Goodbye October, Hello November

Key Weekly Performance Stats:

- S&P 500: +0.71% (New High)

- Nasdaq 100: +1.94% (New High)

- Russel 2000: -1.28%

- Bitcoin: -1.34%

Last week, market momentum held strong to close out October. The S&P 500 climbed around 0.7%, and the Nasdaq popped roughly 2.2%, buoyed by standout tech earnings from the likes of Amazon and fresh strength in longer-dated Treasuries following the Federal Reserve’s announcement. Growth stocks carried the day, while smaller-cap names lagged behind -- funny how the size of your ticker still matters.

The economic calendar delivered its punchy moments: On Tuesday, the Consumer Confidence print came in a bit softer (94.6). Wednesday was full force with the Fed lowering rates by 25 bps to 3.75% and leaned into a “we’ll see how the data looks” narrative. Additionally, various positive (ie bullish) developments were revealed with the current US-China Trade War. It should also be noted that most, not all major earnings reports were received well by the market.

Looking ahead to next week, keep tabs on a few key releases. Monday kicks things off with the final October U.S. Manufacturing PMI from S&P Global and the ISM manufacturing index. Tuesday brings September’s trade numbers and factory orders, plus JOLTS job-openings data (potentially). Friday will round it out with both Consumer Sentiment & Consumer Credit. As always, respect your risk and stick to your trading plan. Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, Nov 3rd

Morning: Berkshire Hathaway

Evening: Palantir

Tuesday, Nov 4th

Morning: Hut 8, Pfizer, Shopify, Spotify & Uber

Evening: AMD & Supermicro

Wednesday, Nov 5th

Morning: McDonald's & Unity

Evening: IONQ, Robinhood, Qualcomm & Snap

Thursday, Nov 6th

Evening: Airbnb & Draft Kings

Friday, Nov 7th

Morning: Wendy's

Market Events

Monday, Nov 3rd

09:45 AM ET S&P Global Manufacturing PMI (Oct)

10:00 AM ET ISM Manufacturing PMI & Prices (Oct)

Tuesday, Nov 4th

10:00 AM ET JOLTs Job Openings (Sep) (Maybe)

Wednesday, Nov 5th

08:15 AM ET ADP Nonfarm Employment Change (Oct)

09:45 AM ET S&P Global Services PMI (Oct)

10:00 AM ET ISM Non-Manufacturing PMI & Prices (Oct)

