Flat Thursday

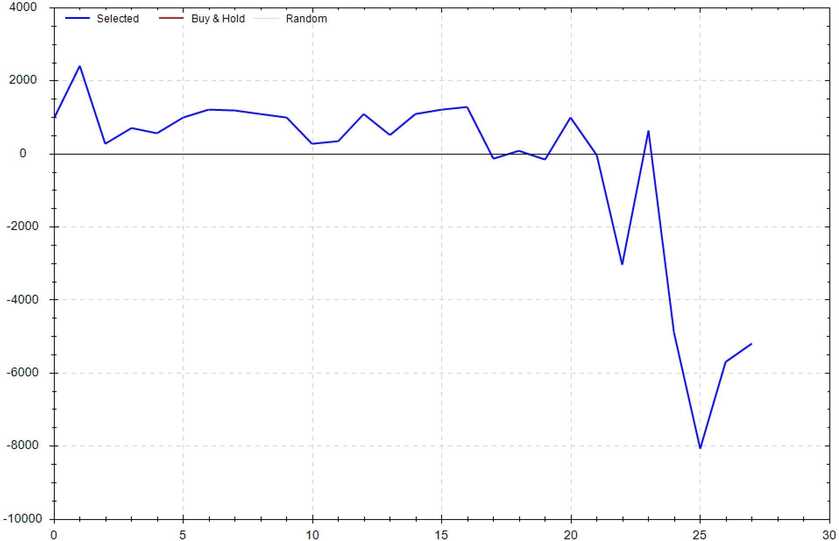

TODAY'S GAIN: -$10

My posted, REAL-TIME TRADES were... flat. Today's trades weren't good but weren't bad. I had one losing trade and one winning trade. I'm not going to complain -- it could have been way worse.

