The Murder of Metals

Key Weekly Performance Stats:

- S&P 500: +0.34% (New High)

- Nasdaq 100: -0.21%

- Russel 2000: -1.68%

- Bitcoin: -12.09%

- Gold: -2.40% (New High)

- Silver: -17.44% (New High)

Last week, stocks mostly went sideways into month end. The S&P 500 managed a small gain, but the Dow, Nasdaq, and small caps faded as traders bounced between solid earnings headlines and lingering worries about rates staying higher for longer. It felt like a market waiting for direction rather than committing to one.

Macro news added to the hesitation. The Fed held rates steady at its January meeting and didn’t signal any rush to cut, keeping policy talk firmly in “data dependent” mode. Late-week headlines around a new Fed chair being lined up added another wrinkle to the outlook. Meanwhile, gold and silver went completely off the rails. After ripping higher, both saw sharp reversals, with silver especially getting slammed as volatility exploded and margin requirements were raised. That kind of move tends to ripple across the broader macro tape, and you could feel it in risk appetite.

Looking ahead to next week, you better buckle up! Monday kicks off with ISM Manufacturing and the final S&P Global manufacturing PMI. Tuesday brings JOLTS job openings. Wednesday is busy with ADP jobs, final S&P Global services and composite PMIs, plus ISM Services. Thursday adds weekly jobless claims, and Friday closes it out with the January jobs report, including payrolls, unemployment, and wages. If the market is going to pick a real direction, odds are it comes from that data. As always, stick to your trading plan and respect your risk. Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, Feb 2nd

Morning: Disney

Evening: Palantir

Tuesday, Feb 3rd

Morning: PayPal, Pepsi & Pfizer

Evening: AMD, Chipotle & SuperMicro

Wednesday, Feb 4th

Morning: Novo Nordisk, Lilly, Uber & UBS

Evening: Alphabet, ARM, Qualcomm & Snap

Thursday, Feb 5th

Evening: Affirm, Amazon, Iren, Reddit, Roblox & Strategy

Friday, Feb 6th

Morning: Under Armour

Market Events

Monday, Feb 2nd

09:45 AM ET S&P Global Manufacturing PMI (Jan)

10:00 AM ET ISM Manufacturing PMI & Prices (Jan)

Tuesday, Feb 3rd

10:00 AM ET JOLTS Job Openings (Dec)

Wednesday, Feb 4th

08:15 AM ET ADP Nonfarm Employment Change (Jan)

09:45 AM ET S&P Global Services PMI (Jan)

10:00 AM ET ISM Non-Manufacturing PMI & Prices (Jan)

Thursday, Feb 5th

08:15 AM ET ECB Interest Rate Decision

08:30 AM ET Initial Jobless Claims

Friday, Feb 6th

08:30 AM ET Unemployment Report (Jan)

08:30 AM ET Nonfarm Payrolls (Jan)

