Merry Christmas!

Hey Y'all,

SANTA IS COMING TO TOWN!!!

The rally has successfully continued! Both the Dow and the Nasdaq have notched a new all-time high. The S&P 500 is within spitting distance of the doing the same. Bitcoin, gold & bonds are all pushing higher as well. Enjoy the good times while they're here. The market euphoria won't last forever.

It's beyond fair to ask "why?". Why has seemingly the entire market continued to push higher? To play devil's advocate, I would ask "why not?". I would never say the market is rational. I mean seriously -- I'm in the market, and I'm definitely not rational. As much as that's a joke, it's also accurate. The market and the economy are related, yet distinct entities. I fully agree the economy feels like it's on a shaky foundation. However, the market is reacting to the perception of where things are headed. Inflation is high, but the velocity of its growth is slowing down. Unemployment remains low. And now, the market is forecasting multiple Fed Rate cuts in 2024. The bullish perception that we might be able to pull off a "soft landing" was enough to get people to yolo in the long direction. Bullishness begets bullishness, which has quickly created a fomo situation.

With all that being said, will the current rally last forever? God no!

Markets expand, market contract. Markets push up, markets fall down. Nothing lasts forever in the degenerate game we call trading. Ride the trend as long as the trend exists. Pull the ripcord when things start to revert not when your gut tells you they well. I believe the market is overextended, but guess what? It keeps pushing! We all have our own thoughts and opinions, but please forget them at the opening bell. Trade what the market gives you. Be reactive, not predictive. I have no clue what the coming market days will bring, but I do know strength is still being shown and the seasonality favors the bulls. I'll be remaining long and strong until there is a clear reason not to.

Happy Holidays,

Matt

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Dec. 25th

ALL DAY MARKET CLOSED (Merry Christmas!)

Tuesday, Dec. 26th

NONE

Wednesday, Dec. 27th

NONE

Thursday, Dec. 28th

08:30 AM ET Initial Jobless Claims

10:00 AM ET Pending Home Sales (MoM) (Nov)

Friday, Dec. 29th

NONE

Upcoming Earnings

None

Seasonality Update

S&P 500 Seasonal Bias (Monday, Dec. 25th)

- MARKET CLOSED

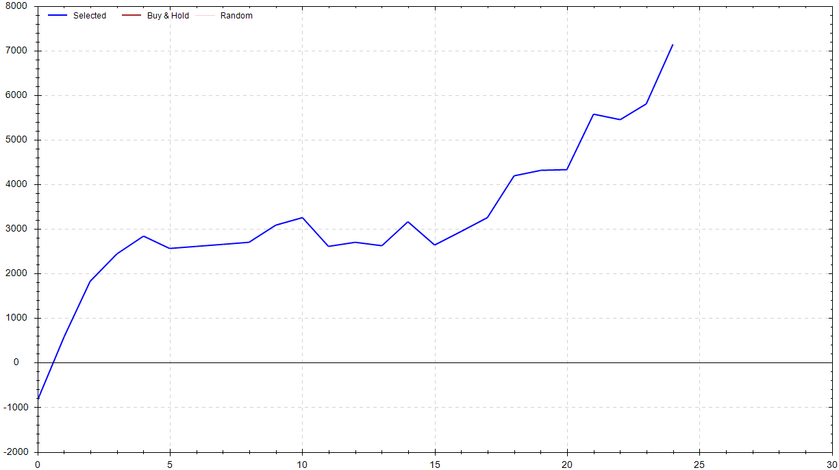

S&P 500 Seasonal Bias (Tuesday, Dec. 26th)

- Bull Win Percentage: 76%

- Profit Factor: 3.87

- Bias: Bullish

Equity Curve -->

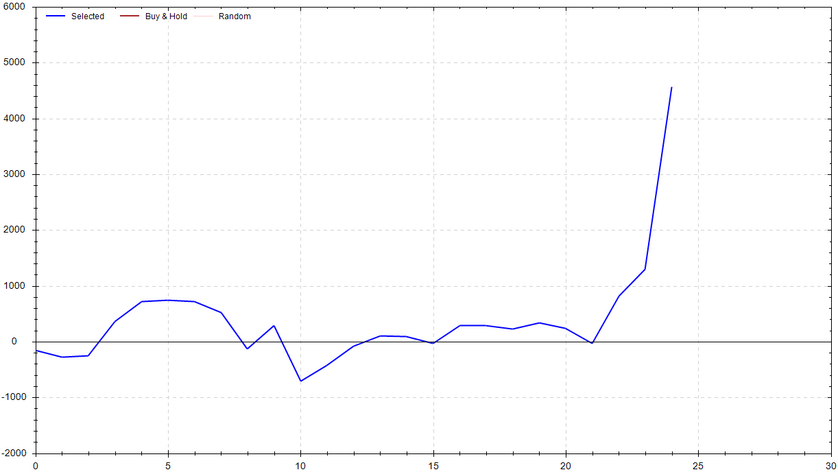

S&P 500 Seasonal Bias (Wednesday, Dec. 27th)

