March Market Madness

Bonjourno,

Up, up & away we go!!!

You've been hearing me say this a lot, but we hit another new all-time high. HUGE CONGRATS to those of you who have been riding the wave! The profits are plenty.

Folks, if you haven't figured it out, we are in la la land. If you're attempting to accurately assess "fair fundamental value", the current market will cause you to spiral into an insane asylum. Keep it simple, stupid. The trend is your friend! There is truly no need to overcomplicate things. If the market is trending up, be bullish. If the market is trending down, be bearish. If there is no trend, sit on your hands. It's a loser's game to try to pick tops and bottoms. Even if you do, it's not repeatable -- It's pure luck.

Do I think the market is overvalued? Without a doubt! With that being said, it's not stopping me from degenerately firing off bullish trades. I'm trading with the trend because that's what pays. Don't forget: Trading and investing are two completely different sports played on the same field. Don't confuse the two.

To be fair, the market pushing higher in the short-term isn't the most insane thing. There were various reports last week the suggested inflation is continuing to trend in the right direction. The bull camp was more than willing to accept the news and pump everything higher.

Will this last? I have no clue -- No one does. What I do know is we have a handful of impactful announcements this week, but there is something even more exciting going down. The Chairmen of the Fed, Jerome Powell, will be testifying in front on Congress. Things are destined to get spicy. Details below!

Ciao,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Mar. 4th

None

Tuesday, Mar. 5th

09:45 AM ET S&P Global Services PMI (Feb)

10:00 AM ET ISM Non-Manufacturing PMI (Feb)

10:00 AM ET ISM Non-Manufacturing Prices (Feb)

Wednesday, Mar. 6th

08:15 AM ET ADP Nonfarm Employment Change (Feb)

10:00 AM ET JOLTs Job Openings (Jan)

10:00 AM ET Fed Chair Powell Testifies -- I'll STREAM THIS!

10:30 AM ET Crude Oil Inventories

Thursday, Mar. 7th

08:30 AM ET ECB Interest Rate Decision (Mar)

08:30 AM ET Initial Jobless Claims

08:45 AM ET ECB Press Conference

10:00 AM ET Fed Chair Powell Testifies -- I'll STREAM THIS!

Friday, Mar. 8th

08:30 AM ET Unemployment Rate (Feb)

08:30 AM ET Nonfarm Payrolls (Feb)

08:30 AM ET Average Hourly Earnings (MoM) (Feb)

