Santa Is Coming!

Key Weekly Performance Stats:

- S&P 500: +0.31%

- Nasdaq 100: +1.01%

- Russel 2000: +1.11%

- Bitcoin: -1.71%

Last week, stocks drifted higher to start off December, with all three major indices inching toward record territory. It was one of those “quiet but confident” stretches where nothing rocked the boat and rate-cut hopes did most of the heavy lifting. Tech led the charge, small caps lagged, and Ulta Beauty stole headlines with a blowout quarter that gave the holiday retail narrative a nice shot of energy.

Economic data told a pretty mixed story, but nothing that rattled sentiment. Manufacturing stayed soft, services kept the expansion alive, and jobless claims slipped to their lowest level in nearly two years. ADP showed a small private-sector decline, Challenger layoffs cooled, and consumer sentiment ticked higher as inflation expectations eased. The only oddity: markets had to trade the week without a fresh jobs report since BLS delayed November’s release — meaning a lot of assumptions, not a lot of confirmation.

Looking ahead to next week, things get much busier. We’ll see the NFIB Small Business survey, updated productivity numbers, and long-awaited JOLTS data. But the real spotlight is Wednesday’s Fed meeting, complete with new projections and a Powell press conference. Then come PPI, jobless claims, and the Fed’s Flow of Funds on Thursday. Throughout the week, there will also be various bond auctions. As always, stick to your trading plan and respect your risk. Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, Dec 8th

None

Tuesday, Dec 9th

Evening: Cracker Barrel & GameStop

Wednesday, Dec 10th

Morning: Chewy

Evening: Adobe & Oracle

Thursday, Dec 11th

Evening: Broadcom, Costco & Lululemon

Friday, Dec 12th

None

Market Events

Monday, Dec 8th

None

Tuesday, Dec 9th

10:00 AM ET JOLTs Job Openings (Sep)

01:00 PM ET 10-Year Note Auction

Wednesday, Dec 10th

08:30 AM ET CPI MoM & YoY (Oct)