- Bull Win Percentage: 52%

- Profit Factor: 2.68

- Bias: Bullish

Equity Curve -->

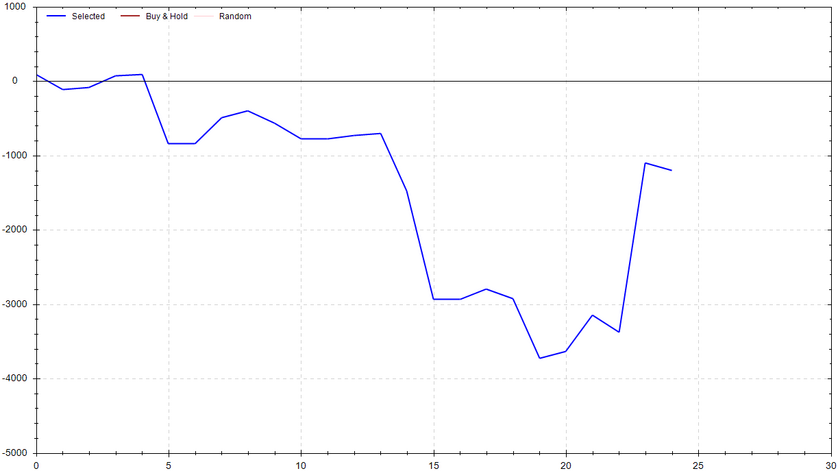

S&P 500 Seasonal Bias (Thursday, Dec. 28th)

- Bull Win Percentage: 48%

- Profit Factor: 0.76

- Bias: Bearish

Equity Curve -->

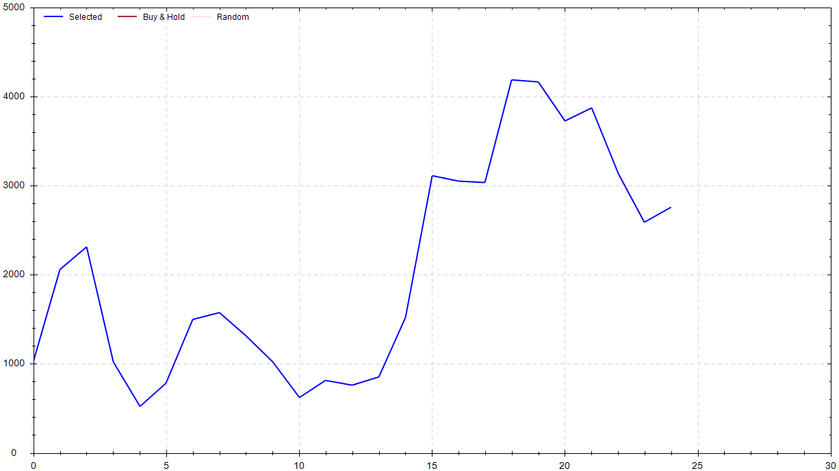

S&P 500 Seasonal Bias (Friday, Dec. 29th)

- Bull Win Percentage: 52%

- Profit Factor: 1.60

- Bias: Leaning Bullish

Equity Curve -->

Options Strategy Update

The 0 DTE signal hit 9 for 11 times this past week (Signal Accuracy: ~81.8%).

The new unit-scaling aspect of this strategy has officially dropped! Even though the week wasn't perfect, I'm still happy with the results. The accuracy was within expectations, and the profits were higher than predicted. I don't think many adjustments will be required, but I'll monitor things closely in the coming weeks to be safe. Let me know if you have any questions!

Current Streak: 2

December Record: 28/31

Monday Dec. 18th

SPY PUT Credit Spread (2 units @ $470 / $469) 🟢

QQQ PUT Credit Spread (2 units @ $404 / $403) 🟢

Tuesday Dec. 19th

SPY PUT Credit Spread (2 units @ $472 / $471) 🟢

QQQ PUT Credit Spread (1 unit @ $407 / $406) 🟢

Wednesday Dec. 20th

SPY PUT Credit Spread (1 unit @ $473 / $472) 🔴

QQQ PUT Credit Spread (1 unit @ $408 / $407) 🔴

Thursday Dec. 21st

SPY CALL Credit Spread (1 unit @ $473 / $474) 🟢

QQQ CALL Credit Spread (1 unit @ $408 / $409) 🟢

Friday Dec. 22nd

NONE

Charts of Interest

SPY

Long & Strong! The bulls continue to dominate. I see no reason in betting against the evident, strongly-establish trend. The chance of picking the exact is slim to fucking none. Don't be that person. In my humble opinion, it's far easier to simply go with the flow. I'm looking for a break & hold above $476 (the recent high). My first upside target would the all-time high, $480. After that, it would be time to white knuckle the open range breakout. If the market were to close below $467, I would be looking for a continued consolidation.

QQQ

The NASDAQ has a very similar vibe to the S&P 500. It is worthwhile to note that the tech sector is stronger (ie more bullish) on a relative basis. A new all-time high was established this past week around $410. A close above that could easily trigger an open range breakout. If a close below $403 were to happen, I would be looking for a consolidation and/or healthy pullback.

