The New Era of Crypto

Aloha,

Welcome to the new age of cryptocurrency! The BIG news of the past week shined a bright light on Bitcoin -- The SEC finally approved spot Bitcoin ETFs. If you've been diamond handing digital gold over the past few years or more, a massive congrats to you. I hope the coming years are even more exciting.

Beyond internet monies, there were various other developments over the past week you should know about. There were two inflation reports, CPI & PPI. The data came in hot (higher than expected) and cool (lower than expected) respectively. To make the party even more exciting, Earnings Season officially commenced as well. A handful of major financial players report their performance. Thus far, the results have been a mixed bag. It will take a bit more clarity to know if the bulls or the bears have the upper hand.

Looking ahead there are various macroeconomic and earnings reports dropping in the upcoming, shortened trading week (details posted below). Stay frosty!

Peace,

Matt

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Jan. 15th

ALL DAY Market Closed for MLK Day

Tuesday, Jan. 16th

09:00 PM ET China GDP Report (YoY) (Q4)

Wednesday, Jan. 17th

05:00 AM ET Eurozone CPI (YoY)

08:30 AM ET Retail Sales (MoM) (Dec)

Thursday, Jan. 18th

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Fed Manufacturing Index (Jan)

11:00 AM ET Crude Oil Inventories

Friday, Jan. 19th

10:00 AM ET Existing Home Sales (Dec)

Upcoming Earnings

Monday

None

Tuesday

AM: Goldman Sachs, Morgan Stanley & PNC

PM: IBKR

Wednesday

AM: Charles Schwab

PM: Discover

Thursday

AM: TSMC

Friday

AM: Ally & SLB

Seasonality Update

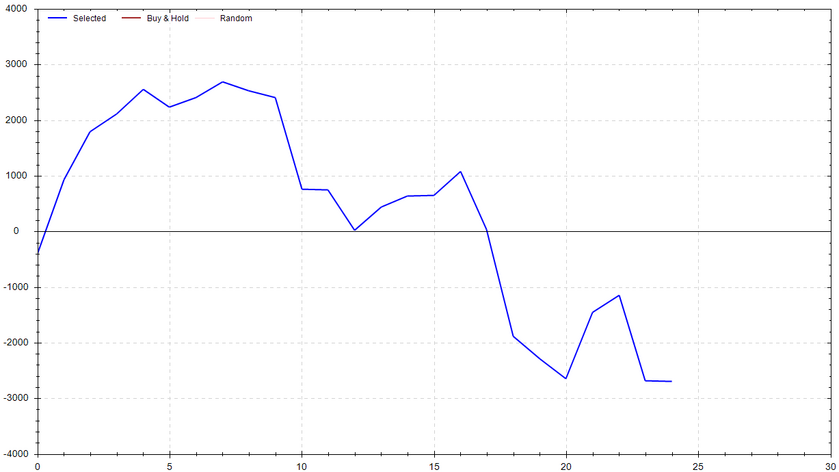

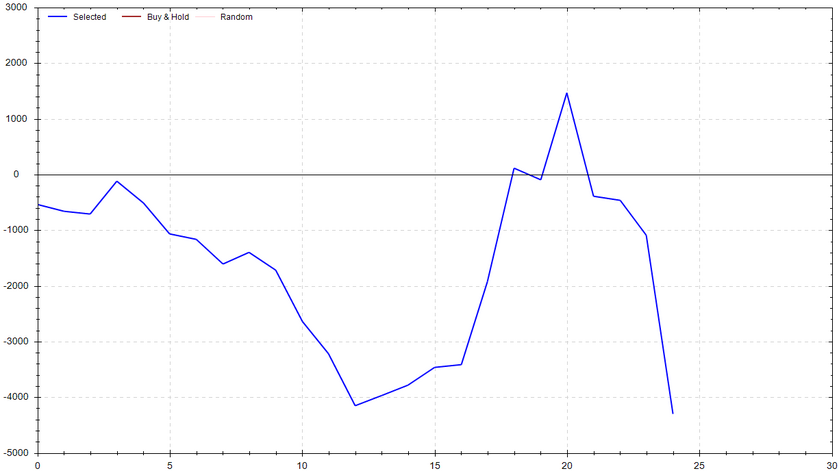

S&P 500 Seasonal Bias (Monday, Jan. 15th)

