Grinding Lower

It was one of those where you get angry at yourself for watching the market all day -- Time you will never get back. You could have meditated. You could have gone to the gym. You could have spent time with your wife. But no, you watched numbers go up and down all day. The worst part? They essentially went as much up as they went down. You'll never get all that time back. Ready to do it all over again tomorrow?

With respect to Market Events, the ADP Report dropped at 8:15am ET (145k vs 261 Exp). There was initially a positive reaction, but it did not hold for long. The first half of the day was essentially a slow bleed. The latter half was a bit of a recovery, but it was nothing too special.

Tomorrow, we will get more info on the current job situation before the market opens. In terms of seasonality, the bulls are favored.

Detailed below is what the best trader on this side of the Mississippim (me) is doing with Tesla now. Let's ride!

PSA: The market will be closed Friday, April 7th in observation of Good Friday. Additionally, the Unemployment Report will be dropped at 8:30am ET that morning.

Market Events: Thursday, April 6th

08:30AM Initial Jobless Claims

08:30AM Continuing Jobless Claims

10:00AM St. Louis Fed President Bullard Speaks

Seasonality Update

S&P 500 Seasonal Bias (April 6th)

- Bull Win Percentage: 60%

- Profit Factor: 2.91

- Bias: Bullish

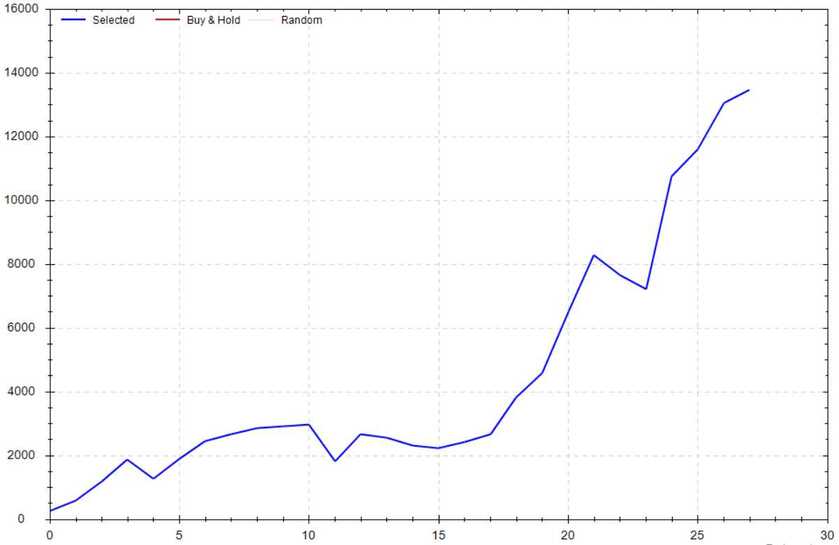

Equity Curve -->

Current Account Value (April 5th)

$11,752

Daily Realized P&L: +$0

YTD Realized P&L: +$725

Closed Position(s)

None

Current Position(s)

SPY Call Credit Spread (5) April 6th

- Sold: $406 & Bought: $407 --> Credit: $12

- Max Return: $23 & Max Risk: $77

- Current Value: $66

- Profit Target: $10

- Profit Odds: 31%

SPY Iron Condor (3) April 6th

- $411/$412 Call Spread --> Credit: $18

- $386/$385 Put Spread --> Credit: $19

- Max Return: $37 & Max Risk: $63

- Current Value: $10

- Profit Target: $15

- Profit Odds: 87%

SPY Iron Condor (3) April 10th

- $407/$408 Call Spread --> Credit: $23

- $387/$386 Put Spread --> Credit: $16

- Max Return: $39 & Max Risk: $61

- Current Value: $55

- Profit Target: $15

- Profit Odds: 45%

SPY Iron Condor (3) April 10th

- $405/$406 Call Spread --> Credit: $22

- $384/$383 Put Spread --> Credit: $16

- Max Return: $38 & Max Risk: $62

- Current Value: $68

- Profit Target: $15

- Profit Odds: 33%

SPY Put Credit Spread (15) April 10th

- Sold: $402 & Bought: $403 --> Credit: $18

- Max Return: $18 & Max Risk: $82

- Current Value: $21

- Profit Target: $0

- Profit Odds: 77%

SPY Iron Condor (5) April 14th

- $411/$412 Call Spread --> Credit: $20

- $375/$374 Put Spread --> Credit: $17

- Max Return: $37 & Max Risk: $63

- Current Value: $42

- Profit Target: $15

- Profit Odds: 62%

SPY Iron Condor (5) April 14th

- $413/$414 Call Spread --> Credit: $18

- $380/$379 Put Spread --> Credit: $16

- Max Return: $34 & Max Risk: $66

- Current Value: $34

- Profit Target: $15

- Profit Odds: 70%

SPY Iron Condor (3) April 21st

- $420/$422 Call Spread --> Credit: $48

- $397/$395 Put Spread --> Credit: $30

- Max Return: $78 & Max Risk: $122

- Current Value: $48

- Profit Target: $30

- Profit Odds: 76%

SPY Iron Condor (3) April 28th

- $422/$424 Call Spread --> Credit: $41

- $393/$391 Put Spread --> Credit: $28

- Max Return: $69 & Max Risk: $131

- Current Value: $64

- Profit Target: $30

- Profit Odds: 78%

New Position(s)

None

My Thoughts

Nothing too crazy happened today. In all reality, it was a grind of a day.

