Bulls, Bears & Kangaroos

We are back in action! I hope everyone had a great weekend!

Things started off notably strong this morning. We closed out last week at $395.75, and then gapped up to +$398 this morning. If you caught today's stream, you know we talked about the downside gap fill potential as we normally do when the opportunity exists. Like clockwork, it was a profitable trade once again. The gap fill to $395.84 hit around 11:15am ET. Congrats to all who made some money off it!

With respect to Market Events, there were none today during normal market hours. For the next two days, Fed Governor Barr will be testifying to Congress about the banking debacle. You can bet your button dollar I'll be streaming it so we can enjoy the fireworks together. I also want to alert you that the PCE report, an inflation report, will be dropping this Friday. Make sure you mark your calendar.

Overall, today was a little bearish, a little bullish, but stocks mainly hopped around like a kangaroo. Today marks the 7th day of range consolidation. I know it's tough, but patience will pay. The potential gain from the next serious trend far outweighs the doldrums we have to currently deal with.

Market Events: Tuesday, March 28th

08:30 AM Advanced U.S. Trade Balance In Goods

08:30 AM Advanced Retail Inventories

08:30 AM Advanced Wholesale Inventories

09:00 AM S&P Case-Shiller Home Price Index

09:00 AM FHFA Home Price Index

10:00 AM U.S. Consumer Confidence

10:00 AM Fed Gov. Barr Testifies To Senate On Banks (I'm Streaming This!!!)

Seasonality Update

S&P 500 Seasonal Bias (March 28th)

- Bull Win Percentage: 44%

- Profit Factor: 0.75%

- Bias: Bearish

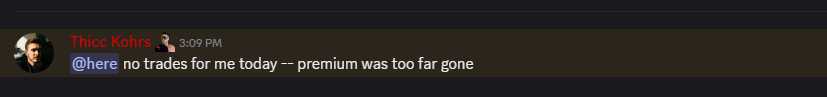

Equity Curve -->

Current Account Value (March 27th)

$10,300

Daily Realized P&L: +$0

YTD Realized P&L: +$436

Closed Position(s)

None

New Position(s)

SPY CALL Credit Spread (3) April 10th

- Sold: $407 & Bought: $408 --> Credit: $23

- Max Return: $23 & Max Risk: $77

- Current Value: $22

- Profit Target: ~$8

- Profit Odds: 80%

SPY PUT Credit Spread (3) April 10th

- Sold: $387 & Bought: $386 --> Credit: $16

- Max Return: $16 & Max Risk: $84

- Current Value: $19

- Profit Target: ~$8

- Profit Odds: 75%

Reasoning: Continuing the Iron Condor train!

Current Position(s)

NVDA Call Credit Spread (2) March 31st

- Sold: $270 & Bought: $275 --> Credit: $71

- Max Return: $71 & Max Risk: $429

- Current Value: $139

- Profit Target: $25

- Profit Odds: 64%

OXY Put Credit Spread (10) March 31st

- Sold: $58 & Bought: $57 --> Credit: $20

- Max Return: $20 & Max Risk: $80

- Current Value: $17

- Profit Target: $8

- Profit Odds: 75%

QQQ Call Credit Spread (10) March 31st

- Sold: $312 & Bought: $313 --> Credit: $0.20

- Max Return: $20 & Max Risk: $80

- Current Value: $39

- Profit Target: $8

- Profit Odds: 66%

TSLA Call Credit Spread (4) March 31st

- Sold: $200 & Bought: $202.50 --> Credit: $37

- Max Return: $37 & Max Risk: $213

- Current Value: $53

- Profit Target: $15

- Profit Odds: 74%

JPM Put Credit Spread (5) April 6th

- Sold: $125 & Bought: $120 --> Credit: $100

- Max Return: $100 & Max Risk: $400

- Current Value: $95

- Profit Target: $40

- Profit Odds: 69%

SPY Call Credit Spread (5) April 6th

- Sold: $406 & Bought: $407 --> Credit: $12

- Max Return: $23 & Max Risk: $77

- Current Value: $22

- Profit Target: $10

- Profit Odds: 81%

SPY Iron Condor (3) April 6th

- $411/$412 Call Spread --> Credit: $18

- $386/$385 Put Spread --> Credit: $19

- Max Return: $37 & Max Risk: $63

- Current Value: $24

- Profit Target: $15

- Profit Odds: 77%

TSLA Call Credit Spread (5) April 6th

- Sold: $207.50 & Bought: $210 --> Credit: $40

- Max Return: $40 & Max Risk: $210

- Current Value: $50

- Profit Target: $15

- Profit Odds: 76%

SPY Iron Condor (5) April 14th

- $411/$412 Call Spread --> Credit: $20

- $375/$374 Put Spread --> Credit: $17

- Max Return: $37 & Max Risk: $63

- Current Value: $29

- Profit Target: $15

- Profit Odds: 84%

TLT Put Credit Spread (10) April 21st

- Sold: $101 & Bought: $100 --> Credit: $27

- Max Return: $27 & Max Risk: $73

- Current Value: $23

- Profit Target: $10

- Profit Odds: 73%

My Thoughts

Not the most exciting start to the week. The major trade of the day was the downside gap fill on the SPY. I'm hoping the Fed Governor's testimony to Congress over the next two days will prompt a more exciting trading environment. Most of the plays I'm watching have been continuing their random chop pattern from last week. I do want to quickly point out that TSLA might be setting up for a move in the near future. Looking for a classic bounce or breakdown.