Upcoming Earnings

Monday

PM: GitLab

Tuesday

AM: Nio & Target

PM: CrowdStrike & Nordstrom

Wednesday

AM: Campbell's & JD.com

Thursday

AM: Kroger

PM: Broadcom, Costco, DocuSign & GAP

Friday

None

Seasonality Update

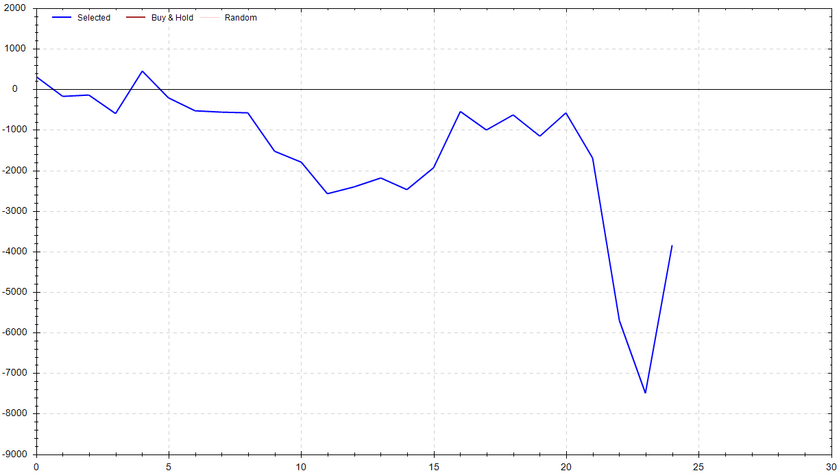

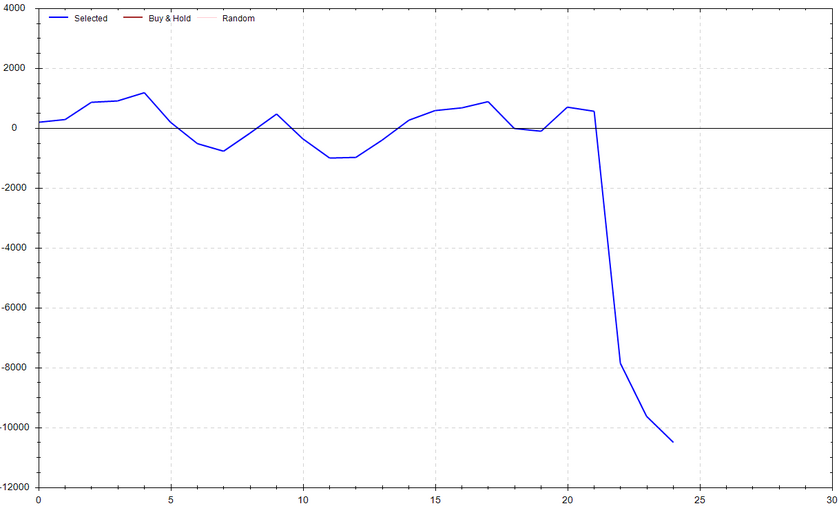

S&P 500 Seasonal Bias (Monday, Mar. 4th)

- Bull Win Percentage: 40%

- Profit Factor: 0.68

- Bias: Bearish

Equity Curve -->

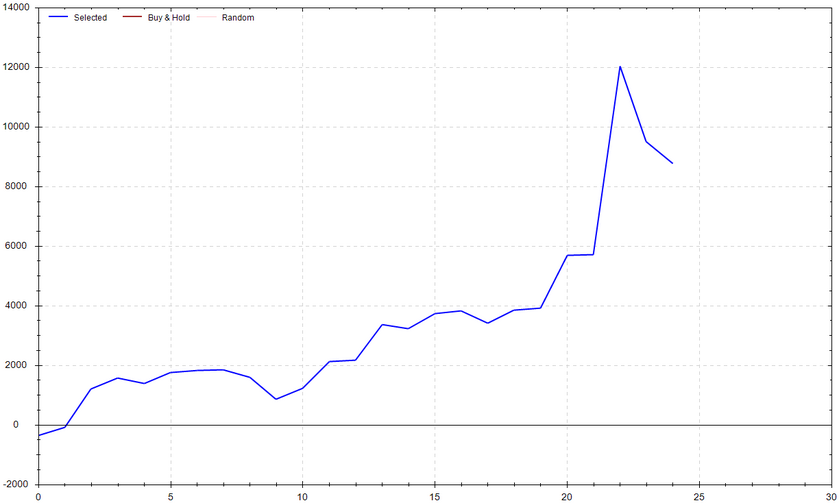

S&P 500 Seasonal Bias (Tuesday, Mar. 5th)

- Bull Win Percentage: 68%

- Profit Factor: 2.64

- Bias: Bullish

Equity Curve -->

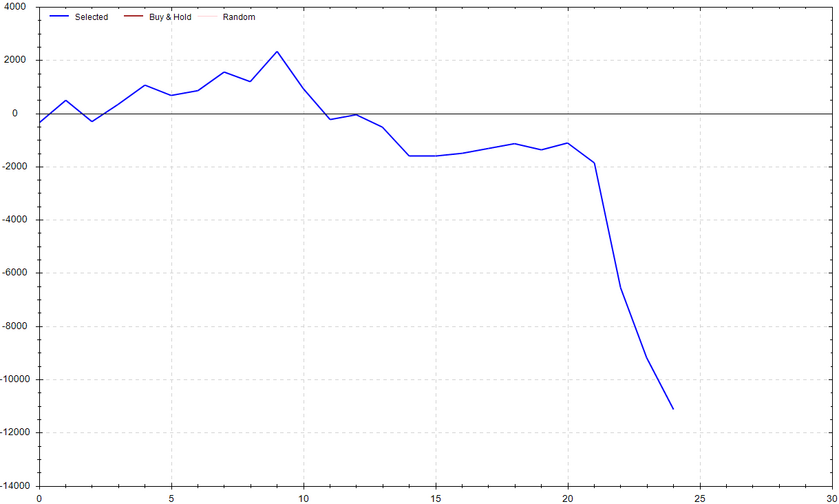

S&P 500 Seasonal Bias (Wednesday, Mar. 6th)

