More Pain To Come???

Hey,

Key Weekly Performance Stats:

- S&P 500: -1.60%

- Nasdaq 100: -2.24%

- Russel 2000: -3.62%

- Bitcoin: -1.39%

Last week, the ole casino went a bit wild. Major indices clocked record highs early in the week. However, by Friday, the tune had changed -- The Dow Jones Industrial Average had plummeted over 700 points, marking its worst day of the year. The S&P 500 and Nasdaq also got rocked, erasing all earlier gains.

Several factors contributed to this bloodbath. Walmart reported a strong fourth quarter but issued cautious guidance for the year, raising concerns about consumer spending amid inflation and potential new tariffs. Additionally, the University of Michigan's consumer sentiment index fell by 10% to 64.7, reflecting increased pessimism about the economic outlook. These factors, coupled with fears of stagflation—a combination of stagnant growth and persistent inflation—unsettled markets.

Looking ahead, there are many things to keep in mind. The Conference Board's Consumer Confidence Index for February will offer a gauge of consumer sentiment on Tuesday. Thursday brings the second estimate of fourth-quarter Gross Domestic Product (GDP), weekly jobless claims, and January's durable goods orders, shedding light on economic growth and labor market conditions. Finally, on Friday, the Personal Consumption Expenditures (PCE) Price Index for January will be released. Clearly, volatility is back on the menu. As always, stick to your plan and respect your risk. Godspeed.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, February 24th

Morning: Berkshire Hathaway

Evening: Hims+Hers, Riot & Zoom

Tuesday, February 25th

Morning: Home Depot & Krispy Kreme

Evening: AMC, Cava & Lucid

Wednesday, February 26th

Morning: Lowe's

Evening: C3.AI, Nvidia, Salesforce & Snowflake

Thursday, February 27th

Morning: Norwegian & TD Bank

Evening: Dell

Friday, February 28th

Morning: Fubo TV

Market Events

Monday, February 24th

05:00 AM ET Eurozone CPI YoY & MoM (Jan)

Tuesday, February 25th

10:00 AM ET Consumer Confidence (Feb)

01:00 PM ET Richmond Fed President Barkin Speaks

Wednesday, February 26th

10:00 AM ET New Home Sales (Jan)

12:00 PM ET Atlanta Fed President Bostic Speaks

Thursday, February 27th

08:30 AM ET GDP Q4 (2nd Reading)

08:30 AM ET Durable Goods (Jan)

08:30 AM ET Initial Jobless Claims

09:15 AM ET Kansas City Fed President Schmid Speaks

10:00 AM ET Pending Home Sales (Jan)

01:15 PM ET Cleveland Fed President Hammack Speaks

03:15 PM ET Philadelphia Fed President Harker Speaks

Friday, February 28th

08:30 AM ET PCE YoY & MoM (Jan)

08:30 AM ET Personal Spending & Income (Jan)

08:30 AM ET Initial Jobless Claims

08:30 PM ET Richmond Fed President Barkin Speaks

09:45 AM ET Chicago PMI (Feb)

10:00 AM ET Existing Home Sales (Jan)

10:00 AM ET Consumer Sentiment (Feb)

10:15 PM ET Chicago Fed President Goolsbee Speaks

Seasonality Update

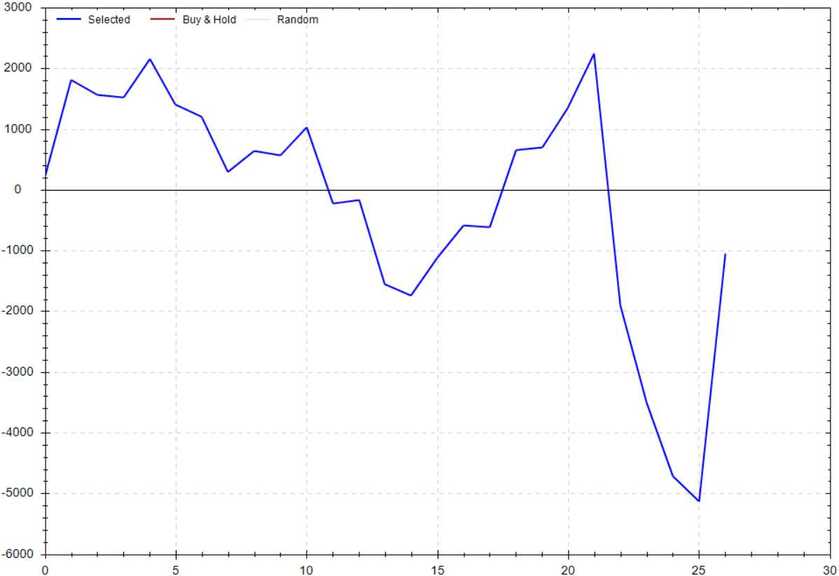

S&P 500 Seasonal Bias (Monday, February 24th)

