Hello October!

Key Weekly Performance Stats:

- S&P 500: +1.08%

- Nasdaq 100: +1.15%

- Russel 2000: +1.66%

- Bitcoin: +11.51%

Last week, stocks finished mostly higher, with the S&P 500 and NASDAQ notching fresh records. Optimism lingered around the Fed’s potential for further rate cuts, helping offset mixed earnings and uneven sector performance. Defensives and dividend payers saw renewed strength as traders rotated slightly away from momentum names heading into October.

The macro backdrop turned murky after the government shutdown froze major data releases, including the September jobs report. That left investors relying on private signals, like ADP’s payroll data showing a 32,000-job drop and the ISM services index slipping to 50—right on the edge of contraction. Together, the numbers painted a picture of a slowing but not collapsing economy, keeping the “soft landing” narrative alive even as uncertainty grew.

With official data on pause, markets drifted mostly on sentiment, headlines, and hope. Volatility ticked up as traders waited for clarity, and attention shifted toward when the shutdown would end and the economic calendar could resume. Once it does, the long-delayed releases on employment, factory orders, and trade will set the tone for October—determining whether the Fed’s easing path still looks justified or if the market’s optimism has run too far ahead of the data.

Looking ahead to next week, we should finally find some answers. If the shutdown ends, the September jobs report, factory orders, and trade balance will all hit at once, offering the first real look at how resilient the economy remains. Every print will matter, especially with rate-cut hopes hanging on evidence that growth is cooling but not collapsing. As always, stick to your trading plan and respect your risk. Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Oct 6th

None

Tuesday, Oct 7th

03:00 PM ET Consumer Credit (Aug)

Wednesday, Oct 8th

10:30 AM ET Crude Oil Inventories

01:00 PM ET 10-Year Note Auction

Thursday, Oct 9th

08:30 AM ET Fed Chair Powell Speech

08:30 AM ET Initial Jobless Claims

01:00 PM ET 30-Year Bond Auction

Friday, Oct 10th

08:30 AM ET Unemployment Report (Sep) (Maybe)

08:30 AM ET Nonfarm Payrolls (Sep) (Maybe)

10:00 AM ET Consumer Credit (Oct)

