We Are So Back!

What's Up,

The market is crushing it -- I hope you are too!!! Out of last week's five trading days, we bagged five green daily bars. In fact, the market's recent performance was so strong that we are only 0.50% away from a new all-time high in the S&P 500. How long will it last? I have absolutely no clue, but I will be riding the trend as long as it persists.

You're probably wondering what was announced that caused the market to be so bullish. The accurate, yet confusing, answer is nothing. There were a handful of macroeconomic announcements, but nothing that was massively impactful. The same could be said about individual earnings announcements. We are in a strange market phase where the lack of bearish news is seemingly being interpreted as bullish.

Don't get me wrong. I'm not complaining at all. Piper's signals hit with perfection. I obviously would love for the trend to continue, but I'm not holding my breath on that outcome. This upcoming week has considerable number of events we should all pay attention to. There are various economic announcements, Fed speeches, and earnings reports.

As always, I'll take what the market offers. I'm not inherently bullish or bearish. I simply want to ride the trend as long as I can. With that in mind, the current trend is clearly bullish, so I'm heading into the week with a bit of optimism.

All the key details for the upcoming week are posted below -- Godspeed.

Let's Do This Thing,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, May 13th

09:00 AM ET Cleveland Fed President Loretta Mester Speaks

09:00 AM ET Fed Vice Chair Philip Jefferson Speaks

Tuesday, May 14th

08:30 AM ET Producer Price Index YoY & MoM

09:10 AM ET Fed Governor Lisa Cook Speaks

10:00 AM ET Fed Chair Powell Speaks

Wednesday, May 15th

08:30 AM ET Consumer Price Index YoY & MoM

08:30 AM ET Retail Sales (MoM) (Apr)

10:30 AM ET Crude Oil Inventories

12:00 PM ET Minneapolis Fed President Neel Kashkari Speaks

03:20 PM ET Fed Governor Michelle Bowman Speaks

Thursday, May 16th

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Fed Manufacturing Index (May)

12:00 PM ET Cleveland Fed President Loretta Mester Speaks

01:00 PM ET New York Fed President John Williams Speaks

03:50 PM ET Atlanta Fed President Raphael Bostic Speaks

Friday, May 17th

05:00 AM ET Eurozone CPI (YoY) (Apr)

10:00 AM ET US Leading Economic Indicators

10:15 AM ET Fed Governor Christopher Waller Speaks

Upcoming Earnings

Monday

None

Tuesday

Morning: Alibaba, Home Depot & Sony

Evening: Rumble

Wednesday

Morning: Hut 8

Evening: Cisco

Thursday

Morning: JD, John Deere, Under Armour & Walmart

Evening: Take Two Interactive

Friday

None

Seasonality Update

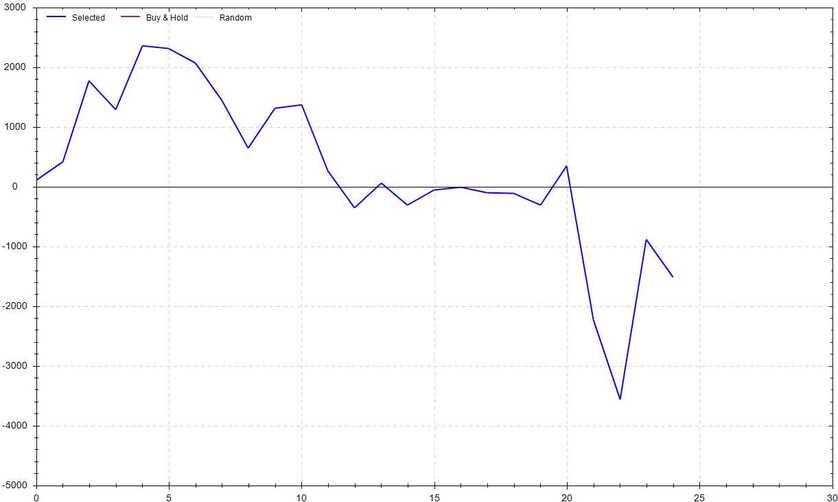

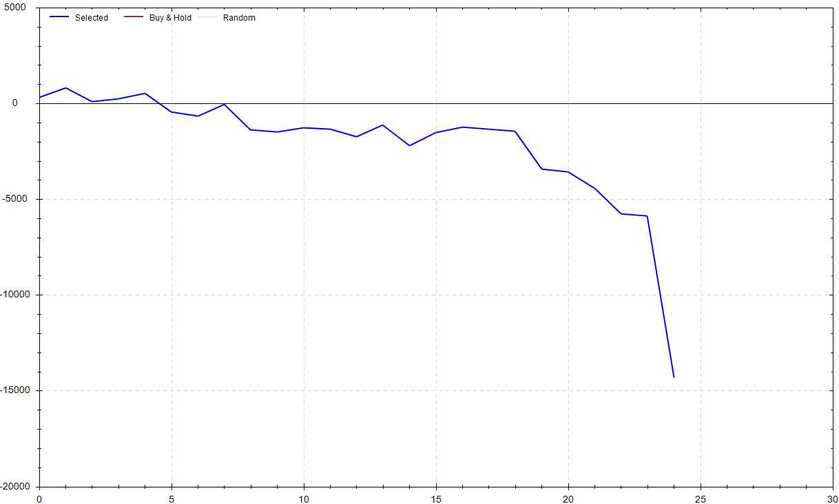

S&P 500 Seasonal Bias (Monday, May 13th)

