Chopped Again

Well... fuck.

Another day of violent nothingness -- I hope you didn't get too screwed. We are in the middle of earnings season and major market reports are dropping over the next two weeks. All of the earnings and reports will be detailed below as the time gets closer.

As of now, we have a mixed-bag situation. Both good and bad information has been coming out over the past week. Even if you didn't pay attention to any of the announcements, just look at the price again. We opened the week 17 cents above where we closed out the week. We've done a phenomenal job at going absolutely nowhere.

I'm hopeful things will change this upcoming week. Major information will be released, which ideally should break the hold pattern.

Market Events: Monday, April 24th

None

Earnings: April 24th - 28th

Monday --

Morning: Coca Cola & Philips

Evening: First Republic Bank

Tuesday --

Morning: 3M, GE, GM, McDonalds, PepsiCo, Spotify, UPS & Verizon

Evening: Alphabet, Chipotle, Microsoft & Visa

Wednesday --

Morning: Boeing, Hilton & Hess

Evening: Meta & Roku

Thursday --

Morning: Abbvie, American Airlines, Caterpillar, Crocs, Mastercard, Merck & Southwest

Evening: Amazon, Cloudflare, Intel, Pinterest & Snap Inc

Friday --

Morning: Chevron & Exxon Mobil

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

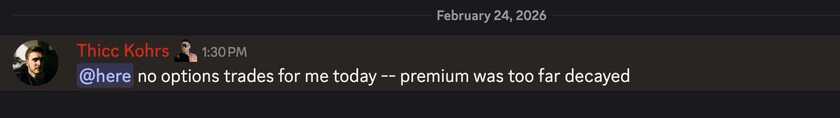

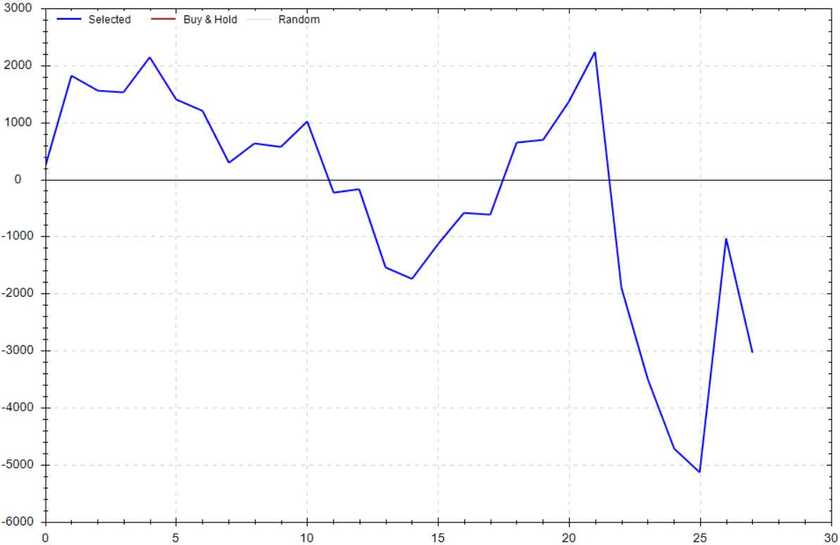

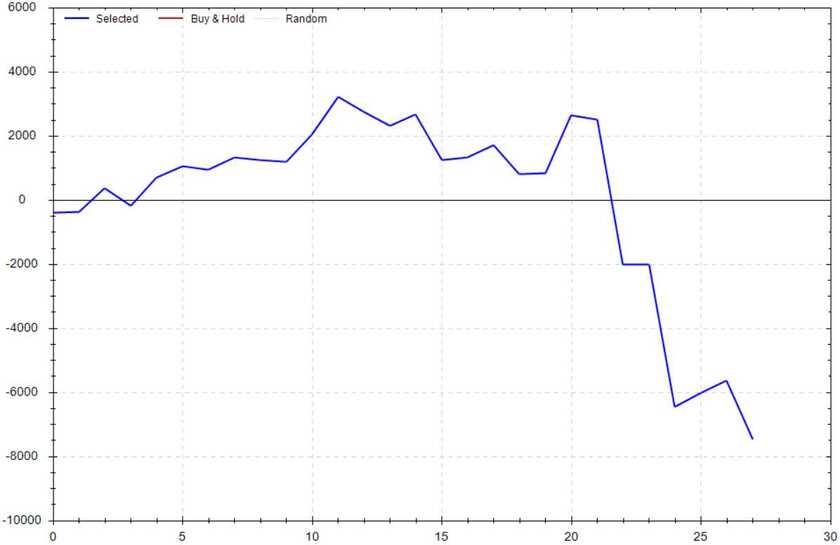

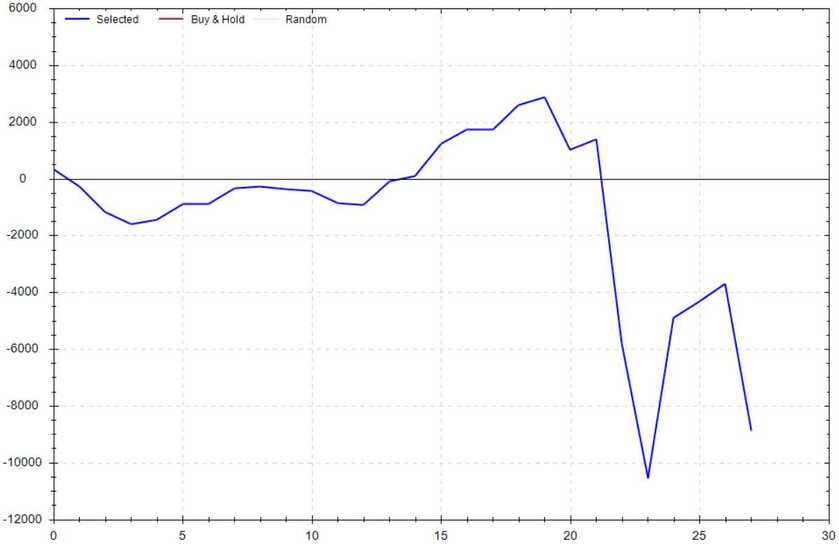

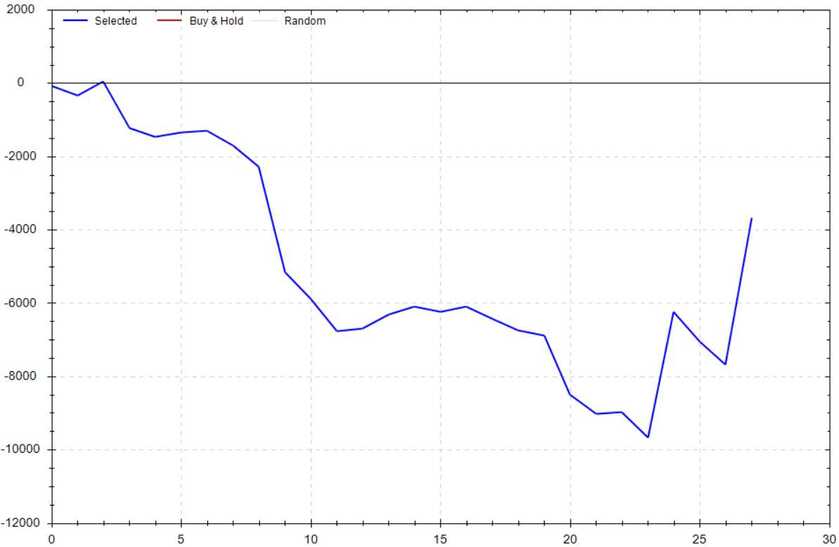

S&P 500 Seasonal Bias (April 24th)

- Bull Win Percentage: 64%

- Profit Factor: 0.78

- Bias: Leaning Bearish

Equity Curve -->

Current Account Value (April 21st)

Daily Realized P&L: +$0

YTD Realized P&L: +$505

Closed Position(s)

None

Current Position(s)

