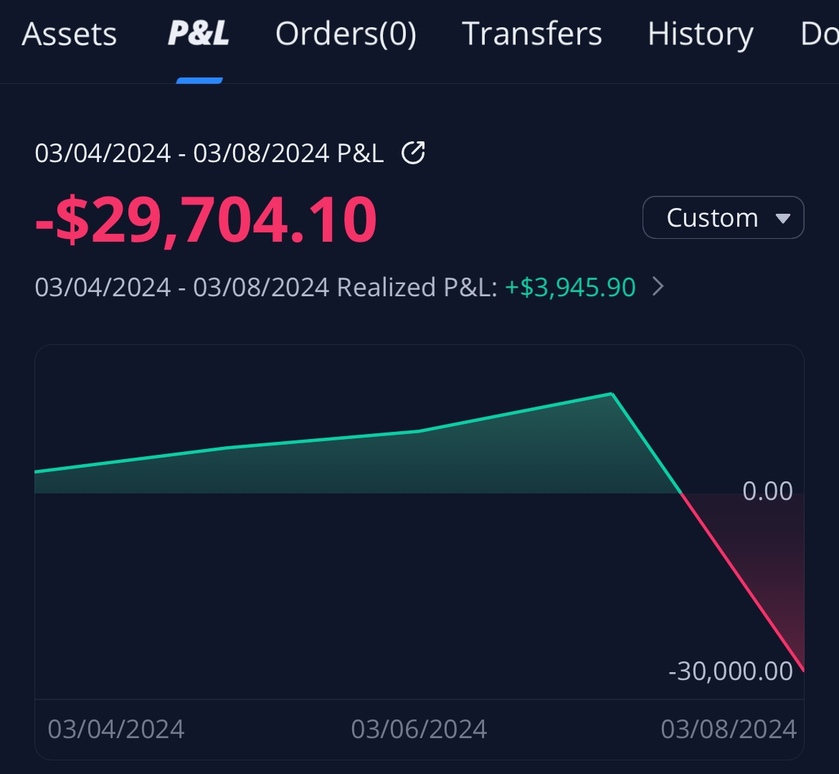

I GOT STEAMROLLED...

(Sharing for the sake of transparency)

FUCK. Fuck this. Fuckity McFuck fuck. I'm loser. My degeneracy got the best of me.

I'll explain everything that went wrong when I'm in a better mood. Don't me like me, be better.

It's all going down THIS FRIDAY!!!

The team at SpotGamma will be joining the MK Show to discuss various options trading strategies. (Yes, it will include 0 DTEs for you degens).

This is 100% FREE options trading education.

All you need to do is be where you normally watch me at 10am ET!

If you're having any issues getting connected to the Goonie Discord, don't hesitate to reach out to me. (IT CAN TAKE UP TO 24 HOURS FOR YOUR ACCOUNT TO PROCESS)

DMing me on Discord would be the most efficient (@mmk147) or you could email me at: [email protected]

Use the code GOONIE to switch from a Local's Member to a Local's Support for FREE to get premium access.

Discord Link: https://discord.gg/3dxBRVrgGG

PRO TIP: Make sure you are logged into the correct Discord account when you sync your two accounts.