Seasonality Update

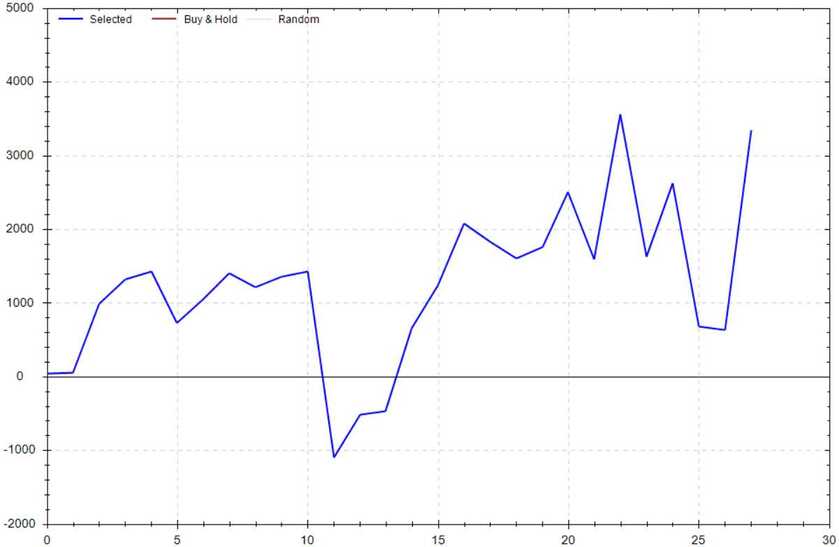

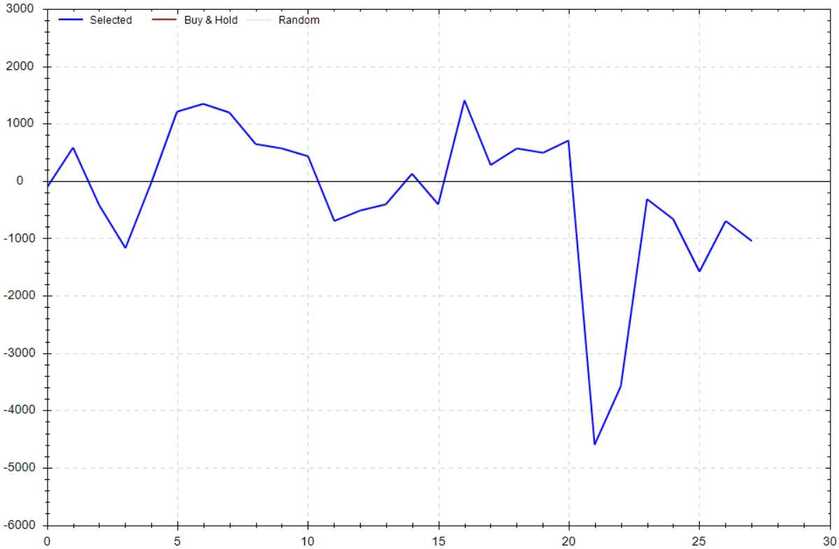

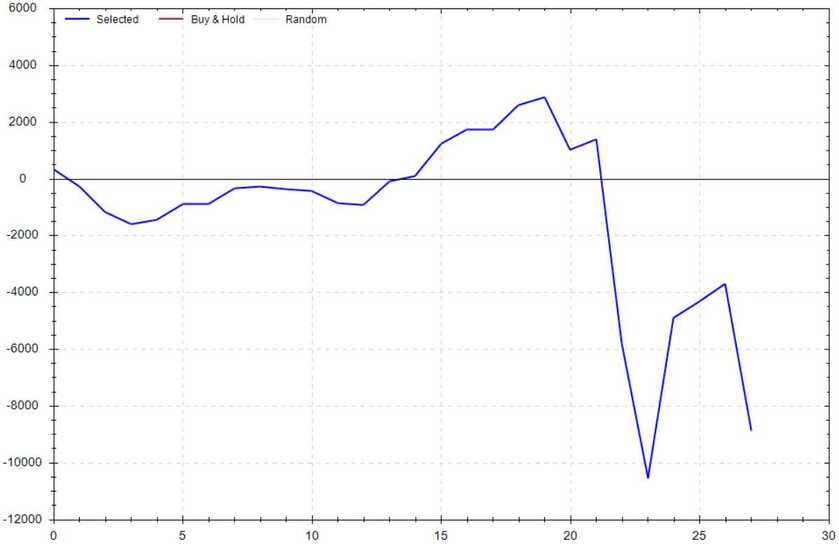

S&P 500 Seasonal Bias (Monday, Oct 6th)

