Breaking Upward!

Hey,

Key Weekly Performance Stats:

- S&P 500: +2.92%

- Nasdaq 100: +3.45%

- Russel 2000: +3.31%

- Bitcoin: +2.35%

Last week, the stock market staged a solid recovery. By May 2, the S&P 500 posted its longest winning streak since 2004, rising 1.5% on the day and 2.9% for the week. The Nasdaq and Dow also logged gains. Still, all major indexes remained negative year-to-date, reflecting continued uncertainty. Notably, Apple estimated a $900 million hit from tariffs, and Amazon issued a cautious outlook, weighing on sentiment.

The economic picture was mixed. On April 30, GDP data showed a first-quarter contraction—the first in three years—stirring recession concerns. However, the April jobs report released on May 2 beat expectations, with 177,000 jobs added versus the 133,000 forecast, and unemployment holding steady at 4.2%. Meanwhile, tensions over tariffs persisted, though news that China is reviewing U.S. trade proposals offered a glimmer of hope. It marked the first public sign of potential talks since both nations imposed over 100% tariffs, helping ease some market anxiety.

Looking ahead, key economic data—including inflation and manufacturing reports—will shape the outlook. Progress in U.S.-China trade talks remains a major driver for global markets. Corporate earnings, especially in tech, will shed light on how companies are managing tariff pressures. Also, keep an eye on commodity prices and any Federal Reserve commentary for clues on future policy. As always, stick to your trading plan and respect your risk. Godspeed.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, May 5th

Morning: Berkshire Hathaway

Evening: Ford & Palantir

Tuesday, May 6th

Morning: Celsius

Evening: AMD, Rivian Supermicro & Wynn

Wednesday, May 7th

Morning: Disney, Novo Nordisk & Uber

Evening: ARM, Doordash & OXY

Thursday, May 8th

Morning: Crocs, Peloton & Shopify

Evening: Affirm, Cloudflare, Coinbase & Draft Kings

Friday, May 9th

None

Market Events

Monday, May 5th

09:45 AM ET S&P Global Services PMI (Apr)

10:00 AM ET ISM Non-Manufacturing PMI & Prices (Apr)

Tuesday, May 6th

01:00 PM ET 10-Year Note Auction

Wednesday, May 7th

10:30 AM ET Crude Oil Inventories

02:00 PM ET Fed Interest Rate Decision & FOMC Statement

02:30 PM ET FOMC Press Conference

03:00 PM ET Consumer Credit (Mar)

