Welcome To Hell

Ahoy Sailors,

The markets have been shit, but at least we are having fun, right? ...right?

Now that we have officially put a bow on the month of September, it's time to applaud those of you who had bearish positions. The market dropped ~5% by the time the dust settled. For those of you who had bullish positions, there is always next month. There is always another opportunity for you to finally stick to your rules, follow your risk management and stop betting your entire account on every play.

(Pause for laughter).

Anyway, a hawkish fed, incompetent elected officials, and a looming credit downgrade can make the market feel some sort of way. I wish I could tell you that everyone is overeating, and yes, as I'm writing this it was announced "Biden signs 45-day funding bill to keep government open". But on the other hand, ratings agencies won't like that the government came extremely close to shutting down. Anyone who is paying attention won't like that our representatives are still spending money like a drunken sailor.

I wish I could tell you that this is nothing but a hiccup, but that would be a lie. From a statistical standpoint, the start of October is one of the worst periods of the entire trading year. Please plan accordingly.

The rest of the newsletter will contain all the major things I'm paying attention to over the following week. As always, don't marry your position. Bulls & Bears eat -- Hogs get slaughtered.

This Rain Is Real Wet,

Matt

Market Events

Monday, Oct. 2nd

10:00 AM ET ISM Manufacturing PMI (Sep)

10:00 AM ET ISM Manufacturing Prices (Sep)

11:00 AM ET Fed Chair Powell Speaks

23:30 AM ET RBA Interest Rate Decision (Oct)

Tuesday, Oct. 3rd

10:00 AM ET JOLTs Job Openings (Aug)

Wednesday, Oct. 4th

08:15 AM ET ADP Nonfarm Employment Change (Sep)

09:45 AM ET S&P Global Services PMI (Sep)

10:00 AM ET ISM Non-Manufacturing PMI (Sep)

10:00 AM ET ISM Non-Manufacturing Prices (Sep)

10:30 AM ET Crude Oil Inventories

Thursday, Oct. 5th

08:30 AM ET Initial Jobless Claims

Friday, Oct. 6th

08:30 AM ET Average Hourly Earnings (MoM) (Sep)

08:30 AM ET Nonfarm Payrolls (Sep)

08:30 AM ET Unemployment Rate (Sep)

Upcoming Earnings

Monday

None

Tuesday

Morning: McCormick

Wednesday

Morning: Tilray

Thursday

Evening: Levi's

Friday

None

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

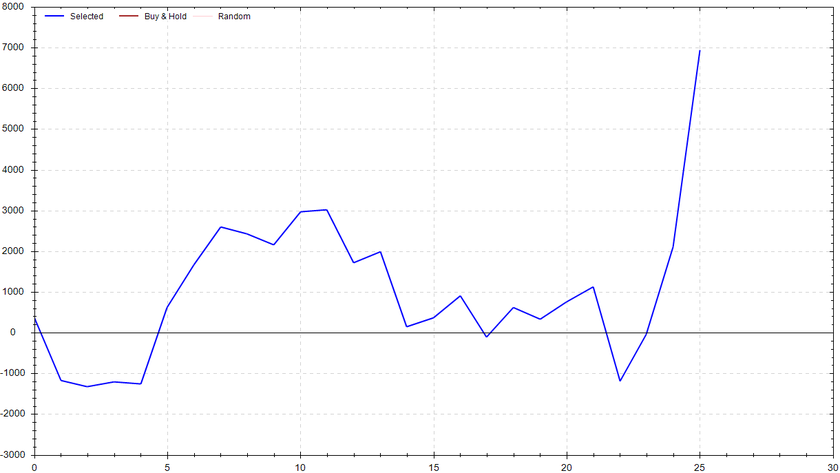

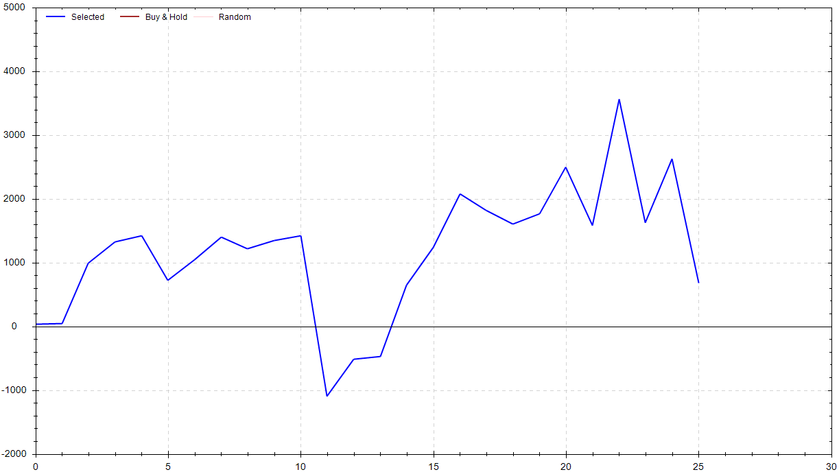

S&P 500 Seasonal Bias (Monday, Oct. 2nd)

