Clash of The Titans

Greetings,

How was that for a bit of razzle dazzle?! After getting pummeled two weeks ago, the market had a solid recovery. It's a little too early to know if that was a fake out breakdown, but the heightened volatility is giving us some beautiful trading ranges. I hope you're crushing it more than normal!

With respect to the overall economy, there are two major things I want to discuss. The Q1 GDP report came in considerably below expectations (1.6% vs 2.5%). The very next day the PCE inflation report came in hotter than expected (2.8% vs 2.6%). This brings up the very real concern of stagflation -- A weakening economy in a rising inflation environment. I don't want to bore you with the nerdy economic details, but it's a no bueno situation.

Speaking of fucked situations, the Fed is currently in a lose-lose-lose-lose-lose situation. The economy is slowing. Inflation is once again ticking higher. US debt is nearing $35 trillion. Credit card debit is at a record of $1.1 trillion. And yo top it all off, we are now dealing with multiple wars. There is a high probability oil prices will push higher along with a disruption in global supply chains. Buckle up! We are clearly in for quite the ride.

Please don't forget we are in the middle of earnings season. Thus far, the reports have been a mixed bag. We have witnessed both solid winners and upsetting losers. In my opinion, there is no clear trend. I'm hoping the upcoming week offers us a more concise direction.

All the key information is posted below -- Enjoy!

Warm Regards,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Apr. 29th

None

Tuesday, Apr. 30th

05:90 AM ET Eurozone CPI (YoY) (Apr)

09:45 AM ET Chicago PMI (Apr)

10:00 AM ET Consumer Confidence (Apr)

Wednesday, May 1st

08:15 AM ET IADP Nonfarm Employment Chnage (Apr)

09:45 AM ET S&P Global US Manufacturing PMI (Apr)

10:00 AM ET ISM Manufacturing PMI (Apr)

10:00 AM ET ISM Manufacturing Prices (Apr)

10:00 AM ET JOLTS Job Openings (Mar)

10:30 AM ET Crude Oil Inventories

02:00 PM ET FOMC Interest Rate Decision

02:30 PM ET FOMC Press Conference

Thursday, May 2nd

08:30 AM ET Initial Jobless Claims

Friday, May 3rd

08:30 AM ET Unemployment Rate (Apr)

08:30 AM ET Nonfarm Payrolls (Apr)

08:30 AM ET Avg. Hourly Earnings (MoM) (Apr)

09:45 AM ET S&P Global Services PMI (Apr)

10:00 AM ET ISM Non-Manufacturing PMI (Apr)

10:00 AM ET ISM Non-Manufacturing Prices (Apr)