Thursday, Nov 6th

None

Friday, Nov 7th

10:00 AM ET Consumer Sentiment

03:00 PM ET Consumer Credit

Seasonality Update

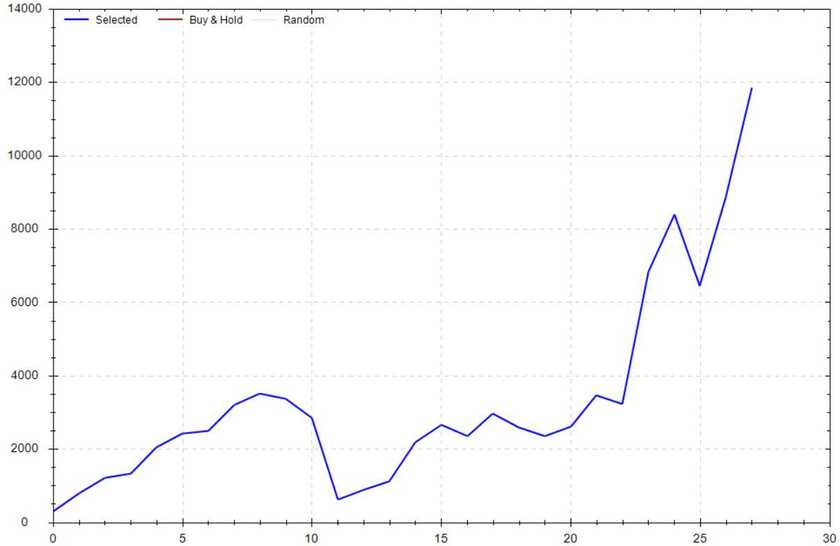

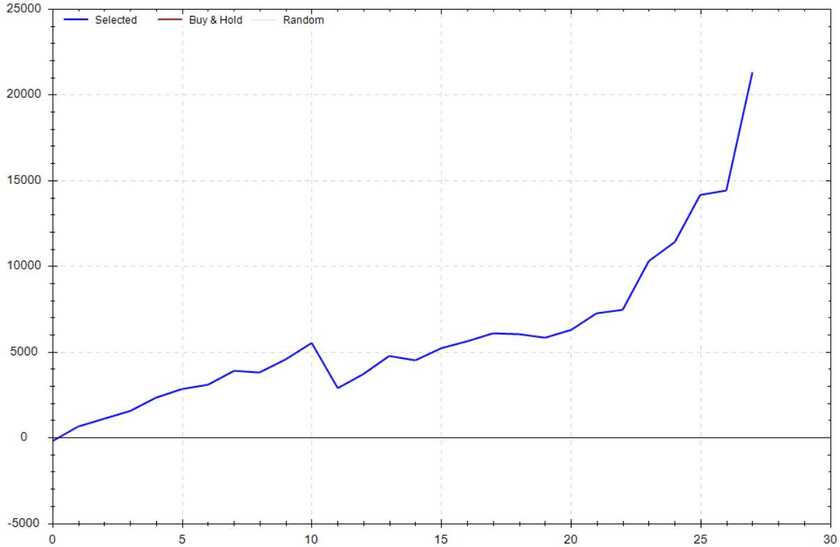

S&P 500 Seasonal Bias (Monday, Nov 3rd)

- Bull Win Percentage: 64%

- Profit Factor: 2.52

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Tuesday, Nov 4th)

- Bull Win Percentage: 64%

- Profit Factor: 1.78

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Wednesday, Nov 5th)

- Bull Win Percentage: 72%

- Profit Factor: 2.98

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, Nov 6th)

- Bull Win Percentage: 78%

- Profit Factor: 7.16

- Bias: Very Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Nov 7th)

- Bull Win Percentage: 61%

- Profit Factor: 2.24

- Bias: Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

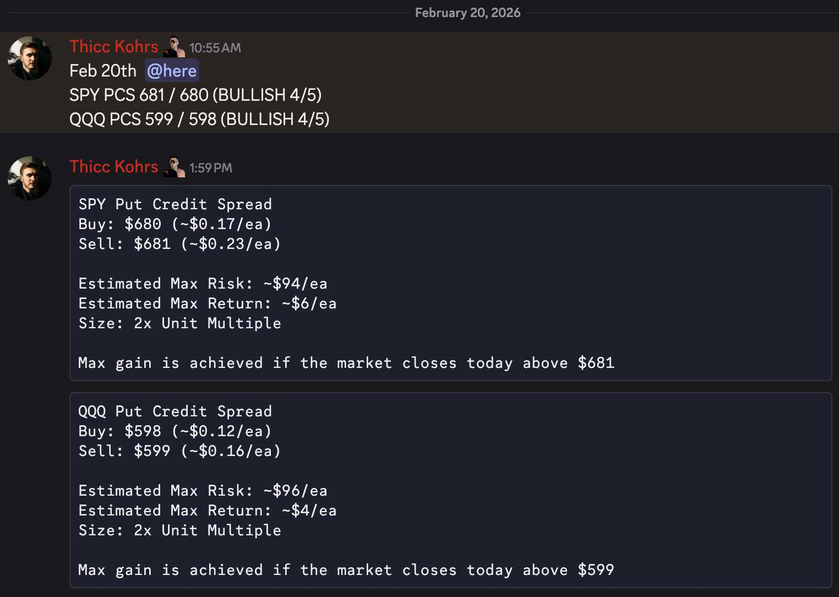

Options Strategy Update

The 0 DTE signal hit 7 for 8 times (16 for 18 total units) this past week.

Signal Accuracy: ~87.5%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 5 Trades