BTC

Digital gold has broken out and has successfully held. The final question is now: How far will this push go? My first target is $45k followed by $48k & $50k. The breakout would be invalidated with a close below $40k. Stay frosty.

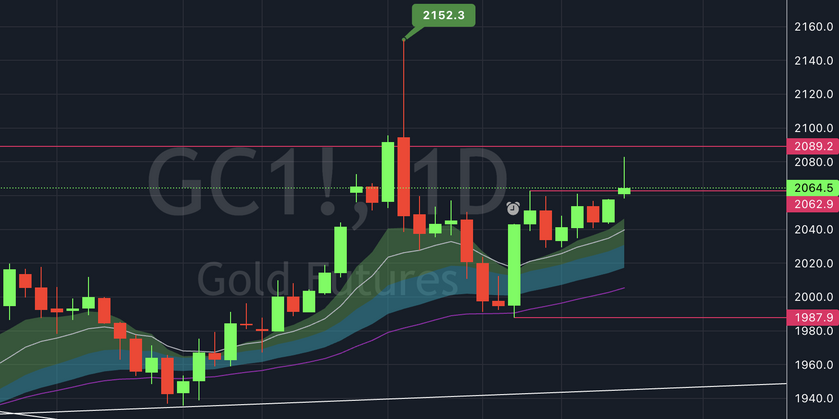

GC (Gold)

Similar to Bitcoin, literal gold has broken out and has successfully held. Before a push to the all-time high of 2,152, I'll be looking to see how price reacts to the resistance region of 2090 to 2100. It really doesn't get easier than this setup. A truly classic breakout, consolidation & continuation. It doesn't "work" every single time, but it's considerably profitable over a large dataset with proper risk management.

TSLA

I'm starting to sound like a broken record, but Tesla broke out & held. Personally, I would now set my trailing stop to $246. I would also be praying for a $260 breakout to lead to $270. Higher highs & higher lows are a beautiful thing to see.

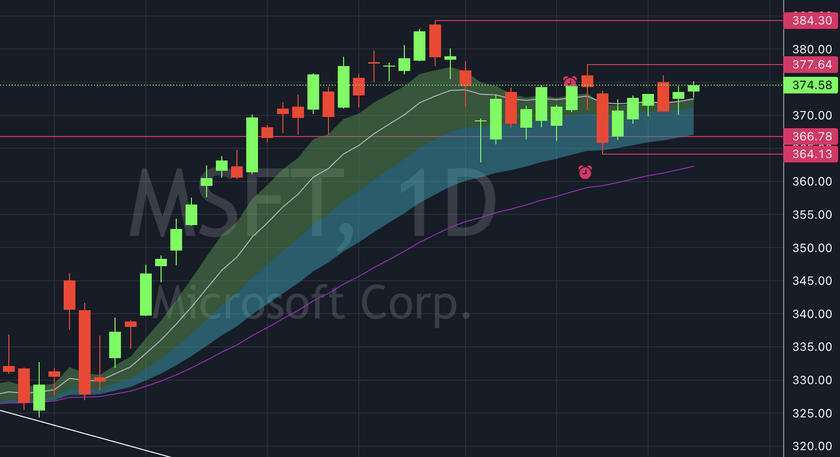

MSFT

Microsoft continues to be a top "on deck" callout for me. I'm looking for a close above $376ish to lead to $384. If things get real spicy, we might even be looking at a new all-time high. As I'm writing this, I've decided to start building a swing position -- Risk is set to $363.

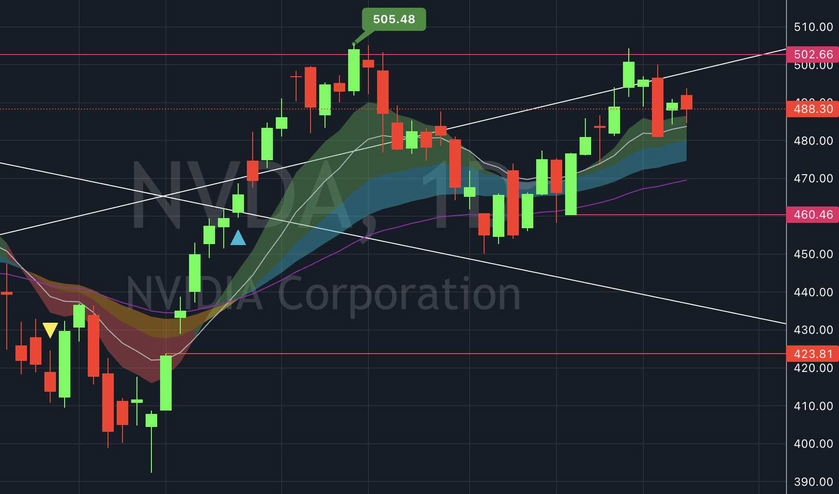

NVDA

Potential triple top. Potential cup & handle. Potential inverse head & shoulders. Potential for big moves. Worth a watch.

Christmas Trees Toppled By Piper

3.7 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!