07:45 PM ET Chicago Fed President Austan Goolsbee Speaks

08:15 PM ET New York Fed President John Williams Speaks

Upcoming Earnings

Monday

Morning: Domino's & SoFi

Evening: Chegg, Logitech & Paramount

Tuesday

Morning: Coca Cola, McDonalds & PayPal

Evening: AMD, Amazon, Pinterest & Starbucks

Wednesday

Morning: CVS, Mastercard, Norwegian Cruise Line & Pfizer

Evening: Devon, Etsy & Qualcomm

Thursday

Morning: Novo Nordisk & Peloton

Evening: Apple, Coinbase & Draft Kings

Friday

Morning: Fubo TV & Hershey

Seasonality Update

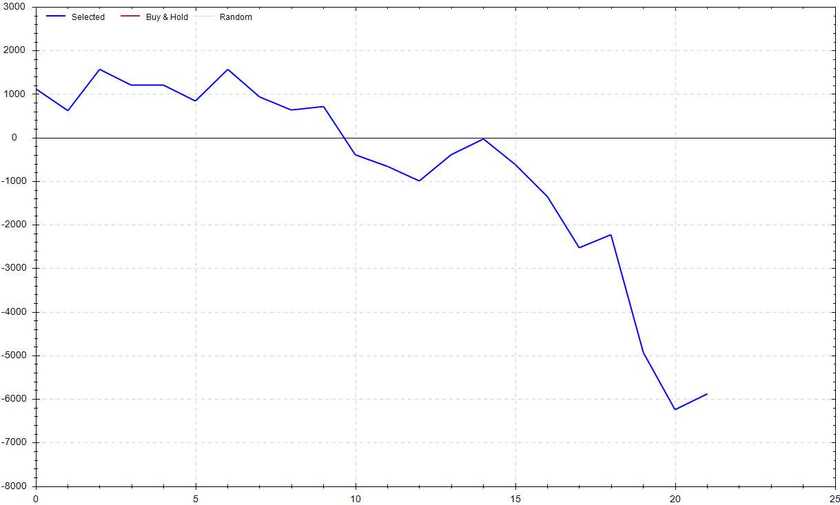

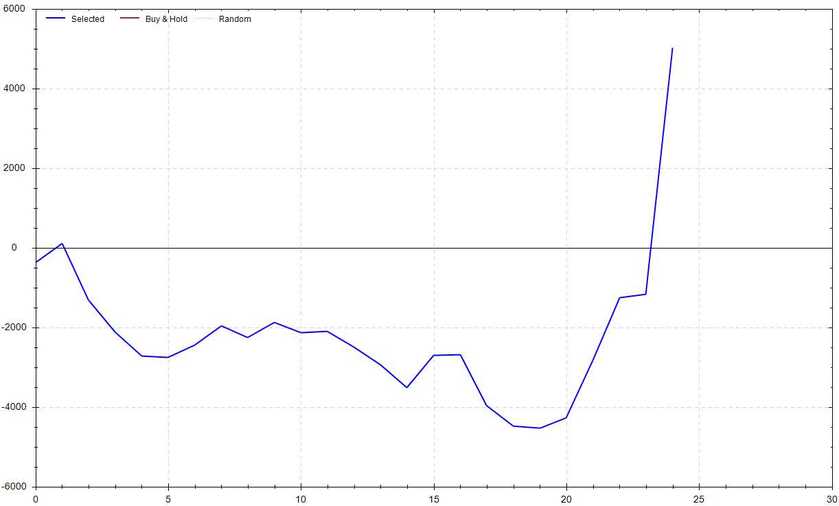

S&P 500 Seasonal Bias (Monday, Apr. 29th)

- Bull Win Percentage: 36%

- Profit Factor: 0.43

- Bias: Bearish

Equity Curve -->

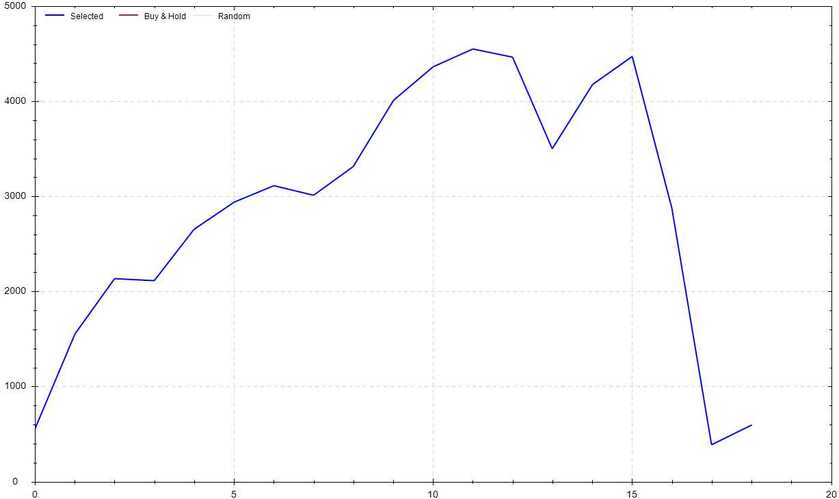

S&P 500 Seasonal Bias (Tuesday, Apr. 30th)

