Welcome To February!

Hey Y'all,

New month, new all-time market high! Both the S&P 500 and Nasdaq 100 hit a new record to conclude the week and kickstart February. I hope you haven't been fighting the trend because it has been paying massively to go with the flow.

We have lots to chitchat about. There has been tons of market developments and data releases over the past week. Consumer confidence came in higher than expected. Unemployment came in lower than expected. And most importantly, the Fed interest rate decision was to do. With respect to the upcoming week, the results of the Treasury Auctions will have a noteworthy impact. Make sure to pay close attention to Bonds, the Dollar, and Gold.

Not only did the overall market like the macroeconomic reports, but it also enjoyed the vibe of the earnings announcements. Microsoft, Amazon, and Meta all had bullish reports. The only company that particularly dropped the ball was Apple. The party doesn't stop there though. The upcoming week contains a handful of pivotal earnings reports.

Below you will find the upcoming macroeconomic reports, earnings announcements, and the daily seasonality.

Later,

Matt

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Feb. 5th

09:45 AM ET S&P Global Services PMI (Jan)

10:00 AM ET ISM Non-Manufacturing PMI (Jan)

10:00 AM ET ISM Non-Manufacturing Prices (Jan)

10:30 PM ET RBA Interest Rate Decision (Feb)

Tuesday, Feb. 6th

None

Wednesday, Feb. 7th

10:30 AM ET Crude Oil Inventories

01:00 PM ET 10-Year Note Auction

Thursday, Feb. 8th

08:30 AM ET Initial Jobless Claims

01:00 PM ET 30-Year Bond Auction

Friday, Feb. 9th

None

Upcoming Earnings

Monday

AM: Allegiant, Caterpillar & McDonalds

PM: Palantir

Tuesday

AM: BP, Eli Lilly, Hertz & Spotify

PM: Chipotle, Enphase, Ford & Snapchat

Wednesday

AM: Alibaba, CVS, Roblox & Uber

PM: ARM, Disney, PayPal & Wynn Resorts

Thursday

AM: Spirit Airlines

PM: Affirm, Cloudflare & Pinterest

Friday

AM: Canopy Growth Co. & Pepsi

Seasonality Update

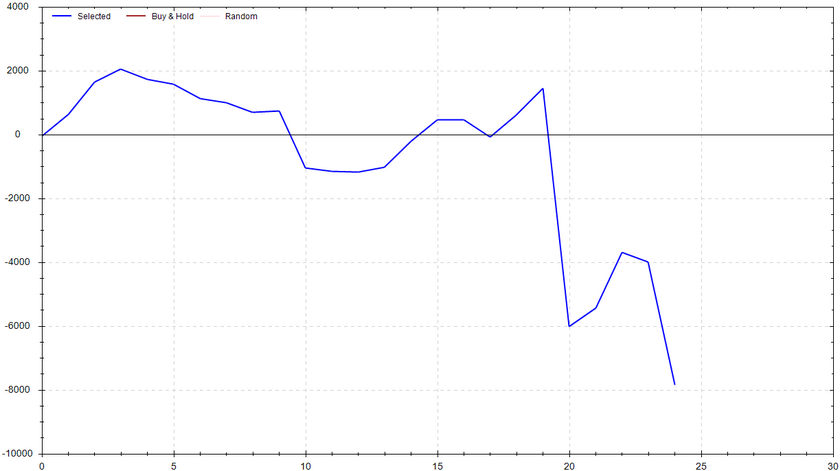

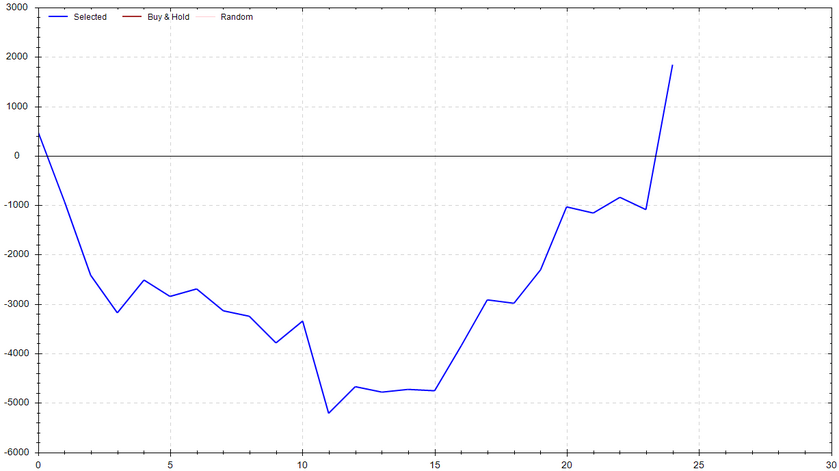

S&P 500 Seasonal Bias (Monday, Feb. 5th)

