FOMC Incoming!

Hey,

Key Weekly Performance Stats:

- S&P 500: -0.39%

- Nasdaq 100: -0.60%

- Russel 2000: -1.56%

- Bitcoin: +1.65%

Last week, the stock market opened on a positive note, boosted by optimism over U.S.-China trade talks and a strong May jobs report. The Dow, S&P 500, and Nasdaq all posted modest gains early in the week. But sentiment shifted sharply on June 13, when Iran retaliated against Israeli airstrikes. The geopolitical escalation sent oil prices surging and triggered a broad market selloff. The Dow lost 770 points on Friday alone, ending the week down 1.3%. The S&P 500 slipped 0.4%, while the Nasdaq declined 0.6%.

On the economic front, inflation data pointed to easing price pressures. The May Consumer Price Index (CPI), released on June 11, rose 2.4% year-over-year—slightly above April’s 2.3% but below forecasts. Core CPI came in at 2.8%, also under expectations. The next day, the Producer Price Index (PPI) rose just 0.1% month-over-month, undershooting the 0.2% estimate. Meanwhile, progress in U.S.-China trade negotiations appeared to stall, tempering investor optimism.

Looking ahead to next week, all eyes will be on the Federal Reserve. The FOMC meets June 17–18, and markets are watching closely for any changes to interest rate policy or forward guidance. Key economic reports, including retail sales and industrial production on June 17, will offer more clarity on consumer and manufacturing trends. Developments in the Middle East and any movement in U.S.-China trade talks will also remain in focus. As always, stick to your trading plan and respect your risk. Godspeed.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, June 16th

08:30 AM ET Empire State Manufacturing Survey (June)

01:00 PM ET 20-Year Bond Auction

Tuesday, June 17th

08:30 AM ET Retial Sales MoM & YoY (May)

01:00 PM ET 5-Year TIPS Auction

Wednesday, June 18th

05:00 AM ET Eurozone CPI MoM & YoY (May)

08:30 AM ET Initial Jobless Claims

02:00 PM ET FOMC Interest Rate Decision

02:30 PM ET Chair Powell Press Conference

Thursday, June 19th

ALL DAY Market Closed (Juneteenth)

Friday, June 20th

08:30 AM ET Philadelphia Fed Manufacturing Index (June)

10:00 AM ET US Leading Economic Indicators (May)

Seasonality Update

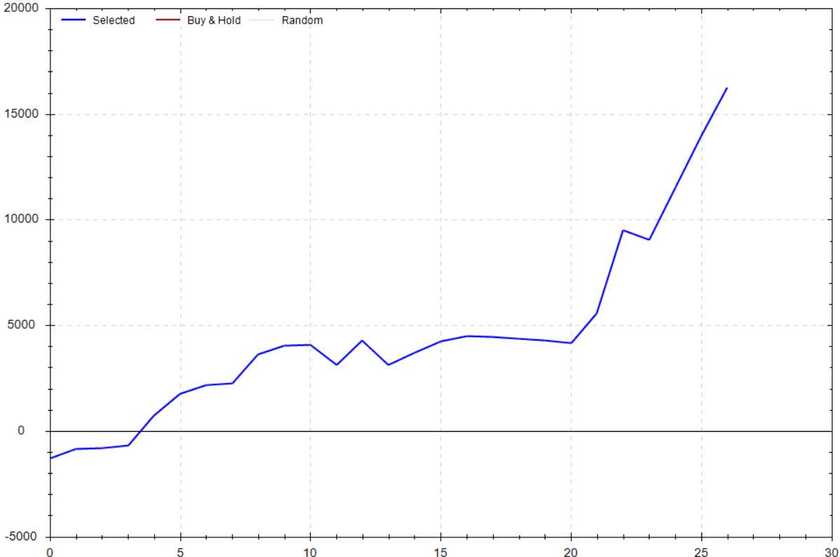

S&P 500 Seasonal Bias (Monday, June 16th)

