Happy New Year!

Key Weekly Performance Stats:

- S&P 500: +1.40% (New Record High)

- Nasdaq 100: +1.18%

- Russel 2000: +0.21%

- Bitcoin: -0.90%

Stocks wrapped up the holiday week quietly higher, keeping the Santa rally narrative intact. With an early close on Christmas Eve and markets shut on Christmas Day, volume was thin and price action was smooth rather than exciting. The S&P 500, Nasdaq, and Dow all nudged higher, mostly drifting upward as traders avoided rocking the boat during a shortened week.

Economic data was light but not nonexistent. Durable goods orders came in weaker, reminding everyone that manufacturing demand is still uneven. Consumer confidence dipped again, reinforcing the idea that households are feeling a bit more cautious. Meanwhile, jobless claims stayed low, which continues to signal a labor market that’s cooling gradually but not cracking.

Looking ahead to next week, the situation will remain awkward. Markets are open Monday through Wednesday, closed Thursday for New Year’s Day, then reopen Friday. The main item worth watching is the Fed’s December meeting minutes on Tuesday afternoon, as traders look for any hints about rate cuts or shifts in tone heading into 2026. Outside of that, expect low liquidity, end-of-year positioning, and plenty of chop if anyone tries to push size. As always, stick to your trading plan and respect your risk. Godspeed.

Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Dec 29th

10:00 AM ET Pending Home Sales (Nov)

Tuesday, Dec 30th

02:00 PM ET FOMC Meeting Minutes (Dec)

Wednesday, Dec 31st

08:30 AM ET Initial Jobless Claims

Thursday, Jan 1st

ALL DAY Market Closed (Happy New Year!)

Friday, Jan 2nd

09:45 AM ET S&P Global Manufacturing PMI (Dec)

Seasonality Update

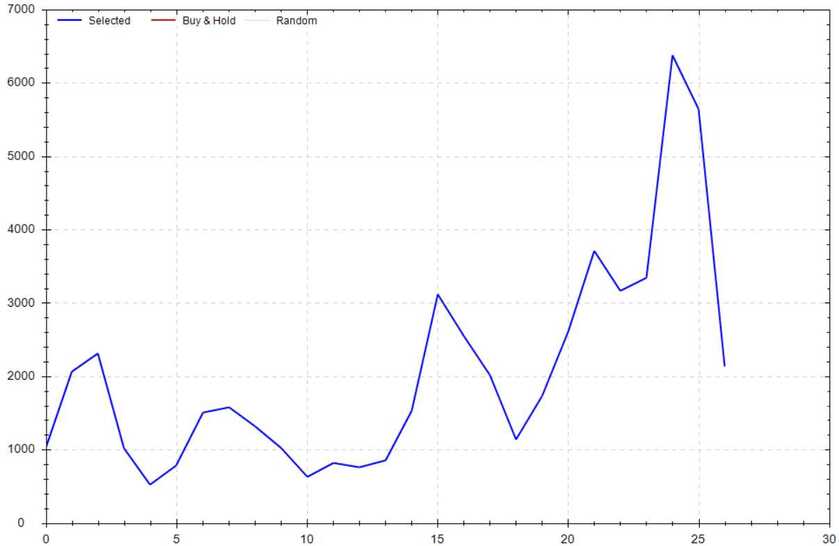

S&P 500 Seasonal Bias (Monday, Dec 29th)

- Bull Win Percentage: 56%

- Profit Factor: 1.22

- Bias: Leaning Bullish

Equity Curve -->

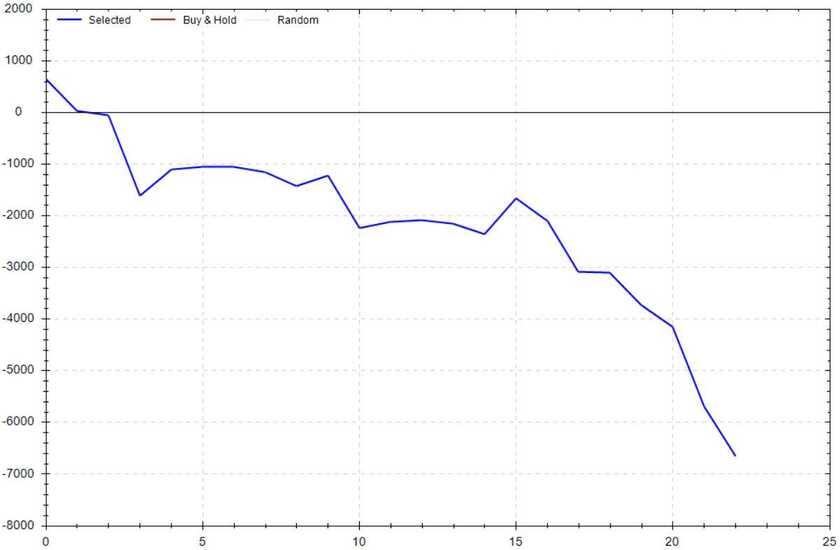

S&P 500 Seasonal Bias (Tuesday, Dec 30th)

