Another Day of Nothing

We went up. We went down. We went up a little more. We went down even more. Then, to close things out, we recovered. If you're ripping out your hair, I completely understand.

Whatever hair you have left will most likely leave due to boredom from the Fed Congressional testimony. Talk about a clown show. If this is the group of people who are supposed to be protecting us, I'm more concerned than ever.

In a general sense, we saw some of the tech sector start to crack today. It was nothing too special, but I'm going to be paying close attention to major names like TSLA, NVDA & AMZN. We are clearly still in a hold pattern; patience will pay.

Market Events: Tuesday, March 29th

10:00 AM Pending U.S. Home Sales

10:00 AM Fed Gov. Barr Testifies To House On Banks (I'll be streaming this!!!)

Seasonality Update

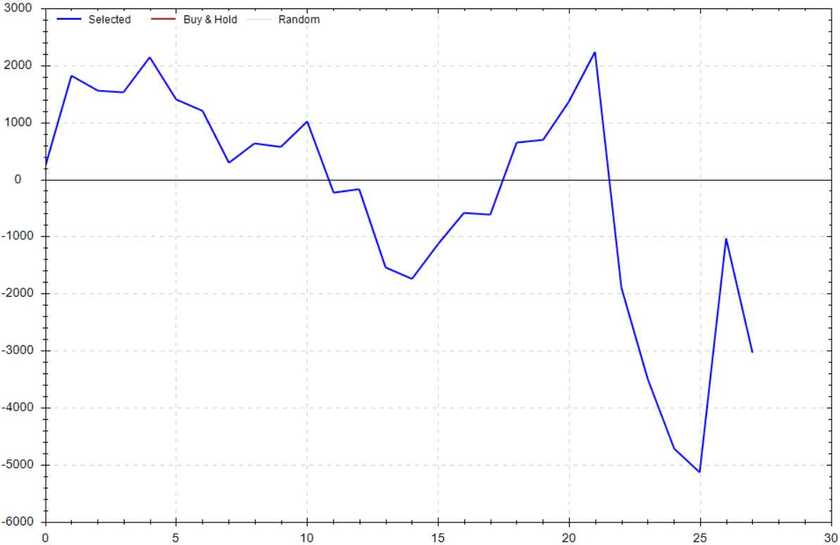

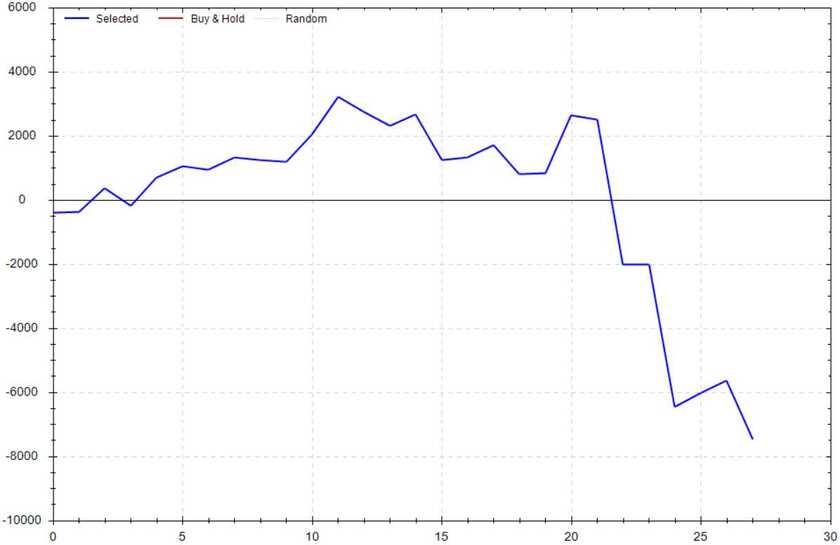

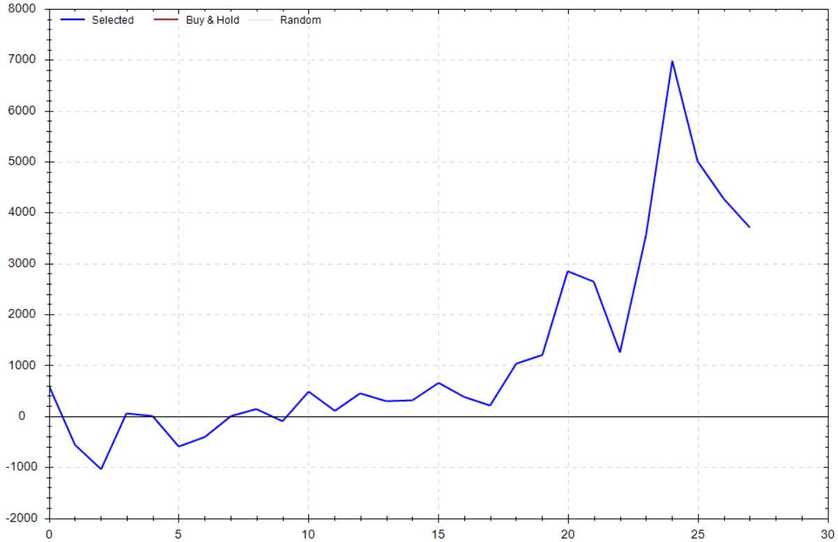

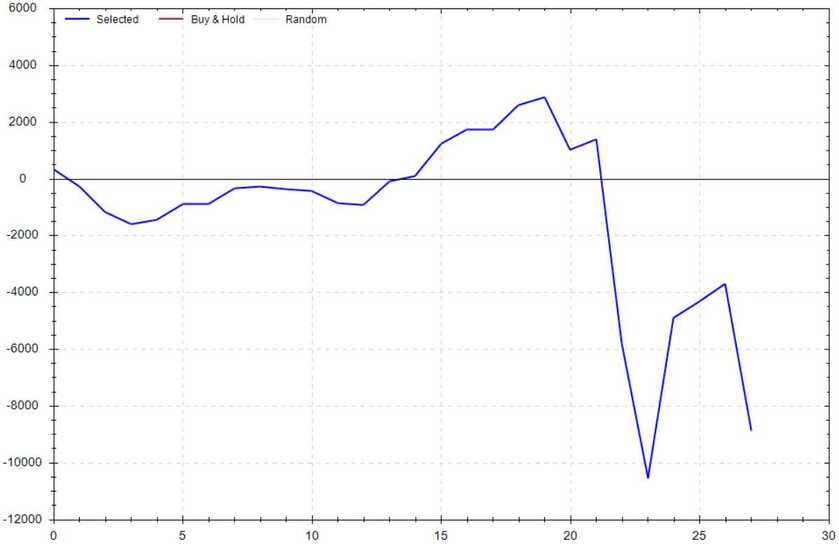

S&P 500 Seasonal Bias (March 29th)

- Bull Win Percentage: 72%

- Profit Factor: 9.44

- Bias: Very Bullish

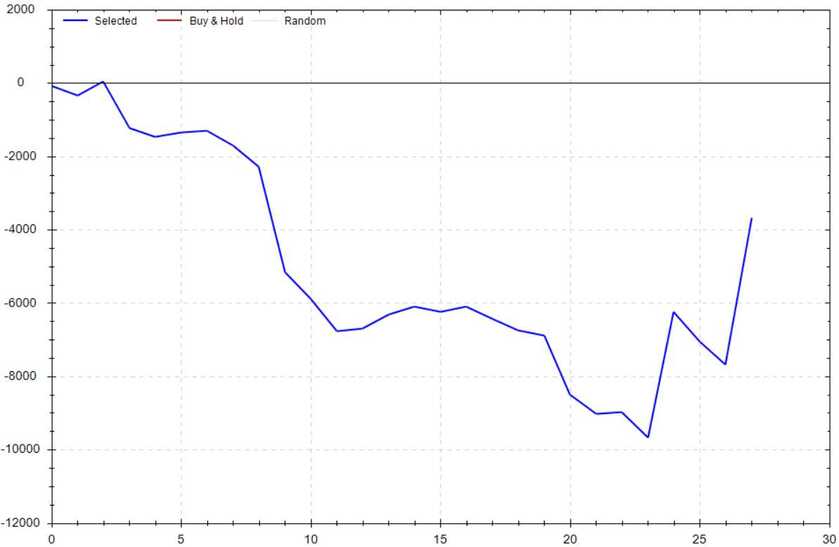

Equity Curve -->

Current Account Value (March 28th) +$120

$10,948

Daily Realized P&L: +$120

YTD Realized P&L: +$556

Closed Position(s) +$120

OXY $58/$57 Put Credit Spread (10) March 31st

- Original Credit: $20

- Closed Debit: $8

- P&L: +$120 (+60%)

