The Bulls Take A Breather

Hey,

Key Weekly Performance Stats:

- S&P 500: -2.61%

- Nasdaq 100: -2.39%

- Russel 2000: -3.11%

- Bitcoin: +3.70%

Last week was rough for stocks. The Dow slid 2.5%, the S&P 500 lost 2.6%, and the Nasdaq dropped 2.4%. Year to date, that leaves the Dow down 2.2%, the S&P off 1.3%, and the Nasdaq trailing by 3%. Moody’s downgrade of the U.S. credit rating—echoing S&P’s cut in 2011 and Fitch’s in 2023—put deficits and rising interest costs front and center. Then the House passed the tongue-in-cheek-named “One Big Beautiful Bill” on May 22, extending the 2017 tax cuts and adding about $3 trillion to the tab over the next decade. Stimulative? A bit. Comforting to deficit hawks? Definitely not.

Bond yields jumped in response: the 10-year pushed past 4.5% while the 30-year topped 5%, as traders dialed back hopes for near-term Fed cuts. Layer on President Trump’s latest tariff saber-rattling—50% duties on EU goods and a 25% swipe at Apple—and you had the recipe for a broad market pullback.

Looking ahead, keep three dates on your radar. First, Nvidia reports on May 28; given its AI clout, that release could jolt the whole tech complex. Next up is Fed Chair Powell’s speech on May 26—any hawkish undertone will matter with yields already on the rise. Finally, May 30 brings the second read on Q1 GDP plus the PCE inflation print, both key for gauging how hot (or not) the economy really is. As always, stick to your trading plan and respect your risk.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

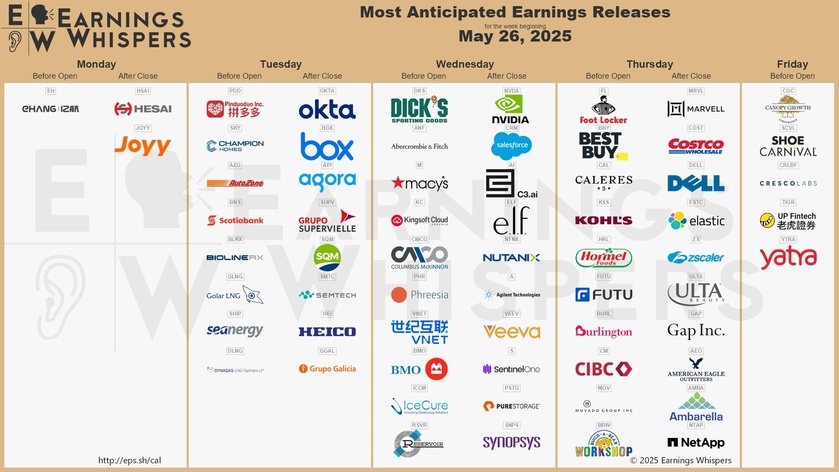

Earnings

Monday, May 26th

None

Tuesday, May 27th

None

Wednesday, May 28th

Morning: Dick's & Macy's

Evening: C3.ai, Nvidia & Snowflake

Thursday, May 29th

Morning: Best Buy, Foot Locker & Kohl's

Evening: Costco & Dell

Friday, May 30th

Morning: Canopy Growth

Market Events

Monday, May 26th

ALL DAY Market Closed For Memorial Day

Tuesday, May 27th

08:30 AM ET Durable Goods MoM & YoY (Apr)

10:00 AM ET Consumer Confidence (May)

Wednesday, May 28th

02:00 PM ET FOMC Meeting Minutes (May)

Thursday, May 29th

08:30 AM ET GDP QoQ (Q1)

08:30 AM ET Initial Jobless Claims

12:00 PM ET Crude Oil Inventories

Friday, May 30th

08:30 AM ET PCE Price Index MoM & YoY (Apr)

09:45 AM ET Chicago PMI (May)

10:00 AM ET Consumer Sentiment (May)

