Record Highs!

Hey,

Key Weekly Performance Stats:

- S&P 500: +3.44%

- Nasdaq 100: +4.20%

- Russel 2000: +3.80%

- Bitcoin: +3.67%

Last week, markerts surged!!! The S&P 500 pumped up 3.4% to 6,173, the Nasdaq gained 4.2% to 20,273, and the Dow jumped 3.8% to 43,819 — all closing at record highs. The rally was driven by a ceasefire between Israel and Iran, which eased geopolitical tensions and sent oil prices sharply lower. That, combined with growing optimism around Fed rate cuts (two or three expected this year), boosted investor confidence. Tech stocks, especially AI names like Nvidia and Microsoft, led the charge.

On the economic front, WTI crude dropped 13% to $65 a barrel, helping ease inflation worries. May’s core PCE came in at 2.7% — slightly above estimates but still supportive of a potential Fed pivot. Retail sales continued to disappoint, hinting at slowing consumer momentum. The Fed maintained its outlook for two rate cuts this year, with long-term rates expected to settle around 3%.

Looking ahead, the week ahead is packed with key data. Chicago PMI hits on June 30, followed by construction spending, ISM manufacturing, and JOLTS on July 1. ADP employment numbers arrive July 2, and the big one — June’s jobs report — drops July 3. With markets closed on the 4th, expect lighter trading late in the week, though surprises in economic data or global headlines could still move markets. As always, stick to your trading plan and respect your risk. Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, June 30th

09:45 AM ET Chicago PMI (June)

Tuesday, July 1st

05:00 AM ET Eurozone CPI MoM & YoY (June)

09:30 AM ET Fed Chair Powell Speaks

09:45 AM ET S&P Global Manufacturing PMI (June)

10:00 AM ET ISM Manufacturing PMI & Prices (June)

10:00 AM ET JOLTS Job Openings (May)

Wednesday, July 2nd

08:15 AM ET ADP Nonfarm Employment Change (June)

Thursday, July 3rd

08:30 AM ET Unemployment Rate & Nonfarm Payrolls (June)

08:30 AM ET Avg. Hourly Earnings (June)

08:30 AM ET Initial Jobless Claims

09:45 AM ET S&P Global Services PMI (June)

10:00 AM ET ISM Non-Manufacturing PMI & Prices (June)

01:00 PM ET Market Closes Early

Friday, July 4th

ALL DAY MARKET CLOSED (Independence Day)

Seasonality Update

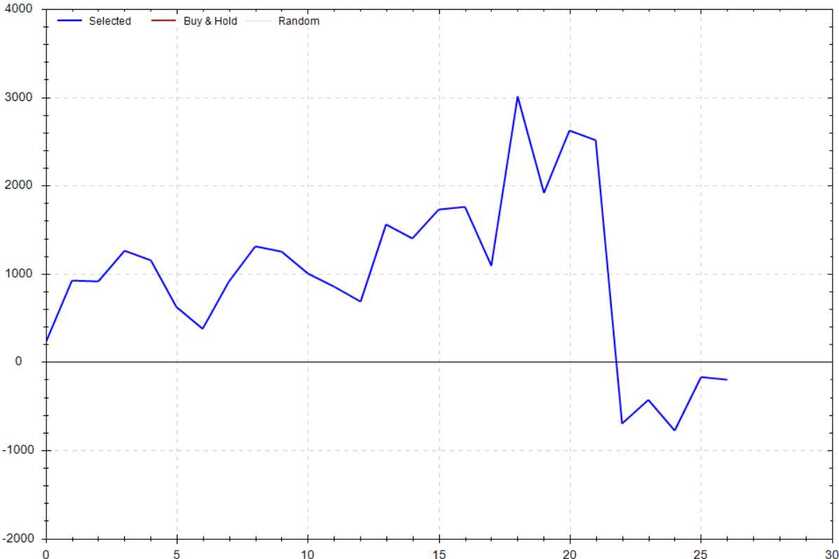

S&P 500 Seasonal Bias (Monday, June 30th)

