I <3 Trading

To Whom It Will Concern,

I love the concept that there is a game where numbers go up and down, and if you pick the right numbers, you can profit -- I love trading.

Thus far, the markets have been awesome in 2024. There is seemingly ample money-making opportunities most trading days. I truly hope you've been taking advantage of the current environment and making bank.

Does any of this make sense? In my opinion, not really. The market, especially the tech sector, continues to push higher despite various inflation reports that came in hotter than expected. The CPI, PPI & Retail Sales reports all suggested the government doesn't have inflation under control. Originally, the markets were anticipating six rate cuts this year. The expectation has now dropped to three. In the face of more hawkish monetary policy, stonks continue to rip to kingdom come.

It doesn't make sense, but I don't care. Investing and trading are two different sports that are played on the same field. I like both, but don't conflate the two. If you're an active trader, you're profits will most likely come from riding the trend. Your goal should be to capture the meat of the move. Your profits and losses come from price action. Your profits and losses don't come from your gut feeling of the overall economy being properly reflected in the stock market. These are two dramatically different things. The market's current strength doesn't make sense to me, but that's not stopping me from making money. Don't let the mismatch hinder your performance either.

The major market-moving events of the upcoming week will be the results of the various treasury auctions. There are also a handful of earnings you might be interested in. All the key details are highlighted below. Cheers!

Keep Frosty,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Feb. 19th

ALL DAY MARKET CLOSED (Presidents' Day)

Tuesday, Feb. 20th

01:00 PM ET 1-Year Bill Auction Results

Wednesday, Feb. 21st

01:00 PM ET 20-Year Bond Auction Results

02:00 PM ET FOMC Meeting Minutes

Thursday, Feb. 22nd

05:00 AM ET Eurozone CPI (YoY) (Jan)

08:30 AM ET Initial Jobless Claims

09:45 AM ET S&P Global US Manufacturing PMI (Feb)

09:45 AM ET S&P Global Services PMI (Feb)

10:00 AM ET Existing Home Sales (Jan)

01:00 PM ET 30-Year Bond Auction Results

Friday, Feb. 23rd

None

Upcoming Earnings

Monday

None

Tuesday

AM: Home Depot & Walmart

Wednesday

PM: Etsy, Rivian & Nvidia

Thursday

AM: Moderna, Nikola & Wayfair

PM: Block

Friday

AM: Warner Bros.

Seasonality Update

S&P 500 Seasonal Bias (Monday, Feb. 19th)

MARKET CLOSED

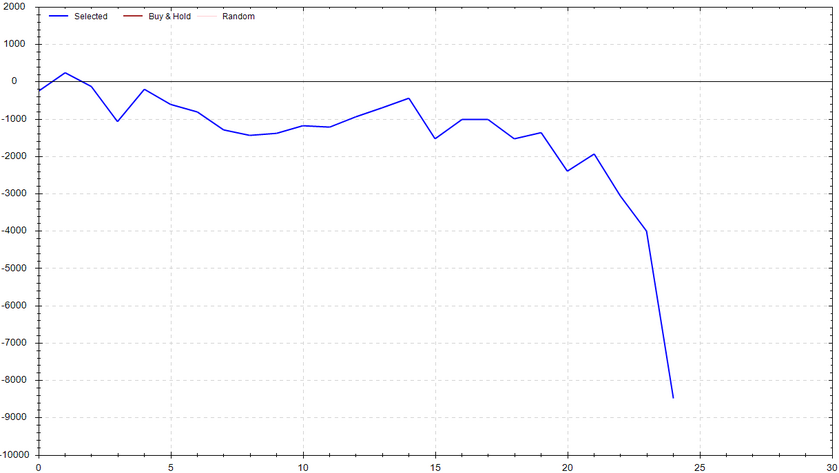

S&P 500 Seasonal Bias (Tuesday, Feb. 20th)

- Bull Win Percentage: 40%

- Profit Factor: 0.29

- Bias: Bearish

Equity Curve -->

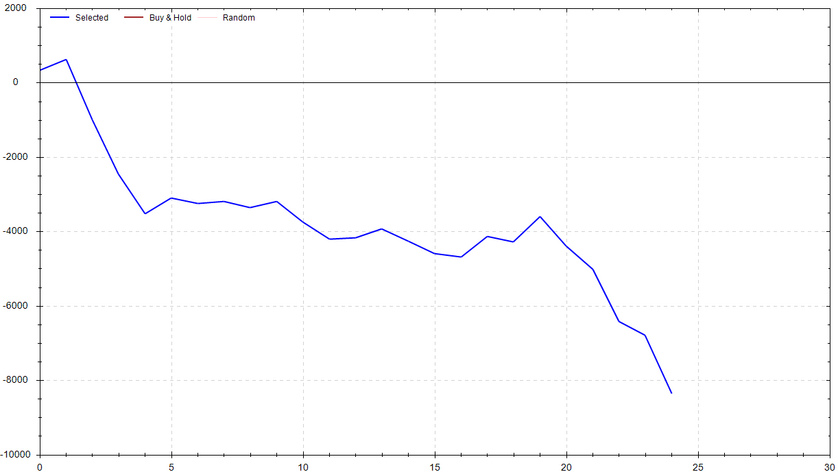

S&P 500 Seasonal Bias (Wednesday, Feb. 21st)