- Bull Win Percentage: 48%

- Profit Factor: 0.69

- Bias: Bearish

Equity Curve -->

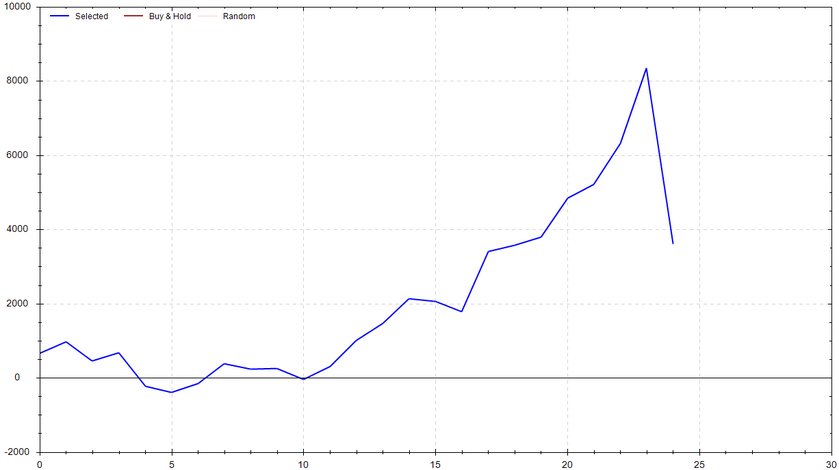

S&P 500 Seasonal Bias (Tuesday, Jan. 16th)

- Bull Win Percentage: 68%

- Profit Factor: 1.51

- Bias: Bullish

Equity Curve -->

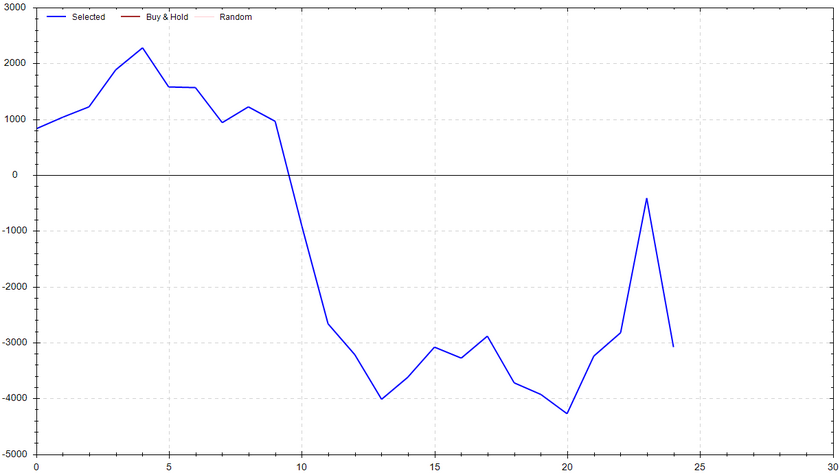

S&P 500 Seasonal Bias (Wednesday, Jan. 17th)