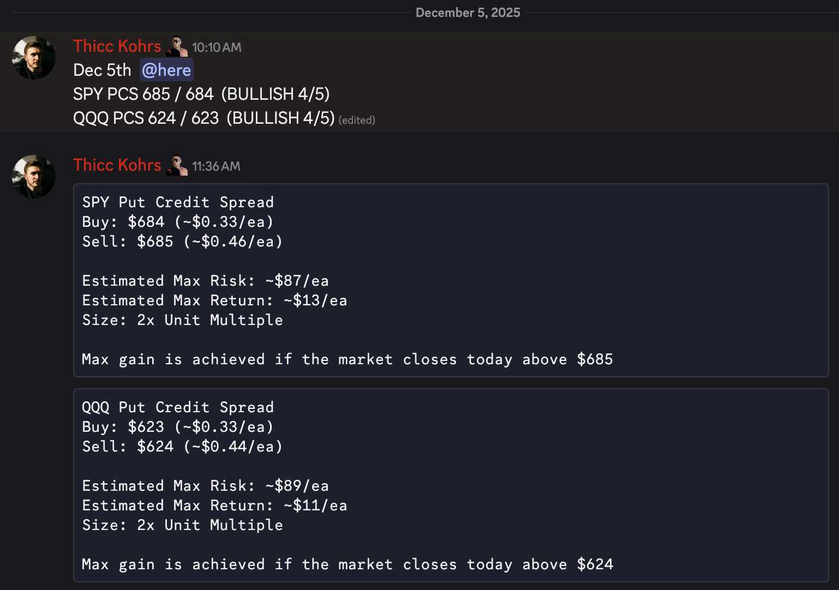

THICC RETURN: +$1,400

My posted, REAL-TIME TRADES PAID -- Today's trades would have paid for MORE THAN TWO YEARS OF GOONIE DISCORD ACCESS!

If you're curious about what I trade & how I trade, join the Goonie Trading Discord. You can be a premium member for 1 month free of charge. It's a riskless opportunity for you to become a Goonie today!

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

PIPER'S RETURN: +$48 (+100%)

A BULLISH signal, 4/5 strength, was generated around 10:10am ET by Piper. The signal was used with various advanced options strategies to score (don't worry, I'll teach you every aspect of the strategy). Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units!

SPY Return: +$26 (+100%) per $174 signal capital requirement

QQQ Return: +$22 (+100%) per $178 signal capital requirement

Total Return: +$48 (+100%) per $352 signal capital requirement

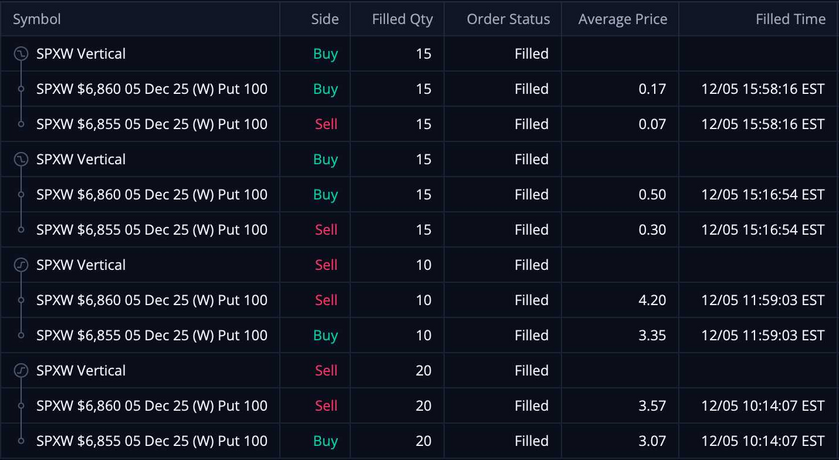

Trade One: 20 SPX 6,860/6,855 Call Credit Spreads These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

Trade One Return: +$1,400

These trades alone would have paid for MORE THAN TWO YEARS OF GOONIE MEMBERSHIP!