Thursday, May 8th

08:30 AM ET Initial Jobless Claims

01:00 PM ET 30-Year Note Auction

Friday, May 9th

08:30 AM ET Fed Governor Kugler Speech

08:30 AM ET Fed Governor Waller & NY Fed President Williams Speak

Seasonality Update

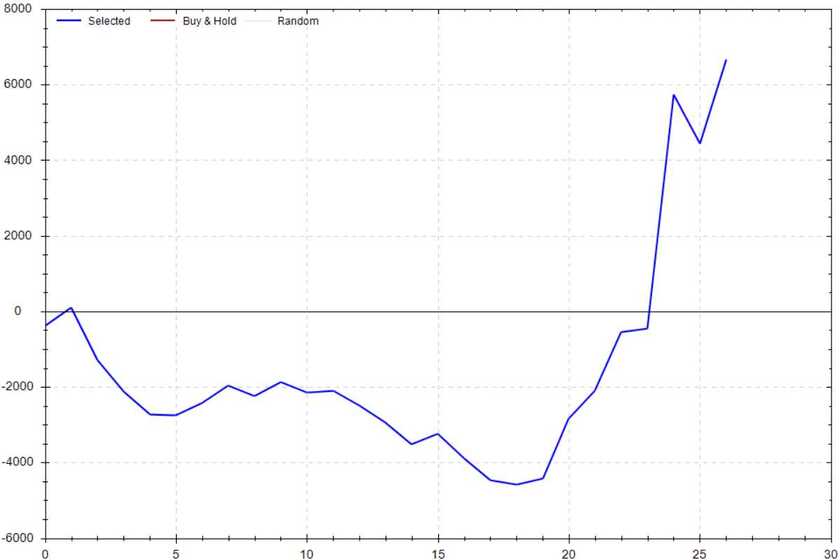

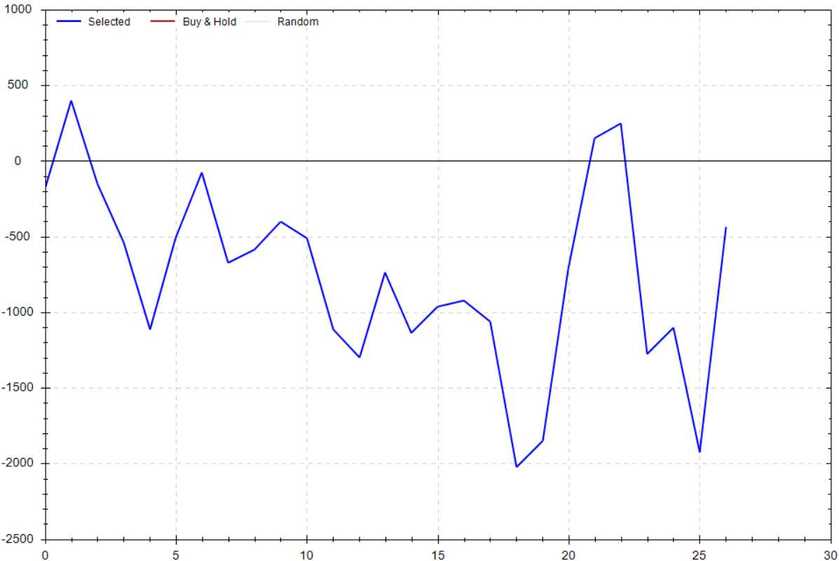

S&P 500 Seasonal Bias (Monday, May 5th)

- Bull Win Percentage: 48%

- Profit Factor: 1.85

- Bias: Leaning Bullish

Equity Curve -->

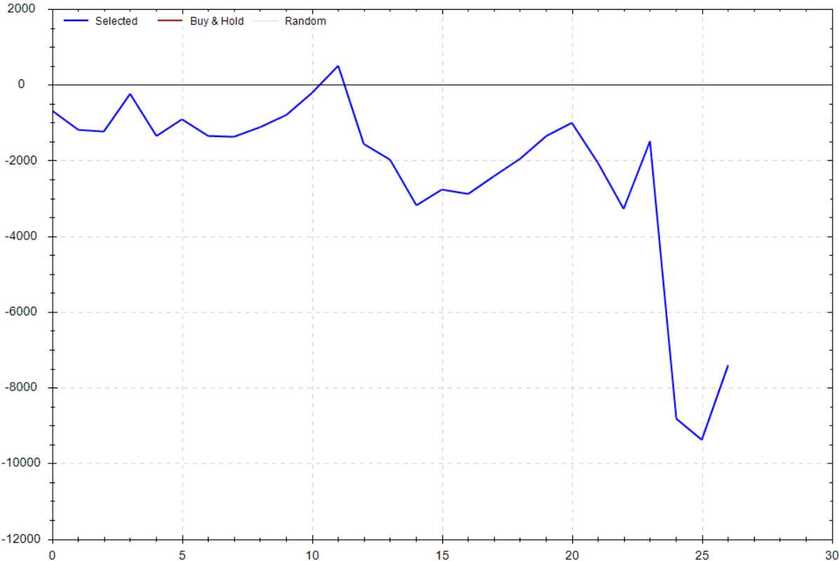

S&P 500 Seasonal Bias (Tuesday, May 6th)

- Bull Win Percentage: 48%

- Profit Factor: 0.56

- Bias: Bearish

Equity Curve -->

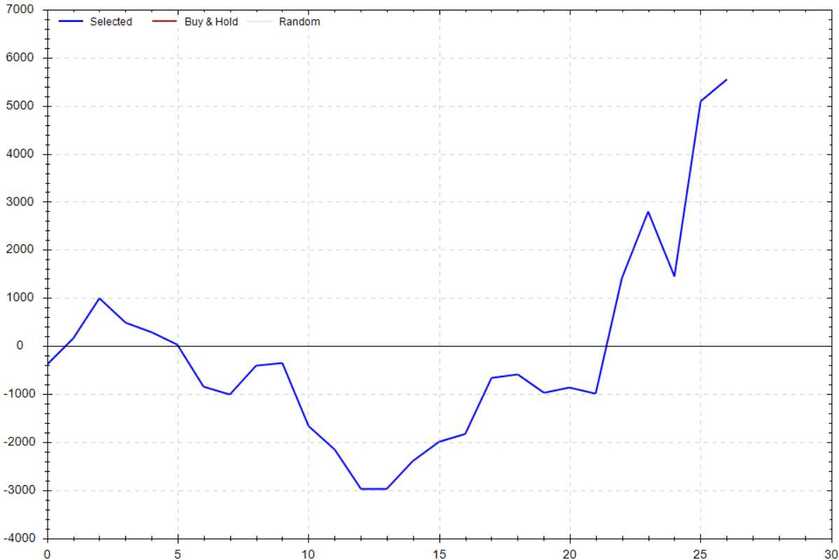

S&P 500 Seasonal Bias (Wednesday, May 7th)

