How High Can We Go???

Hey,

Key Weekly Performance Stats:

- S&P 500: +5.36%

- Nasdaq 100: +7.52%

- Russel 2000: +4.15%

- Bitcoin: +0.50%

Last week’s big story was the breakthrough on U.S.–China trade. Both sides agreed to roll back tariffs for 90 days, cutting U.S. duties on Chinese imports from a punishing 145% to 30%, while China trimmed its own tariffs to 10%. The move injected a fresh dose of optimism into the market and set the stage for broader negotiations.

The macro data added fuel to the rally. April CPI ticked up just 0.2% month-over-month—softer than the 0.3% economists expected—while PPI surprised everyone by dropping 0.5%, its sharpest decline since 2020. Retail sales eked out a 0.1% gain, suggesting consumers are still feeling cautious, and Fed Chair Jerome Powell reinforced the central bank’s “wait-and-see” stance, acknowledging solid growth but underscoring the lingering tariff uncertainty.

Equities loved the combo of cooling inflation and tariff relief. The S&P 500 and Nasdaq finally flipped green for the year, powered by a tech surge that saw Tesla and NVIDIA jump more than 15%. Consumer discretionary and utilities joined the party as well. Options-expiration week magnified the upside: many bearish bets simply melted away.

For the week ahead, keep an eye on the next round of U.S.–China trade talks—any hint of progress (or backtracking) could swing sentiment quickly. On the data front, watch industrial production and a slate of Fed-speak for clues on growth and the rate-cut timeline. As always, stick to your trading plan and respect your risk. Godspeed.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, May 19th

None

Tuesday, May 20th

Morning: Home Depot

Evening: Palo Alto Networks

Wednesday, May 21st

Morning: Target & TJX

Evening: Snowflake & Zoom

Thursday, May 22nd

None

Friday, May 23rd

None

Market Events

Monday, May 19th

05:00 AM ET Eurozone CPI MoM & YoY (Apr)

08:45 AM ET New York Fed President Williams Speaks

10:00 AM ET US Leading Economic Indicators (Apr)

Tuesday, May 20th

09:00 AM ET Richmond Fed President Barkin Speaks

01:00 PM ET St. Louis Fed President Musalem Speaks

Wednesday, May 21st

10:30 AM ET Crude Oil Inventories

Thursday, May 22nd

08:30 AM ET Initial Jobless Claims

09:45 AM ET S&P Global Manufacturing & Services PMI (May)

10:00 AM ET Existing Home Sales (Apr)

02:00 PM ET New York Fed President Williams Speaks

Friday, May 23rd

09:35 PM ET Kansas City Fed President Schmid Speaks

10:00 AM ET New Home Sales (Apr)

Seasonality Update

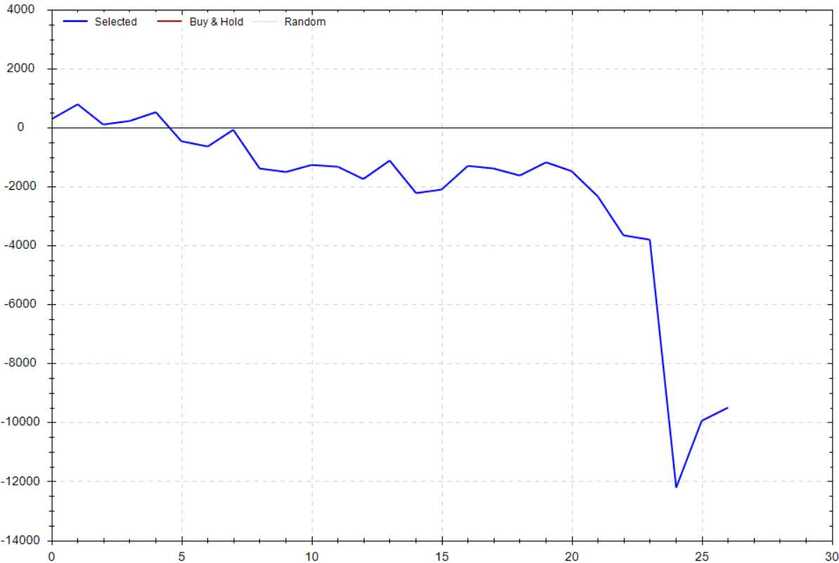

S&P 500 Seasonal Bias (Monday, May 19th)