- Bull Win Percentage: 44%

- Profit Factor: 0.49

- Bias: Bearish

Equity Curve -->

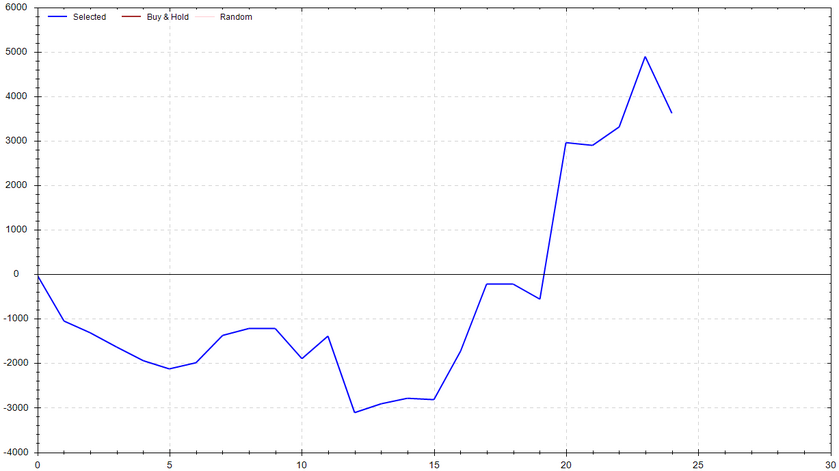

S&P 500 Seasonal Bias (Tuesday, Feb. 6th)

- Bull Win Percentage: 44%

- Profit Factor: 1.58

- Bias: Bullish

Equity Curve -->

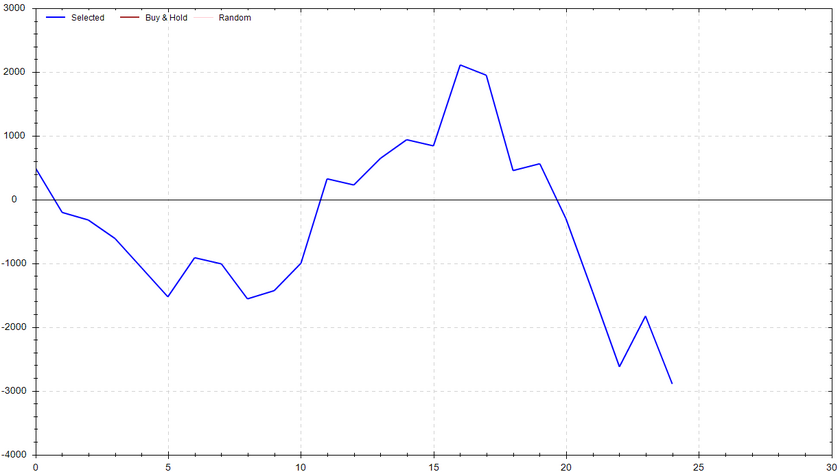

S&P 500 Seasonal Bias (Wednesday, Feb. 7th)

- Bull Win Percentage: 40%

- Profit Factor: 0.67

- Bias: Leaning Bearish

Equity Curve -->

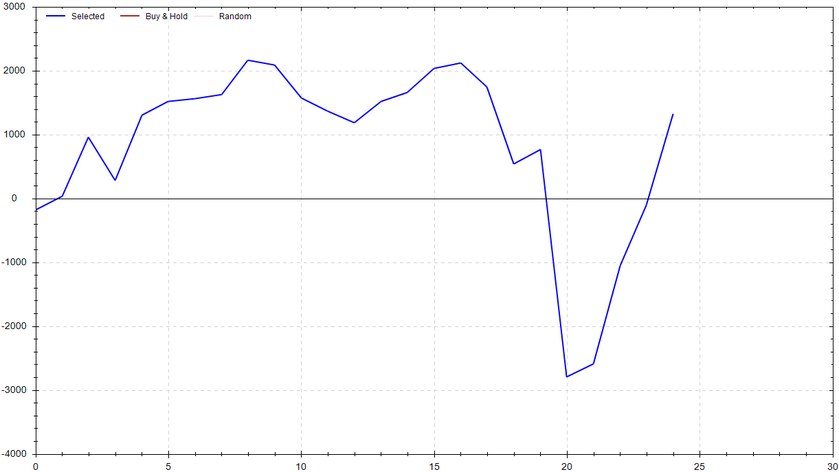

S&P 500 Seasonal Bias (Thursday, Feb. 8th)