- Bull Win Percentage: 68%

- Profit Factor: 1.38

- Bias: Leaning Bullish

Equity Curve -->

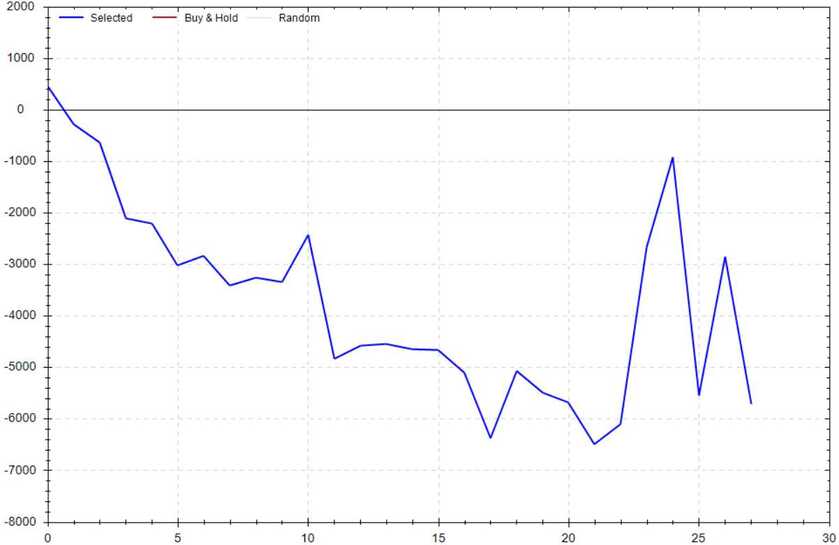

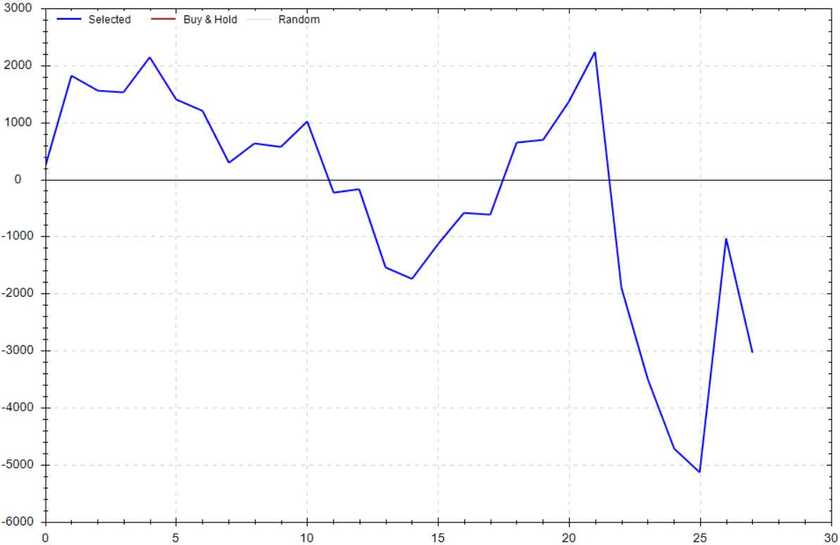

S&P 500 Seasonal Bias (Tuesday, Oct 7th)