- Bull Win Percentage: 48%

- Profit Factor: 0.71

- Bias: Bearish

Equity Curve -->

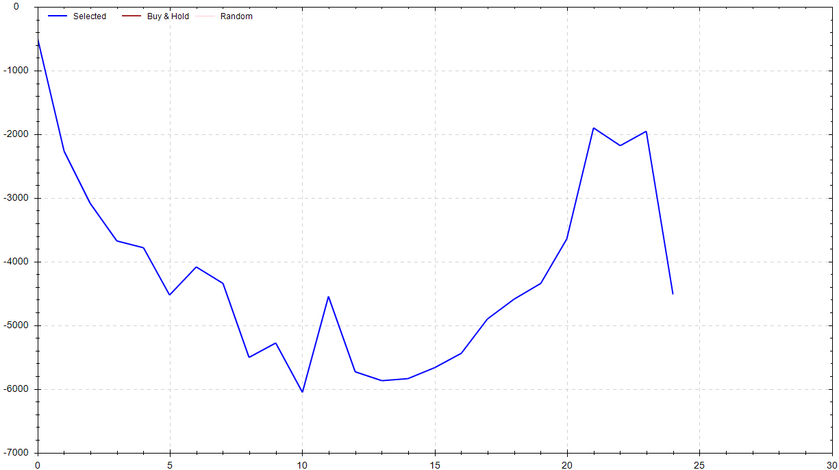

S&P 500 Seasonal Bias (Thursday, Jan. 18th)

- Bull Win Percentage: 48%

- Profit Factor: 0.59

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Jan. 19th)

- Bull Win Percentage: 36%

- Profit Factor: 0.61

- Bias: Bearish

Equity Curve -->

Options Strategy Update

The 0 DTE signal hit 5 for 5 times (16 for 16 total units) this past week (Signal Accuracy: ~100%).

FUCKING CRUSHED IT!!!

The Piper bot is running red hot -- I hope you've been to utilize the signal to improve your own degen trading. I'm very happy with the recent performance. It won't be out in the immediate future, but I want you to know I’m working on a new 0 DTE trading system, the Roo bot. Stay tuned!

Current Streak: 12

January Record: 30/32

Monday Jan. 8th

SPY PUT Credit Spread (3x Multiple @ $468 / $467) 🟢

QQQ PUT Credit Spread (3x Multiple @ $397 / $396) 🟢

Tuesday Jan. 9th

SPY PUT Credit Spread (1x Multiple @ $471 / $470) 🟢

QQQ PUT Credit Spread (1x Multiple @ $401 / $400) 🟢

Wednesday Jan. 10th

SPY PUT Credit Spread (2x Multiple @ $473 / $472) 🟢

QQQ PUT Credit Spread (2x Multiple @ $405 / $404) 🟢

Thursday Jan. 11th

SPY CALL Credit Spread (1x Multiple @ $478 / $479) 🟢

QQQ CALL Credit Spread (1x Multiple @ $411 / $412) 🟢

Friday Jan. 12th

SPY CALL Credit Spread (1x Multiple @ $475 / $474) 🟢

QQQ CALL Credit Spread (1x Multiple @ $408 / $407) 🟢

Top 3 Charts of Interest

MSFT

Microsoft finally broke out! Thus far it's paying nicely. My trailing stop is currently set to $376. I'm currently looking for a test of $400.

Microsoft finally broke out! Thus far it's paying nicely. My trailing stop is currently set to $376. I'm currently looking for a test of $400.

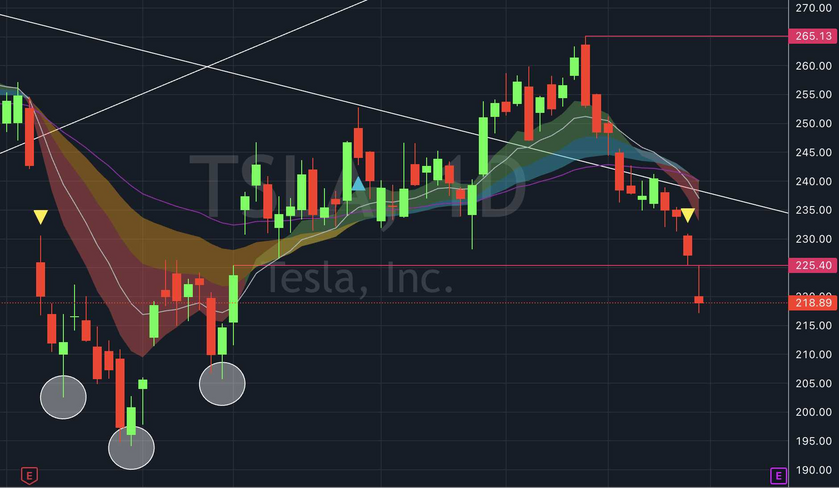

TSLA

Tesla plummeted to the recently posted target of $225. I personally didn't take this trade (I missed the entry), but I if I had, my trailing stop would be $232, and I would be targeting $205.