- Bull Win Percentage: 64%

- Profit Factor: 1.19

- Bias: Leaning Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Feb. 9th)

- Bull Win Percentage: 48%

- Profit Factor: 1.25

- Bias: Bullish

Equity Curve -->

Options Strategy Update

The 0 DTE signal hit 10 for 10 times (16 for 16 total units) this past week.

Signal Accuracy: ~100%

A strong close to January and an even stronger start to February! The streak of perfection continues for a third full week!

Piper has already been printing money as if she were Powell, but with the extra insights from Roo, she is on another level. Eventually Roo will be spun off as her own distinct system. Until additional testing is completed (more out-of-sample testing is need), the analysis generated by Roo will be utilized to improve Piper. As shown below, the results clearly speak for themself.

Current Streak: 38

January Record: 72/74

February Record: 8/8

Monday Jan. 29th

SPY PUT Credit Spread (1x Multiple @ $482 / $481) 🟢

QQQ PUT Credit Spread (1x Multiple @ $420 / $419) 🟢

Tuesday Jan. 30th

SPY PUT Credit Spread (1x Multiple @ $490 / $489) 🟢

QQQ PUT Credit Spread (1x Multiple @ $425 / $424) 🟢

Wednesday Jan. 31st

SPY CALL Credit Spread (2x Multiple @ $490 / $491) 🟢

QQQ CALL Credit Spread (2x Multiple @ $422 / $423) 🟢

Thursday Feb. 1st

SPY PUT Credit Spread (2x Multiple @ $483 / $482) 🟢

QQQ PUT Credit Spread (2x Multiple @ $417 / $416) 🟢

Friday Feb. 2nd

SPY PUT Credit Spread (2x Multiple @ $488 / $487) 🟢

QQQ PUT Credit Spread (2x Multiple @ $422 / $421) 🟢

Top 3 Charts of Interest

Bitcoin

Hold on to your butts! BTC's chart is looking like a hot tamale. Obviously, nothing is ever guaranteed, but I'm really liking the short-term risk to reward on ole digital gold. A solid break and hold of $43.5k could easily trigger a push to $48k. For now, I'll be patiently waiting for an entry trigger.

Coinbase

Similar to Bitcoin, COIN appears to be reverting from a bearish phase to a bullish phase. A break and hold of $136 would setup my next target of $180. As always, I would only take the trade if the risk were within reason. I would imagine this trade and the BTC callout will be highly correlated.

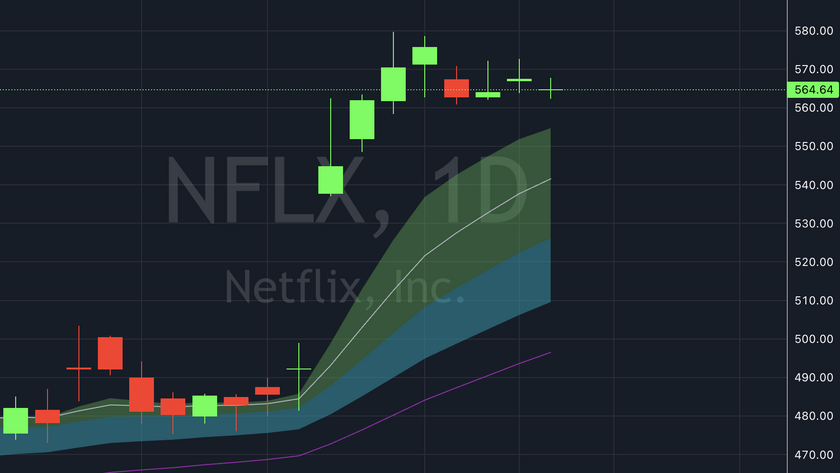

Netflix

I know NFLX's price is already sky-high, but I believe it has more room to run. This isn't some big brain analysis -- It's a well-known phenomenon known as "earnings drift". Stocks tend to keep trending in the same direction as the initial reaction to the company's earnings report. I'll be looking for the consolidation to break above $572ish as entry signal.

Times The Pilot Wouldn't Let Me Fly The Plane

2.7 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!