategy Update

The 0 DTE signal went 8 out of 10 (~80% accuracy).

As I've discussed in the past, the bane of existence for this particular strategy appears to be Friday's session. I said I'd no longer be trading it on Friday -- I broke that rule & it cost me dearly. Beyond being more disciplined, I do have a few ideas on continued improvements. The next round of adjustments will relate to examining the strength of the combined signals (SPY & QQQ). I'll keep you posted.

Current Streak: 0

November Record: 13/16

Monday Nov. 6th

SPY CALL Credit Spread ($437 / $438) 🟢

QQQ CALL Credit Spread ($370 / $371) 🟢

Tuesday Nov. 7th

SPY PUT Credit Spread ($434 / $433) 🟢

QQQ PUT Credit Spread ($369 / $368) 🟢

Wednesday Nov. 8th

SPY CALL Credit Spread ($438 / $440) 🟢

QQQ CALL Credit Spread ($374 / $376) 🟢

Thursday Nov. 9th

SPY CALL Credit Spread ($438 / $440) 🟢

QQQ CALL Credit Spread ($374 / $376) 🟢

Friday Nov. 10th

SPY CALL Credit Spread ($437 / $438) 🔴

QQQ CALL Credit Spread ($374 / $375) 🔴

Charts of Interest

Overall, the week was most choppy. However, the bull camp put on a stellar performance on Friday. If this momentum were to continue, my next target is the major trendline, roughly $444. From there, your guess would be as good as mine if it breaks out or get rejected. Above $444, I'll be looking at $448, $452 and then $453. If the bears gain some strength, I'll be looking for $437, $434 and then $431 (the gap fill).

Overall, the week was most choppy. However, the bull camp put on a stellar performance on Friday. If this momentum were to continue, my next target is the major trendline, roughly $444. From there, your guess would be as good as mine if it breaks out or get rejected. Above $444, I'll be looking at $448, $452 and then $453. If the bears gain some strength, I'll be looking for $437, $434 and then $431 (the gap fill).

The tech sector had a beautiful bull channel breakout, retest & upward follow through. My next levels of interest are $379, $384 and $388. The price action is far away from the EMA cloud. Mean reversion is a very fair phenomena to consider in this situation. I would want to see some consolidation before I chase this higher. I would need a higher quality support to base my risk off. With the being said, the strength on Friday was undeniable.

The tech sector had a beautiful bull channel breakout, retest & upward follow through. My next levels of interest are $379, $384 and $388. The price action is far away from the EMA cloud. Mean reversion is a very fair phenomena to consider in this situation. I would want to see some consolidation before I chase this higher. I would need a higher quality support to base my risk off. With the being said, the strength on Friday was undeniable.

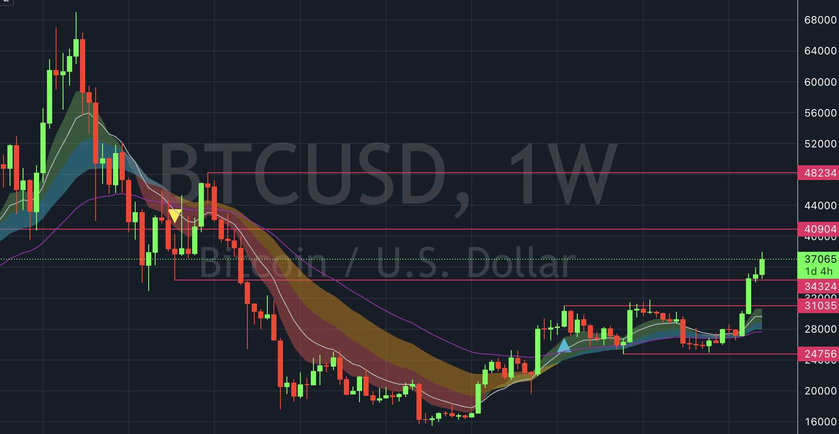

The crypto bulls are still fighting like no other. My next target is $40K-$41K. From there, I'll be watching $48k. If the bulls lose their footing, $35K followed by $31K will most likely serve as support.