- Bull Win Percentage: 71%

- Profit Factor: 4.84

- Bias: Bullish

Equity Curve -->

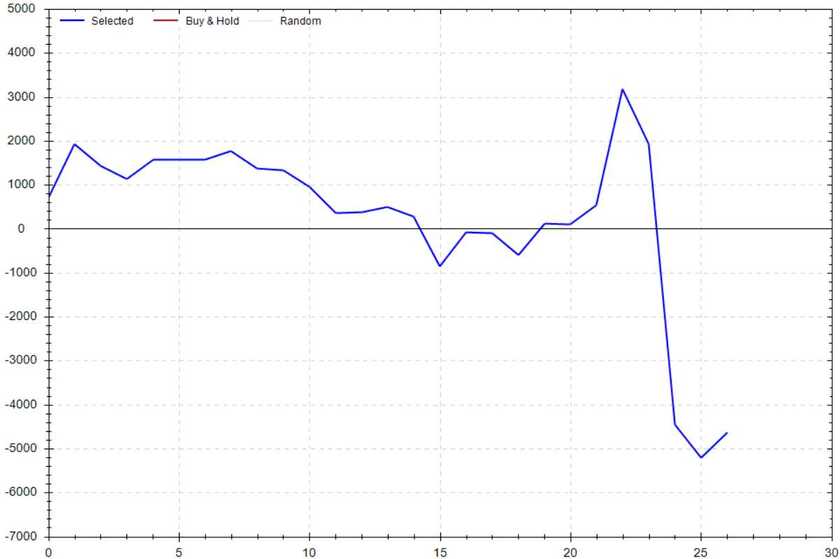

S&P 500 Seasonal Bias (Tuesday, June 17th)

- Bull Win Percentage: 44%

- Profit Factor: 0.63

- Bias: Bearish

Equity Curve -->

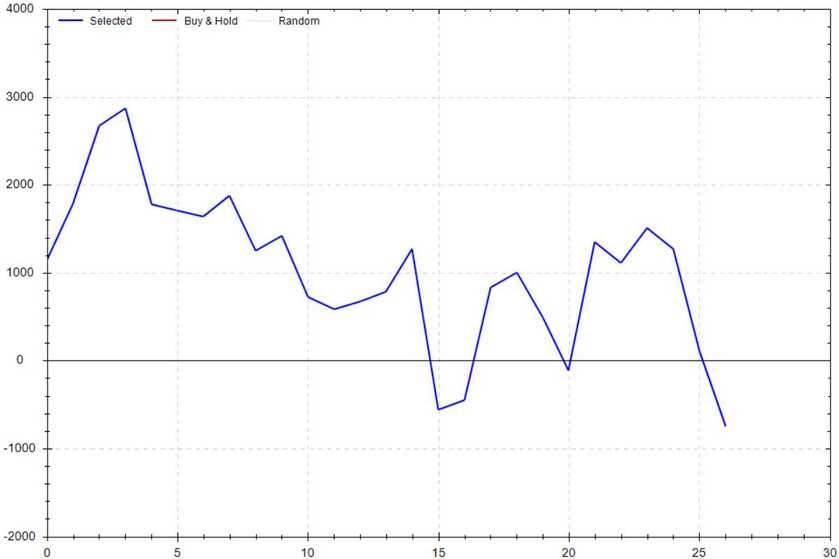

S&P 500 Seasonal Bias (Wednesday, June 18th)

- Bull Win Percentage: 52%

- Profit Factor: 0.91

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, June 19th)

- MARKET CLOSED (Juneteenth)