I'll let you know if I see any other interesting developments.

Thanks for reading -- Much Love!

Notes

Max Return (Credit Spreads): The credit received when creating the position. This is achieved when you get to the expiration date and the price is below the sold contract for a Call Credit Spread and above the sold contract for a Put Credit Spread.

Max Risk (Credit Spreads): The difference between the spread's two strikes minus the credit received when the position was created.

Breakeven (Credit Spreads): The sold strike plus the credit for CCS and the strike minus the credit for PCS.

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

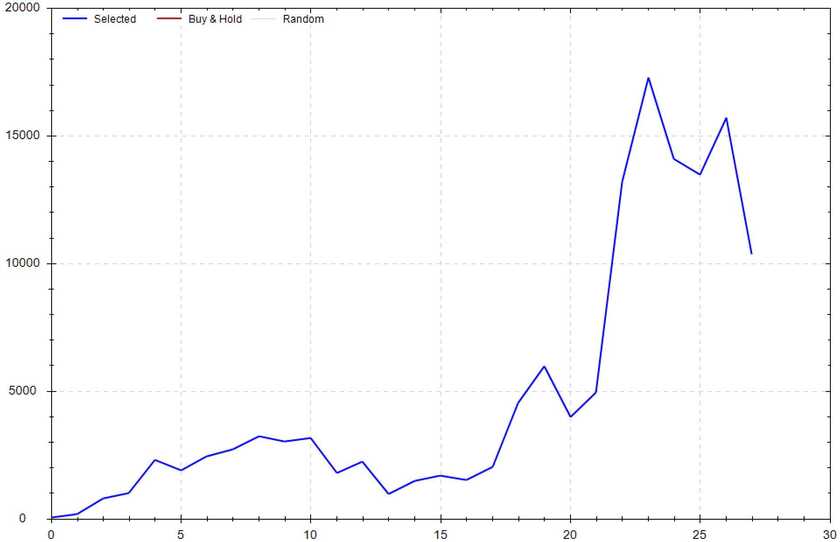

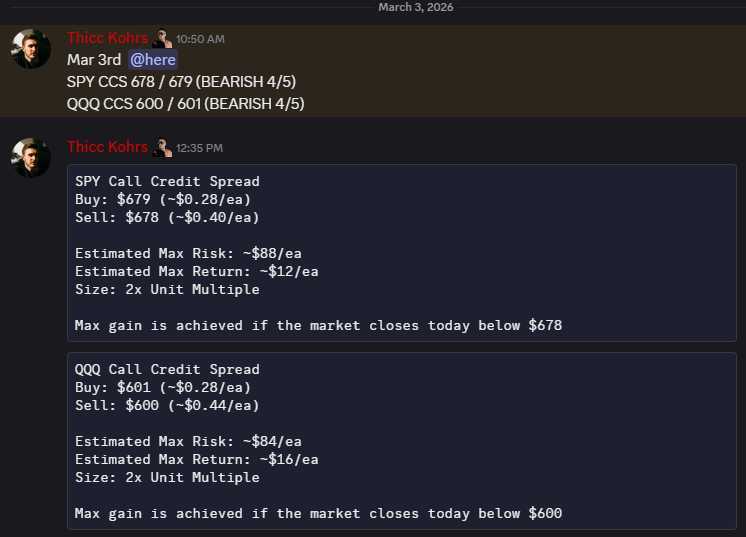

Both missed :(

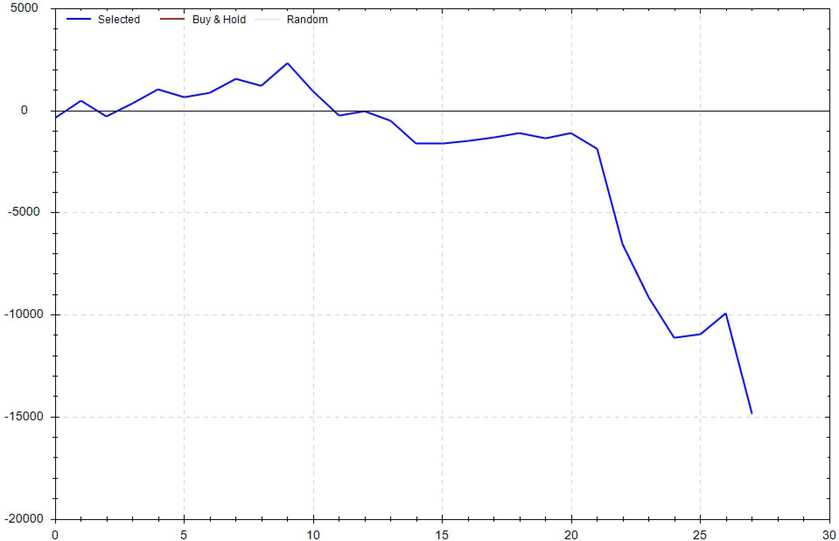

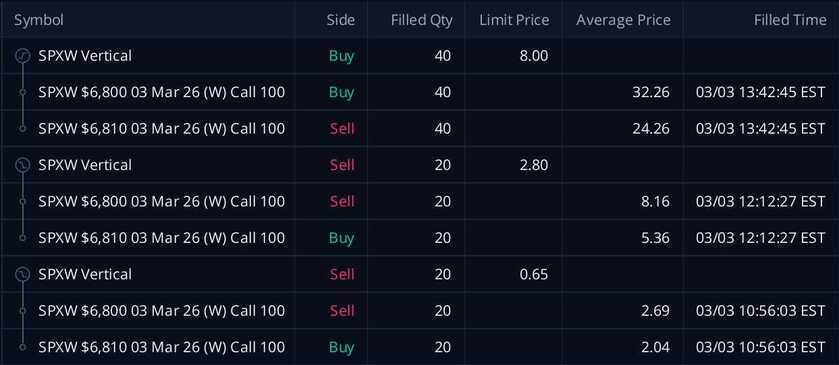

Both missed :( These CCS's were sold at $1.73/ea and were bought back at $8.00/ea -- This means tilted, revenge trading cost me $25,080.

These CCS's were sold at $1.73/ea and were bought back at $8.00/ea -- This means tilted, revenge trading cost me $25,080.

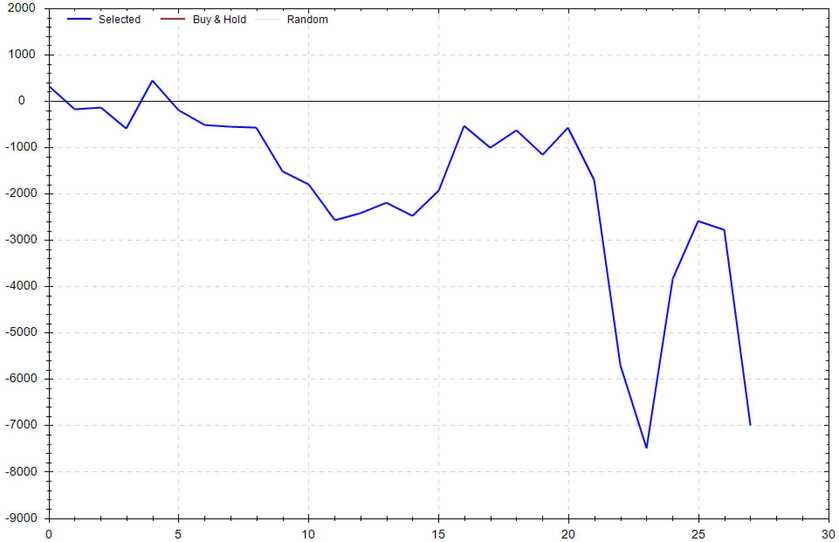

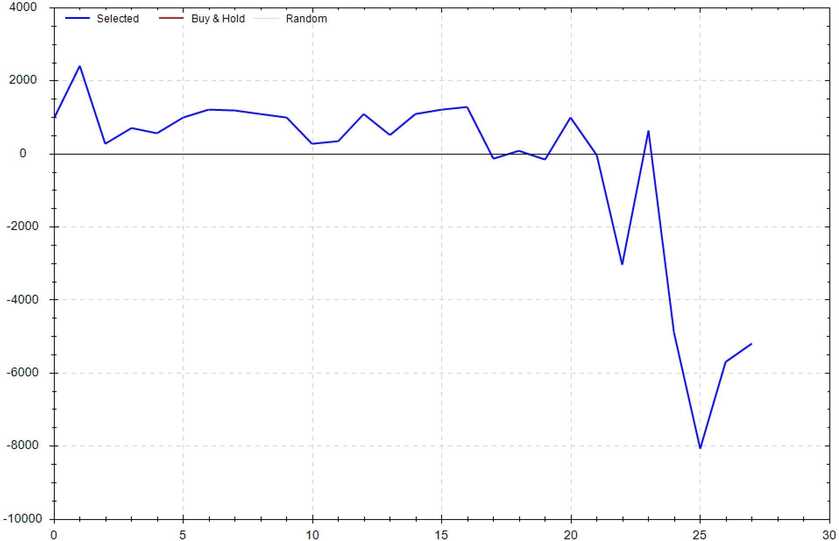

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!