- Bull Win Percentage: 48%

- Profit Factor: 0.92

- Bias: Leaning Bearish

Equity Curve -->

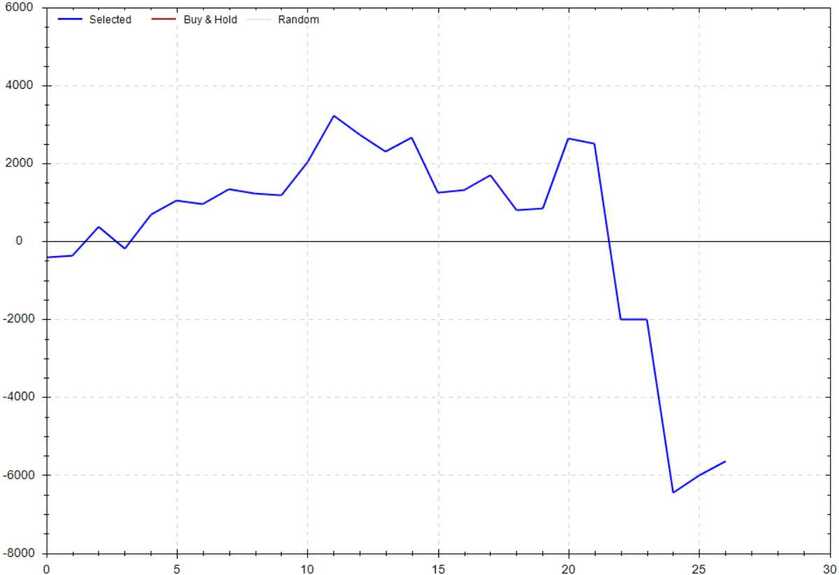

S&P 500 Seasonal Bias (Tuesday, February 25th)

- Bull Win Percentage: 52%

- Profit Factor: 0.58

- Bias: Leaning Bearish

Equity Curve -->

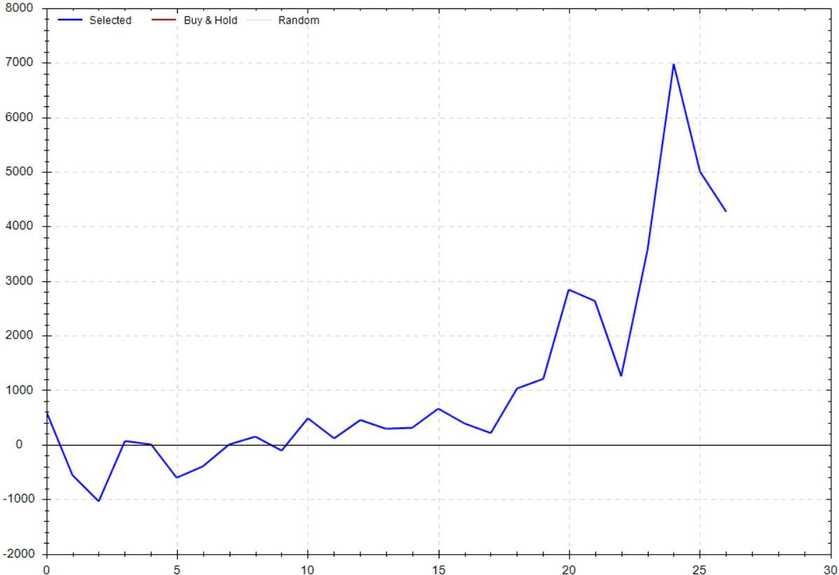

S&P 500 Seasonal Bias (Wednesday, February 26th)

- Bull Win Percentage: 52%

- Profit Factor: 1.54

- Bias: Leaning Bullish

Equity Curve -->

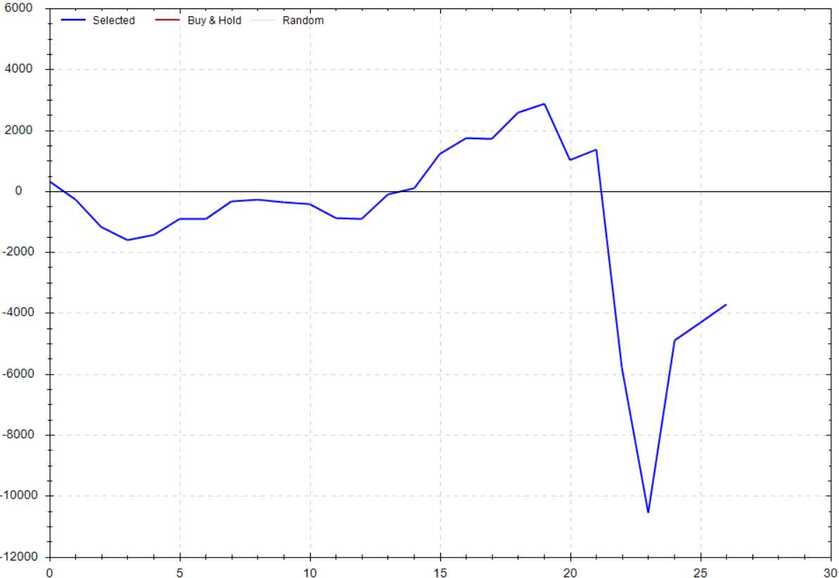

S&P 500 Seasonal Bias (Thursday, February 27th)

- Bull Win Percentage: 56%

- Profit Factor: 0.77

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, February 28th)

- Bull Win Percentage: 33%

- Profit Factor: 0.39

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 7 for 8 times (15 for 16 total units) this past week.

Signal Accuracy: ~87.5%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 5 Trades

February Record: 46/52 Units

Monday, February 18th

Markets Closed (President's Day)

Tuesday, February 18th

SPY Call Credit Spread (1x Multiple @ $608/$607) 🟢

QQQ Call Credit Spread (1x Multiple @ $535/$534) 🟢

Wednesday, February 19th

SPY Call Credit Spread (1x Multiple @ $612/$613) 🔴

QQQ Call Credit Spread (1x Multiple @ $540/$541) 🟢

Thursday, February 20th

SPY Call Credit Spread (3x Multiple @ $612/$613) 🟢

QQQ Call Credit Spread (3x Multiple @ $540/$541) 🟢

Friday, February 21st

SPY Call Credit Spread (3x Multiple @ $612/$613) 🟢

QQQ Call Credit Spread (3x Multiple @ $539/$540) 🟢

Times I Missed Mexico

88 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units!