- Bull Win Percentage: 44%

- Profit Factor: 0.32

- Bias: Bearish

Equity Curve -->

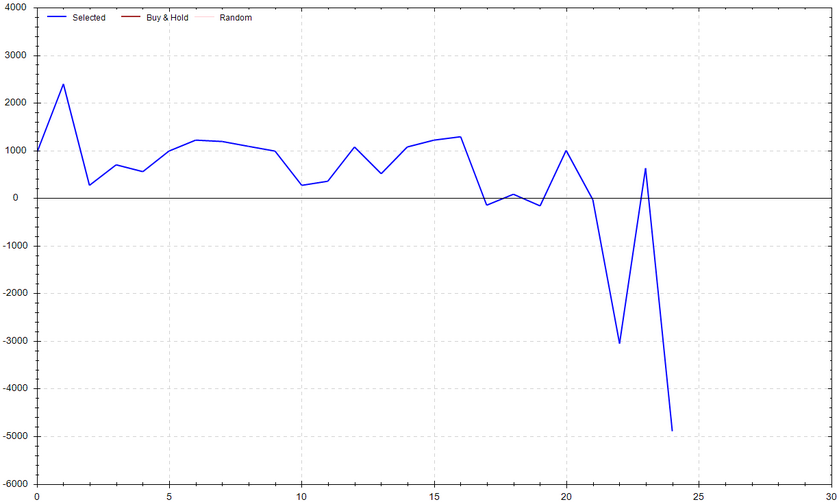

S&P 500 Seasonal Bias (Thursday, Mar. 7th)

- Bull Win Percentage: 52%

- Profit Factor: 0.67

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Mar. 8th)

- Bull Win Percentage: 56%

- Profit Factor: 0.33

- Bias: Leaning Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 8 times (12 for 12 total units) this past week.

Signal Accuracy: ~100%

Piper is the GOAT. I feel for any man who attempts to defy her. Nothing but heartbreak and financial ruin can be found as a dissenter.

Piper's Current Signal Streak: 23 Trades

February Record: 60/62 Units

March Record: 4/4 Units

Monday Feb. 26th

No Signal Generated

Tuesday Feb. 27th

SPY CALL Credit Spread (2x Multiple @ $502 / $503) 🟢

QQQ CALL Credit Spread (2x Multiple @ $435 / $436) 🟢

Wednesday Feb. 28th

SPY PUT Credit Spread (1x Multiple @ $505 / $504) 🟢

QQQ PUT Credit Spread (1x Multiple @ $434 / $433) 🟢

Thursday Feb. 29th

SPY PUT Credit Spread (1x Multiple @ $506 / $505) 🟢

QQQ PUT Credit Spread (1x Multiple @ $436 / $435) 🟢

Friday Mar. 1st

SPY PUT Credit Spread (2x Multiple @ $508 / $507) 🟢

QQQ PUT Credit Spread (2x Multiple @ $439 / $438) 🟢

Top 5 Charts of Interest

Bitcoin

Buckle up! Bitcoin is mooning!!! If BTC can hold the $60k region and eventually surmount the resistance at $65k, I personally believe it will quickly prompt a battle at the all-time high of $69k.