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

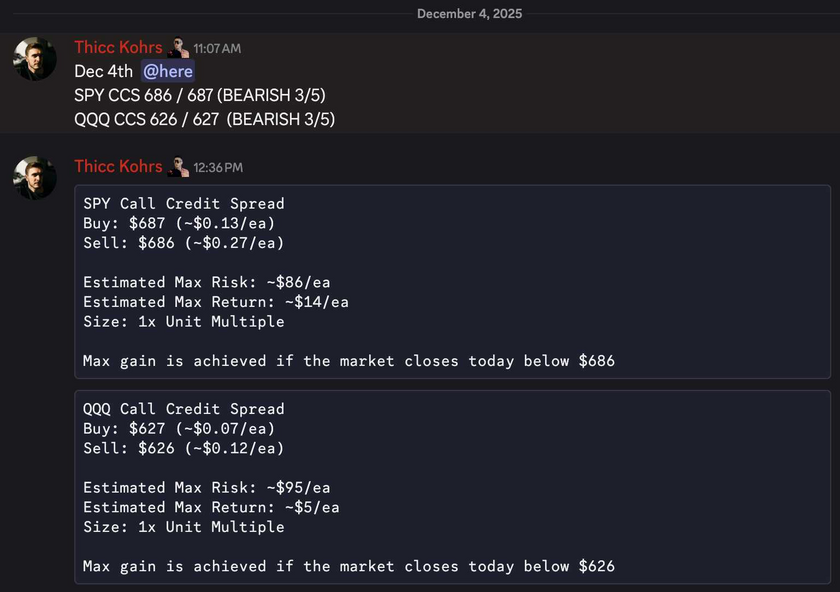

THICC RETURN: +$660

My posted, REAL-TIME TRADES PAID -- Today's trades would have paid for MORE THAN AN ENTIRE YEAR OF GOONIE DISCORD ACCESS!

If you're curious about what I trade & how I trade, join the Goonie Trading Discord. You can be a premium member for 1 month free of charge. It's a riskless opportunity for you to become a Goonie today!

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

PIPER'S RETURN: +$19 (+100%)

A BEARISH signal, 3/5 strength, was generated around 11:10am ET by Piper. The signal was used with various advanced options strategies to score (don't worry, I'll teach you every aspect of the strategy). Both of these trades hit if held until close -- 2 total units!

Both of these trades hit if held until close -- 2 total units!

SPY Return: +$14 (+100%) per $86 signal capital requirement

QQQ Return: +$5 (+100%) per $95 signal capital requirement

Total Return: +$19 (+100%) per $181 signal capital requirement

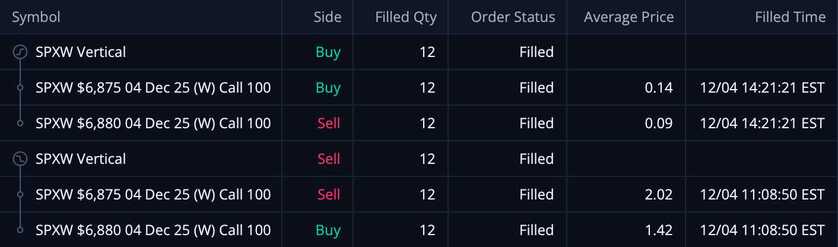

Trade One: 12 SPX 6,875/6,880 Call Credit Spreads These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

Trade One Return: +$660

These trades alone would have paid for MORE THAN AN ENTIRE YEAR OF GOONIE MEMBERSHIP!

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

THICC RETURN: +$600

My posted, REAL-TIME TRADES PAID -- Today's trades would have paid for AN ENTIRE YEAR OF GOONIE MEMBERSHIP!

If you're curious about what I trade & how I trade, join the Goonie Trading Discord. You can be a premium member for 1 month free of charge. It's a riskless opportunity for you to become a Goonie today!

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

PIPER'S RETURN: +$38 (+100%)

A BULLISH signal, 4/5 strength, was generated around 10:40am ET by Piper. The signal was used with various advanced options strategies to score (don't worry, I'll teach you every aspect of the strategy). Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units!

SPY Return: +$16 (+100%) per $184 signal capital requirement

QQQ Return: +$22 (+100%) per $178 signal capital requirement

Total Return: +$38 (+100%) per $362 signal capital requirement

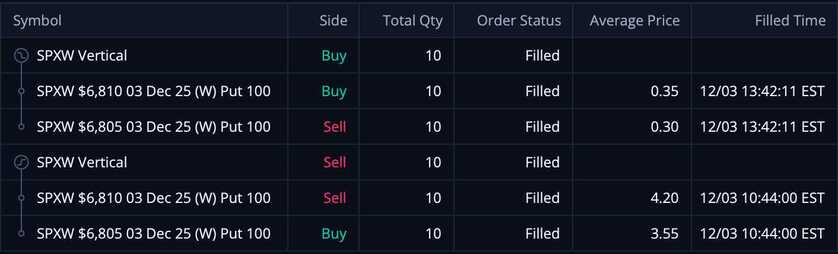

Trade One: 10 SPX 6,810/6,805 Put Credit Spreads These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!

These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!

Trade One Return: +$600

These trades alone would have paid for AN ENTIRE YEAR OF GOONIE DISCORD MEMBERSHIP!

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.