- Bull Win Percentage: 36%

- Profit Factor: 0.25

- Bias: Bearish

Equity Curve -->

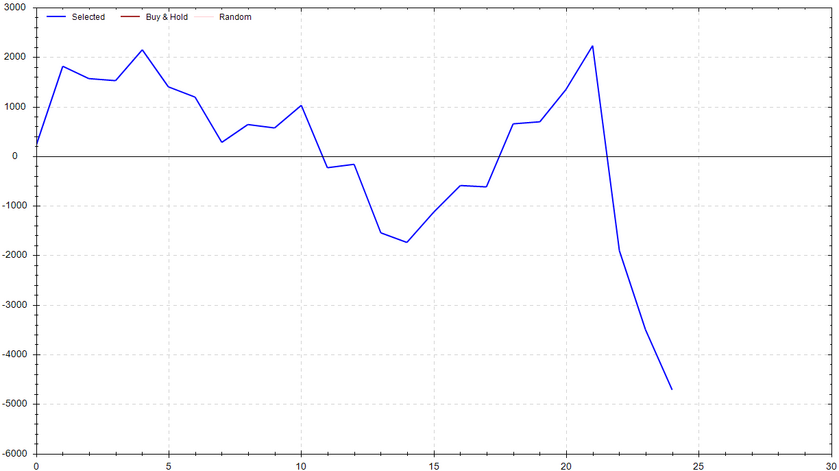

S&P 500 Seasonal Bias (Thursday, Feb. 22nd)

- Bull Win Percentage: 48%

- Profit Factor: 0.61

- Bias: Leaning Bearish

Equity Curve -->

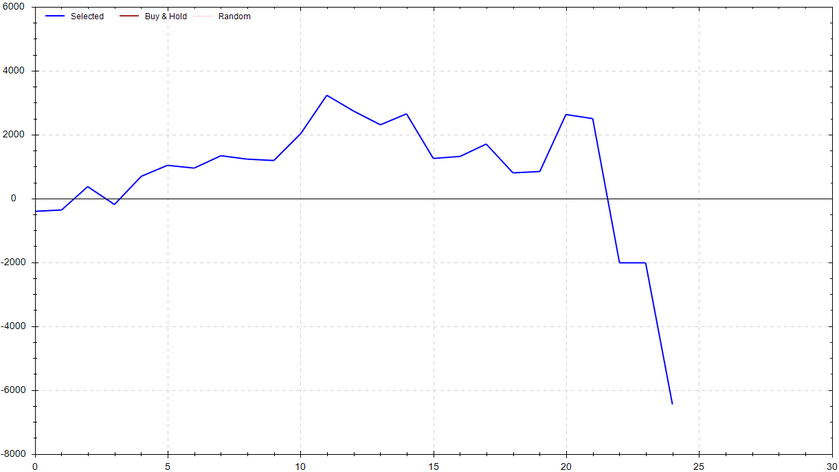

S&P 500 Seasonal Bias (Friday, Feb. 23rd)

- Bull Win Percentage: 48%

- Profit Factor: 0.52

- Bias: Leaning Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 9 for 10 times (16 for 18 total units) this past week.

Signal Accuracy: ~90%

All trading streaks eventually come to an end, but it doesn't make it any less painful. Piper was just shy of hitting 50 trades in a row. I suppose setting that as a new target is worthwhile goal to work towards. On a statistical note, Piper dramatically outperformed expectations. I'm honestly surprised she stayed perfect for as long as she did. Let's see if the next run is even better -- Stay tuned!

