Sailing Off The Edge

Hola Doodies,

I hope you've been bearish. If not, I feel for your losses.

As promised, last week delivered fireworks. Granted, they were bear-lit red fireworks that you didn't enjoy if you were yoloing calls. If you missed the action, the TLDR is that the FOMC decision suggested that the Fed Rate will "remain higher for longer". This, paired with Powell's hawkish comments, were no bueno for the markets.

In my opinion, the pain is not over. The price action was controlled by the bears, there were various technical breakdowns (shown below), and now the US gov'nt is facing a shutdown (sprinkles on top of the bloodbath sundae). My bias is bearish, but it's not a committed relationship. It's more of an open relationship so we can both "find out true selves". Without reliving my college relationships, what I'm trying to say is -- take what the price action gives you. Don't be stubborn. Control your risk. Ride the wave.

Warmest Regards,

Mateo Julio Ricardo Montoya de la Rosa Kohrs

Market Events

Tuesday, Sept. 26th

08:00 AM ET Building Permits

10:00 AM ET CB Consumer Confidence

10:00 AM ET New Home Sales (Aug)

Wednesday, Sept. 27th

08:30 AM ET Core Durable Goods Orders (MoM) (Aug)

10:30 AM ET Crude Oil Inventories

Thursday, Sept. 28th

08:30 AM ET GDP (QoQ) (Q2)

08:30 AM ET Initial Jobless Claims

10:00 AM ET Pending Home Sales (MoM) (Aug)

04:00 PM ET Fed Chair Powell Speaks

Friday, Sept. 29th

05:00 AM ET EUR CPI (YoY) (Sep)

08:30 AM ET Core PCE Price Index (MoM) (Aug)

08:30 AM ET Core PCE Price Index (YoY) (Aug)