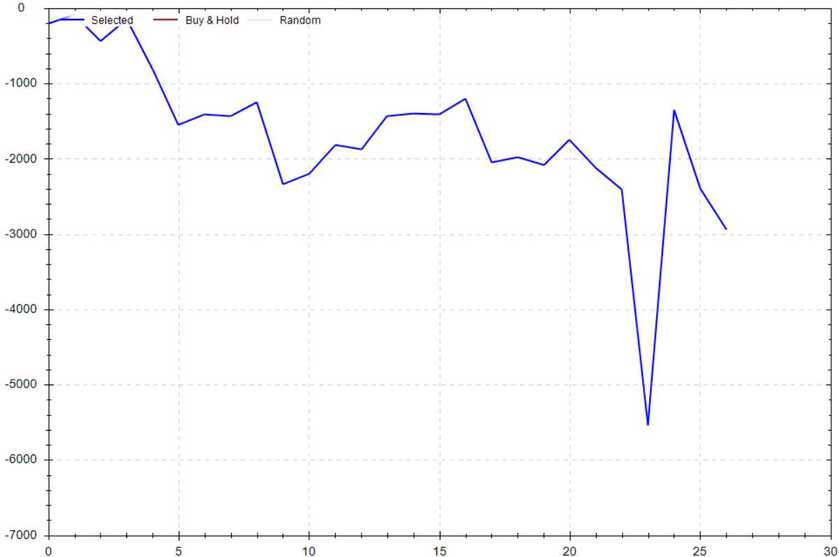

S&P 500 Seasonal Bias (Friday, June 20th)

- Bull Win Percentage: 44%

- Profit Factor: 0.69

- Bias: Leaning Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

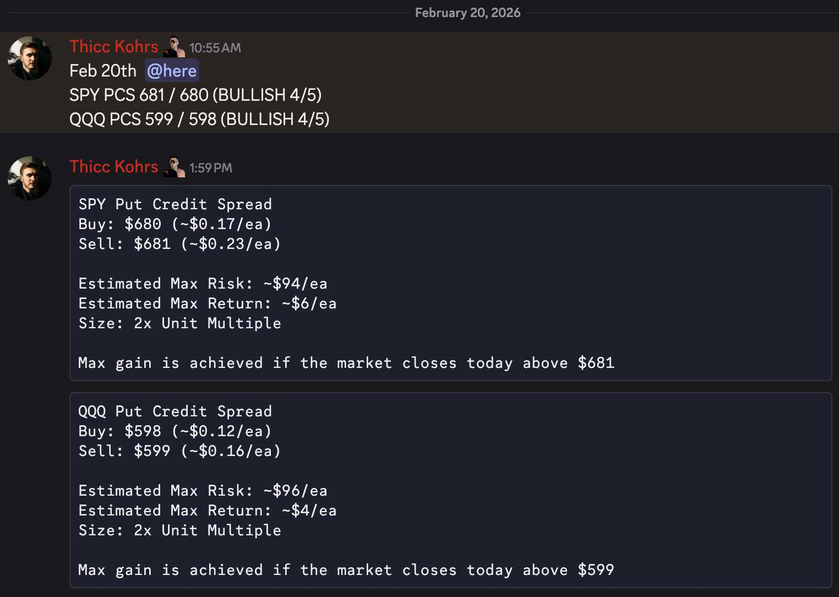

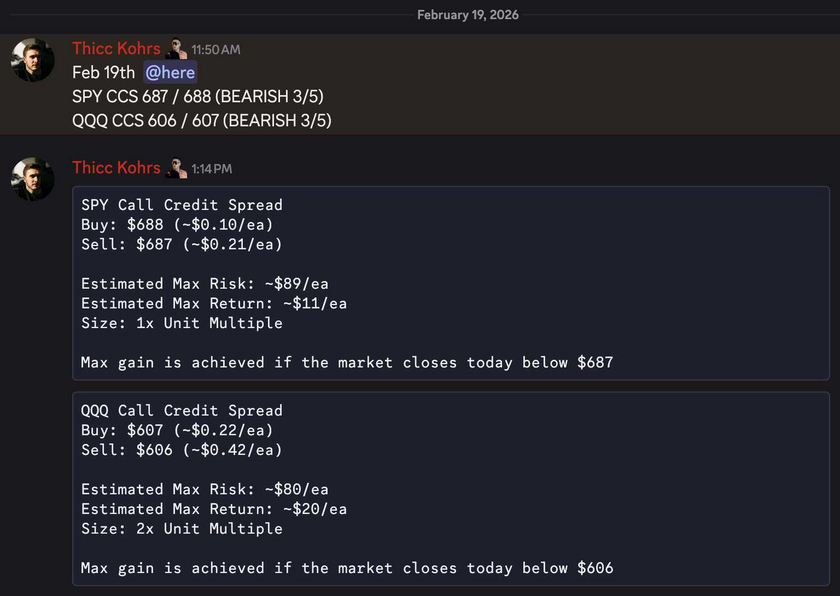

Options Strategy Update

The 0 DTE signal hit 8 for 10 times (16 for 20 total units) this past week.