- Bull Win Percentage: 44%

- Profit Factor: 0.97

- Bias: Neutral

Equity Curve -->

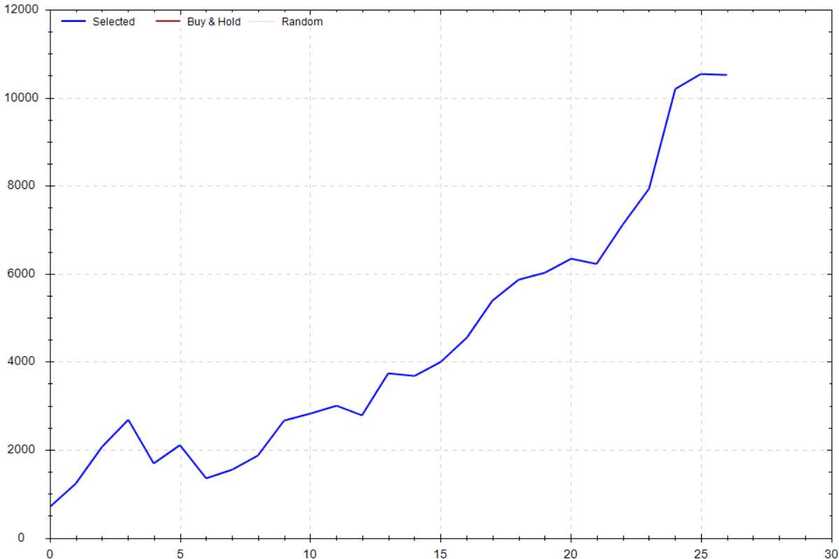

S&P 500 Seasonal Bias (Tuesday, July 1st)

- Bull Win Percentage: 78%

- Profit Factor: 5.78

- Bias: Bullish

Equity Curve -->

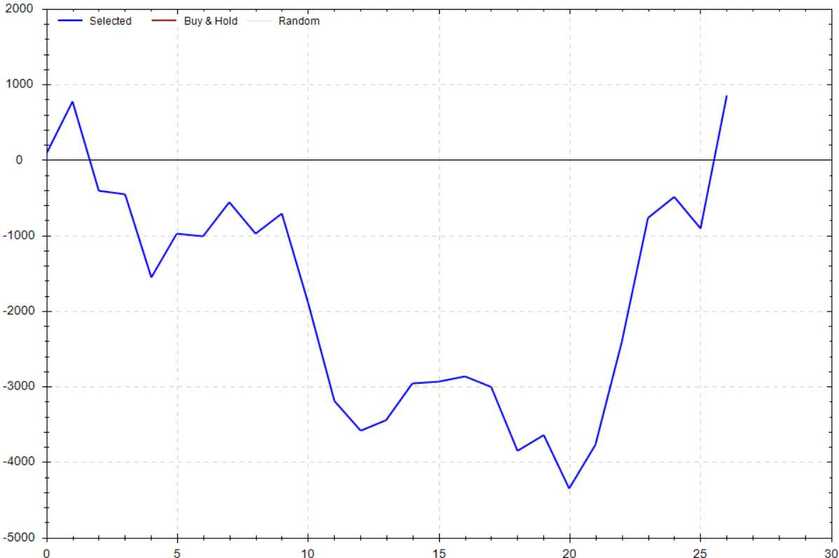

S&P 500 Seasonal Bias (Wednesday, July 2nd)