Seasonality Update

S&P 500 Seasonal Bias (Monday, May 26th)

- MARKET CLOSED ALL DAY (Memorial Day)

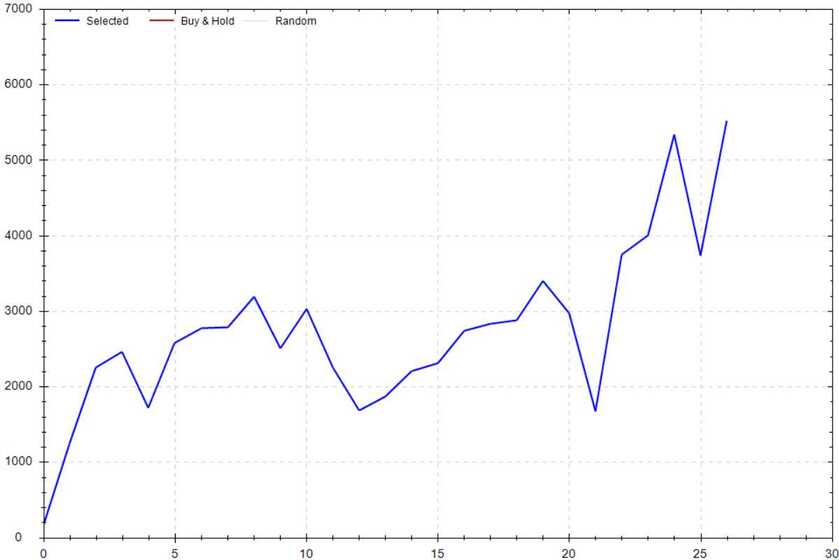

S&P 500 Seasonal Bias (Tuesday, May 27th)

- Bull Win Percentage: 74%

- Profit Factor: 1.91

- Bias: Bullish

Equity Curve -->

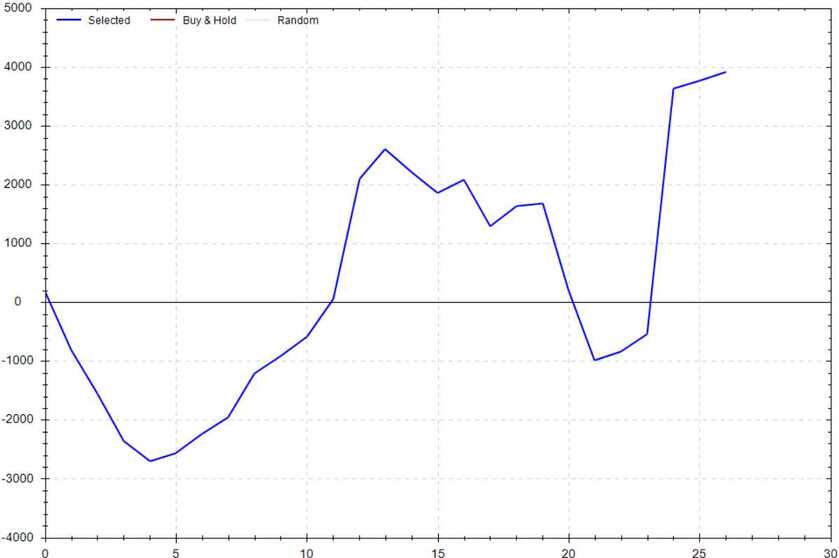

S&P 500 Seasonal Bias (Wednesday, May 28th)