Signal Accuracy: ~80%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 4 Trade

June Record: 26/32 Units

Monday, June 9th

SPY Put Credit Spread (3x Multiple @ $598 / $597) 🟢

QQQ Put Credit Spread (3x Multiple @ $528 / $527) 🟢

Tuesday, June 10th

SPY Put Credit Spread (2x Multiple @ $600 / $599) 🟢

QQQ Put Credit Spread (2x Multiple @ $530 / $529) 🟢

Wednesday, June 11th

SPY Put Credit Spread (2x Multiple @ $602 / $601) 🔴

QQQ Put Credit Spread (2x Multiple @ $533 / $532) 🔴

Thursday, June 12th

SPY Call Credit Spread (1x Multiple @ $605 / $606) 🟢

QQQ Call Credit Spread (1x Multiple @ $536 / $537) 🟢

Friday, June 13th

SPY Call Credit Spread (2x Multiple @ $602 / $603) 🟢

QQQ Call Credit Spread (2x Multiple @ $532 / $533) 🟢

Sangria Consumed

18 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

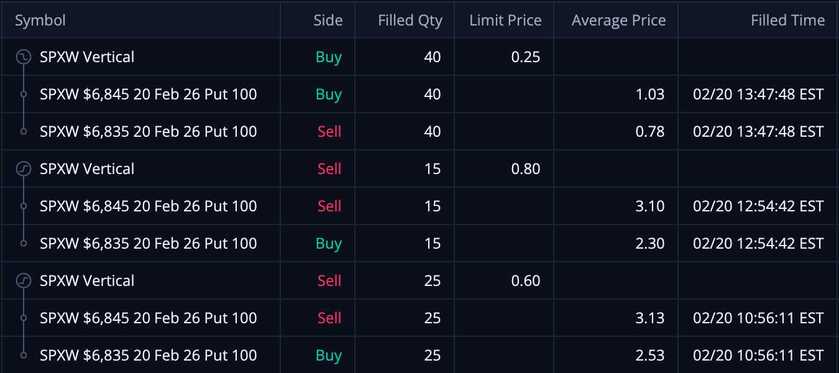

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

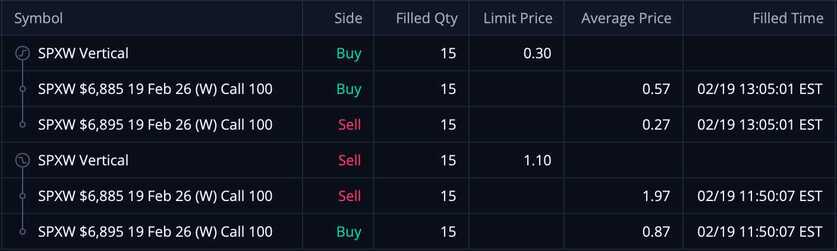

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

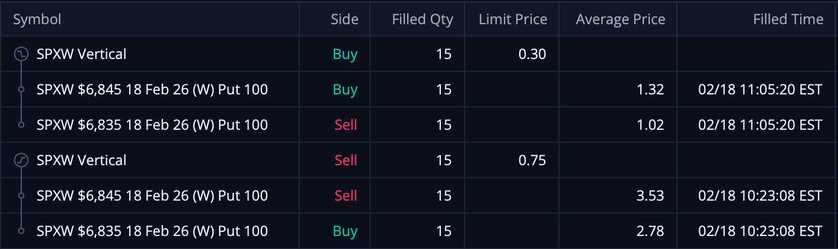

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!

These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!