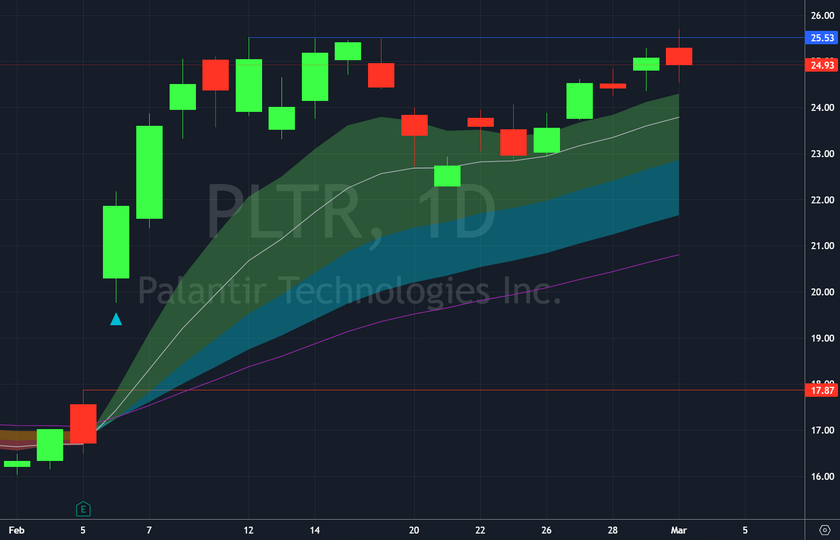

Palantir

Potential breakout brewing! If PLTR were to close above $25.50, it could easily trigger an entire new leg of price action to the upside.

Tesla

After taking a serious hit, TSLA is showing signs that it wants to reverse to the upside. I'm still looking for TSLA to hit the upside gap fill at $207ish.

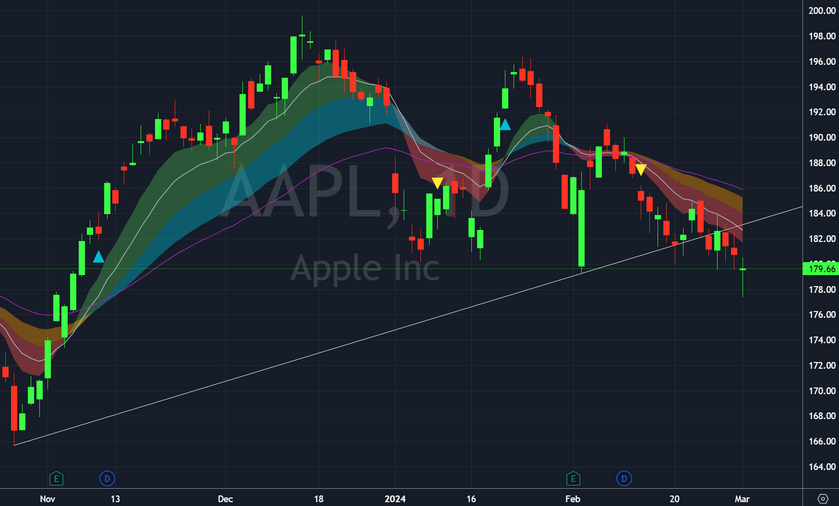

Apple

Breakdown alert! The world's previous largest company is in danger of selling off even more. The technical breakdown in AAPL's chart could spell bad news for the dip-buying bulls in the short-term.

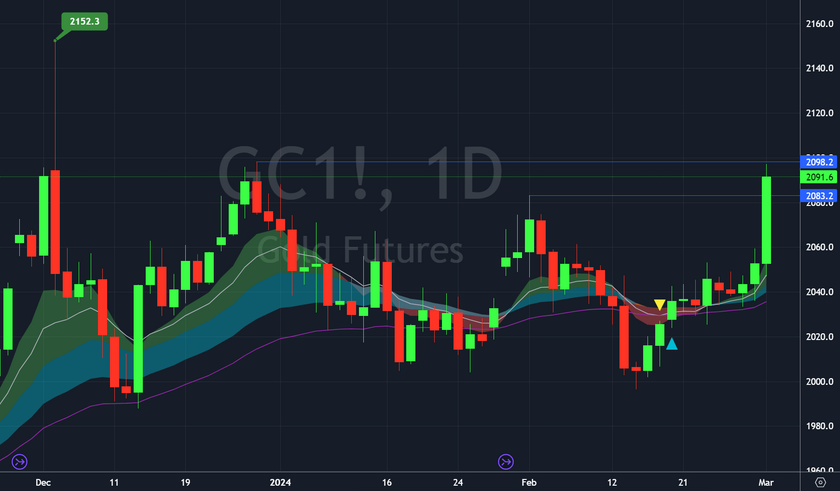

Gold

After a failed breakdown attempt, GC has recovered very nicely. In fact, the price has rebounded so aggressively it's on the verge of breaking out. Watching closely.

Bonus Chart: Oil

Black gold is pushing higher and higher. The bullish trend has been apparent for most of 2024, and now it's time to see if we get the break. A strong hold above $80/barrel would lead me to believe more bullishness is around the corner for CL.

Times I Swore I Wouldn't Break My Trading Rules Anymore

98,729 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!