- Bull Win Percentage: 56%

- Profit Factor: 1.81

- Bias: Bullish

Equity Curve -->

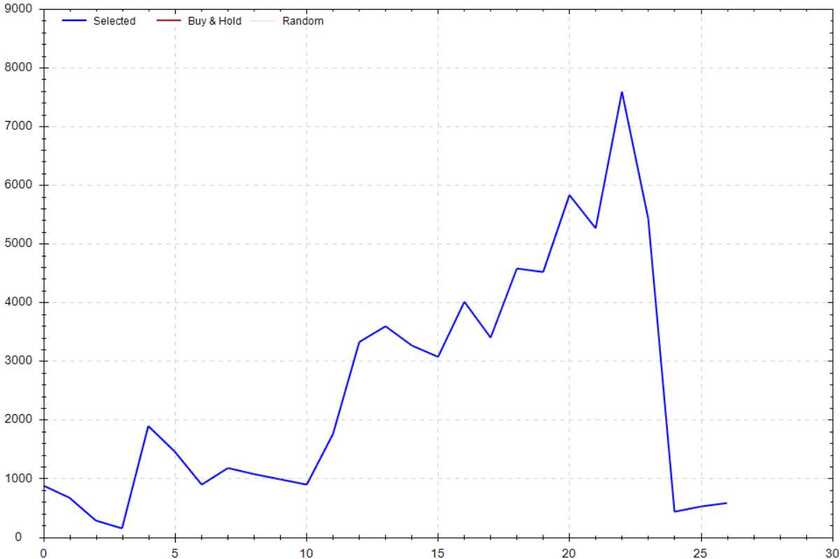

S&P 500 Seasonal Bias (Thursday, May 8th)

- Bull Win Percentage: 44%

- Profit Factor: 1.05

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, May 9th)

- Bull Win Percentage: 52%

- Profit Factor: 0.94

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

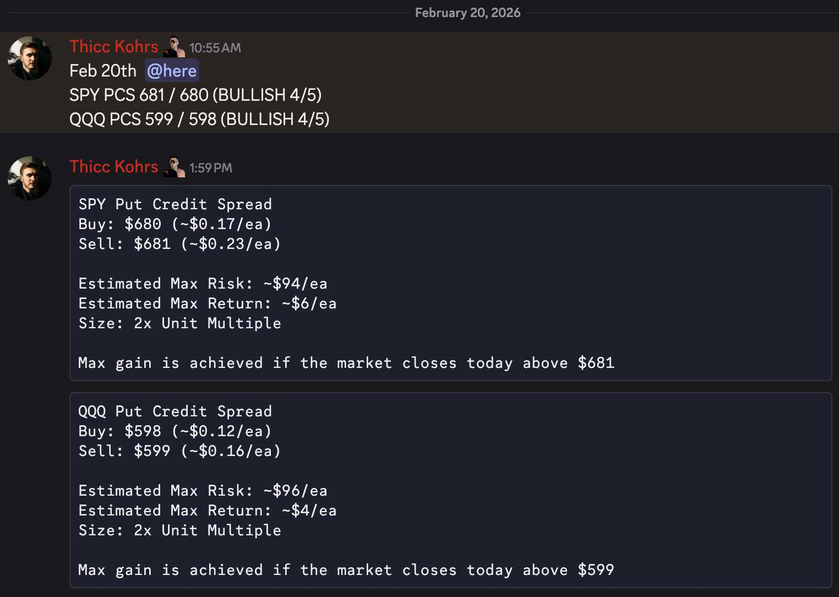

Options Strategy Update

The 0 DTE signal hit 6 for 6 times (12 for 12 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 10 Trades