02:00 PM ET Fed Interest Rate Decision

02:30 PM ET Chair Powell FOMC Press Conference

Thursday, Dec 11th

08:30 AM ET Initial Jobless Claims

01:00 PM ET 30-Year Bond Auction

Friday, Dec 12th

None

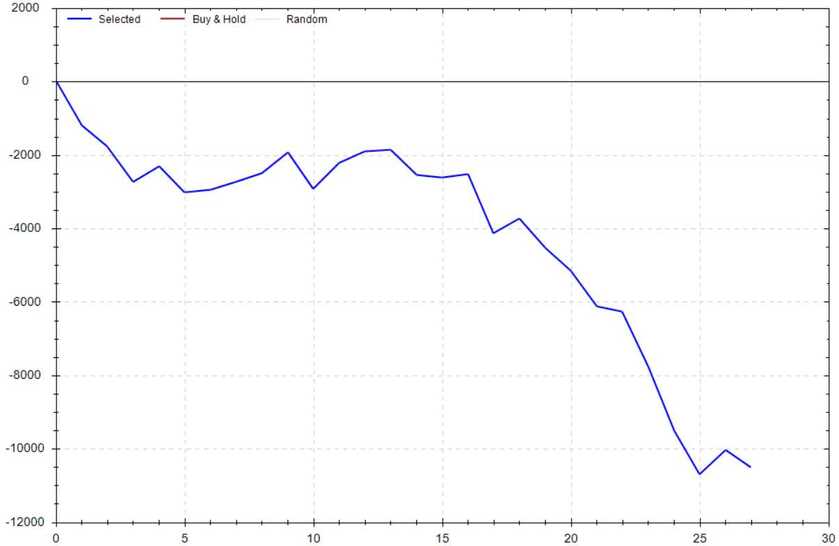

Seasonality Update

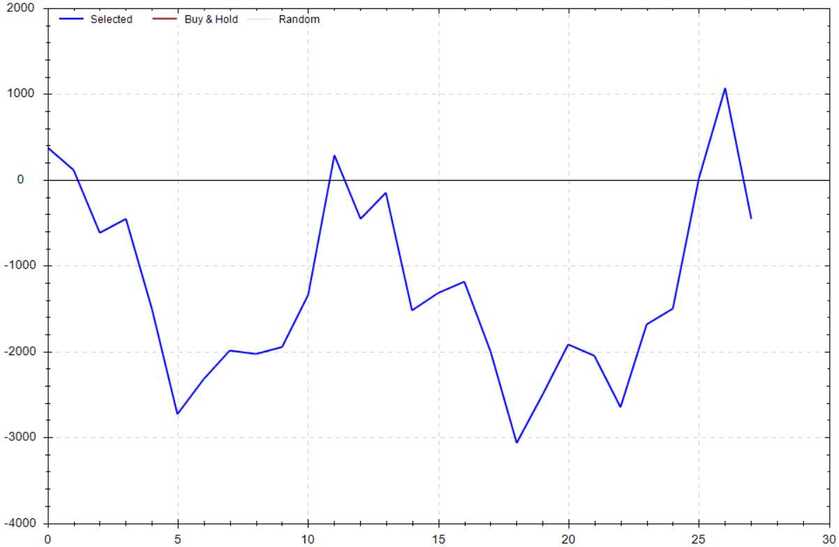

S&P 500 Seasonal Bias (Monday, Dec 8th)

- Bull Win Percentage: 57%

- Profit Factor: 0.95

- Bias: Neutral

Equity Curve -->

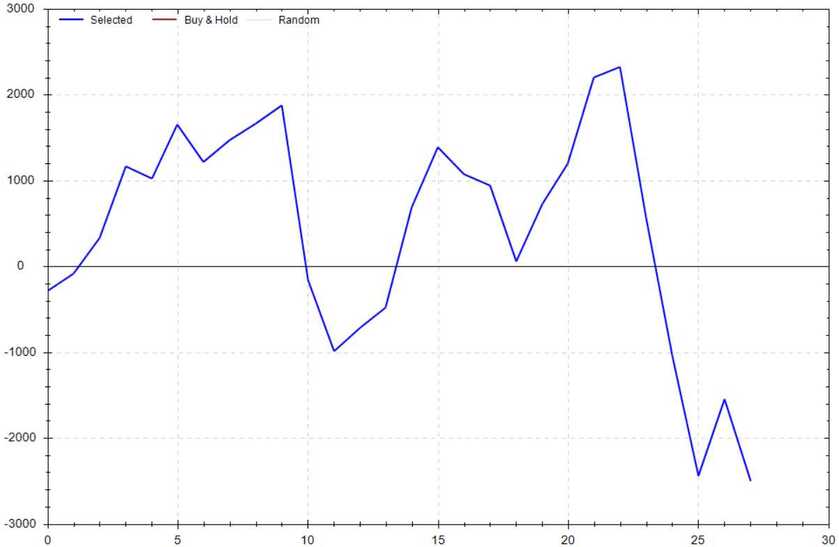

S&P 500 Seasonal Bias (Tuesday, Dec 9th)

- Bull Win Percentage: 57%

- Profit Factor: 0.77

- Bias: Leaning Bearish

Equity Curve -->

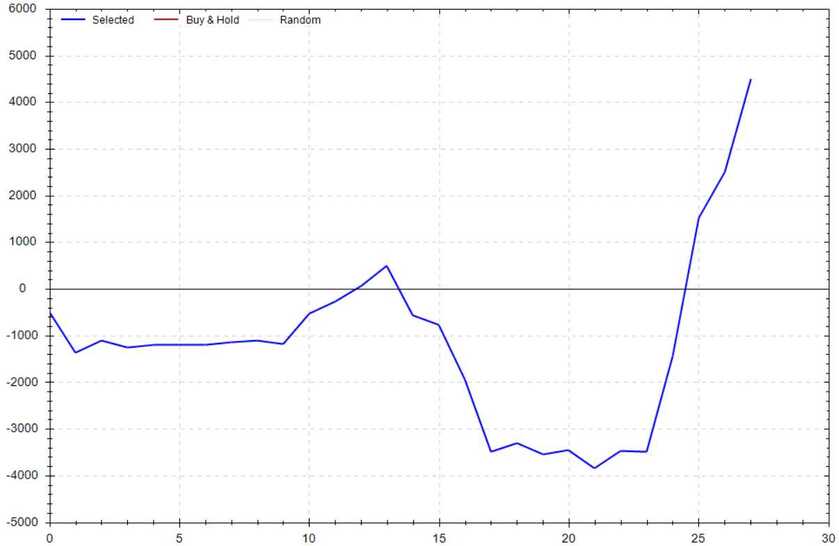

S&P 500 Seasonal Bias (Wednesday, Dec 10th)