- Bull Win Percentage: 39%

- Profit Factor: 0.67

- Bias: Bearish

Equity Curve -->

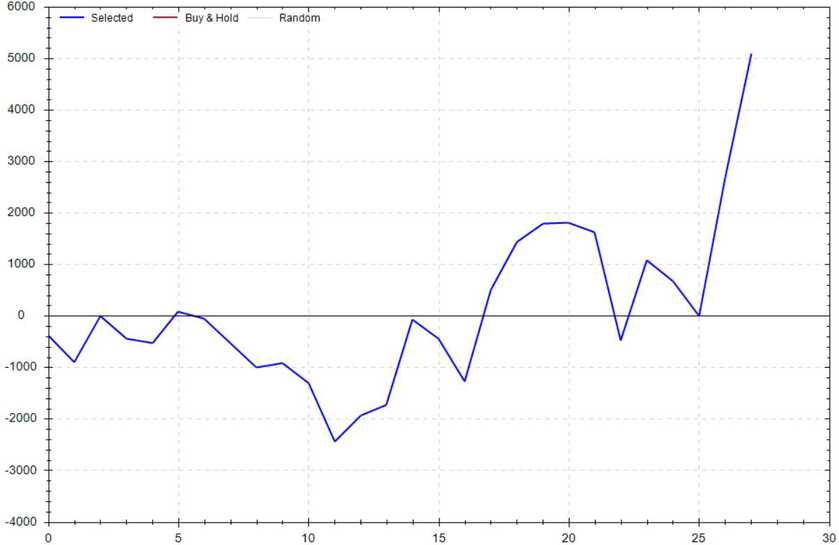

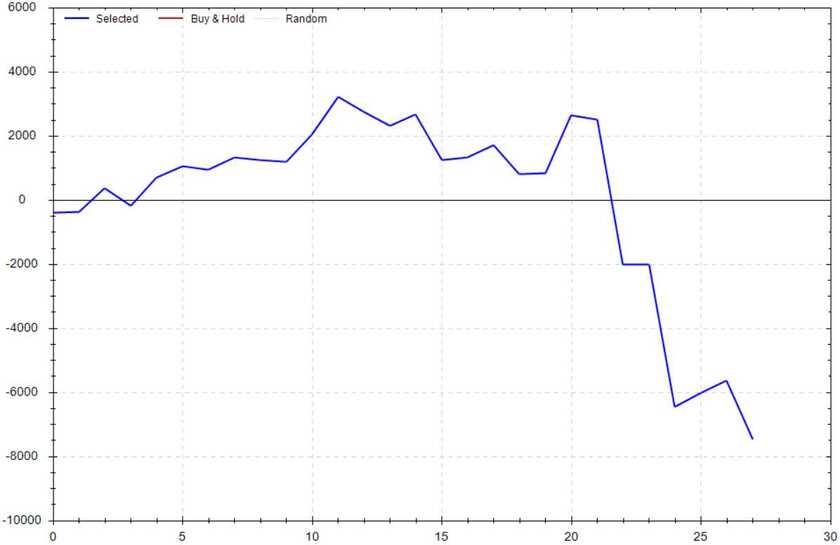

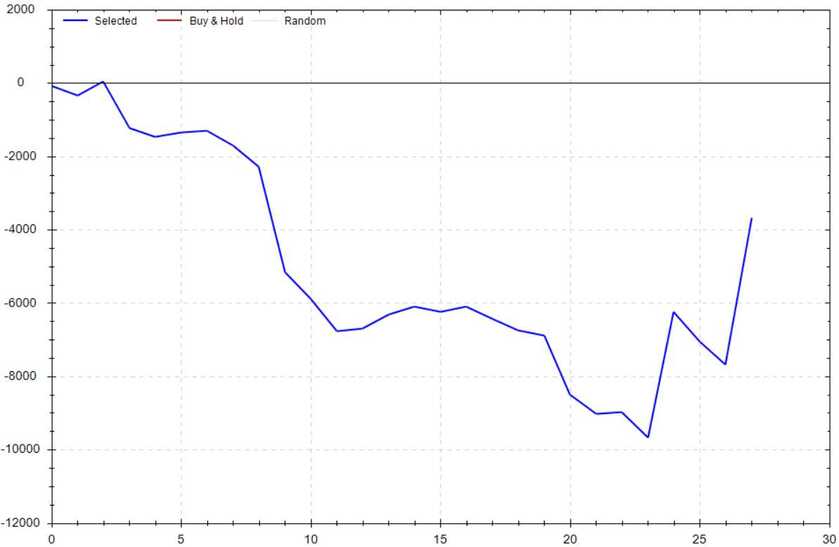

S&P 500 Seasonal Bias (Wednesday, Oct 8th)

