Summer Time Sadness

Hey,

Key Weekly Performance Stats:

- S&P 500: -0.15%

- Nasdaq 100: -0.02%

- Russel 2000: +0.74%

- Bitcoin: -2.64%

Last week was a mixed bag for the stock market. The Dow closed flat at 42,207, the S&P 500 slipped 0.2% to 5,968, and the Nasdaq edged up 0.2% to 19,447. Sector performance was uneven—financials and energy posted gains of 0.89% and 0.87%, while healthcare and basic materials lagged, dropping 2.43% and 1.33%, respectively. On the stock level, EchoStar soared 49.29%, while solar names like Sunrun tumbled nearly 38%, showing just how sector-specific the action was.

On the economic front, the data was just as mixed. The Fed held interest rates steady at 4.25%–4.5% for the fourth straight meeting. Q1 GDP growth came in at –0.2%, but the outlook for Q2 is much stronger, with estimates around 3.4%. Retail sales fell 0.9% in May, though core sales (excluding autos and gas) rose 0.4%—a sign that spending is still holding up in key areas. Inflation continues to ease, with core PCE in April hitting a four-year low. May’s read is expected at 2.6%, but thanks to rising tariffs—now at 15%, the highest since 1936—the full-year inflation forecast was revised up to 3.1%.

Looking ahead, there are big events are on deck. All eyes will be on the PCE inflation data dropping June 27, a key signal for the Fed’s next move. Fed Chair Jerome Powell will testify before Congress on June 24 and 25—expect markets to hang on every word. We’ll also get updates on consumer confidence and new home sales early in the week, both of which could shape sentiment heading into July. And while it’s not a direct economic indicator, geopolitical tension between the U.S. and Iran is heating up. As of this writing, oil prices are spiking—any escalation could drive further volatility, so it’s something to keep a close eye on.

Best,Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

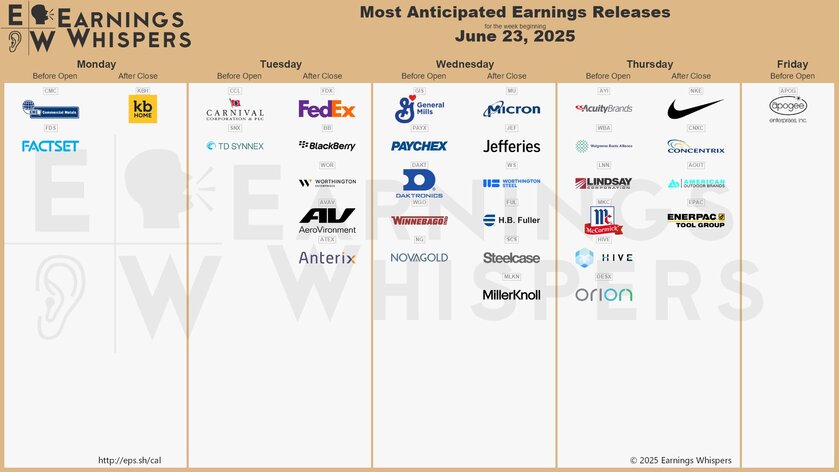

Earnings

Monday, June 23rd

None

Tuesday, June 24th

Morning: Carnival

Evening: BlackBerry & FedEx

Wednesday, June 25th

Morning: General Mills

Evening: Micron

Thursday, June 26th

Morning: Walgreens

Evening: Nike

Friday, June 27th

None

Market Events

Monday, June 23rd

09:45 AM ET S&P Global Manufacturing & Services PMI (June)

10:00 AM ET Existing Home Sales (May)

Tuesday, June 24th

10:00 AM ET Consumer Confidence (June)

10:00 AM ET Fed Chair Powell Testifies

01:00 PM ET 2-Year Bond Auction

Wednesday, June 25th

10:00 AM ET New Home Sales (May)