- Bull Win Percentage: 61.5%

- Profit Factor: 1.78

- Bias: Bullish

Equity Curve -->

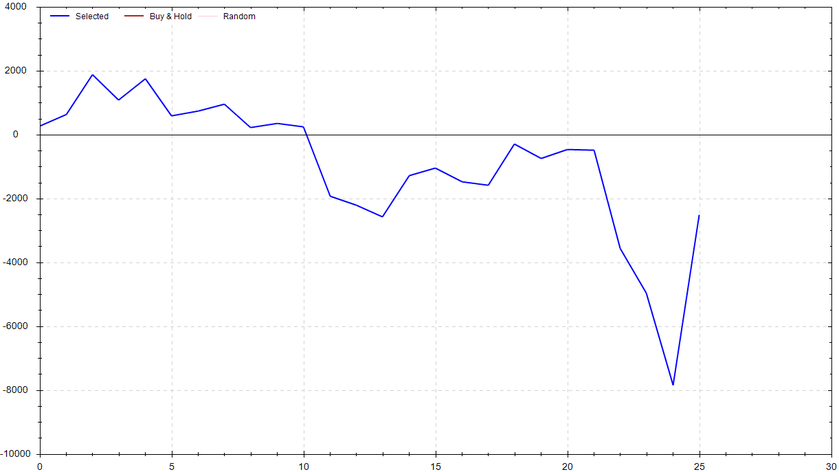

S&P 500 Seasonal Bias (Tuesday, Oct. 3rd)

- Bull Win Percentage: 46.2%

- Profit Factor: 0.82

- Bias: Leaning Bearish

Equity Curve -->

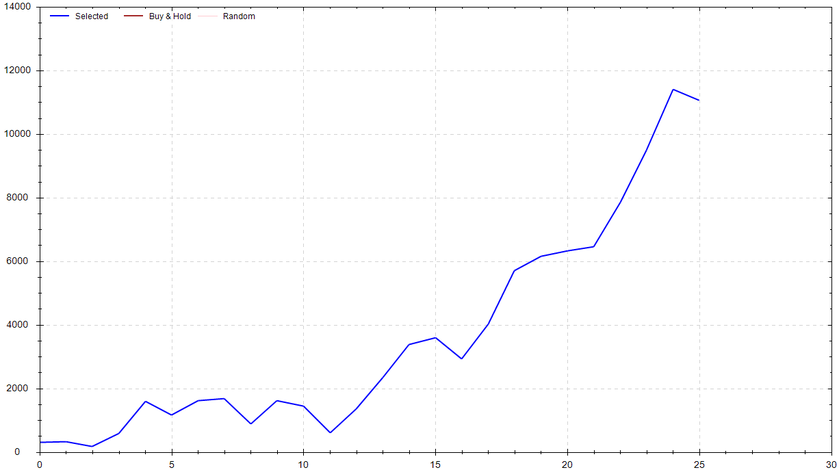

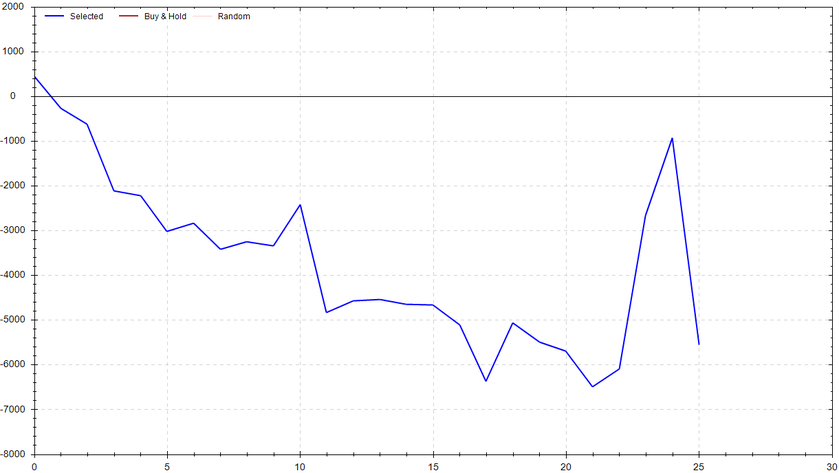

S&P 500 Seasonal Bias (Wednesday, Oct. 4th)

- Bull Win Percentage: 73.1%

- Profit Factor: 4.25

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, Oct. 5th)

- Bull Win Percentage: 69.2%

- Profit Factor: 1.08

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Oct. 6th)

- Bull Win Percentage: 38.5%

- Profit Factor: 0.62

- Bias: Bearish

Equity Curve -->

Options Strategy Update

The 0 DTE signal went 5 out of 6 (~83% accuracy)*.

Another week has come and gone, and the 0DTE strategy is still performing as expected. Personally, I strongly believe there are improvements that can be made. This is the third week in a row that suggests trading the strategy on Fridays is suspicious to say the least. I have some things cooking in the background that should bring this all to the next level. I'll let you know about it all ASAP.

