Going For Gold!

Key Weekly Performance Stats:

- S&P 500: -1.39%

- Nasdaq 100: -1.37%

- Russel 2000: -0.84%

- Bitcoin: -2.43%

- Gold: +1.51%

- Silver: -0.33%

Stocks had a choppy week, with a classic “good vibes Monday, bad vibes Friday” feel. Big tech led the mood swings as investors kept wrestling with how fast AI is reshaping winners and losers. By the closing bell Friday, the week still finished in the red: the S&P 500 fell about 1.4%, the Dow slipped about 1.2%, and the Nasdaq took the bigger hit, down about 2.1%.

On the data front, it was one of those weeks where every macro print had a vote. Tuesday brought the delayed retail sales read, which basically said consumers didn’t fall off a cliff, but they weren’t exactly doing cartwheels either. Wednesday’s January jobs report showed payroll growth at 130,000 with the unemployment rate at 4.3%, plus notable downward revisions to prior months that cooled some of the “too hot” talk. Thursday had weekly jobless claims staying in a “nothing’s breaking” zone, while the housing update was a gut check: existing home sales for January dropped 8.4% to a low not seen since late 2023. Then Friday’s CPI for January came in softer than expected, giving rates a little breathing room and helping stabilize the tape into the weekend.

Looking ahead to next week, it's shorter but still packed. Markets are closed Monday for Presidents Day. Tuesday brings the NAHB homebuilder sentiment index, a quick pulse check on housing confidence. Wednesday is the main event with the Fed’s minutes from the Jan 27–28 meeting, which traders will comb for how close the committee is to another cut. Thursday is busy again with weekly jobless claims, the Conference Board’s Leading Economic Index, and pending home sales, so expect the “rates vs growth” tug-of-war to keep going even in a four-day week. As always, stick to your trading plan and respect your risk. Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, Feb 16th

None

Tuesday, Feb 17th

Evening: Palo Alto Networks

Wednesday, Feb 18th

Evening: Carvana

Thursday, Feb 19th

Morning: John Deere, Klarna & Walmart

Evening: Texas Roadhouse

Friday, Feb 20th

None

Market Events

Monday, Feb 16th

ALL DAY Market Closed (Washington's Birthday)

Tuesday, Feb 17th

None

Wednesday, Feb 18th

08:00 AM ET Durable Goods Orders MoM & YoY (Dec)

02:00 AM ET FOMC Meeting Minutes

Thursday, Feb 19th

08:30 AM ET Philadelphia Fed Manufacturing Index (Feb)

08:30 AM ET Initial Jobless Claims

Friday, Feb 20th

08:30 AM ET PCE Price Index MoM & YoY (Dec)

08:30 AM ET GDP QoQ (Q4)

09:45 AM ET S&P Global Manufacturing & Services PMI (Feb)

10:00 AM ET New Home Sales (Dec)

Seasonality Update

S&P 500 Seasonal Bias (Monday, Feb 16th)

- Market Closed (Washington's Birthday)

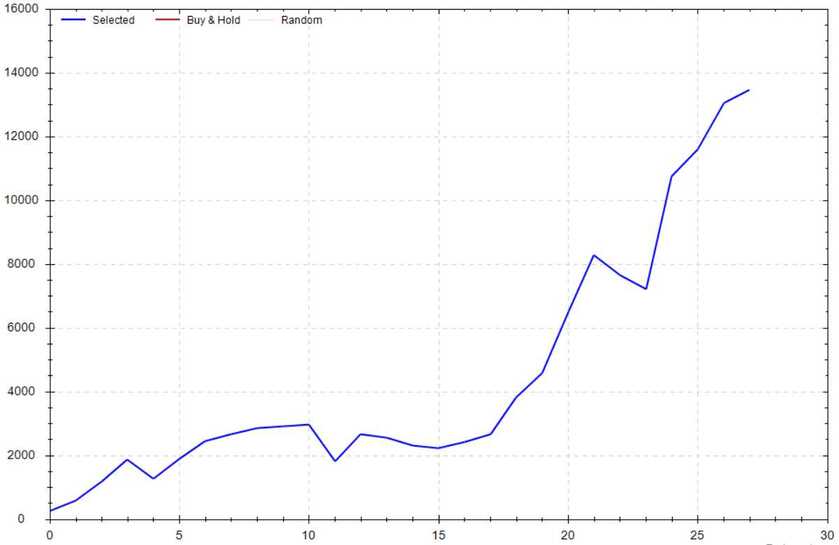

S&P 500 Seasonal Bias (Tuesday, Feb 17th)