New Position(s)

SPY CALL Credit Spread (3) April 10th

- Sold: $405 & Bought: $406 --> Credit: $21

- Max Return: $21 & Max Risk: $79

- Current Value: $25

- Profit Target: ~$8

- Profit Odds: 78%

SPY PUT Credit Spread (3) April 10th

- Sold: $384 & Bought: $383 --> Credit: $16

- Max Return: $16 & Max Risk: $84

- Current Value: $14

- Profit Target: ~$8

- Profit Odds: 81%

Reasoning: Continuing the Iron Condor train!

Current Position(s)

NVDA Call Credit Spread (2) March 31st

- Sold: $270 & Bought: $275 --> Credit: $71

- Max Return: $71 & Max Risk: $429

- Current Value: $104

- Profit Target: $25

- Profit Odds: 72%

QQQ Call Credit Spread (10) March 31st

- Sold: $312 & Bought: $313 --> Credit: $0.20

- Max Return: $20 & Max Risk: $80

- Current Value: $22

- Profit Target: $8

- Profit Odds: 77%

TSLA Call Credit Spread (4) March 31st

- Sold: $200 & Bought: $202.50 --> Credit: $37

- Max Return: $37 & Max Risk: $213

- Current Value: $27

- Profit Target: $15

- Profit Odds: 86%

JPM Put Credit Spread (5) April 6th

- Sold: $125 & Bought: $120 --> Credit: $100

- Max Return: $100 & Max Risk: $400

- Current Value: $79

- Profit Target: $40

- Profit Odds: 71%

SPY Call Credit Spread (5) April 6th

- Sold: $406 & Bought: $407 --> Credit: $12

- Max Return: $23 & Max Risk: $77

- Current Value: $17

- Profit Target: $10

- Profit Odds: 84%

SPY Iron Condor (3) April 6th

- $411/$412 Call Spread --> Credit: $18

- $386/$385 Put Spread --> Credit: $19

- Max Return: $37 & Max Risk: $63

- Current Value: $21

- Profit Target: $15

- Profit Odds: 80%

TSLA Call Credit Spread (5) April 6th

- Sold: $207.50 & Bought: $210 --> Credit: $40

- Max Return: $40 & Max Risk: $210

- Current Value: $43

- Profit Target: $15

- Profit Odds: 81%

SPY Iron Condor (3) April 10th

- $407/$408 Call Spread --> Credit: $23

- $387/$386 Put Spread --> Credit: $16

- Max Return: $39 & Max Risk: $61

- Current Value: $38

- Profit Target: $15

- Profit Odds: 75%

SPY Iron Condor (5) April 14th

- $411/$412 Call Spread --> Credit: $20

- $375/$374 Put Spread --> Credit: $17

- Max Return: $37 & Max Risk: $63

- Current Value: $25

- Profit Target: $15

- Profit Odds: 86%

TLT Put Credit Spread (10) April 21st

- Sold: $101 & Bought: $100 --> Credit: $27

- Max Return: $27 & Max Risk: $73

- Current Value: $20

- Profit Target: $10

- Profit Odds: 74%

My Thoughts

I'm beyond happy with my current positions. If you've been doing something similar, congrats!