The crypto bulls are still fighting like no other. My next target is $40K-$41K. From there, I'll be watching $48k. If the bulls lose their footing, $35K followed by $31K will most likely serve as support.

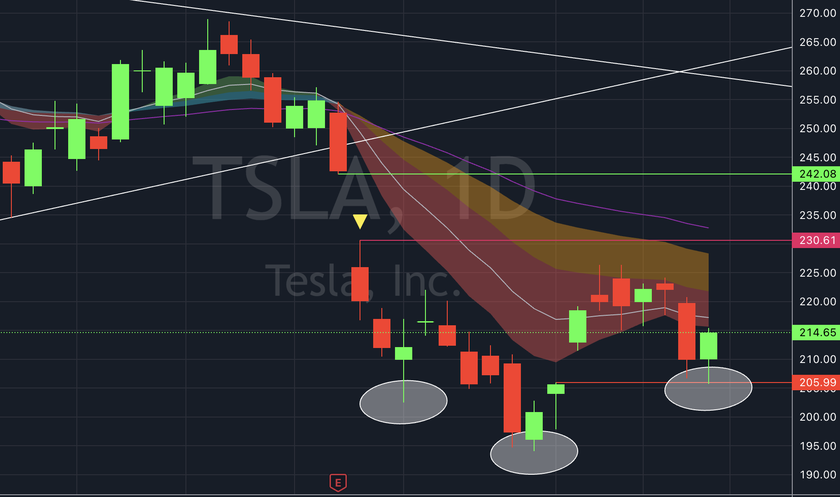

Even though ole Teslerrr has been getting beat up, I'm starting to notice a potential invers head & shoulders. If this is accurate & you consider the state of the overall market, a very nice recovery could ensue. The downside gap fill was hit after an analyst downgrade. I really wouldn't be surprised if the bear camp is running out of energy.

Even though ole Teslerrr has been getting beat up, I'm starting to notice a potential invers head & shoulders. If this is accurate & you consider the state of the overall market, a very nice recovery could ensue. The downside gap fill was hit after an analyst downgrade. I really wouldn't be surprised if the bear camp is running out of energy.

On the news the Nvidia is making new CPUs that can be sold to China, the stock ripped to the high heavens. I'll be watching to see if the current all-time high ($500ish) is tested. It's very possible that a consolidation around $470 plays out first. I'm very impressed that the bears can seemingly never win with this stock -- A true bullish monster.

On the news the Nvidia is making new CPUs that can be sold to China, the stock ripped to the high heavens. I'll be watching to see if the current all-time high ($500ish) is tested. It's very possible that a consolidation around $470 plays out first. I'm very impressed that the bears can seemingly never win with this stock -- A true bullish monster.

Facebook is representing some serious strength along with the overall tech sector. If the bears don't hold the line at $331, there could be a nice breakout & rally. The current rally has already been pretty strong, so I wouldn't necessarily be betting on the continuation happening immediately.

Facebook is representing some serious strength along with the overall tech sector. If the bears don't hold the line at $331, there could be a nice breakout & rally. The current rally has already been pretty strong, so I wouldn't necessarily be betting on the continuation happening immediately.

Netflix is continuing to crush it since its surprise earnings beat. The $445-$453 region is clear resistance. If it's broken to the upside, I'll be looking for the upside gap fill to $470. If it's rejected, I'd be watching for $420 to serve as support.

Netflix is continuing to crush it since its surprise earnings beat. The $445-$453 region is clear resistance. If it's broken to the upside, I'll be looking for the upside gap fill to $470. If it's rejected, I'd be watching for $420 to serve as support.

Wanted to note that the PLTR bulls are dominating. Looking for the previous high (low $20s) to be tested soon.

Wanted to note that the PLTR bulls are dominating. Looking for the previous high (low $20s) to be tested soon.

Times I Thought I Broke My Foot

1.4 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!