- Bull Win Percentage: 56%

- Profit Factor: 1.11

- Bias: Leaning Bullish

Equity Curve -->

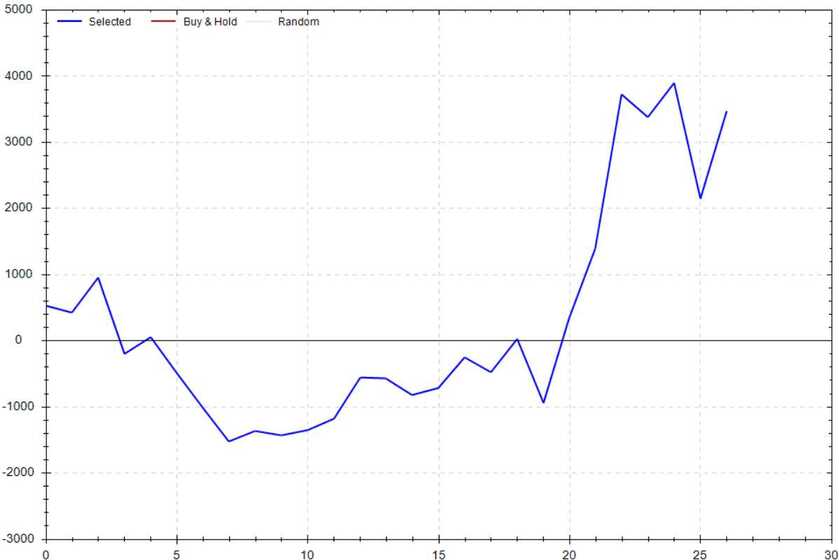

S&P 500 Seasonal Bias (Thursday, July 3rd)

- MARKET CLOSES @ 1:00pm ET

- Bull Win Percentage: 56%

- Profit Factor: 1.54

- Bias: Leaning Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, July 4th)

- MARKET CLOSED

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

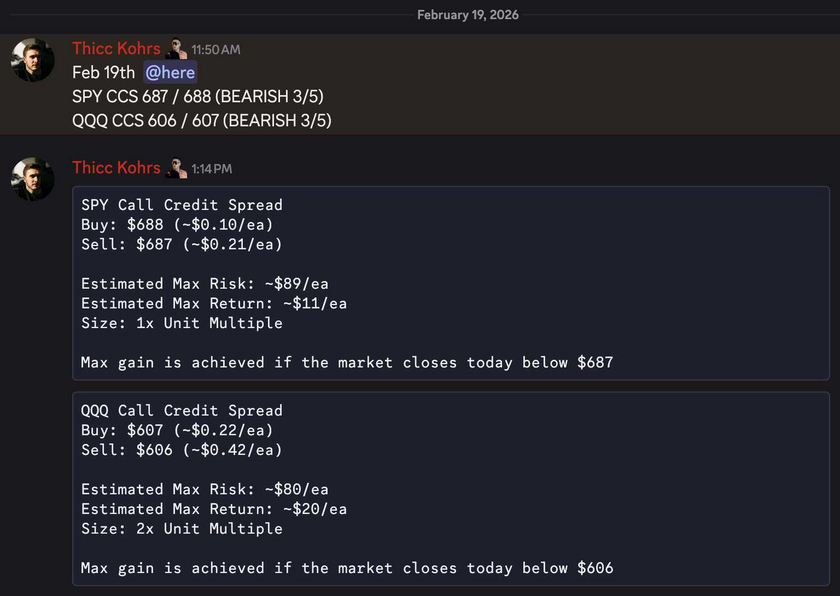

Options Strategy Update

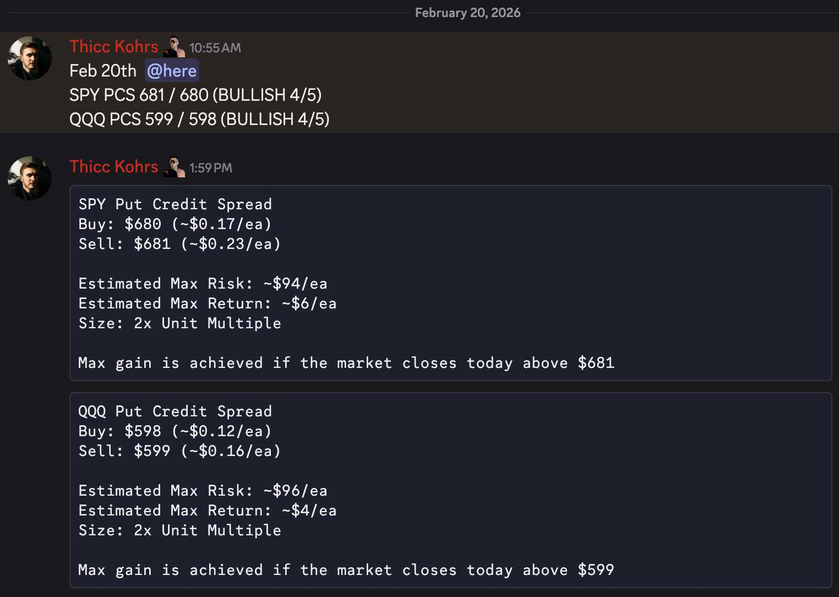

The 0 DTE signal hit 9 for 10 times (24 for 26 total units) this past week.