Monday Sept. 25th

SPY CALL Credit Spread ($432 / $433) 🔴

QQQ CALL Credit Spread ($360 / $361) 🟢

Tuesday Sept. 26th

None

Wednesday Sept. 27th

SPY CALL Credit Spread ($428 / $429) 🟢

QQQ CALL Credit Spread ($357 / $358) 🟢

Thursday Sept. 28th

None

Friday Sept. 29th

SPY PUT Credit Spread ($430 / $429) 🟡

QQQ PUT Credit Spread ($360 / $359) 🟡

* Friday was profitable if the delta hedge was taken. The signals were not profitable if the hedge wasn't taken.

Charts of Interest

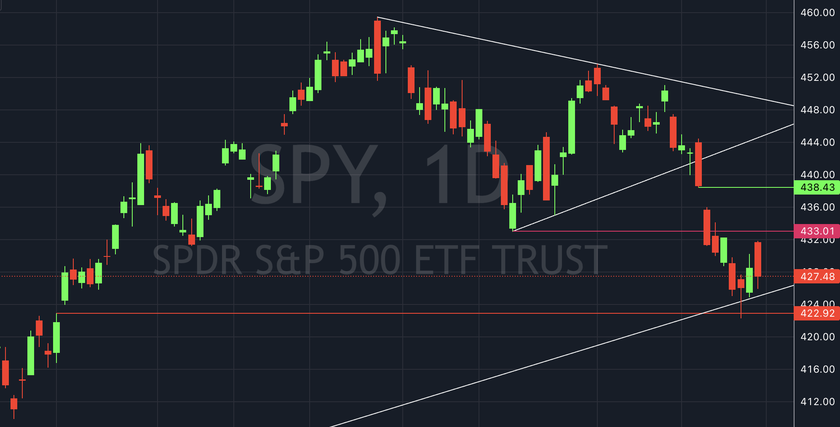

Well, well, well. It looks like last week's downside gap fill callout was a solid one. After the SPY hit $422.92, a decent bounce ensued. If it kept selling off at that point, things could have gotten ugly. I'll be watching for the SPY to hold $423. If it does, there is an upside gap fill to $438.43. If things get smacked, the next level of support I care about is $416.

Well, well, well. It looks like last week's downside gap fill callout was a solid one. After the SPY hit $422.92, a decent bounce ensued. If it kept selling off at that point, things could have gotten ugly. I'll be watching for the SPY to hold $423. If it does, there is an upside gap fill to $438.43. If things get smacked, the next level of support I care about is $416.

The QQQ's breakdown of $354.71 proved to be a fake out breakdown. A failed breakdown is inherently bullish. My first watch will be the upside gap fill at $364.46. After that, I'd be watching the down-slopping trendline. If the reversion doesn't hold, I'd be paying attention to $353 followed by $347.

The QQQ's breakdown of $354.71 proved to be a fake out breakdown. A failed breakdown is inherently bullish. My first watch will be the upside gap fill at $364.46. After that, I'd be watching the down-slopping trendline. If the reversion doesn't hold, I'd be paying attention to $353 followed by $347.

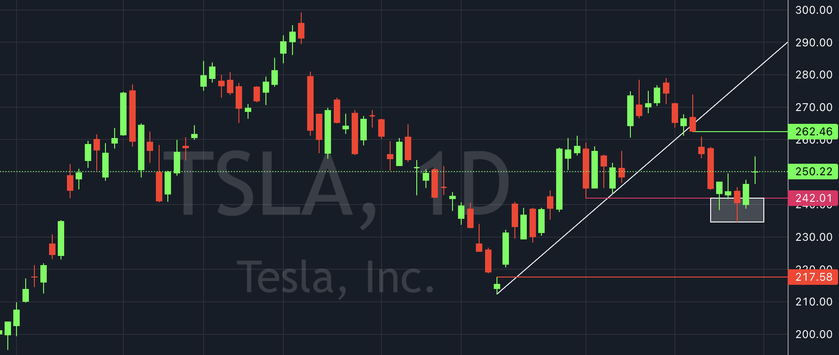

Similar to the QQQs, TSLA saw a fake out breakdown last week. I'll be looking at the $262.46 upside gap fill for this week. If $240ish doesn't hold, $230 (followed by $217.58) could be on the menu.

Similar to the QQQs, TSLA saw a fake out breakdown last week. I'll be looking at the $262.46 upside gap fill for this week. If $240ish doesn't hold, $230 (followed by $217.58) could be on the menu.

Speaking of EV plays, RIVN is looking like a hot tamale. If the breakout holds, I'll be watching for $28+. This trade could easily turn into a bust if $20 doesn't hold.

Speaking of EV plays, RIVN is looking like a hot tamale. If the breakout holds, I'll be watching for $28+. This trade could easily turn into a bust if $20 doesn't hold.

AMD is knocking on the door or a potential breakout. I'd argue it's worth a place on your watchlist because the success or failure will prompt a tradeable event.

AMD is knocking on the door or a potential breakout. I'd argue it's worth a place on your watchlist because the success or failure will prompt a tradeable event.

Times Cried In Shower

5*

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!