Seasonality Update

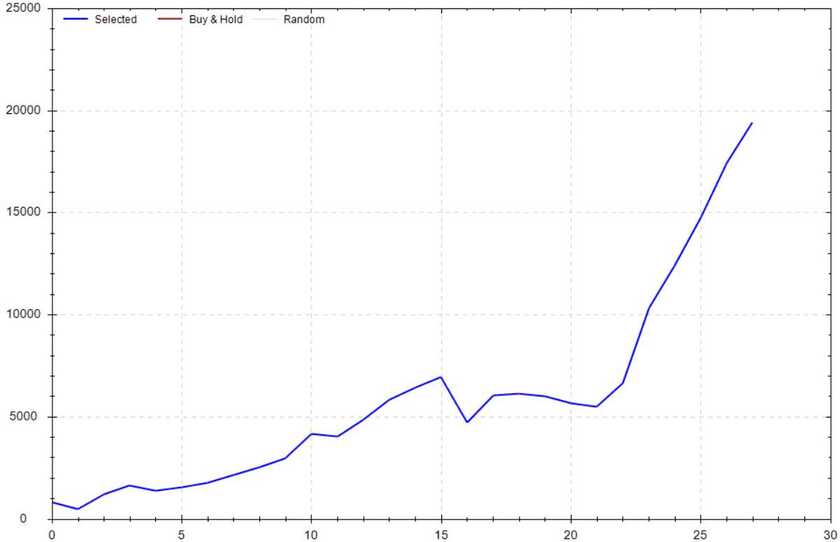

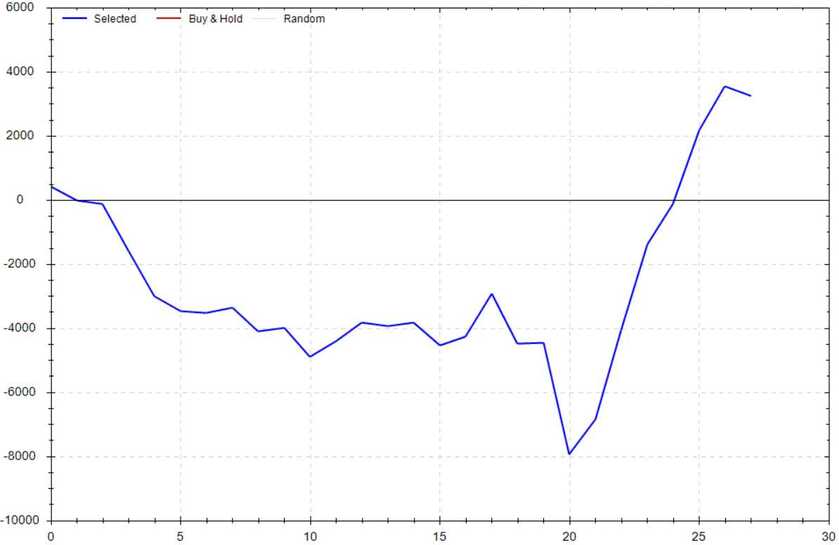

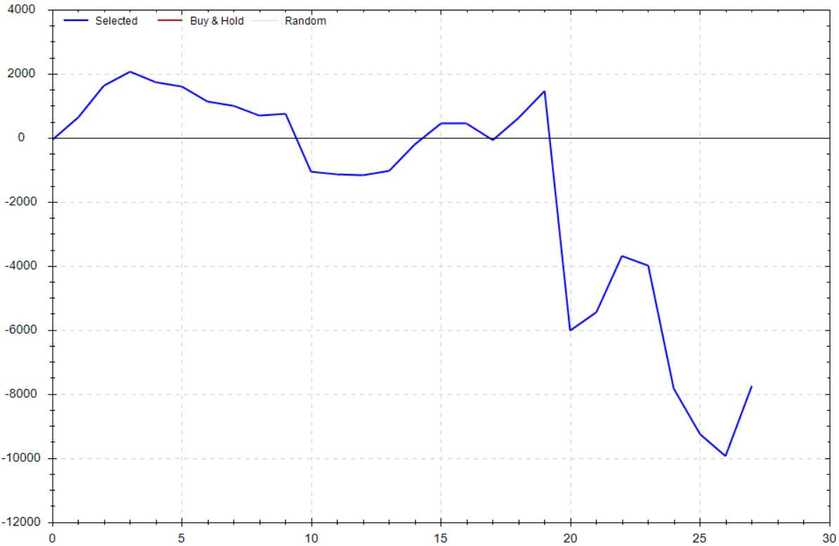

S&P 500 Seasonal Bias (Monday, Feb 2nd)

- Bull Win Percentage: 75%

- Profit Factor: 6.47

- Bias: Bullish

Equity Curve -->

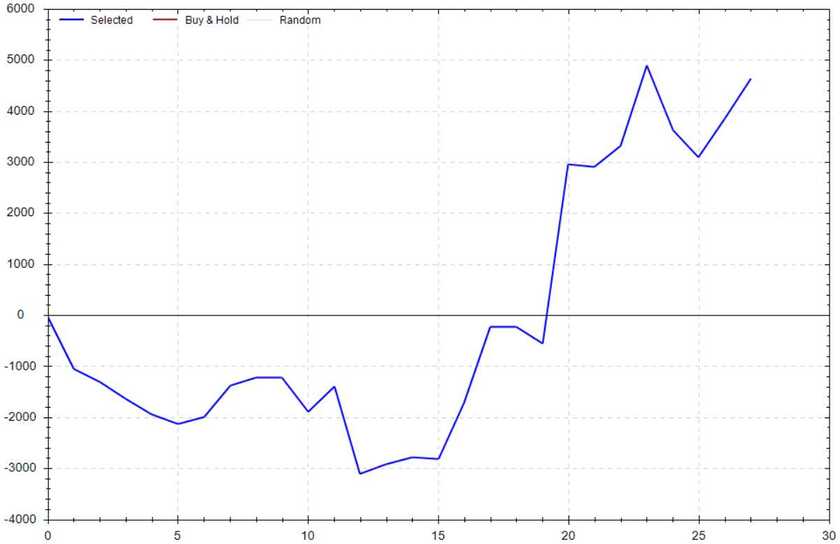

S&P 500 Seasonal Bias (Tuesday, Feb 3rd)