- Bull Win Percentage: 30%

- Profit Factor: 0.25

- Bias: Bearish

Equity Curve -->

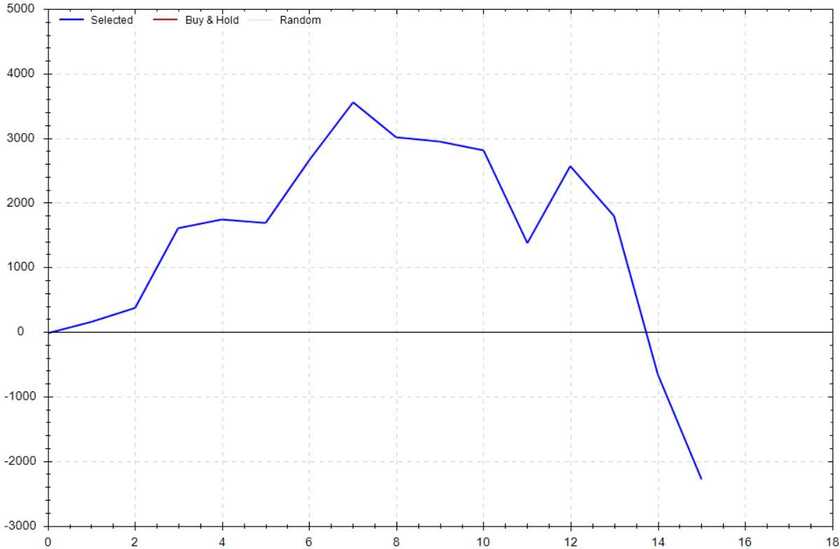

S&P 500 Seasonal Bias (Wednesday, Dec 31st)

- Bull Win Percentage: 44%

- Profit Factor: 0.68

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, Jan 1st)

- Market Closed (Happy New Year!)

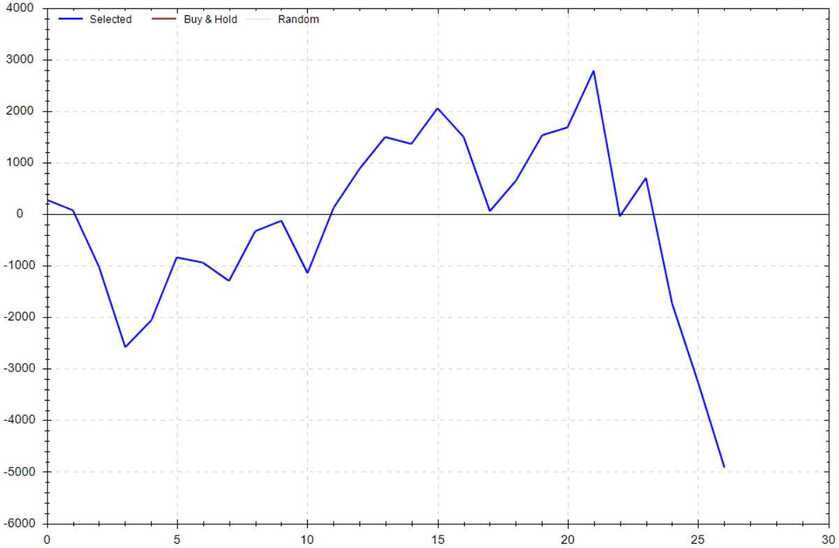

S&P 500 Seasonal Bias (Friday, Jan 2nd)