- Bull Win Percentage: 46%

- Profit Factor: 1.59

- Bias: Leaning Bullish

Equity Curve -->

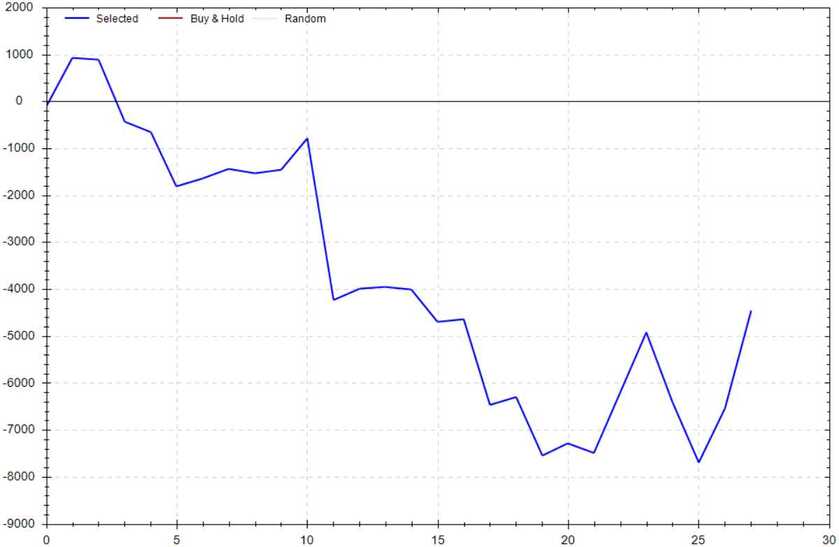

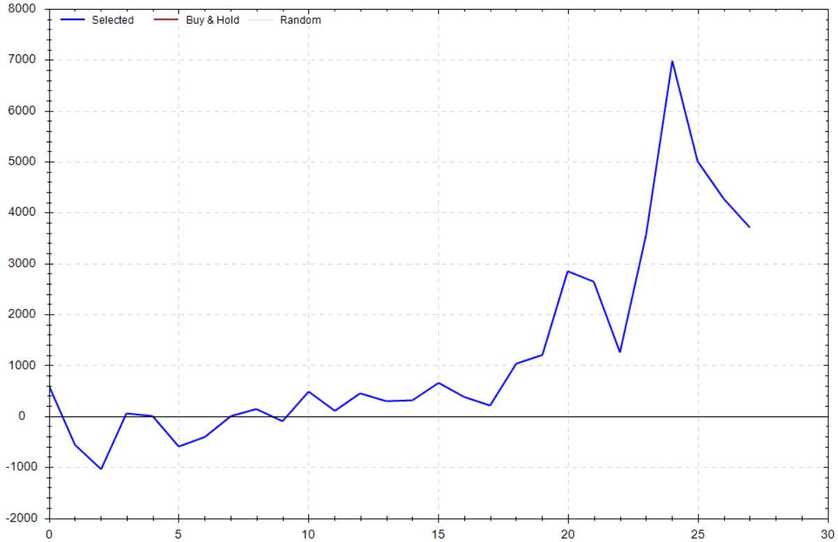

S&P 500 Seasonal Bias (Thursday, Oct 9th)

- Bull Win Percentage: 50%

- Profit Factor: 0.66

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Oct 10th)

- Bull Win Percentage: 46%

- Profit Factor: 0.92

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

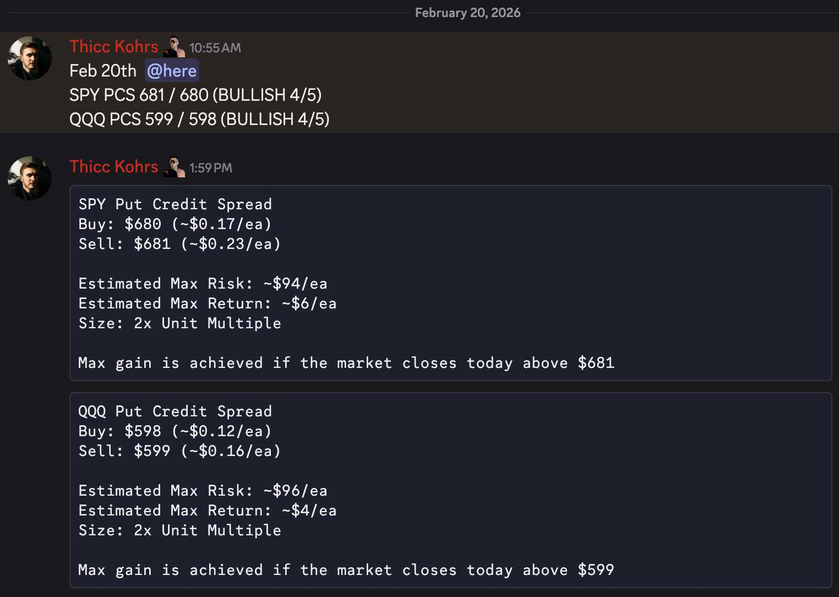

The 0 DTE signal hit 5 for 6 times (12 for 14 total units) this past week.