- Bull Win Percentage: 75%

- Profit Factor: 5.13

- Bias: Bullish

Equity Curve -->

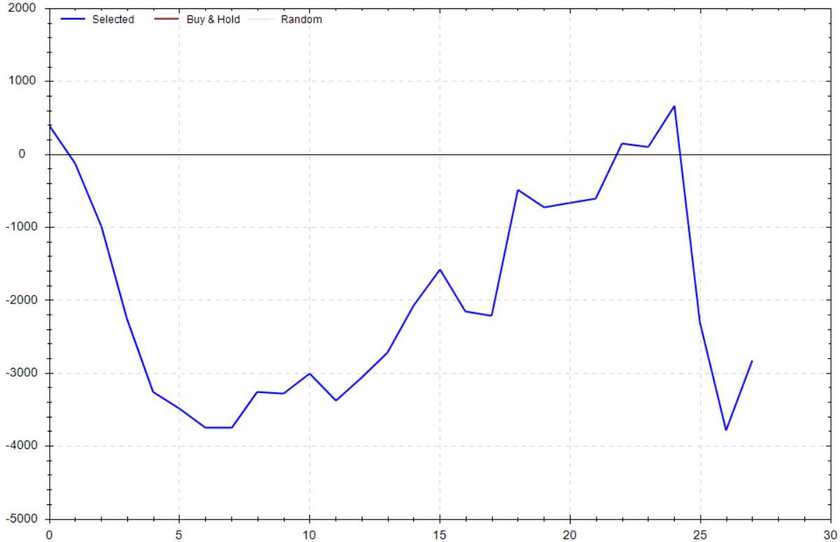

S&P 500 Seasonal Bias (Wednesday, Feb 18th)

- Bull Win Percentage: 46%

- Profit Factor: 0.72

- Bias: Leaning Bearish

Equity Curve -->

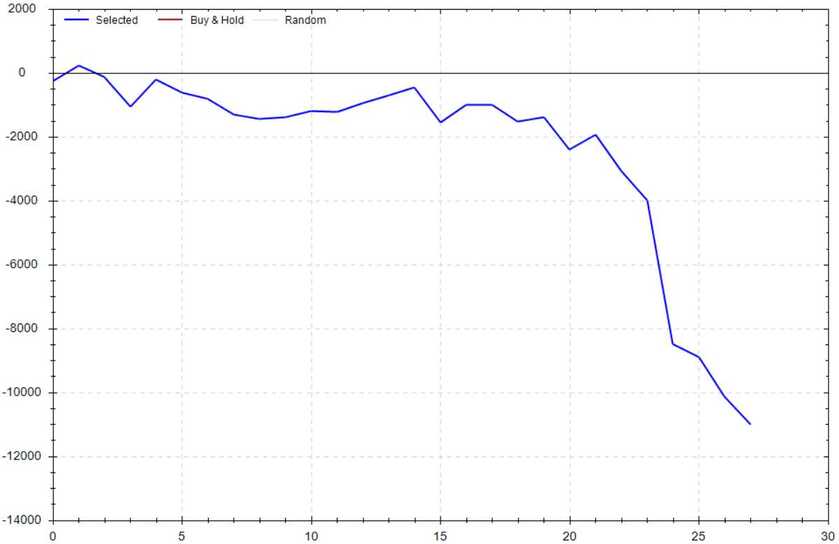

S&P 500 Seasonal Bias (Thursday, Feb 19th)