April Record: 50/56 Units

May Record: 4/4 Units

Monday, April 28th

No Signal Produced

Tuesday, April 29th

SPY Put Credit Spread (2x Multiple @ $548 / $547) 🟢

QQQ Put Credit Spread (2x Multiple @ $469 / $468) 🟢

Wednesday, April 30th

SPY Put Credit Spread (2x Multiple @ $541 / $540) 🟢

QQQ Put Credit Spread (2x Multiple @ $462 / $461) 🟢

Thursday, May 1st

No Signal Produced

Friday, May 2nd

SPY Put Credit Spread (2x Multiple @ $562 / $561) 🟢

QQQ Put Credit Spread (2x Multiple @ $484 / $483) 🟢

Times I Broke My Trading Rules

14 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

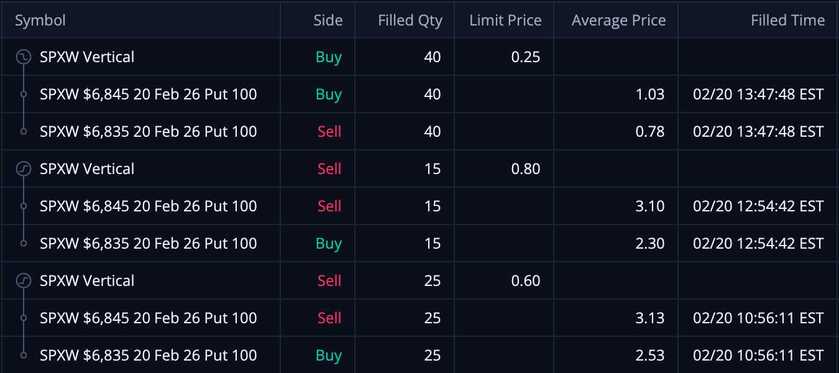

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

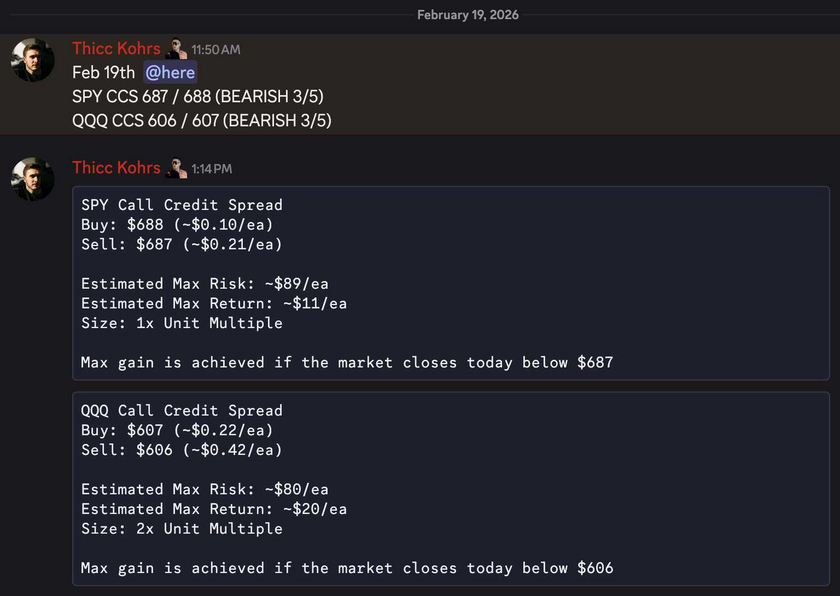

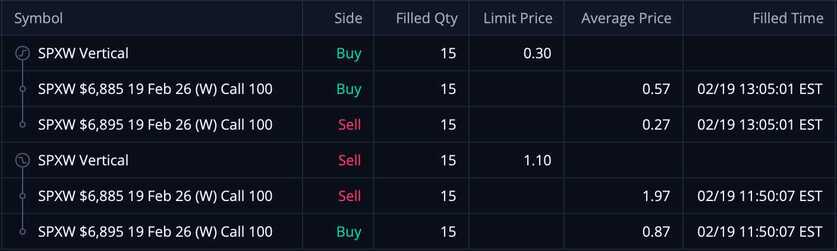

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

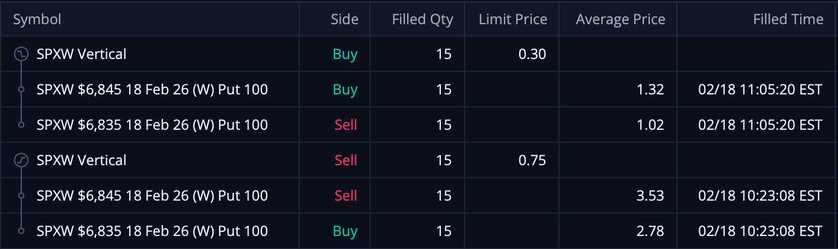

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!

These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!