- Bull Win Percentage: 68%

- Profit Factor: 1.11

- Bias: Neutral

Equity Curve -->

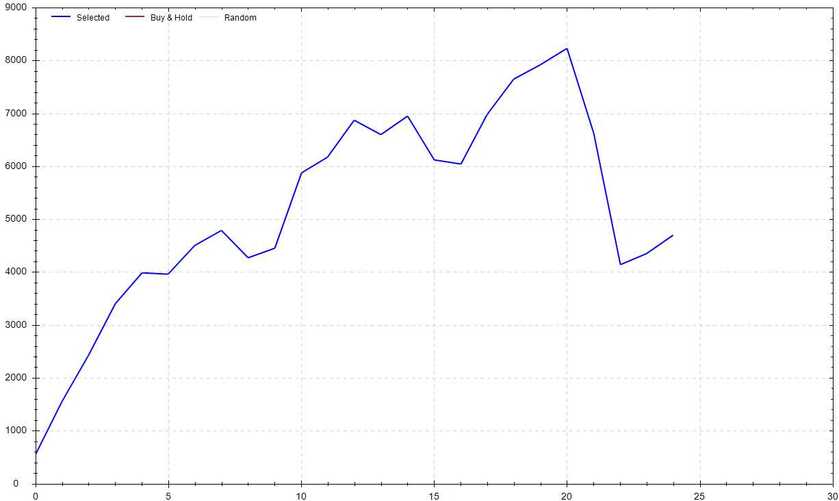

S&P 500 Seasonal Bias (Wednesday, May 1st)

- Bull Win Percentage: 72%

- Profit Factor: 1.81

- Bias: Bullish

Equity Curve -->

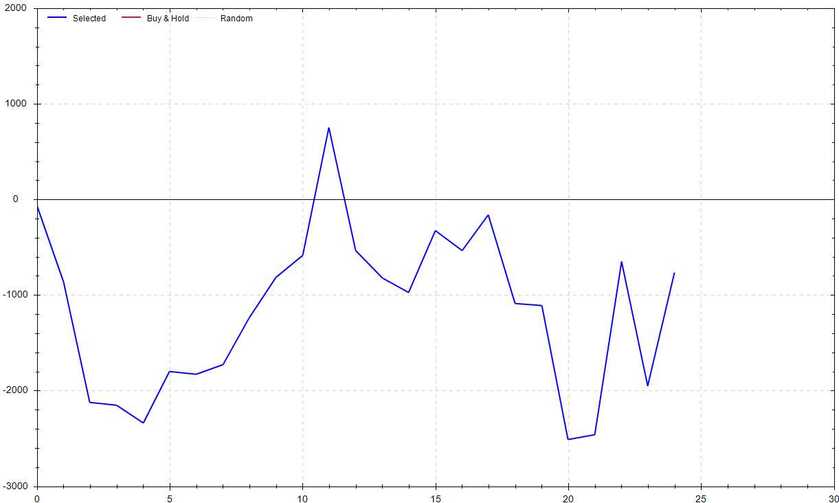

S&P 500 Seasonal Bias (Thursday, May 2nd)

- Bull Win Percentage: 44%

- Profit Factor: 0.90

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, May 3rd)

- Bull Win Percentage: 48%

- Profit Factor: 1.71

- Bias: Leaning Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 10 times (12 for 14 total units) this past week.

Signal Accuracy: ~80%

This past week's performance was exactly at expectations. Of course I would like the signal to hit with perfection, but that is truly impossible when you're dealing with a large dataset. The recent callouts were the next best thing. The losing day was the minimum unit sizing -- I'll happily take this overall performance each week. On to the next one!

Piper's Current Signal Streak: 2 Trades

April Record: 47/56 Units

Monday Apr. 22nd

SPY Put Credit Spread (1x Multiple @ $496 / $495) 🟢

QQQ Put Credit Spread (1x Multiple @ $416 / $415) 🟢

Tuesday Apr. 23rd

SPY Put Credit Spread (2x Multiple @ $501 / $500) 🟢

QQQ Put Credit Spread (2x Multiple @ $420 / $419) 🟢

Wednesday Apr. 24th

SPY Call Credit Spread (1x Multiple @ $508 / $509) 🟢

QQQ Call Credit Spread (1x Multiple @ $430 / $431) 🟢

Thursday Apr. 25th

SPY Call Credit Spread (1x Multiple @ $500 / $501) 🔴

QQQ Call Credit Spread (1x Multiple @ $421 / $422) 🔴

Friday Apr. 26th

SPY Put Credit Spread (2x Multiple @ $506 / $505) 🟢

QQQ Put Credit Spread (2x Multiple @ $426 / $425) 🟢

Stairs Stepped

1,420,069 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!