This Market Is WILD!

Hei,

I'm getting tired of reporting to all your degens the market hit another new all-time high, but here we are. Just smile & wave, boys!

The major news of last weeks was Fed Chair Powell's congressional testimony. He didn't say this too directly, but he strongly indicated we are getting close to rate cuts. The market loved the idea of loose monetary policy, which is we continued our tip higher. We also got an update on the national unemployment. The data reading came in higher than expected. I know this seems like a negative, but don't forget that the Fed is looking for the unemployment rate to increase. In a paradoxical way, more people being unemployment was bullish for the stock market.

Looking ahead, we have a handful of earnings you might be interested in this upcoming week. They are detailed below, but I think there is more exciting things to consider. Tuesday, Wednesday, and Thursday all have highly impactful reports. We will be getting both more inflation readings and the results of key bond auctions. Historically, these have had a considerable influence on the intraday price action. Stay frosty!

Ha det,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Mar. 11th

None

Tuesday, Mar. 12th

08:30 AM ET CPI (YoY) (Feb)

08:30 AM ET CPI (MoM) (Feb)

01:00 PM ET 10-Year Note Auction

Wednesday, Mar. 13th

10:30 AM ET Crude Oil Inventories

01:00 PM ET 30-Year Bond Auction

Thursday, Mar. 14th

08:30 AM ET PPI (MoM) (Feb)

08:30 AM ET Retail Sales (MoM) (Feb)

08:30 AM ET Initial Jobless Claims

Friday, Mar. 15th

None

Upcoming Earnings

Monday

PM: Oracle

Tuesday

AM: Kohl's

Wednesday

AM: Dollar Tree & Petco

Thursday

AM: Dick's & Dollar General

PM: Adobe & ULTA

Friday

None

Seasonality Update

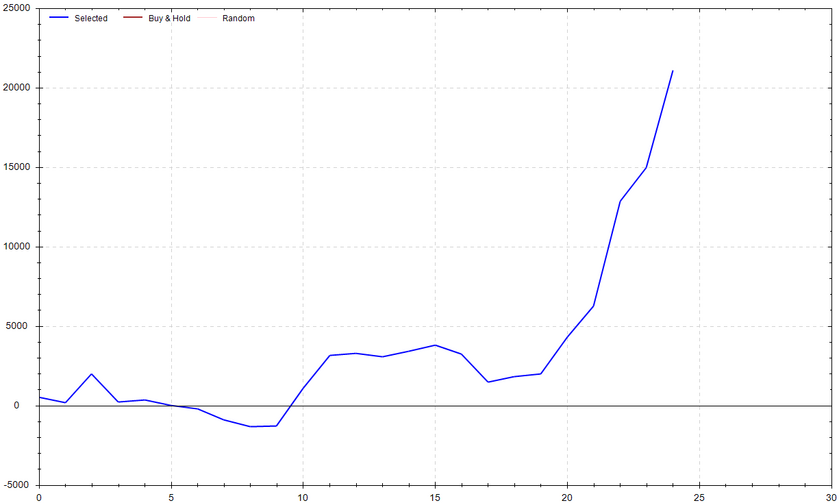

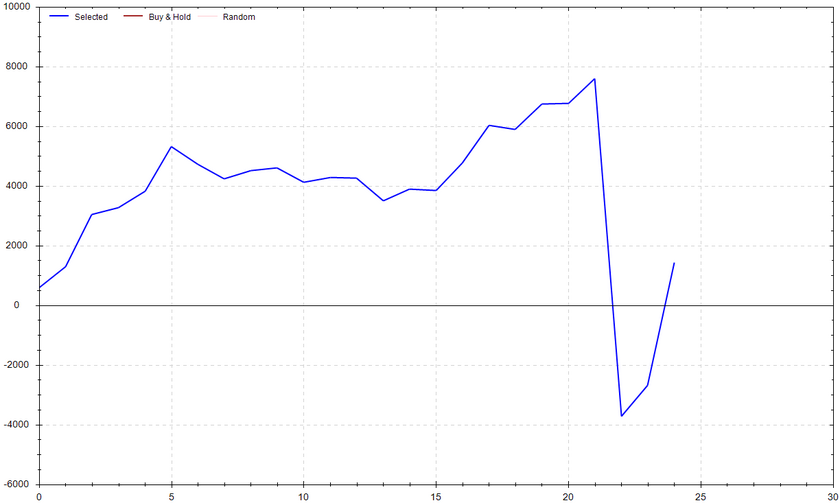

S&P 500 Seasonal Bias (Monday, Mar. 11th)