- Bull Win Percentage: 67%

- Profit Factor: 1.55

- Bias: Bullish

Equity Curve -->

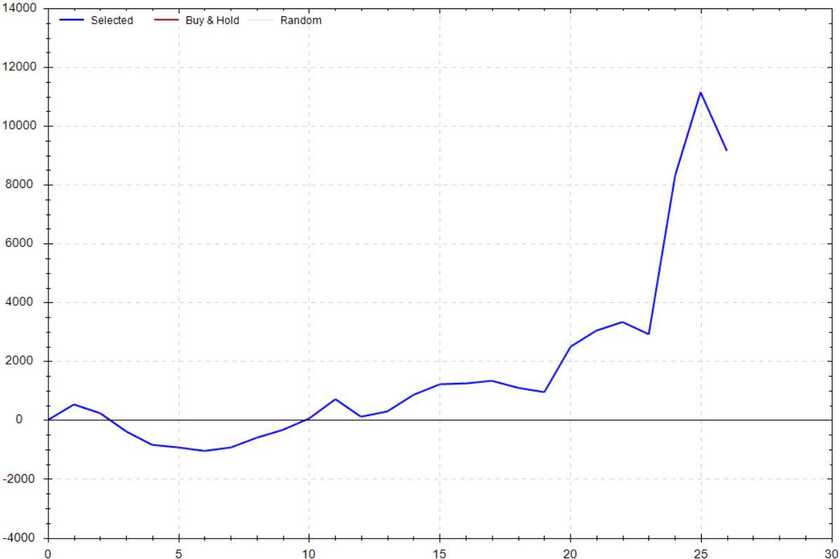

S&P 500 Seasonal Bias (Thursday, May 29th)

- Bull Win Percentage: 59%

- Profit Factor: 2.83

- Bias: Bullish

Equity Curve -->

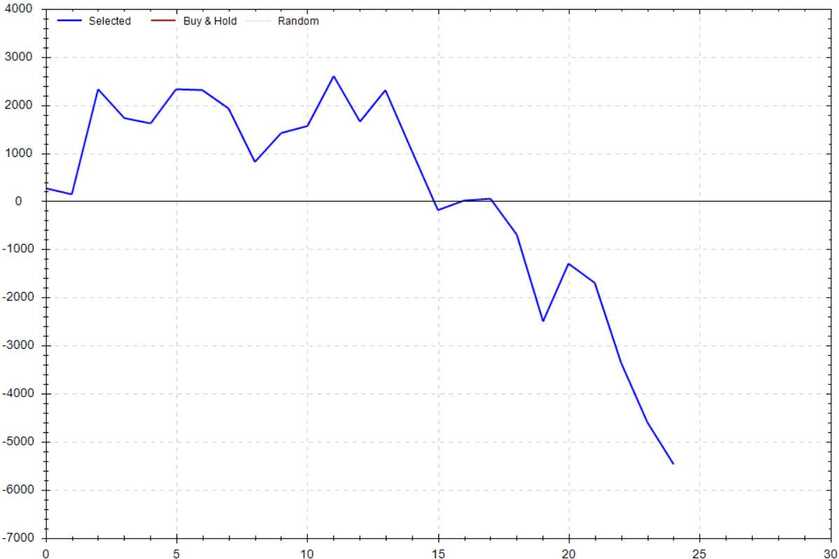

S&P 500 Seasonal Bias (Friday, May 30th)

- Bull Win Percentage: 40%

- Profit Factor: 0.56

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 6 for 8 times (10 for 12 total units) this past week.

Signal Accuracy: ~75%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 2 Trades

May Record: 28/30 Units

Monday, May 19th

SPY Put Credit Spread (2x Multiple @ $587 / $586) 🟢

QQQ Put Credit Spread (2x Multiple @ $513 / $512) 🟢

Tuesday, May 20th

SPY Put Credit Spread (2x Multiple @ $591 / $590) 🟢

QQQ Put Credit Spread (2x Multiple @ $517 / $516) 🟢

Wednesday, May 21st

SPY Put Credit Spread (1x Multiple @ $587 / $586) 🔴

QQQ Put Credit Spread (1x Multiple @ $515 / $514) 🔴

Thursday, May 22nd

SPY Put Credit Spread (1x Multiple @ $581 / $580) 🟢

QQQ Put Credit Spread (1x Multiple @ $512 / $511) 🟢

Friday, May 23rd

No Signal Produced

Tarot Card Prediction Accuracy

100% *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!