Signal Accuracy: ~90%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 9 Trade

June Record: 50/58 Units

Monday, June 23rd

SPY Call Credit Spread (2x Multiple @ $600 / $601) 🔴

QQQ Call Credit Spread (2x Multiple @ $532 / $533) 🟢

Tuesday, June 24th

SPY Put Credit Spread (3x Multiple @ $603 / $602) 🟢

QQQ Put Credit Spread (3x Multiple @ $536 / $535) 🟢

Wednesday, June 25th

SPY Put Credit Spread (2x Multiple @ $605 / $604) 🟢

QQQ Put Credit Spread (2x Multiple @ $539 / $538) 🟢

Thursday, June 26th

SPY Put Credit Spread (3x Multiple @ $607 / $606) 🟢

QQQ Put Credit Spread (3x Multiple @ $540 / $539) 🟢

Friday, June 27th

SPY Put Credit Spread (3x Multiple @ $611 / $610) 🟢

QQQ Put Credit Spread (3x Multiple @ $545 / $544) 🟢

Stream Rant Count

1,228 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

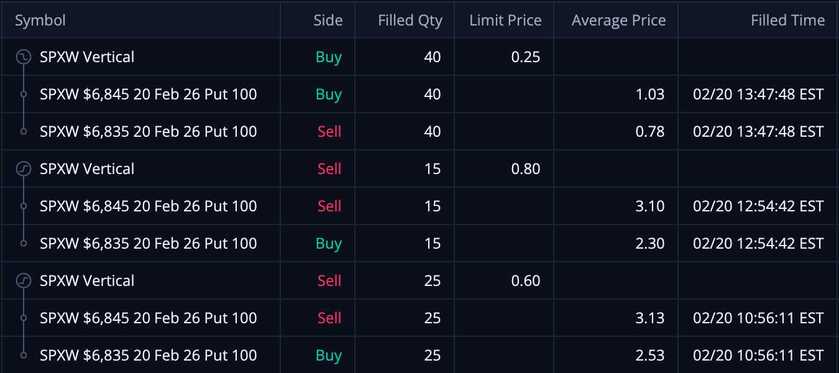

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

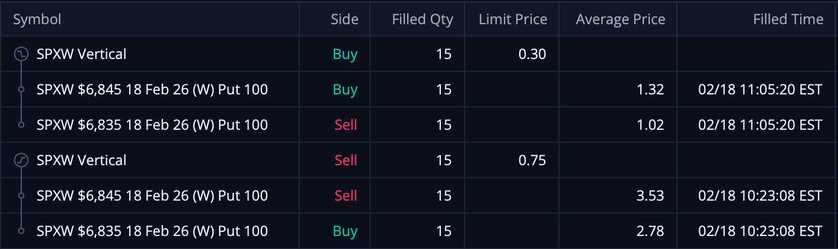

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

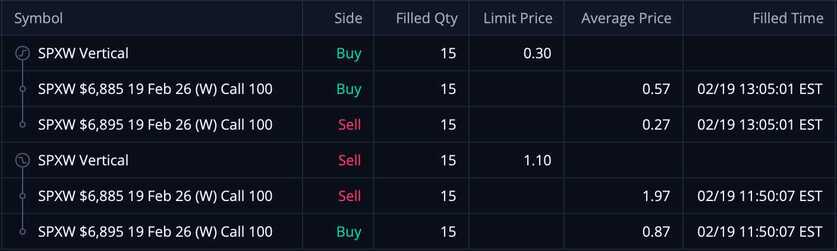

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!

These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!