Signal Accuracy: ~83.33%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 1 Trade

September Record: 54/54 Units

October Record: 12/14 Units

Monday, Sept 29th

No Signal Produced

Tuesday, Sept 30th

No Signal Produced

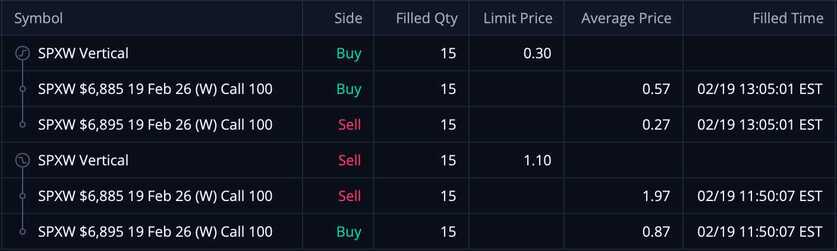

Wednesday, Oct 1st

SPY Put Credit Spread (3x Multiple @ $662 / $661) 🟢

QQQ Put Credit Spread (3x Multiple @ $595/ $594) 🟢

Thursday, Oct 2nd

SPY Put Credit Spread (2x Multiple @ $665 / $664) 🟢

QQQ Put Credit Spread (2x Multiple @ $602/ $601) 🟢

Friday, Oct 3rd

SPY Put Credit Spread (2x Multiple @ $669 / $668) 🟢

QQQ Put Credit Spread (2x Multiple @ $604 / $603) 🔴

Times I Wore The Same Shirt on Stream

0 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

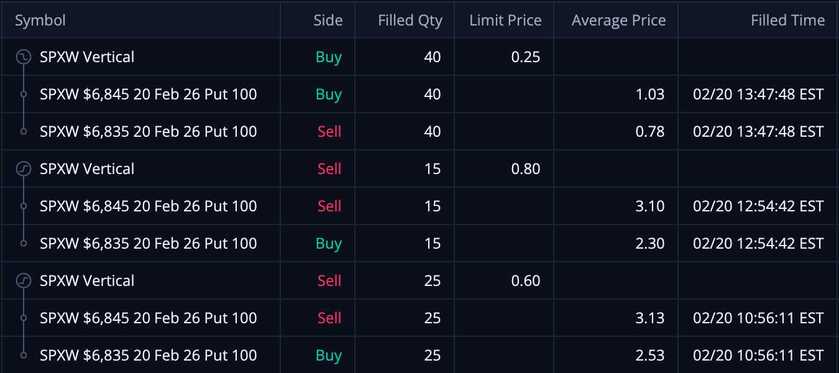

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

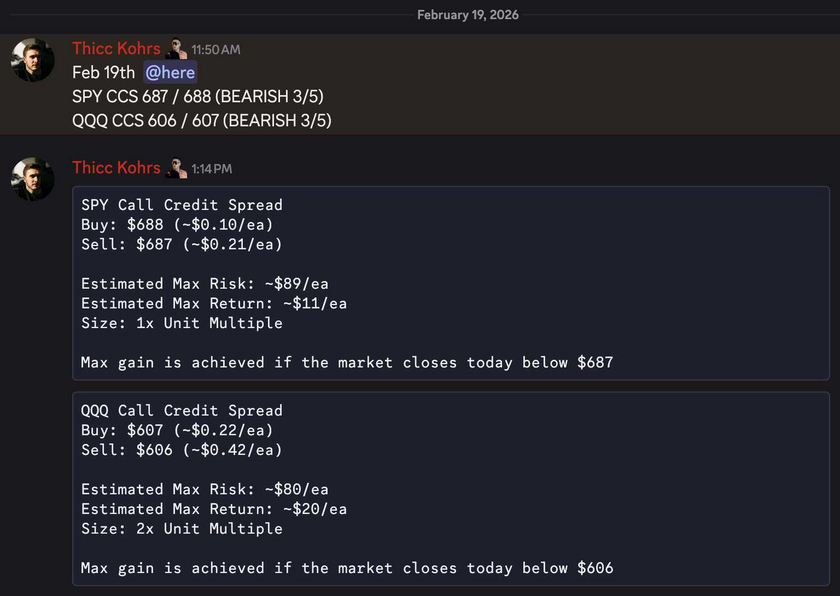

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!