SPY Iron Condor (3) April 28th

- $419/$421 Call Spread --> Credit: $38

- $399/$397 Put Spread --> Credit: $34

- Max Return: $72 & Max Risk: $128

- Current Value: $34

- Profit Target: $30

- Profit Odds: 85%

SPY Iron Condor (3) May 5th

- $418/$419 Call Spread --> Credit: $37

- $403/$402 Put Spread --> Credit: $20

- Max Return: $57 & Max Risk: $43

- Current Value: $55

- Profit Target: $20

- Profit Odds: 69%

SPY Iron Condor (3) May 5th

- $422/$423 Call Spread --> Credit: $23

- $400/$399 Put Spread --> Credit: $18

- Max Return: $41 & Max Risk: $59

- Current Value: $36

- Profit Target: $15

- Profit Odds: 82%

SPY Iron Condor (3) May 5th

- $424/$426 Call Spread --> Credit: $46

- $397/$395 Put Spread --> Credit: $37

- Max Return: $83 & Max Risk: $117

- Current Value: $47

- Profit Target: $30

- Profit Odds: 87%

SPY Iron Condor (3) May 12th

- $426/$428 Call Spread --> Credit: $40

- $399/$397 Put Spread --> Credit: $25

- Max Return: $65 & Max Risk: $135

- Current Value: $58

- Profit Target: $30

- Profit Odds: 86%

New Position(s)

None

My Thoughts

I have nothing special or insightful to say that I haven't shared in the past. The market is choppy as fuck. Wait for the next major trend to start -- Patience is key. Have a great weekend!

Thanks for reading -- Much Love!

Notes

Max Return (Credit Spreads): The credit received when creating the position. This is achieved when you get to the expiration date and the price is below the sold contract for a Call Credit Spread and above the sold contract for a Put Credit Spread.

Max Risk (Credit Spreads): The difference between the spread's two strikes minus the credit received when the position was created.

Breakeven (Credit Spreads): The sold strike plus the credit for CCS and the strike minus the credit for PCS.

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

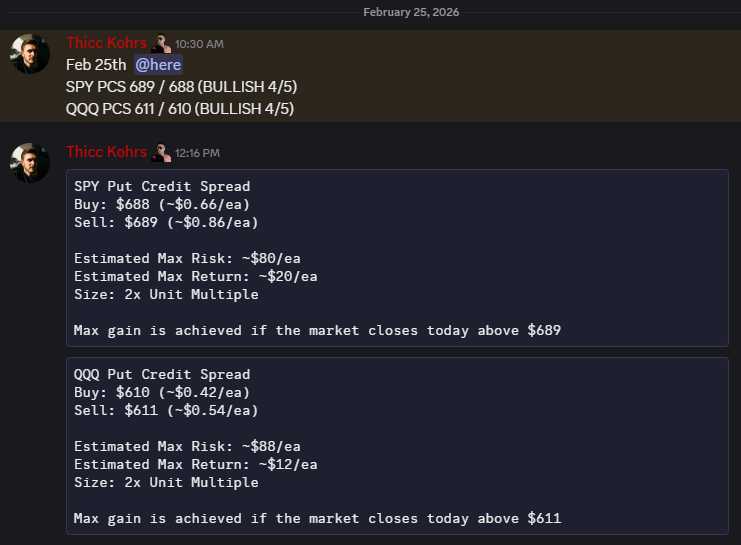

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

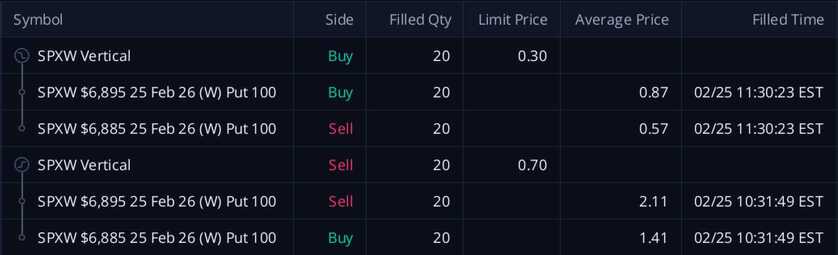

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!

These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!