- Bull Win Percentage: 36%

- Profit Factor: 0.24

- Bias: Bearish

Equity Curve -->

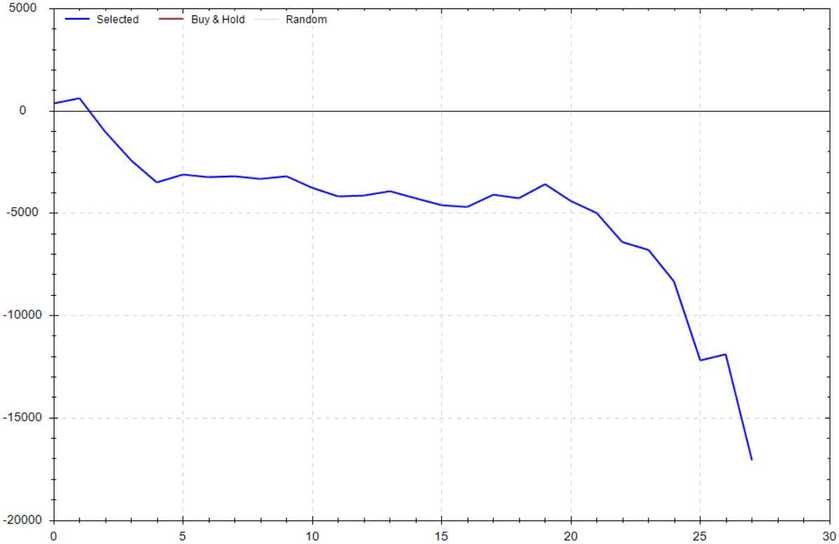

S&P 500 Seasonal Bias (Friday, Feb 20th)

- Bull Win Percentage: 36%

- Profit Factor: 0.15

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 10 times (16 for 20 total units) this past week.

Signal Accuracy: ~80%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 6 Trades

February Record: 36/40 Units

Monday, Feb 9th

SPY Put Credit Spread (2x Multiple @ $688 / $687) 🟢

QQQ Put Credit Spread (2x Multiple @ $605 / $604) 🟢

Tuesday, Feb 10th

SPY Put Credit Spread (2x Multiple @ $693 / $692) 🔴

QQQ Put Credit Spread (2x Multiple @ $512 / $511) 🔴

Wednesday, Feb 11th

SPY Call Credit Spread (2x Multiple @ $698 / $699) 🟢

QQQ Call Credit Spread (2x Multiple @ $617 / $618) 🟢

Thursday, Feb 12th

SPY Call Credit Spread (2x Multiple @ $696 / $697) 🟢

QQQ Call Credit Spread (2x Multiple @ $616 / $617) 🟢

Friday, Feb 12th

SPY Put Credit Spread (2x Multiple @ $677 / $676) 🟢

QQQ Put Credit Spread (2x Multiple @ $596 / $595) 🟢

Times I Thought I Should Join The Olympics

18 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

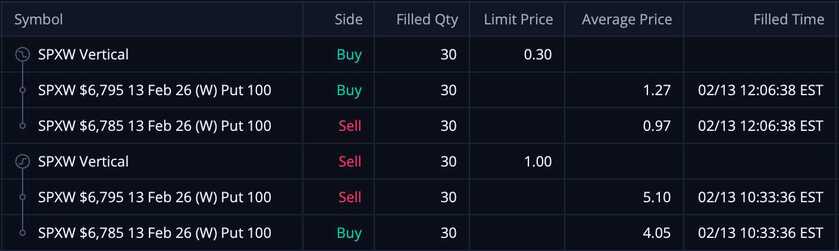

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $1.00/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $2,100!

These PCS's were sold at $1.00/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $2,100!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

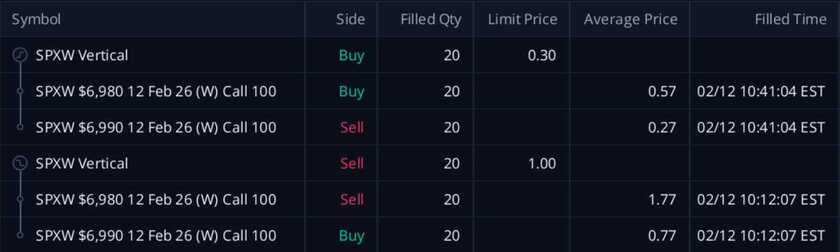

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These CCS's were sold at $1.00/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

These CCS's were sold at $1.00/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!