- Bull Win Percentage: 64%

- Profit Factor: 4.31

- Bias: Bullish

Equity Curve -->

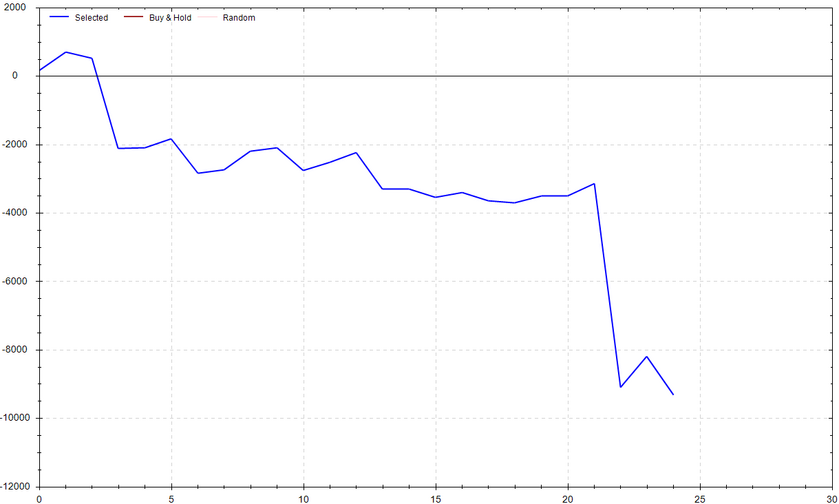

S&P 500 Seasonal Bias (Tuesday, Mar. 12th)

- Bull Win Percentage: 56%

- Profit Factor: 0.29

- Bias: Bearish

Equity Curve -->

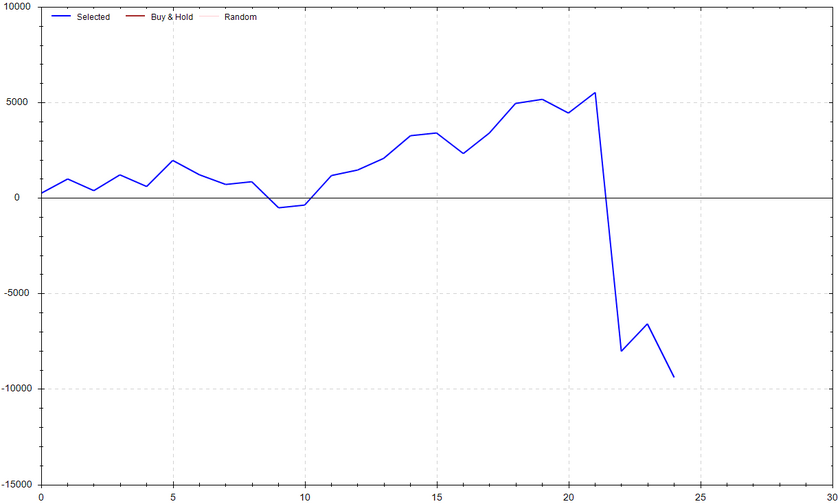

S&P 500 Seasonal Bias (Wednesday, Mar. 13th)

- Bull Win Percentage: 64%

- Profit Factor: 0.57

- Bias: Neutral

Equity Curve -->

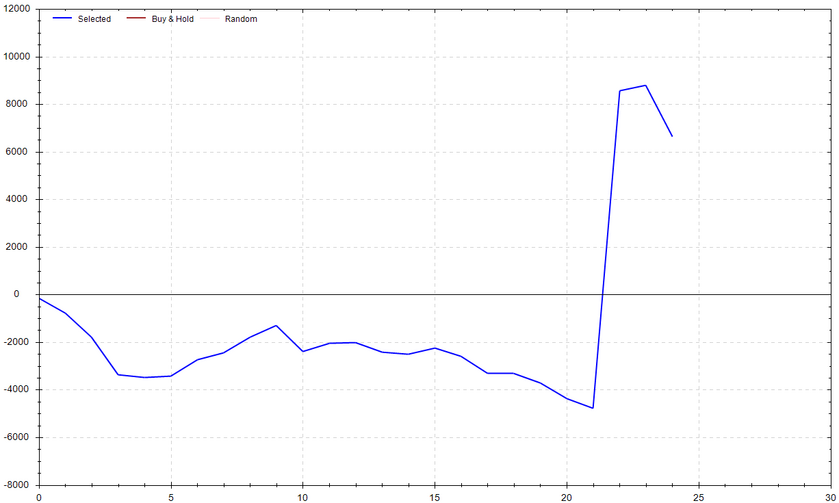

S&P 500 Seasonal Bias (Thursday, Mar. 14th)

- Bull Win Percentage: 40%

- Profit Factor: 1.68

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Mar. 15th)

- Bull Win Percentage: 68%

- Profit Factor: 1.10

- Bias: Leaning Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 10 times (16 for 22 total units) this past week.