- Bull Win Percentage: 44%

- Profit Factor: 0.41

- Bias: Bearish

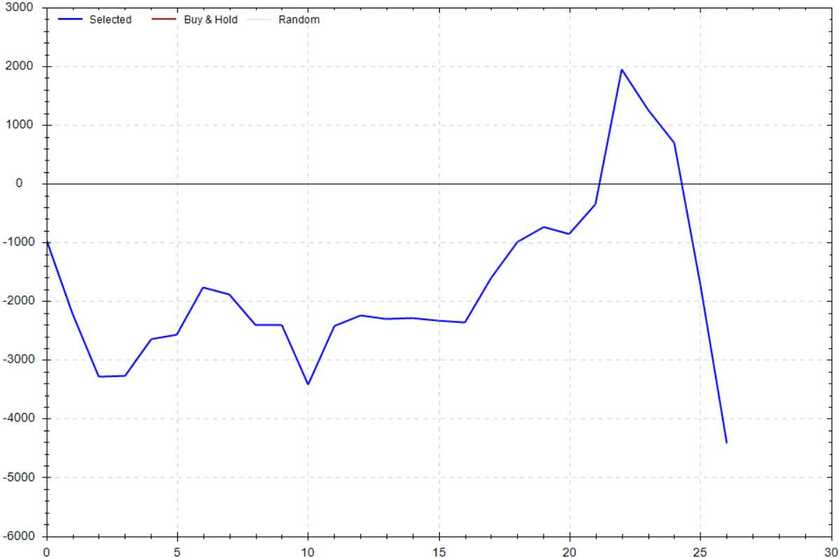

Equity Curve -->

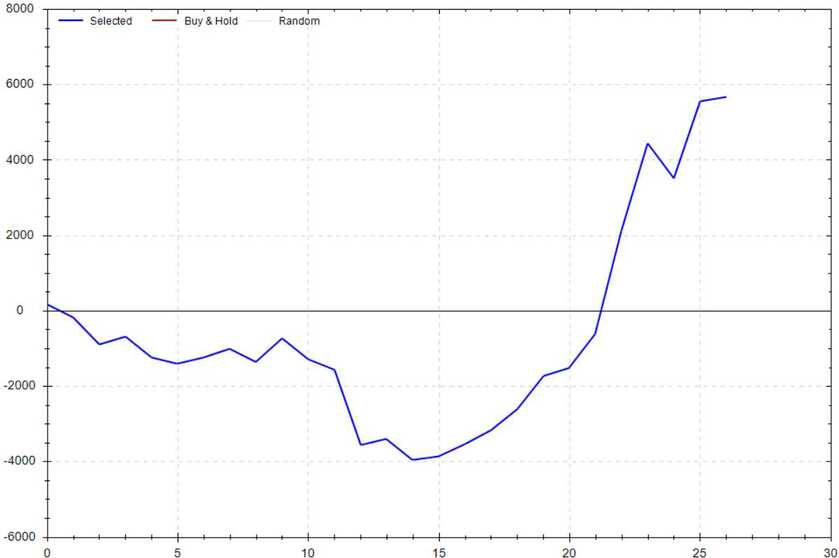

S&P 500 Seasonal Bias (Tuesday, May 20th)