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

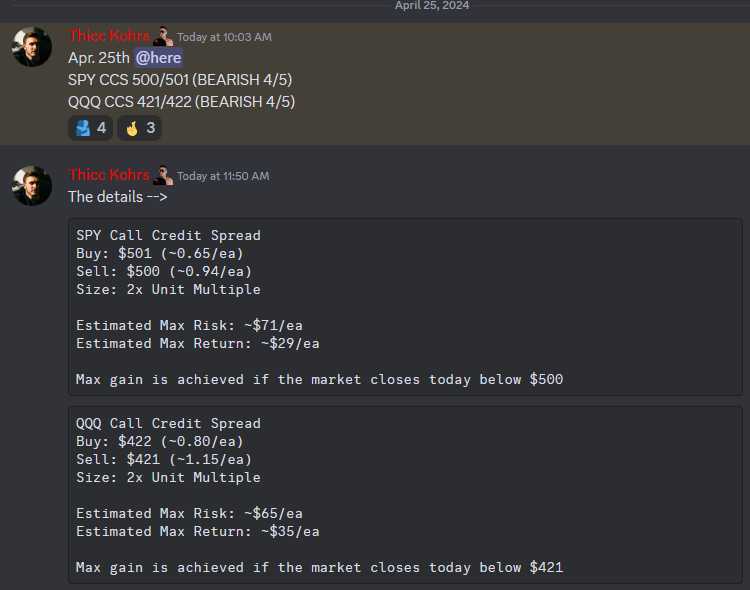

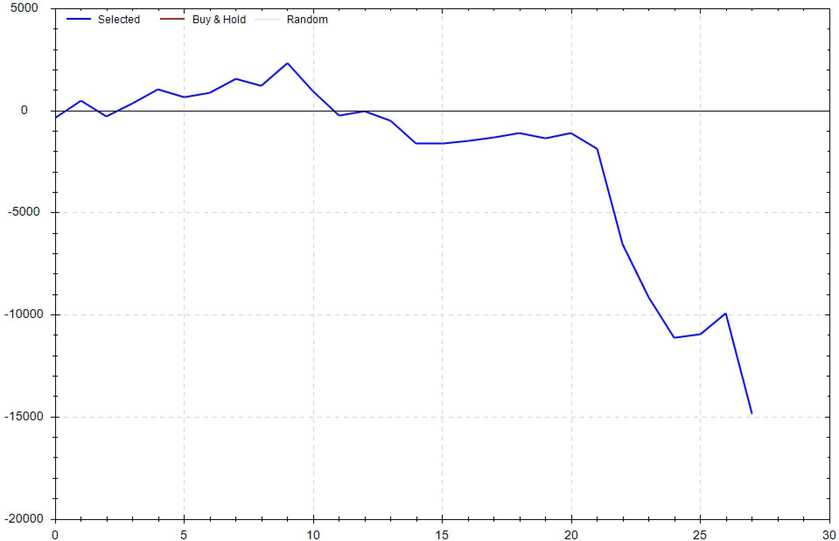

Piper's Picks

A BEARISH signal, 4/5 strength, was generated at 10:30am ET by Piper. The signal was used with various advanced options strategies to score (don't worry, I'll teach you every aspect of the strategy).

Both of these trades missed.

Total Return: -$272/signal

Thicc Matt's Personal Trades

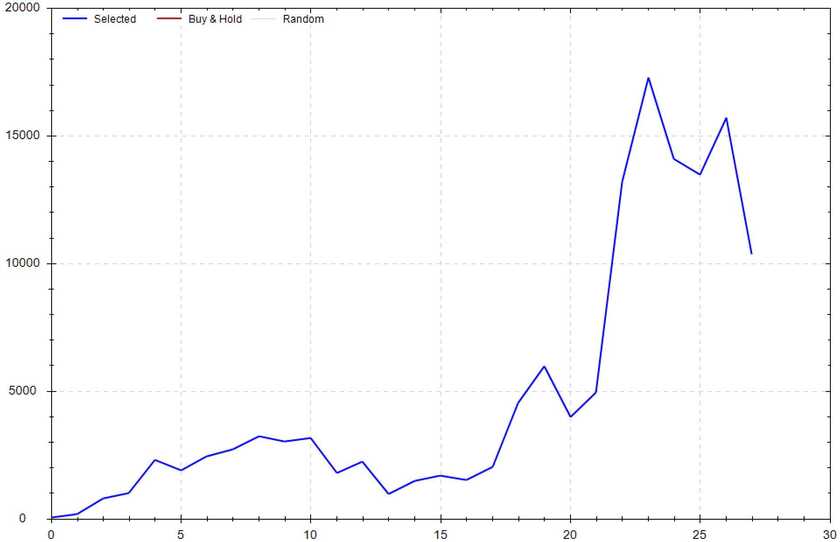

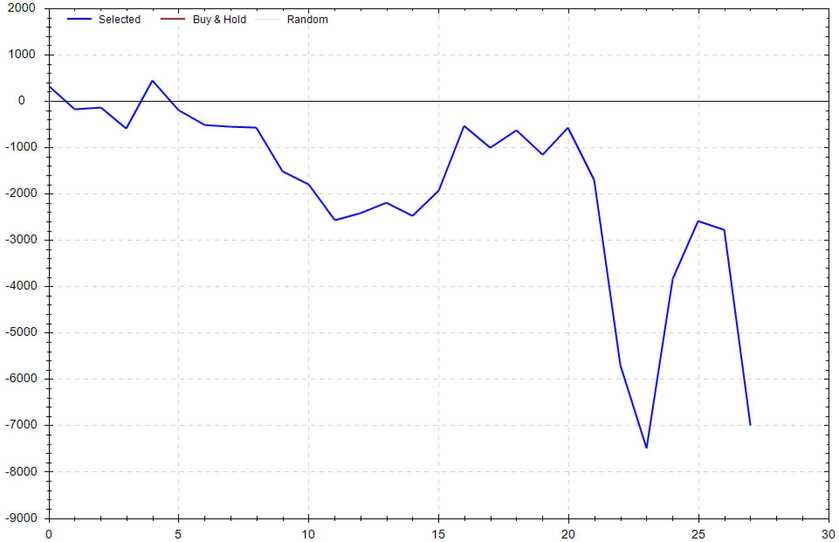

Day #23 of The Comeback Tour!