01:00 PM ET 5-Year Bond Auction

Thursday, June 26th

08:30 AM ET GDP QoQ 2nd Reading (Q1)

08:30 AM ET Durable Goods Orders MoM & YoY (May)

08:30 AM ET Initial Jobless Claims

01:00 PM ET 7-Year Bond Auction

Friday, June 27th

08:30 AM ET PCE Price Index MoM & YoY

08:30 AM ET Personal Spending & Income

10:00 AM ET Consumer Sentiment

Seasonality Update

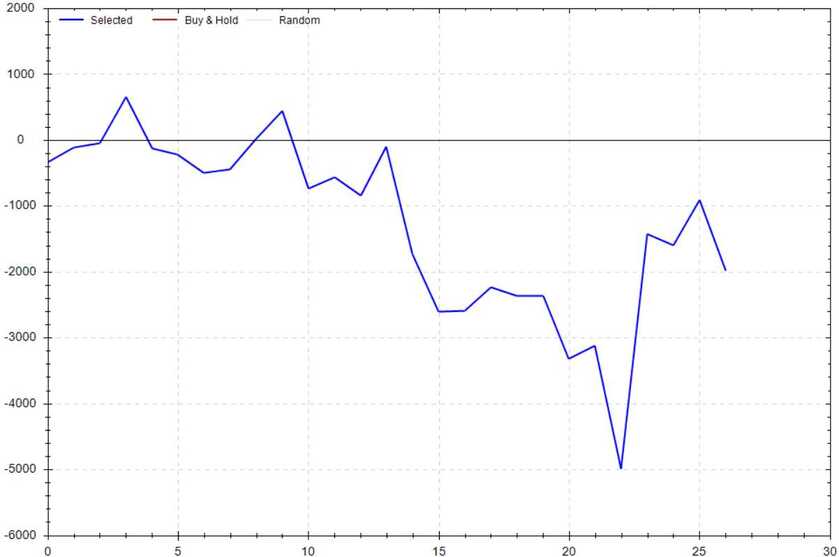

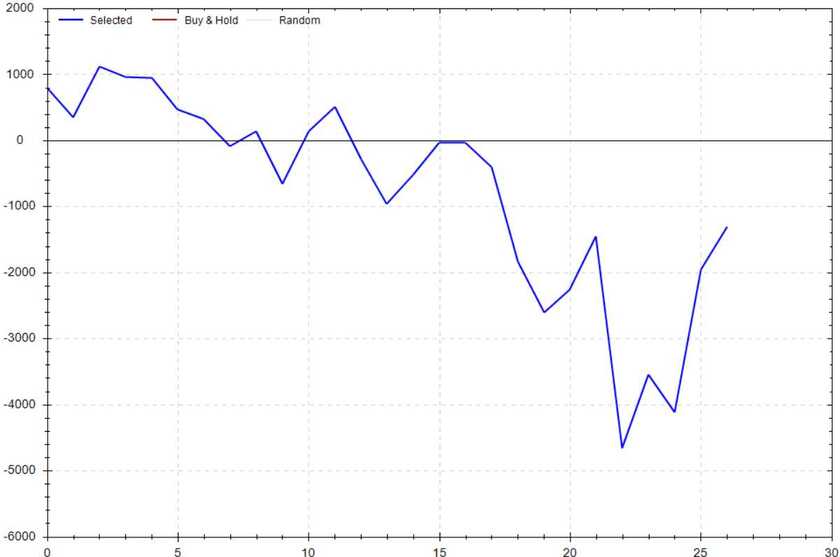

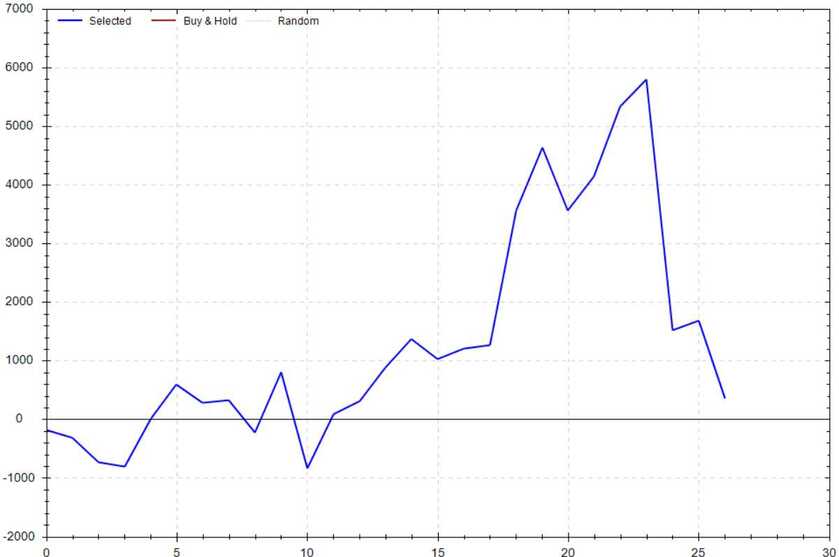

S&P 500 Seasonal Bias (Monday, June 23rd)

- Bull Win Percentage: 48%

- Profit Factor: 0.79

- Bias: Bearish

Equity Curve -->

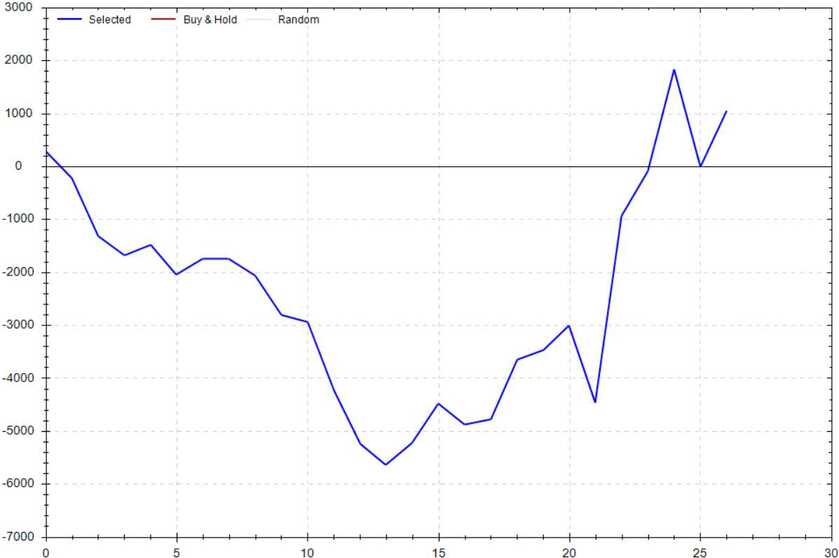

S&P 500 Seasonal Bias (Tuesday, June 24th)