- Bull Win Percentage: 54%

- Profit Factor: 1.28

- Bias: Leaning Bullish

Equity Curve -->

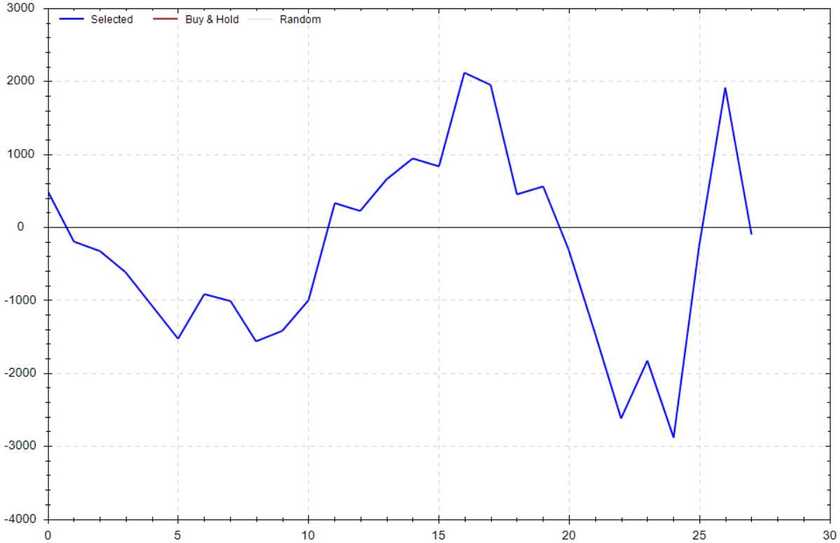

S&P 500 Seasonal Bias (Wednesday, Feb 4th)

- Bull Win Percentage: 43%

- Profit Factor: 0.56

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, Feb 5th)

- Bull Win Percentage: 46%

- Profit Factor: 1.69

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Feb 6th)

- Bull Win Percentage: 43%

- Profit Factor: 0.99

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 6 for 6 times (12 for 12 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 15 Trades

January Record: 64/68 Units

Monday, Jan 26th

SPY Put Credit Spread (2x Multiple @ $688 / $687) 🟢

QQQ Put Credit Spread (2x Multiple @ $621 / $620) 🟢

Tuesday, Jan 27th

SPY Put Credit Spread (2x Multiple @ $693 / $692) 🟢

QQQ Put Credit Spread (2x Multiple @ $627 / $626) 🟢

Wednesday, Jan 28th

No Signal Produced

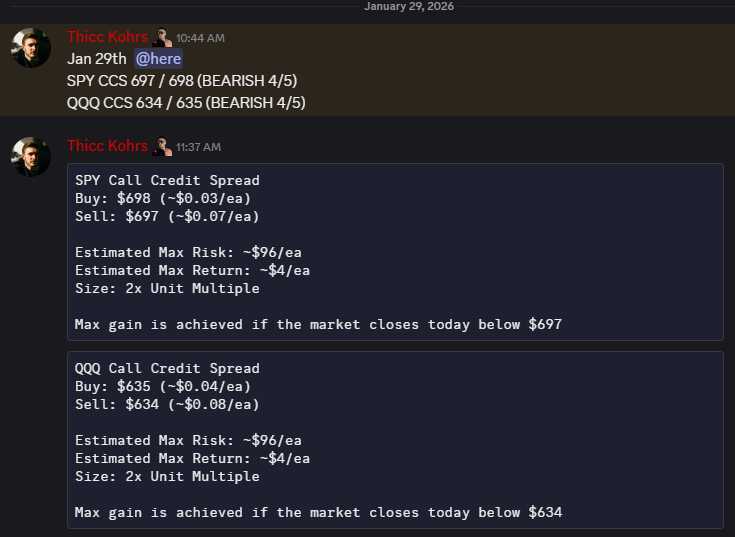

Thursday, Jan 29th

SPY Call Credit Spread (2x Multiple @ $697 / $698) 🟢

QQQ Call Credit Spread (2x Multiple @ $634 / $635) 🟢

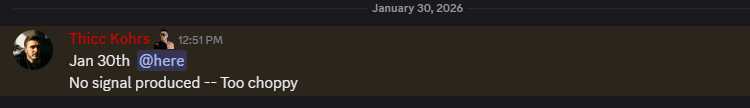

Friday, Jan 30th

No Signal Produced

Times I Got Horribly Titled

1 (I cried in the shower)*

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units!