- Bull Win Percentage: 54%

- Profit Factor: 1.72

- Bias: Leaning Bullish

Equity Curve -->

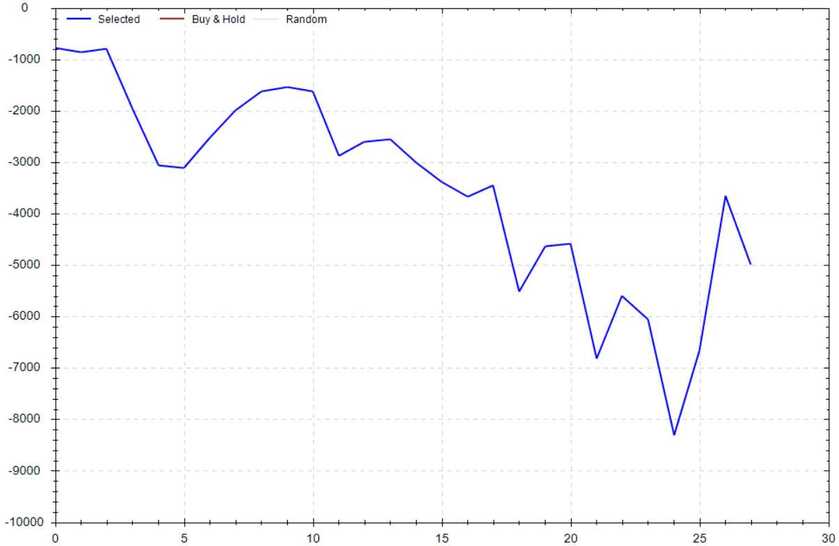

S&P 500 Seasonal Bias (Thursday, Dec 11th)

- Bull Win Percentage: 46%

- Profit Factor: 0.64

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Dec 12th)