- Bull Win Percentage: 48%

- Profit Factor: 1.10

- Bias: Leaning Bullish

Equity Curve -->

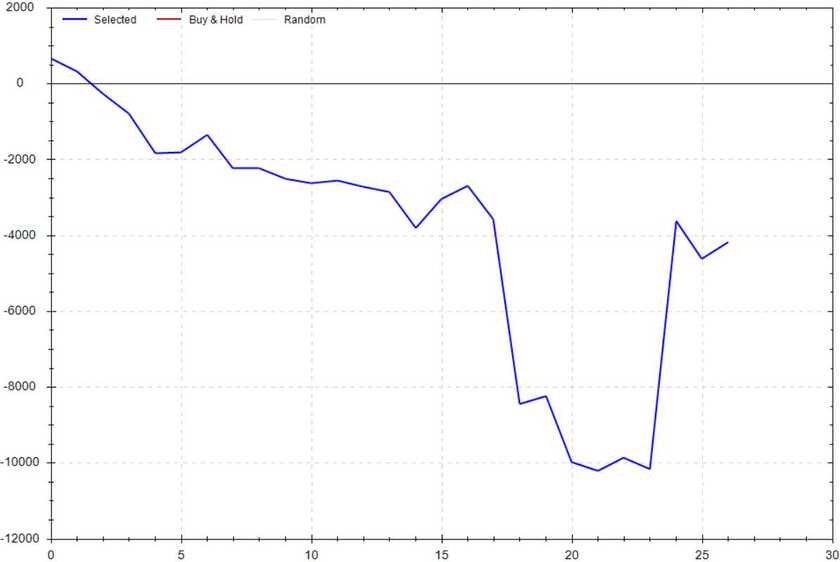

S&P 500 Seasonal Bias (Wednesday, June 25th)

- Bull Win Percentage: 37%

- Profit Factor: 0.70

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, June 26th)

- Bull Win Percentage: 44%

- Profit Factor: 0.87

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, June 27th)

- Bull Win Percentage: 59%

- Profit Factor: 1.03

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

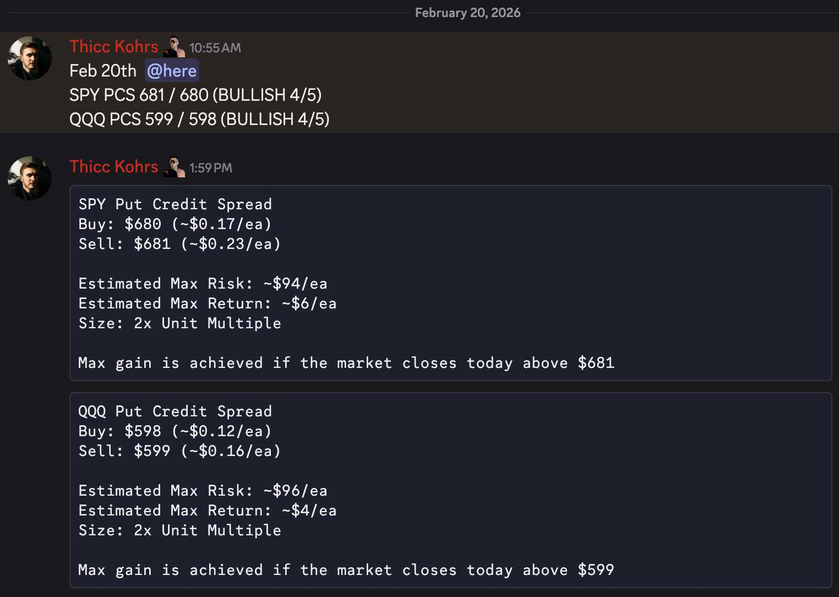

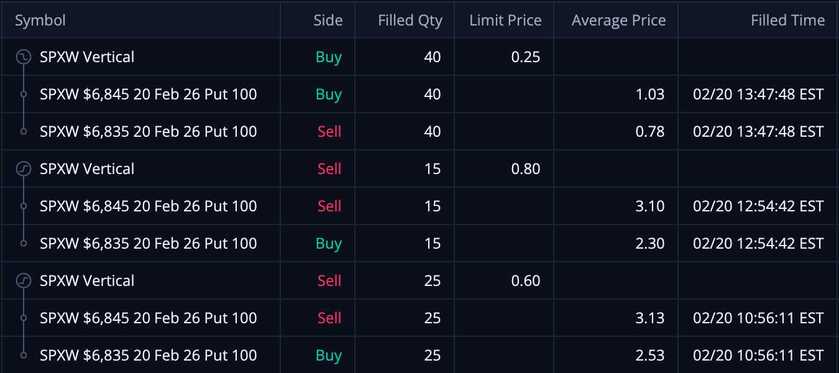

The 0 DTE signal hit 4 for 6 times (8 for 10 total units) this past week.