Earnings

Monday

None

Tuesday

Evening: Costco

Wednesday

Evening: Micron

Thursday

Morning: Accenture & Carmax

Evening: Blackberry, Nike & Vail Resorts

Friday

Morning: Carnival

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

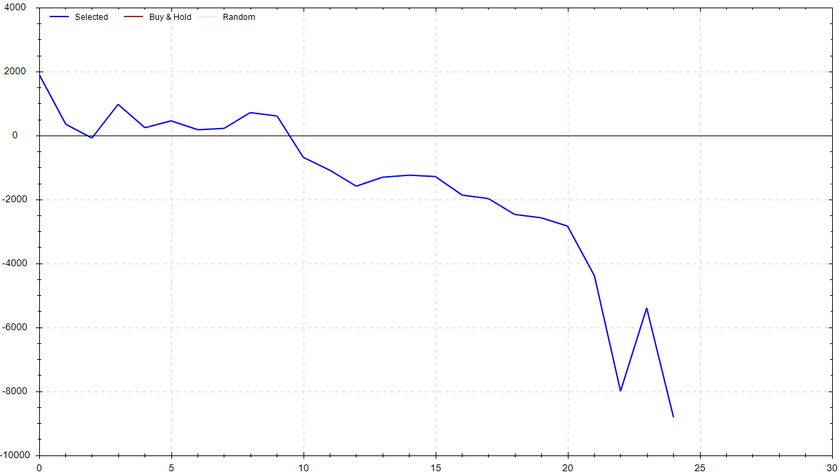

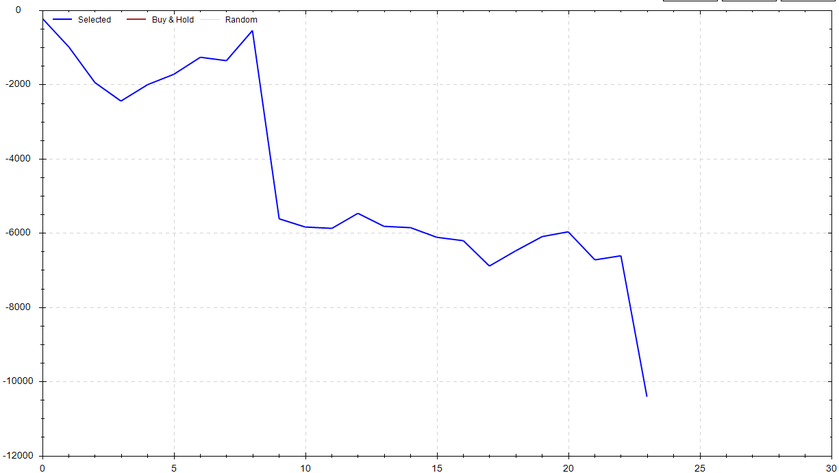

S&P 500 Seasonal Bias (Monday, Sept. 25th)

- Bull Win Percentage: 32%

- Profit Factor: 0.43

- Bias: Bearish

Equity Curve -->

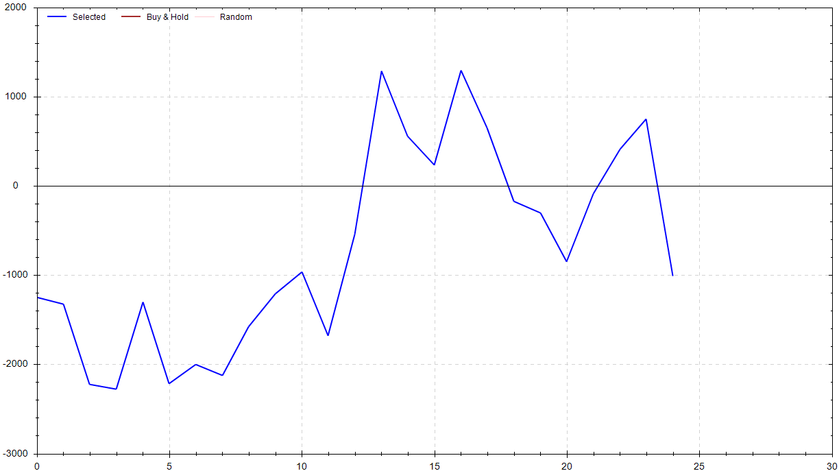

S&P 500 Seasonal Bias (Tuesday, Sept. 26th)

- Bull Win Percentage: 44%

- Profit Factor: 0.89

- Bias: Neutral

Equity Curve -->

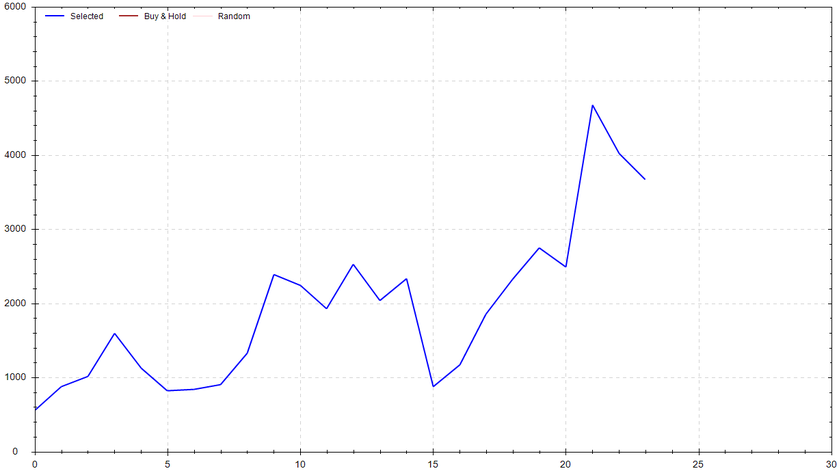

S&P 500 Seasonal Bias (Wednesday, Sept. 27th)