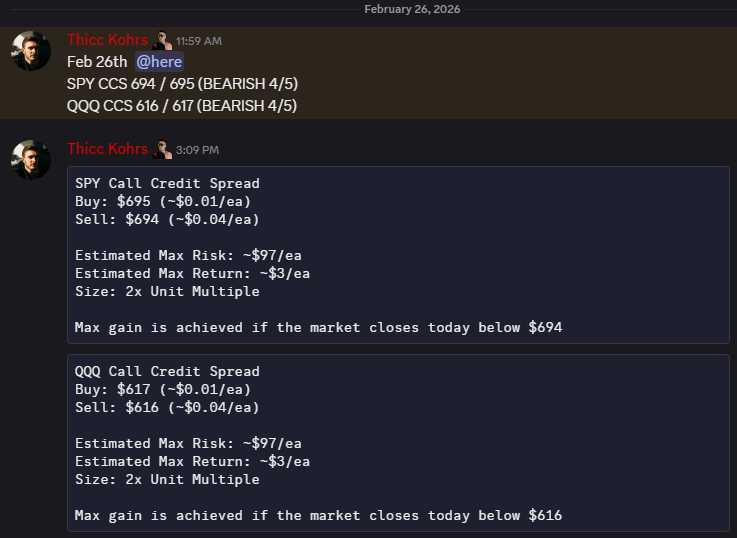

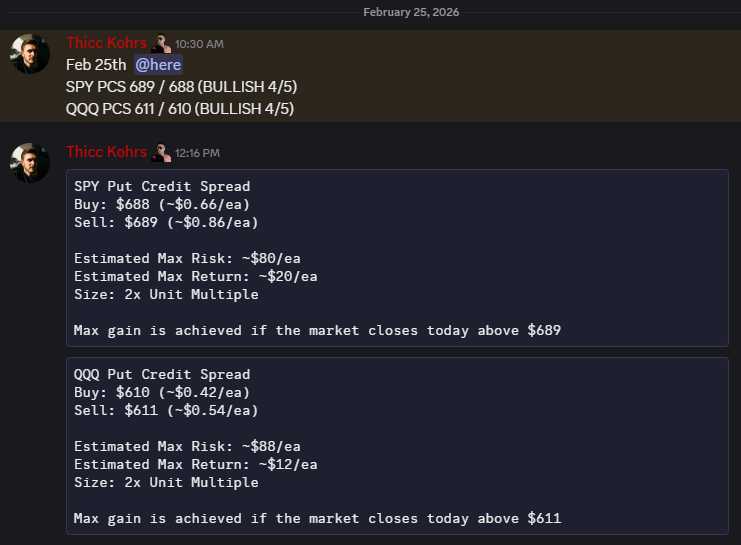

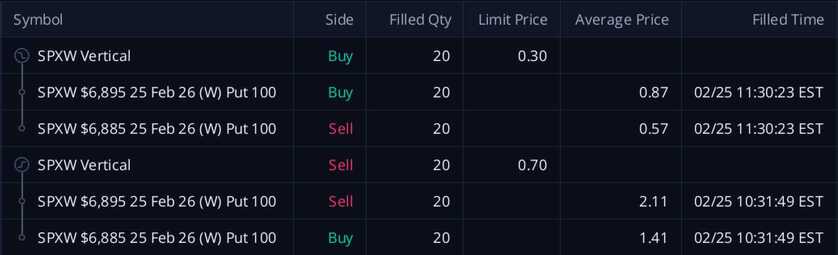

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.60/ea and were bought back at $0.25/ea -- THIS MEANS MY REALIZED GAIN WAS $700!

These PCS's were sold at $0.60/ea and were bought back at $0.25/ea -- THIS MEANS MY REALIZED GAIN WAS $700!

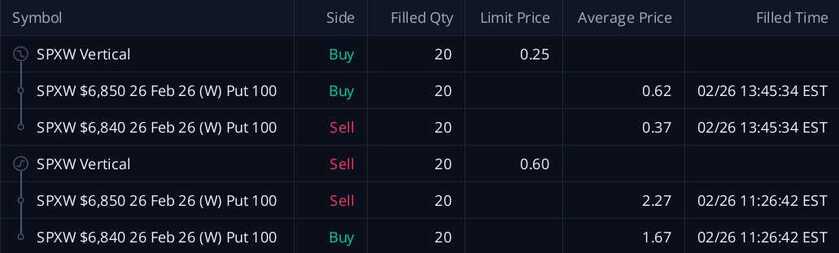

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!

These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!