Tesla plummeted to the recently posted target of $225. I personally didn't take this trade (I missed the entry), but I if I had, my trailing stop would be $232, and I would be targeting $205.

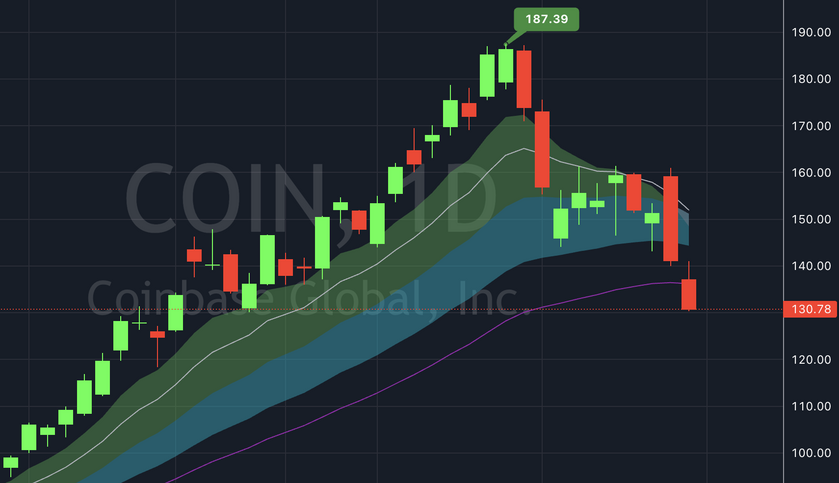

COIN

BREAKDWON ALERT! If Coinbase doesn't quickly recapture $135, I'd be looking for a fall to $118.

BREAKDWON ALERT! If Coinbase doesn't quickly recapture $135, I'd be looking for a fall to $118.

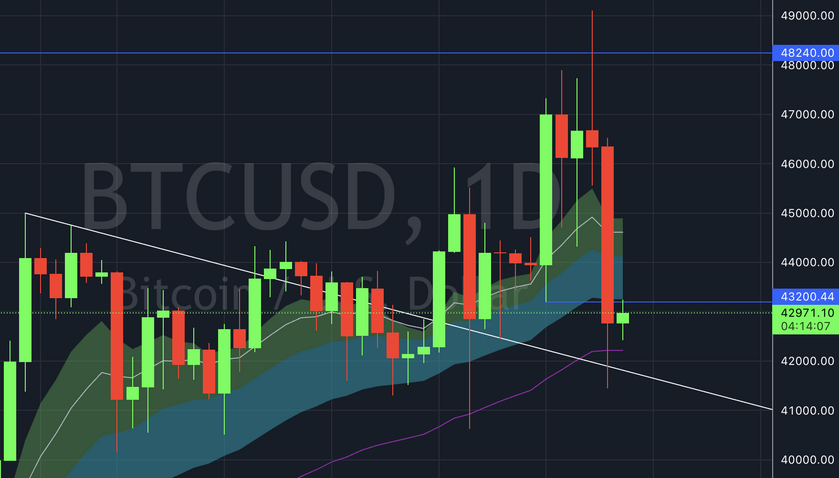

Bonus Chart: BTC

Bitcoin recently cratered but bounced at $42k (aka the 48 EMA). If this support level holds, I'd be watching for a nice bounce trade. This would obviously be invalidated if Bitcoin were to close below $41k.

Bitcoin recently cratered but bounced at $42k (aka the 48 EMA). If this support level holds, I'd be watching for a nice bounce trade. This would obviously be invalidated if Bitcoin were to close below $41k.

Times I Puked On The Stair Stepper

0.4 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!