How Much More Pain?!

Hey,

Key Weekly Performance Stats:

- S&P 500: -3.07%

- Nasdaq 100: -3.22%

- Russel 2000: -4.06%

- Bitcoin: +2.92%

Last week, the economy and he stock market experienced significant turbulence, largely driven by escalating trade war fears. On March 3rd, President Trump announced 25% tariffs on imports from Canada and Mexico, alongside a 10% levy on Chinese goods, sparking a sharp sell-off. The major indices plunged, reflecting investor concerns over rising costs and economic slowdown. Midweek, weaker-than-expected manufacturing data intensified worries, though a brief recovery rally occurred on March 5th after a one-month tariff delay was announced for certain automakers compliant with the USMCA. However, by March 6th, selling resumed as uncertainties persisted, with the Nasdaq entering correction territory and bank stocks like Citigroup and Morgan Stanley sliding 12% and 10% for the week, respectively.

By March 7th, the market remained volatile, with the Dow, S&P 500, and Nasdaq on track for their worst weekly performance since September 2024. Friday brought some late-day relief after an initial negative reaction to the higher-than-expected unemployment report. Despite the late-week rally, broader sentiment remained cautious, with consumer confidence at a four-year low and layoff announcements hitting 2020 highs, attributed partly to government workforce reductions.

Looking ahead, traders have a lot to pay attention to. The February Nonfarm Payrolls and Unemployment Rate will continue to shape expectations about labor market health and Federal Reserve policy—Watch for revisions or reactions in early trading. The ongoing tariff developments, especially Canada and Mexico’s retaliatory measures, could further sway markets. Volatility is likely to persist as all this craziness unfolds. As always, stick to your plan and respect your rules. Godspeed.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, March 10th

Evening: Oracle

Tuesday, March 11th

Morning: Dick's & Kohl's

Wednesday, March 12th

Evening: Adobe

Thursday, March 13th

Morning: Dollar General

Evening: DocuSign & ULTA Beauty

Friday, March 14th

None

Market Events

Monday, March 10th

None

Tuesday, March 11th

10:00 AM ET JOLTs Job Openings (Jan)

Wednesday, March 12th

08:30 AM ET CPI MoM & YoY (Feb)

01:00 PM ET 10-Year Note Auction

Thursday, March 13th

08:30 AM ET PPI MoM & YoY (Feb)

08:30 AM ET Initial Jobless Claims

01:00 PM ET 30-Year Note Auction

Friday, March 14th

10:00 AM ET Consumer Sentiment (Mar)