Even though we saw some of the early day weakness erased in the second half of the day, I would argue the bears still won of the day. Today marks the second red day in a row, and the price action pierced the low of yesterday. I'm not saying it was a dominant bearish day, but I do believe the Negative Nancy’s were in control. As of now, I'm happy with my SPY puts -- I'm still eyeing up the downside gap fills ($404.35, $401.60 & $396.49).

I decided to pull the trigger on the TSLA put play idea discussed yesterday. When $186 couldn't hold, I bought 2 $180 puts for April 21st @ $7.38. My profit targets are $176 and $164. My risk is roughly $200. I like the timing and technical setup. Time to roll the dice. Godspeed.

Thanks for reading -- Much Love!

Notes

Max Return (Credit Spreads): The credit received when creating the position. This is achieved when you get to the expiration date and the price is below the sold contract for a Call Credit Spread and above the sold contract for a Put Credit Spread.

Max Risk (Credit Spreads): The difference between the spread's two strikes minus the credit received when the position was created.

Breakeven (Credit Spreads): The sold strike plus the credit for CCS and the strike minus the credit for PCS.

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

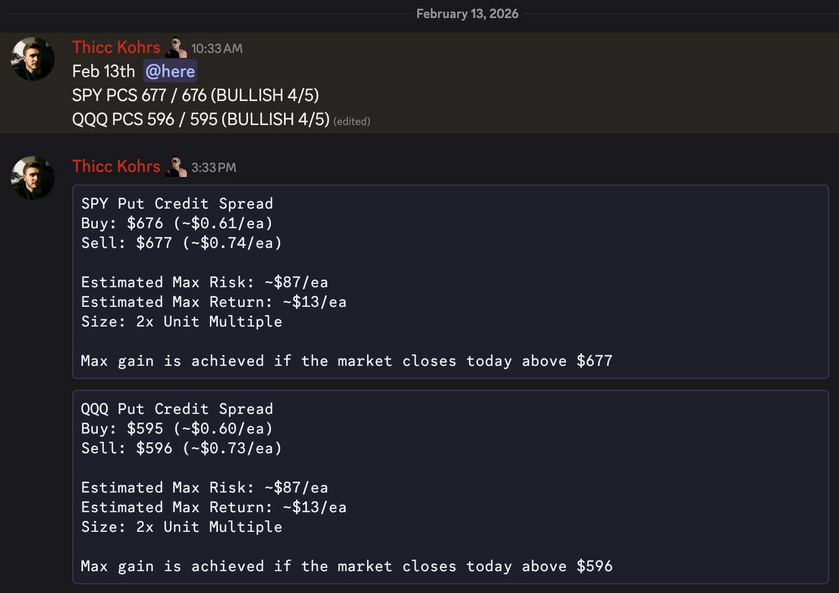

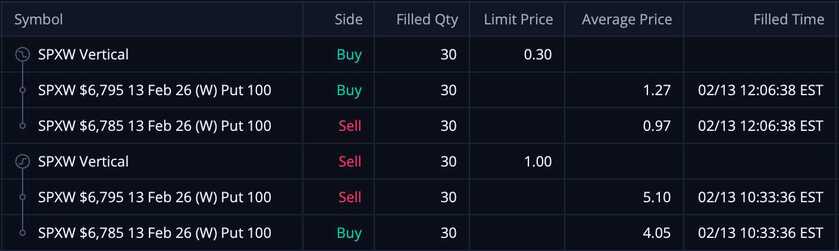

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $1.00/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $2,100!

These PCS's were sold at $1.00/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $2,100!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

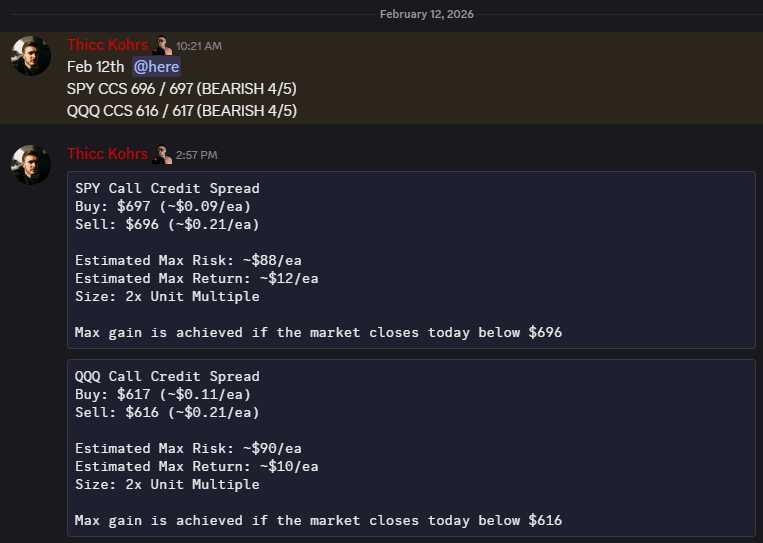

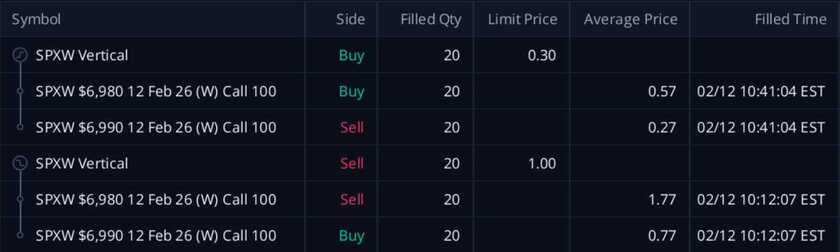

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These CCS's were sold at $1.00/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

These CCS's were sold at $1.00/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!