Signal Accuracy: ~66%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 2 Trade

June Record: 26/32 Units

Monday, June 16th

SPY Put Credit Spread (2x Multiple @ $600 / $599) 🟢

QQQ Put Credit Spread (2x Multiple @ $530 / $529) 🟢

Tuesday, June 17th

SPY Put Credit Spread (1x Multiple @ $599 / $598) 🔴

QQQ Put Credit Spread (1x Multiple @ $530 / $529) 🔴

Wednesday, June 18th

No Signal Produced (FOMC Meeting)

Thursday, June 19th

No Signal Produced (Market Closed)

Friday, June 20th

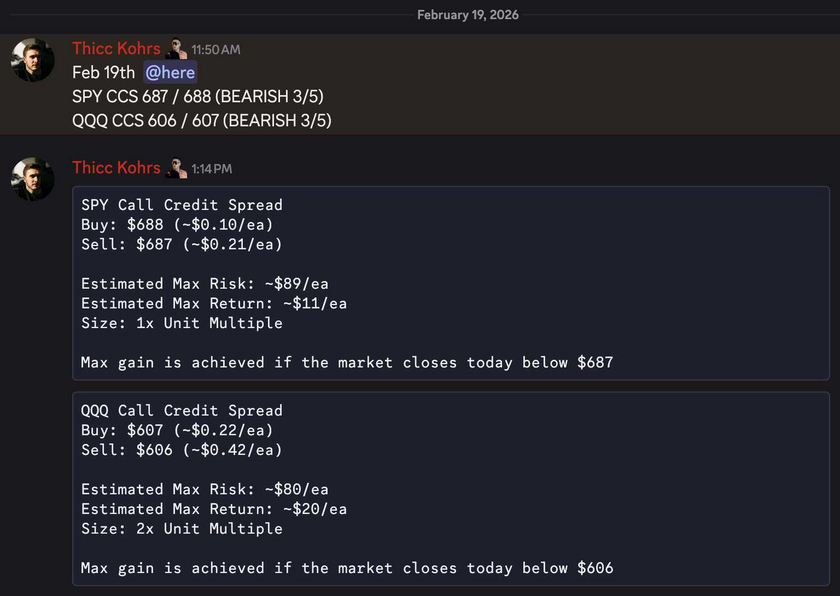

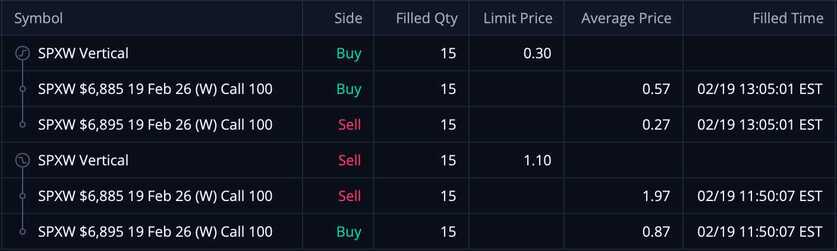

SPY Call Credit Spread (2x Multiple @ $600 / $601) 🟢

QQQ Call Credit Spread (2x Multiple @ $534 / $535) 🟢

Tanning Sessions At The Local Dark Pool

4 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

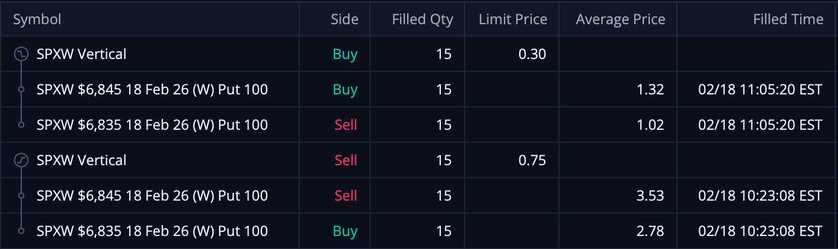

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!

These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!