Seasonality Update

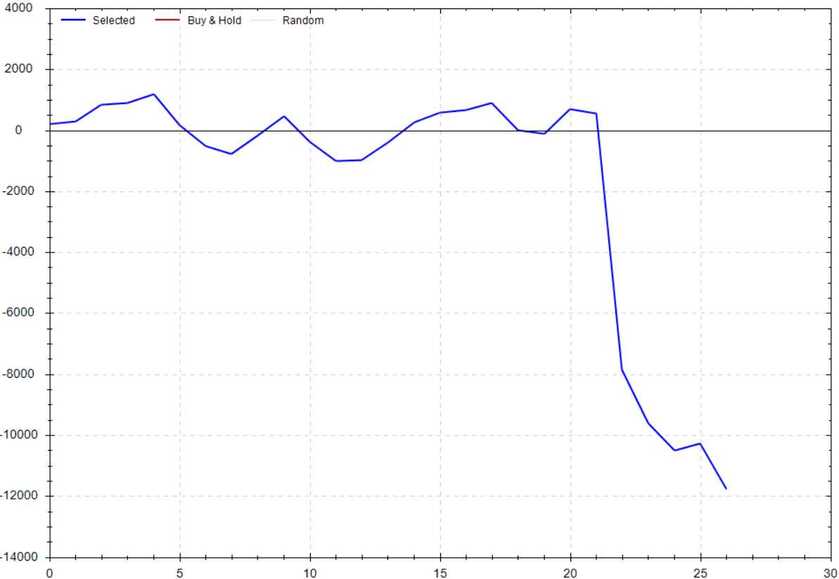

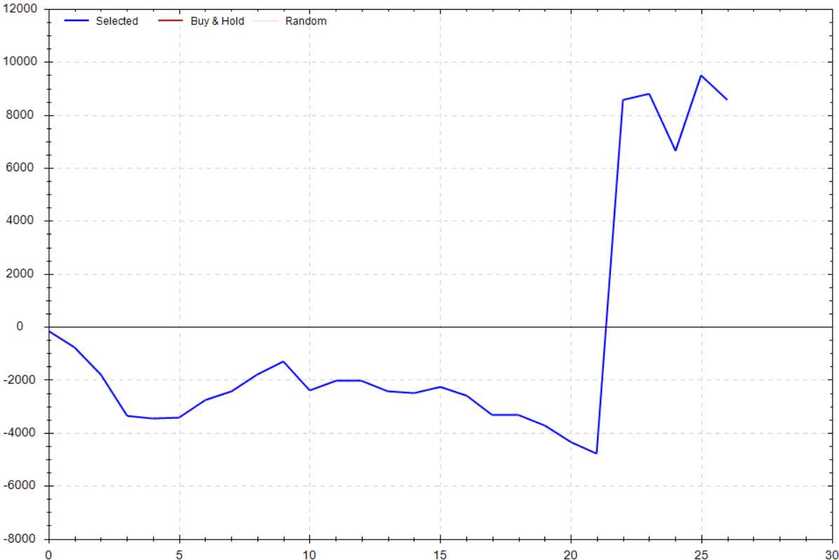

S&P 500 Seasonal Bias (Monday, March 10th)

- Bull Win Percentage: 56%

- Profit Factor: 0.31

- Bias: Bearish

Equity Curve -->

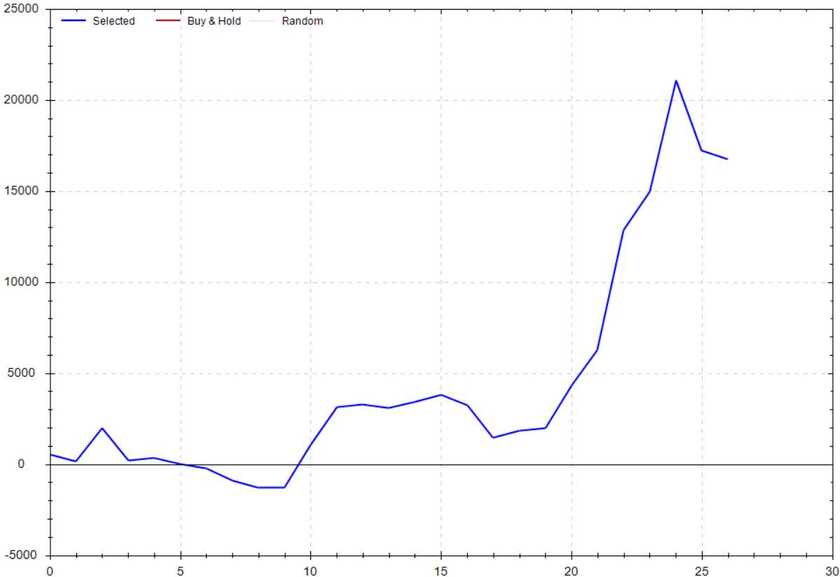

S&P 500 Seasonal Bias (Tuesday, March 11th)