- Bull Win Percentage: 63%

- Profit Factor: 1.88

- Bias: Bullish

Equity Curve -->

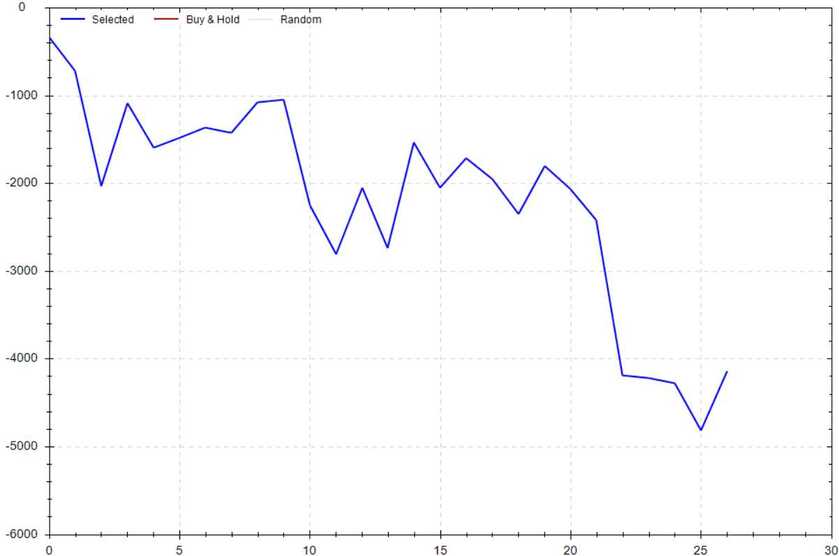

S&P 500 Seasonal Bias (Wednesday, May 21st)

- Bull Win Percentage: 37%

- Profit Factor: 0.55

- Bias: Bearish

Equity Curve -->

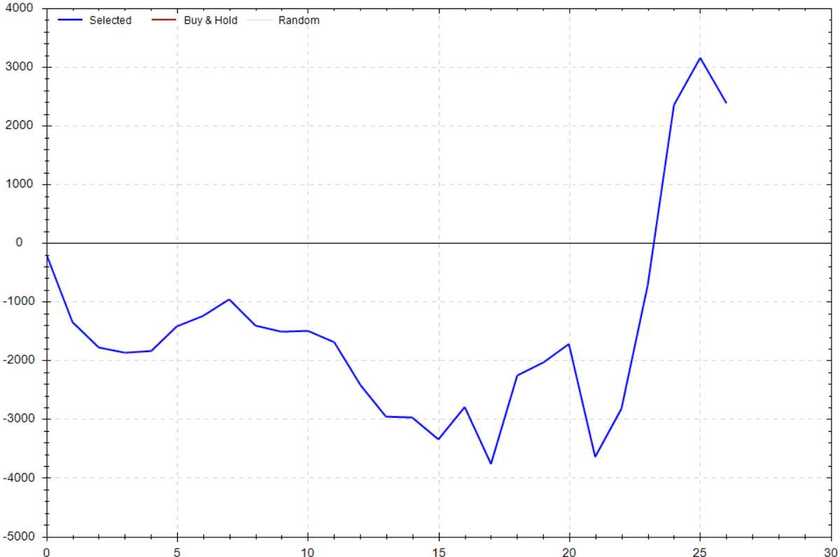

S&P 500 Seasonal Bias (Thursday, May 22nd)

- Bull Win Percentage: 48%

- Profit Factor: 1.30

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, May 23rd)

- Bull Win Percentage: 44%

- Profit Factor: 0.62

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 10 for 10 times (18 for 18 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 32 Trades

May Record: 18/18 Units

Monday, May 12th

SPY Put Credit Spread (1x Multiple @ $576 / $575) 🟢

QQQ Put Credit Spread (1x Multiple @ $501 / $500) 🟢

Tuesday, May 13th

SPY Put Credit Spread (2x Multiple @ $582 / $581) 🟢

QQQ Put Credit Spread (2x Multiple @ $508 / $507) 🟢

Wednesday, May 14th

SPY Put Credit Spread (2x Multiple @ $584 / $583) 🟢

QQQ Put Credit Spread (2x Multiple @ $514 / $513) 🟢

Thursday, May 15th

SPY Put Credit Spread (2x Multiple @ $583 / $582) 🟢

QQQ Put Credit Spread (2x Multiple @ $513 / $512) 🟢

Friday, May 16th

SPY Put Credit Spread (2x Multiple @ $588 / $587) 🟢

QQQ Put Credit Spread (2x Multiple @ $516 / $515) 🟢

Streams I Didn't Yell At Someone

1 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!