- Bull Win Percentage: 43%

- Profit Factor: 0.26

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

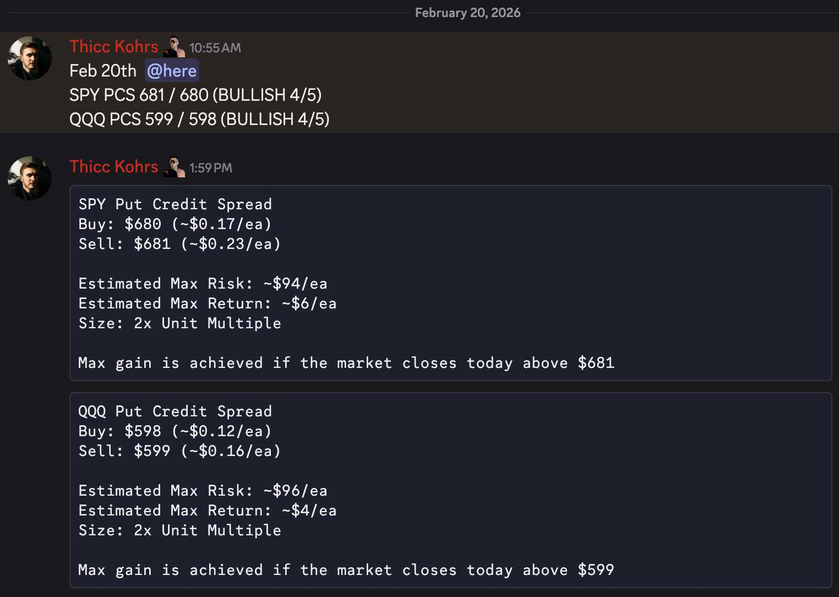

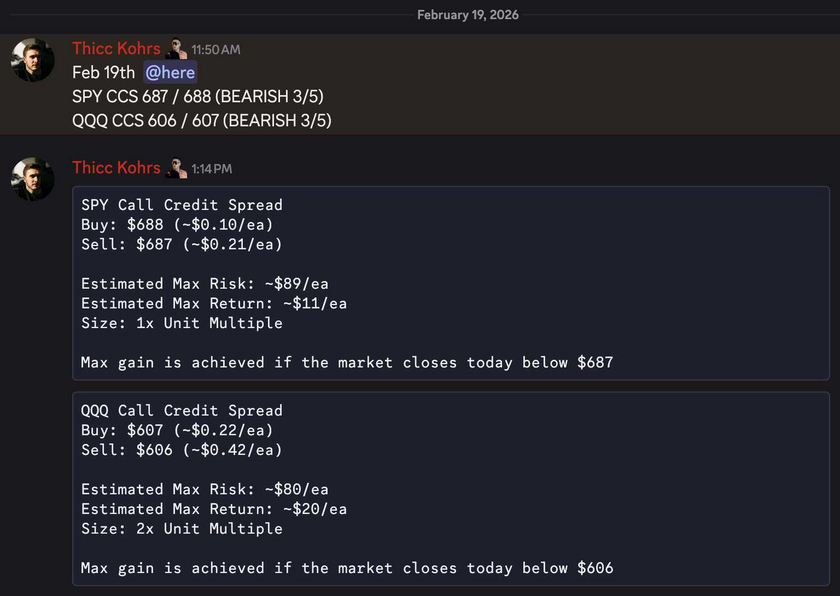

Options Strategy Update

The 0 DTE signal hit 10 for 10 times (18 for 18 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 25 Trades

December Record: 18/18 Units

Monday, Dec 1st

SPY Put Credit Spread (2x Multiple @ $678 / $677) 🟢

QQQ Put Credit Spread (2x Multiple @ $612 / $611) 🟢

Tuesday, Dec 2nd

SPY Put Credit Spread (2x Multiple @ $680 / $679) 🟢

QQQ Put Credit Spread (2x Multiple @ $618 / $617) 🟢

Wednesday, Dec 3rd

SPY Put Credit Spread (2x Multiple @ $678 / $677) 🟢

QQQ Put Credit Spread (2x Multiple @ $617 / $616) 🟢

Thursday, Dec 4th

SPY Call Credit Spread (1x Multiple @ $686 / $687) 🟢

QQQ Call Credit Spread (1x Multiple @ $626 / $627) 🟢

Friday, Dec 5th

SPY Put Credit Spread (2x Multiple @ $685 / $684) 🟢

QQQ Put Credit Spread (2x Multiple @ $624 / $623) 🟢

Piper Attacks During Stream

2 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

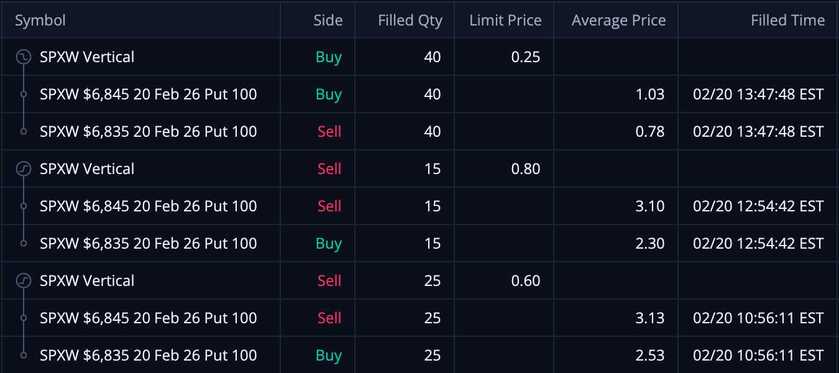

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

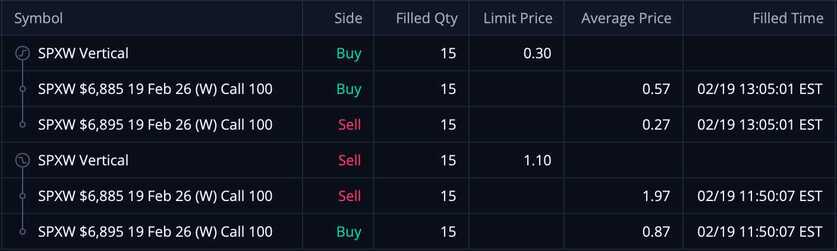

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

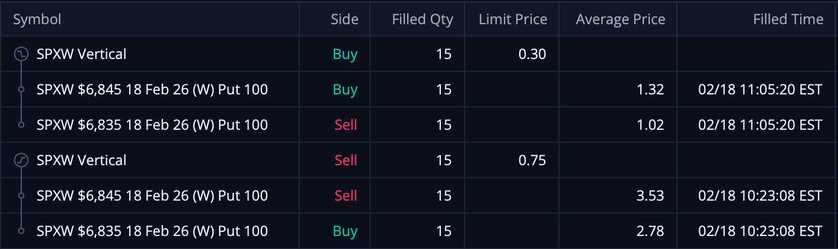

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!

These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!