- Bull Win Percentage: 62%

- Profit Factor: 1.83

- Bias: Bullish

Equity Curve -->

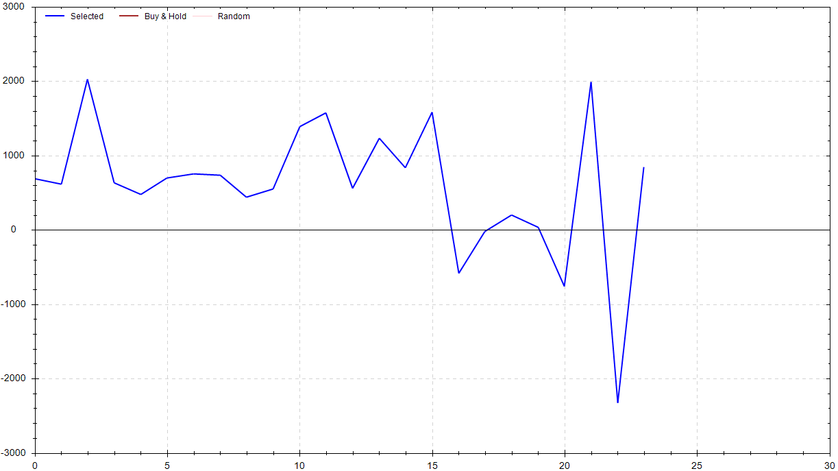

S&P 500 Seasonal Bias (Thursday, Sept. 28th)

- Bull Win Percentage: 54%

- Profit Factor: 1.08

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Sept. 29th)

- Bull Win Percentage: 37%

- Profit Factor: 0.25

- Bias: Bearish

Equity Curve -->

Options Strategy Update

The 0 DTE signal went 6 out of 7 (~86% accuracy).

Similar to last week, the percision of the system was within the expected range. I was pretty confident the week would end with a perfect record, but the puke fest into the close on Friday ruined that for me. I only have the two data points, but the last couple reported Friday's have been losers. I'm considering not trading this strategy on the final day of the week. Sure, it might be bad luck, or you could argue the gamma exposure of Friday screws with things. I'll be paying close attention in the coming weeks.

Monday Sept. 18th

QQQ CALL Credit Spread ($372 / $373) 🟢

Tuesday Sept. 19th

SPY CALL Credit Spread ($444 / $445) 🟢

QQQ CALL Credit Spread ($370 / $371) 🟢

Wednesday Sept. 20th

None

Thursday Sept. 21st

SPY CALL Credit Spread ($437 / $438) 🟢

QQQ CALL Credit Spread ($364 / $365) 🟢

Friday Sept. 22nd

SPY PUT Credit Spread ($431 / $430) 🔴

QQQ PUT Credit Spread ($358 / $357) 🟢

Charts of Interest

The bears are clearly in control. If the selloff continues, I'll be watching the next level of support ($425.82). If that does not hold, there is a downside gap fill at $422.92. However, on the chance that my thesis is wrong, I'd be watching for the upside gap fill to $438.43.

The bears are clearly in control. If the selloff continues, I'll be watching the next level of support ($425.82). If that does not hold, there is a downside gap fill at $422.92. However, on the chance that my thesis is wrong, I'd be watching for the upside gap fill to $438.43.

The bears successfully caused a breakdown last week. My next target is $354.71. From there, I would be watching the $347 region. If the bulls regain control, there is an upside gap fill at $434.46.

The bears successfully caused a breakdown last week. My next target is $354.71. From there, I would be watching the $347 region. If the bulls regain control, there is an upside gap fill at $434.46.

Tesla broke its bullish trend. I'd be watching (In order), $240, $230, then $217.58 next. There is an upside target of $262.59.

Tesla broke its bullish trend. I'd be watching (In order), $240, $230, then $217.58 next. There is an upside target of $262.59.

Watch for the head & shoulders breakdown of PLTR.

Watch for the head & shoulders breakdown of PLTR.

IMO, if NVDA doesn't recapture ~$440 quickly, there is more selling coming. I'll be watching $403, $366, then $306.

IMO, if NVDA doesn't recapture ~$440 quickly, there is more selling coming. I'll be watching $403, $366, then $306.

The bears took control on AMZN (clear rejection at the 52-week high). My next target would be $126.

The bears took control on AMZN (clear rejection at the 52-week high). My next target would be $126.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!