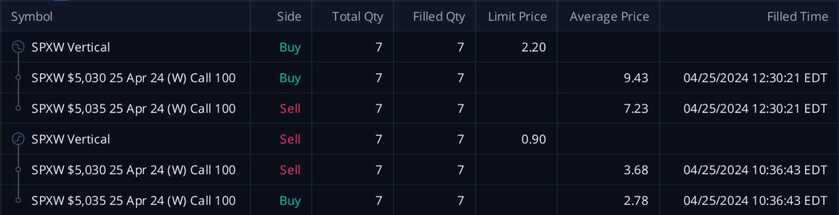

7 x SPX 5030/5035 Call Credit Spread

As shown, losses were taken at $2.20/ea (-$910)

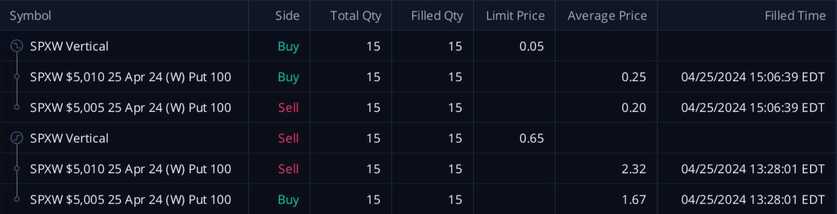

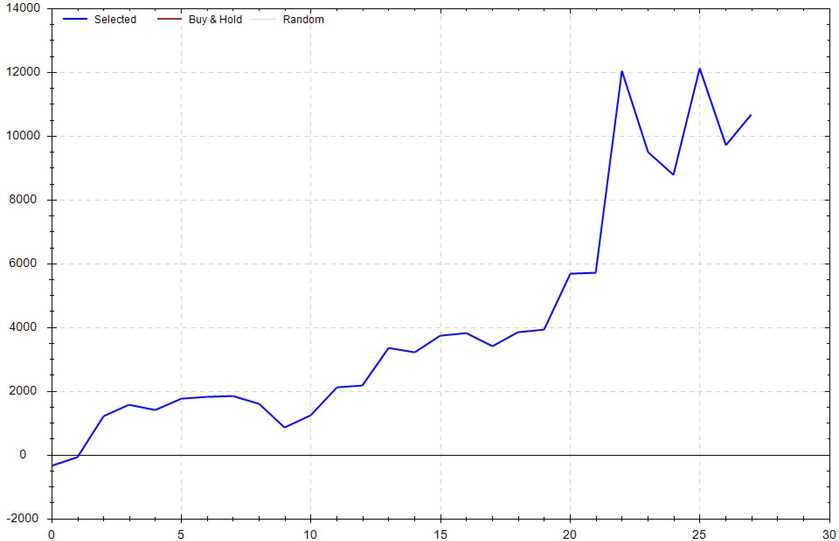

15 x SPX 5010/5105 Put Credit Spread

As shown, profits were taken at $0.05/ea (+92% or +$900)

Total Return: -$10 (before fees)

It wasn't pretty, but it wasn't disastrous -- I'll live to fight another day.

How To Join The Goonie Discord (For FREE)

Join the Goonie Discord if you want access to any of the following:

- My Live Trades & Thoughts

- Weekly Teaching Sessions

- Weekly Newsletter

- Trading Competitions

- Texas Roadhouse Talk

Remember you can join the Discord for FREE with the code GOONIE (Click Here!). This code will allow to become a Locals "supporter". Supporters get full access to the entire Locals Community & Goonie Discord server.

Discord Link: https://discord.gg/3dxBRVrgGG

(Allow up to 24hrs to process after you've become a "supporter". If you have any issues, don't hesitate to reach out -- Feel free to DM on Discord or Twitter.)