- Bull Win Percentage: 52%

- Profit Factor: 0.67

- Bias: Leaning Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

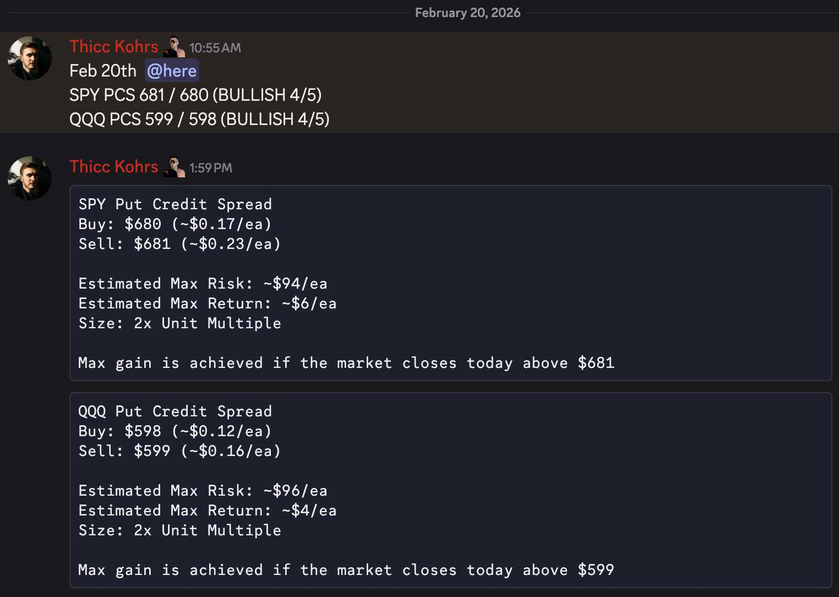

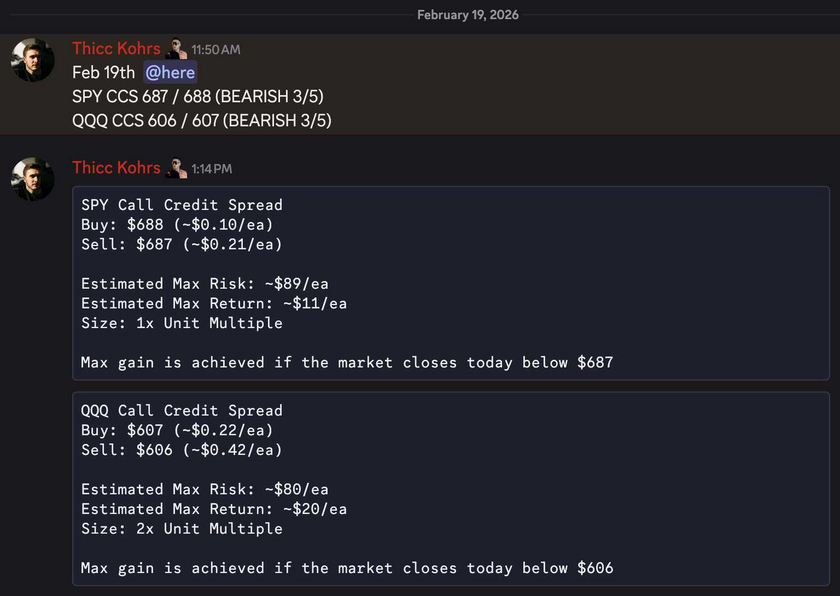

Options Strategy Update

The 0 DTE signal hit 6 for 6 times (12 for 12 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 45 Trades

December Record: 58/58 Units

Monday, Dec 22nd

SPY Put Credit Spread (2x Multiple @ $682 / $681) 🟢

QQQ Put Credit Spread (2x Multiple @ $616 / $615) 🟢

Tuesday, Dec 23rd

SPY Put Credit Spread (2x Multiple @ $683 / $682) 🟢

QQQ Put Credit Spread (2x Multiple @ $617 / $616) 🟢

Wednesday, Dec 24th

No Signal Produced

Thursday, Dec 25th

No Signal Produced

Friday, Dec 26th

SPY Put Credit Spread (2x Multiple @ $689 / $688) 🟢

QQQ Put Credit Spread (2x Multiple @ $622 / $621) 🟢

Christmas Cookies Consumed

67 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

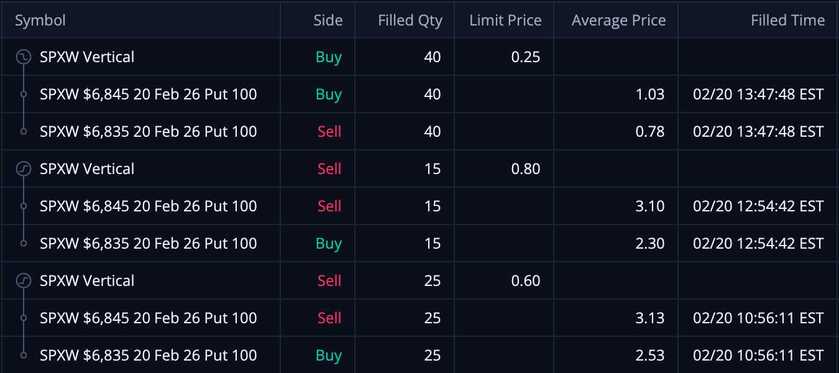

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

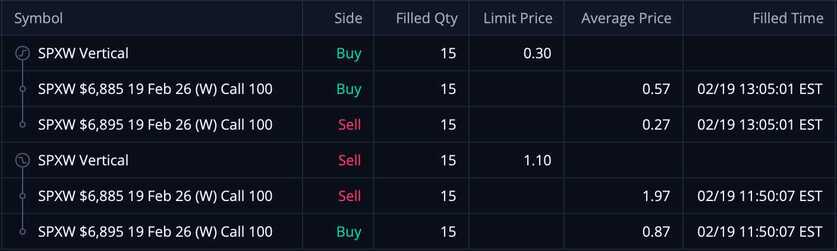

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

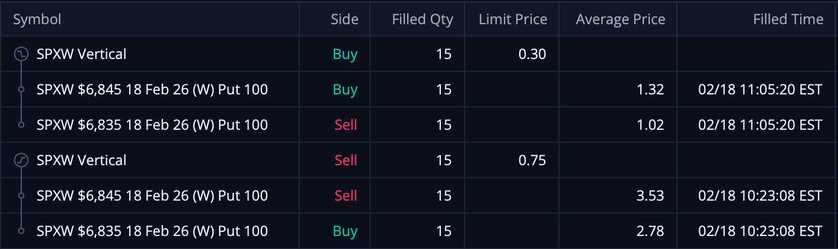

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!

These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!