- Bull Win Percentage: 59%

- Profit Factor: 2.57

- Bias: Bullish

Equity Curve -->

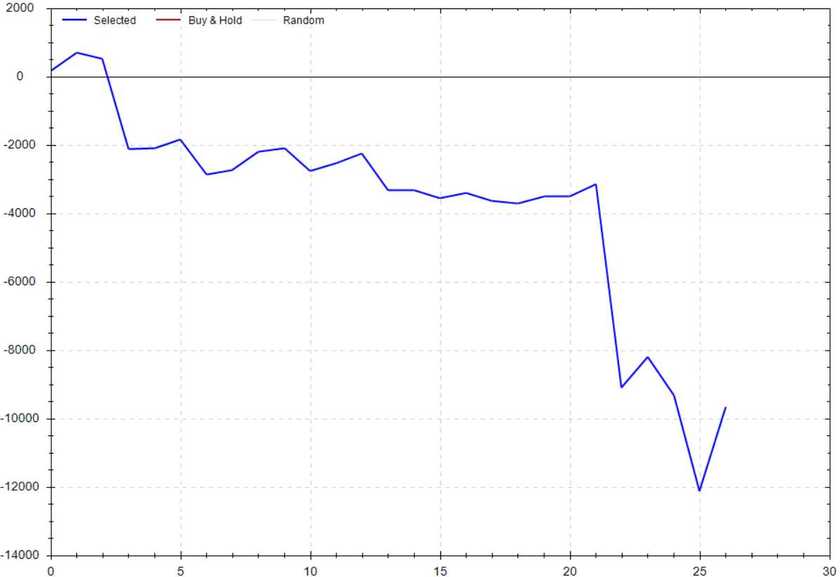

S&P 500 Seasonal Bias (Wednesday, March 12th)

- Bull Win Percentage: 56%

- Profit Factor: 0.40

- Bias: Bearish

Equity Curve -->

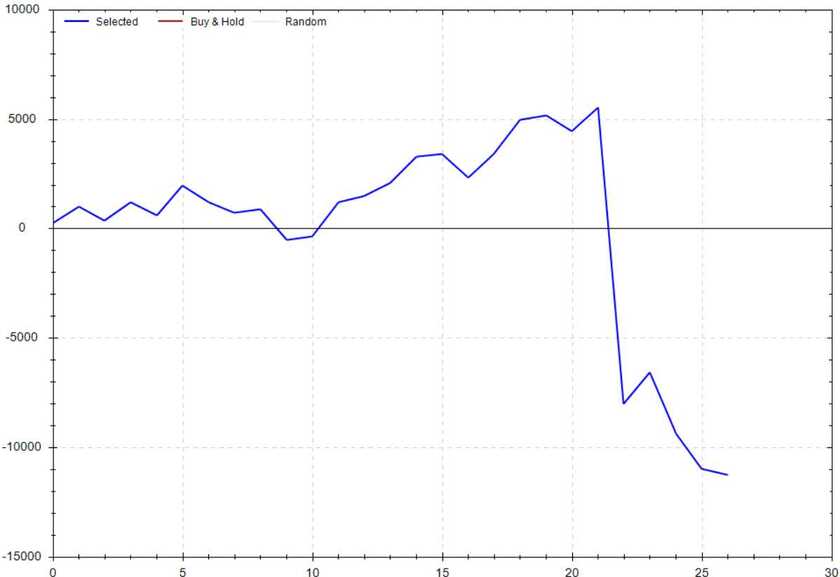

S&P 500 Seasonal Bias (Thursday, March 13th)

- Bull Win Percentage: 59%

- Profit Factor: 0.53

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, March 14th)

- Bull Win Percentage: 41%

- Profit Factor: 1.80

- Bias: Leaning Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 6 for 10 times (14 for 20 total units) this past week.

Signal Accuracy: ~60%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 2 Trades

March Record: 14/20 Units

Monday, March 3rd

SPY Call Credit Spread (2x Multiple @ $599/$600) 🟢

QQQ Call Credit Spread (2x Multiple @ $515/$516) 🟢

Tuesday, March 4th

SPY Call Credit Spread (3x Multiple @ $581/$582) 🟢

QQQ Call Credit Spread (3x Multiple @ $497/$498) 🟢

Wednesday, March 5th

SPY Call Credit Spread (1x Multiple @ $580/$581) 🔴

QQQ Call Credit Spread (1x Multiple @ $499/$500) 🔴

Thursday, March 6th

SPY Put Credit Spread (2x Multiple @ $573/$572) 🔴

QQQ Put Credit Spread (2x Multiple @ $491/$490) 🔴

Friday, March 7th

SPY Call Credit Spread (2x Multiple @ $577/$578) 🟢

QQQ Call Credit Spread (2x Multiple @ $493/$494) 🟢

Total Crying In The Shower Sessions

42 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!