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

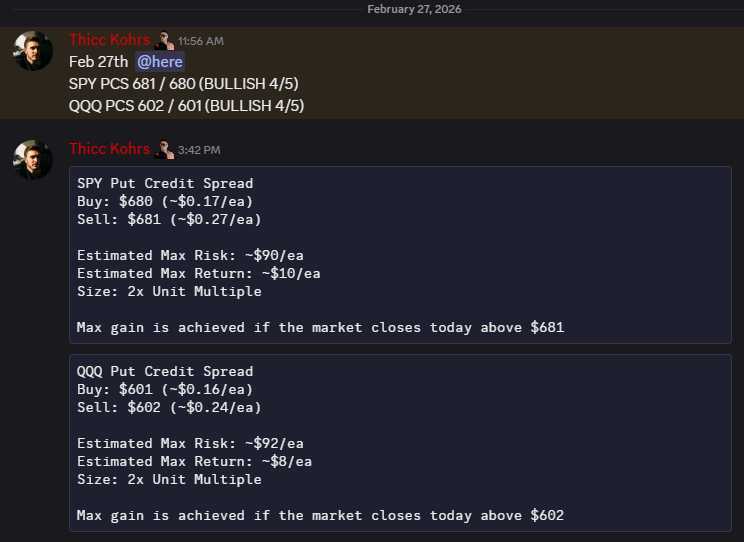

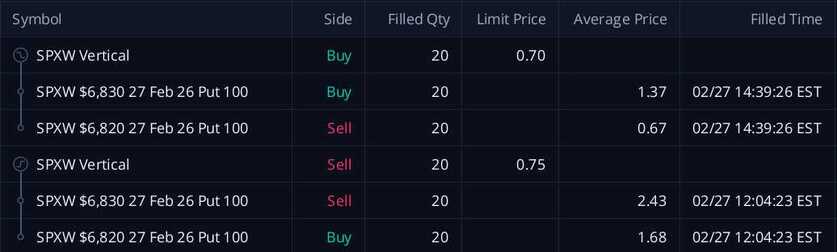

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea and were bought back at $0.70/ea -- THIS MEANS MY REALIZED GAIN WAS $0!

These PCS's were sold at $0.75/ea and were bought back at $0.70/ea -- THIS MEANS MY REALIZED GAIN WAS $0!

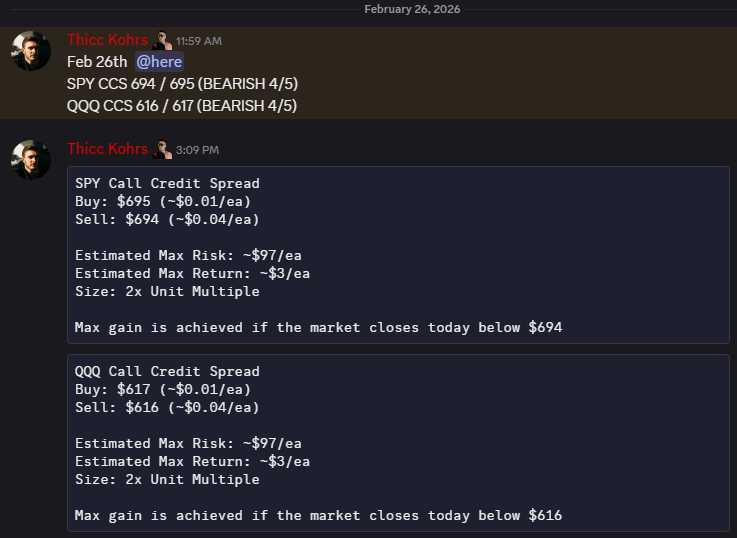

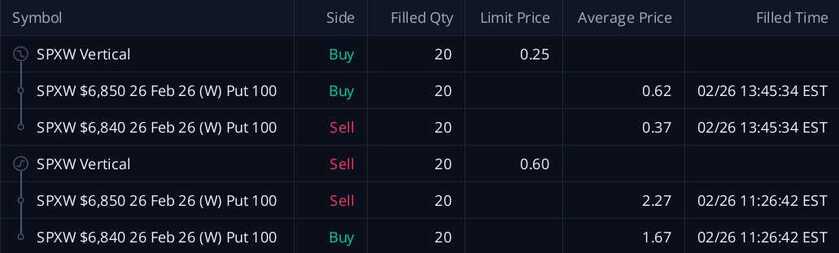

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.60/ea and were bought back at $0.25/ea -- THIS MEANS MY REALIZED GAIN WAS $700!

These PCS's were sold at $0.60/ea and were bought back at $0.25/ea -- THIS MEANS MY REALIZED GAIN WAS $700!