Piper's Current Signal Streak: 9

February Unit Record: 42/44

Monday Feb. 12th

SPY PUT Credit Spread (2x Multiple @ $501 / $500) 🟢

QQQ PUT Credit Spread (2x Multiple @ $436 / $435)

Tuesday Feb. 13th

SPY CALL Credit Spread (2x Multiple @ $496 / $497) 🟢

QQQ CALL Credit Spread (2x Multiple @ $430 / $431) 🟢

Wednesday Feb. 14th

SPY PUT Credit Spread (2x Multiple @ $495 / $494) 🟢

QQQ PUT Credit Spread (2x Multiple @ $430 / $429) 🟢

Thursday Feb. 15th

SPY PUT Credit Spread (1x Multiple @ $499 / $498) 🟢

QQQ PUT Credit Spread (1x Multiple @ $430 / $429) 🟢

Friday Feb. 16th

SPY CALL Credit Spread (2x Multiple @ $502 / $503) 🟢

QQQ CALL Credit Spread (2x Multiple @ $435 / $435) 🟢

Top 3 Charts of Interest

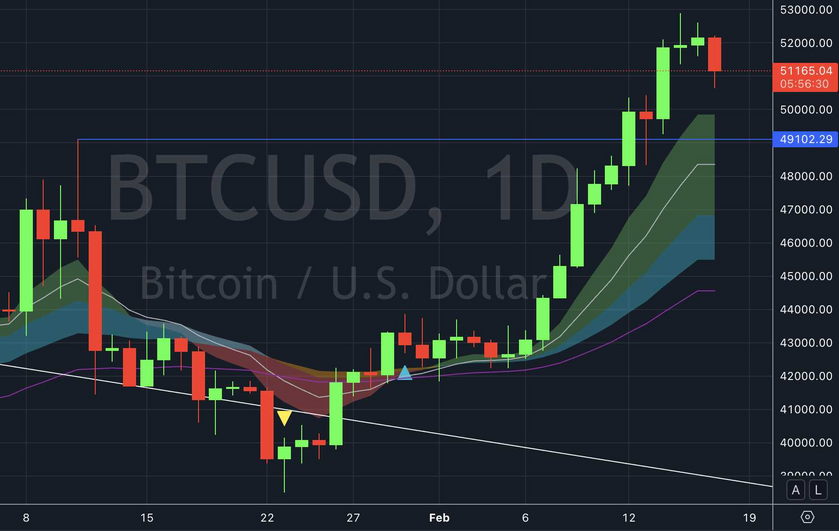

BTC

Bitcoin is showing signs of topping in the short-term. I would consider a pullback to the $48k-$49k region to be healthy. Not everything can continue ripping without taking a breather. Looking for similar path to be taken by COIN, MARA, RIOT, etc. To be clear, the medium-term trend is bullish -- Dips are to be bought.

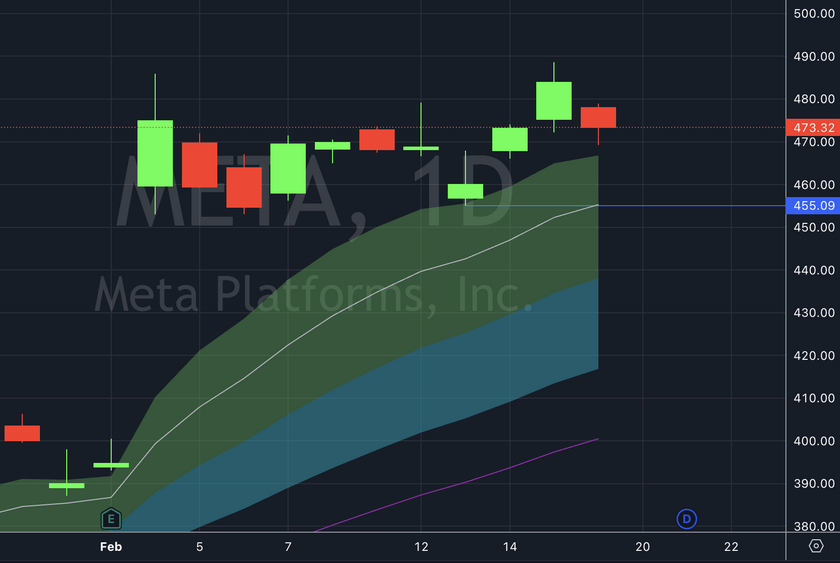

META

Meta is looking like a hot tamale to me. After a solid rip, Meta's stock has entered a clear period of consolidation. I think a bullish breakout is coming in the next few trading days/weeks. Upon to the close above $480, I entered a long position (via calls). A breakdown and close below $453 would invalidate the current setup.

NFLX

Netflix had a solid breakout -- Time to see if the run has any legs. I currently have a long position that will greatly benefit if the price continues to push. My trailing stop is currently set to $548. Let's ride!

Bonus Chart: RUM

Rumble's stock exploded from $3 to $8. Recently, there was a healthy pullback to $7. In my opinion, the bullish structure is still holding. If the price were to fall below $6.75, the situation might become a bit suspect. A breakout and close about $8.50 could easily lead to $10. Defintiely worth a spot on your watchlist.

Times I Saw A Crazy Flordia Lady Do Crazy Things

1* (small magnitude, but still life altering)

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!