October Record: 62/66 Units

Monday, Oct 27th

SPY Put Credit Spread (2x Multiple @ $682 / $681) 🟢

QQQ Put Credit Spread (2x Multiple @ $624 / $623) 🟢

Tuesday, Oct 28th

SPY Call Credit Spread (2x Multiple @ $688 / $689) 🟢

QQQ Call Credit Spread (2x Multiple @ $633 / $632) 🔴

Wednesday, Oct 29th

No Signal Produced

Thursday, Oct 30th

SPY Call Credit Spread (2x Multiple @ $686 / $687) 🟢

QQQ Call Credit Spread (2x Multiple @ $634 / $635) 🟢

Friday, Oct 31st

SPY Call Credit Spread (3x Multiple @ $686 / $687) 🟢

QQQ Call Credit Spread (3x Multiple @ $635 / $636) 🟢

Halloween Candy Eaten

All of it *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

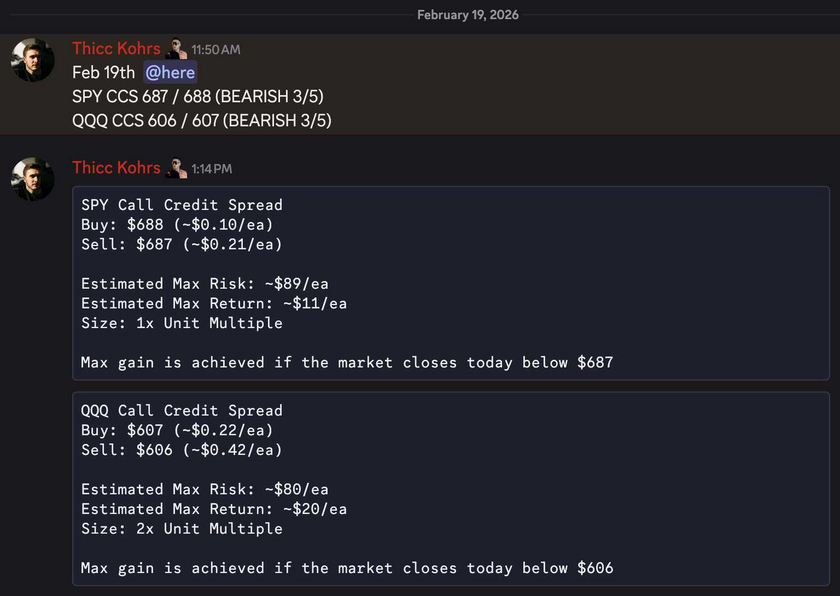

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

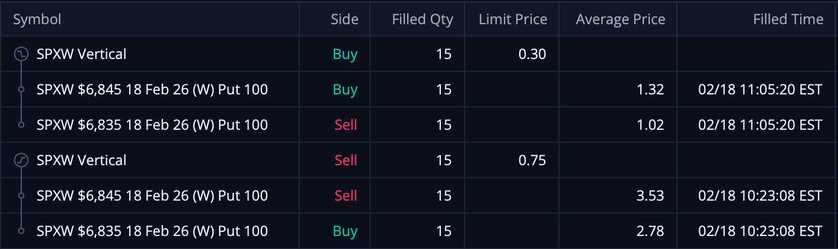

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

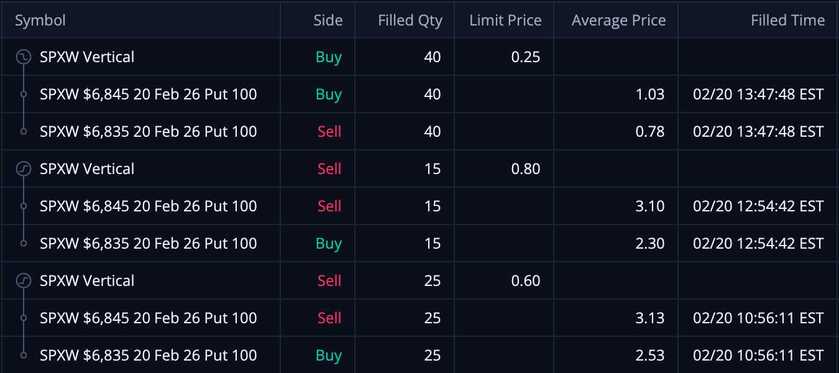

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

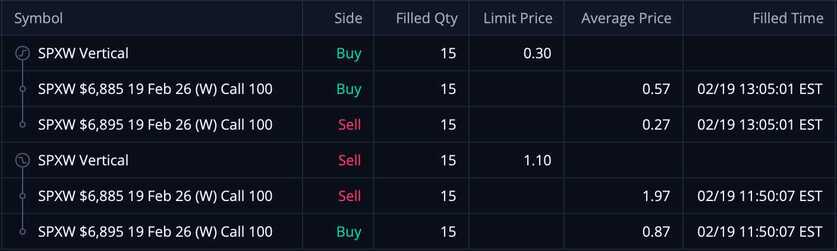

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!

These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!