Signal Accuracy: ~80%

Piper took a stumble the conclude the week. Overall, she is crushing the entire year, but I do find Friday to be problematic. I don't mind that she lost. I mind that she lost on a 5/5 (bullish) confidence day. From a statistics standpoint, Friday was extremely abnormal for a variety of reasons. There is a chance this was a bad beat, but I want to do some research to see if it's avoidable in the future. I'll let you know what I find!

Piper's Current Signal Streak: 0 Trades

March Record: 20/26 Units

Monday Mar. 4th

SPY CALL Credit Spread (2x Multiple @ $512 / $511) 🟢

QQQ CALL Credit Spread (2x Multiple @ $444 / $443) 🟢

Tuesday Mar. 5th

SPY CALL Credit Spread (2x Multiple @ $511 / $512) 🟢

QQQ CALL Credit Spread (2x Multiple @ $441 / $442) 🟢

Wednesday Mar. 6th

SPY PUT Credit Spread (1x Multiple @ $508 / $507) 🟢

QQQ PUT Credit Spread (1x Multiple @ $437 / $436) 🟢

Thursday Mar. 7th

SPY PUT Credit Spread (3x Multiple @ $511 / $510) 🟢

QQQ PUT Credit Spread (3x Multiple @ $440 / $439) 🟢

Friday Mar. 8th

SPY PUT Credit Spread (3x Multiple @ $515 / $514) 🔴

QQQ PUT Credit Spread (3x Multiple @ $445 / $444) 🔴

Top 5 Charts of Interest

Bitcoin

BTC hit a new all-time high! Congrats to all of you who had the balls to hold! Personally, I think the price goes even higher. I'm a big fan of the "high flag" consolidation. I'll be looking for an open range breakout in the near future.

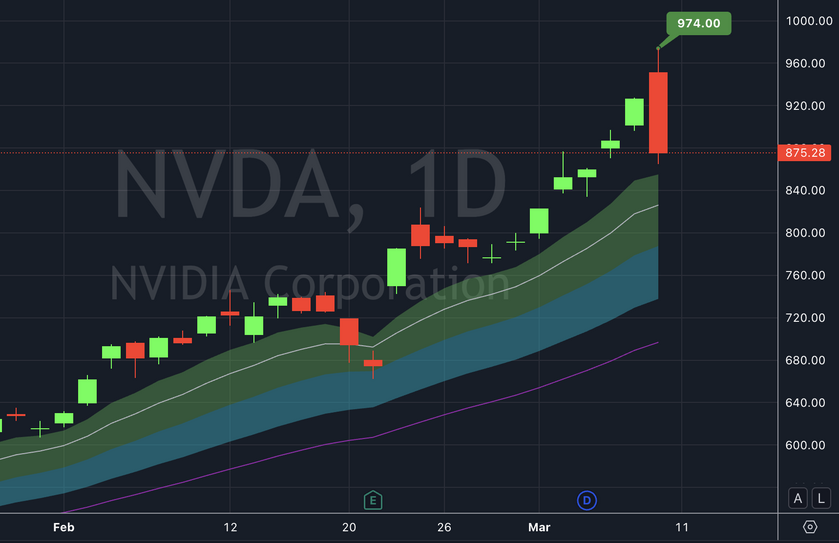

Nvidia

NVDA has been ripping higher and higher for countless days, weeks, and months. Most recently, there was a bearish engulfing candle. This is commonly a sign of buyer exhaustion. I don't think it's smart to bet against such a monster, but I do believe it will need some consolidation before another upside move.

Tesla

TSLA is a pivotal price point. If it bounces, I'll be looking for the upside gap fil to $187ish. If this support cannot hold, I'd be expecting the selloff to continue to $165.

Meta

META is continuing to dominate -- Nothing but higher highs and higher lows. I'm expecting a brief period of consolidation. After that, I'll be watching closely to try to ride the next leg to the upside.

Apple

APPL is getting crushed. I strongly believe there is potential for the price action to lead downward to the $165 support. The bounce or breakdown at the point could have implications on the entire market. Watch this one closely!

Bonus Chart: Gold

Similar to digital gold, actual gold is exploding to the heavens. I don't like chasing, so I personally wouldn't be a buyer here. However, if you got your rocket ticket at the end of February when I first started talking about the potential, huge congrats to you!

Times I Ate Hamburger Helper

0 * (My fiancée won't allow me)

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!