- Bull Win Percentage: 44%

- Profit Factor: 0.83

- Bias: Leaning Bearish

Equity Curve -->

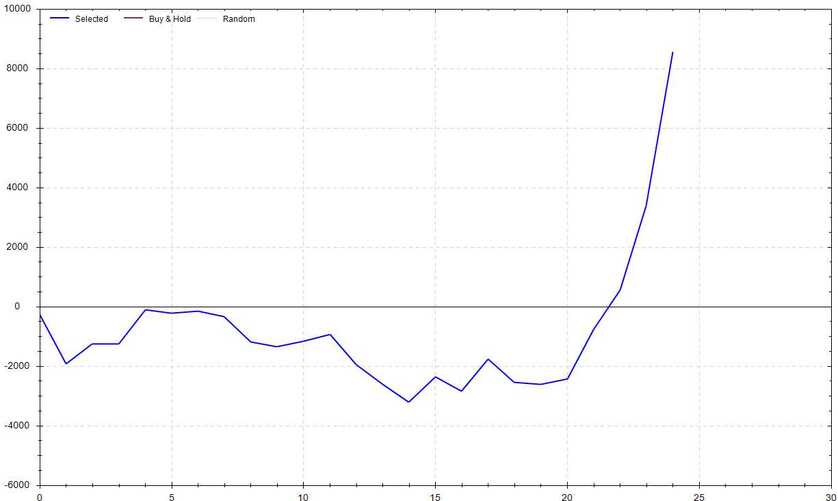

S&P 500 Seasonal Bias (Tuesday, May 14th)

- Bull Win Percentage: 48%

- Profit Factor: 2.25

- Bias: Bullish

Equity Curve -->

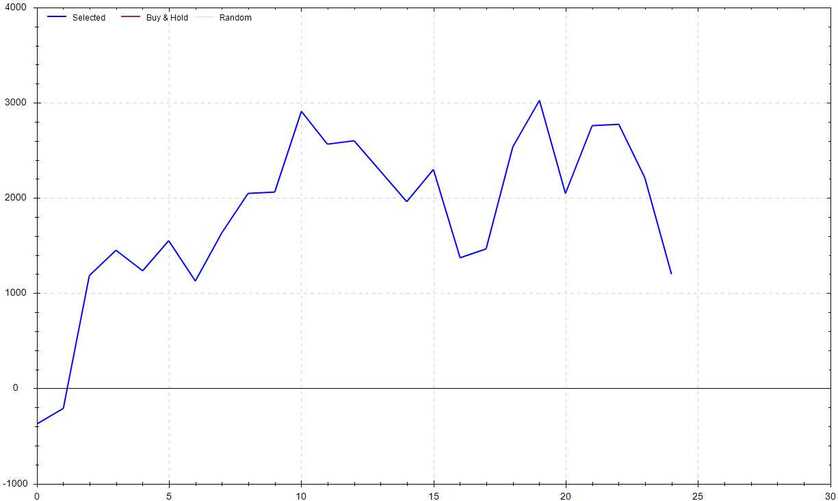

S&P 500 Seasonal Bias (Wednesday, May 15th)

- Bull Win Percentage: 60%

- Profit Factor: 1.22

- Bias: Leaning Bullish

Equity Curve -->

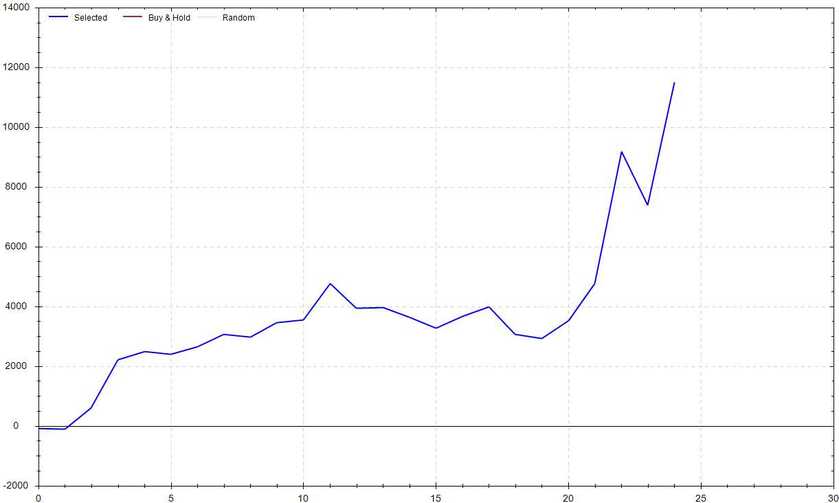

S&P 500 Seasonal Bias (Thursday, May 16th)

- Bull Win Percentage: 60%

- Profit Factor: 3.47

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, May 17th)

- Bull Win Percentage: 36%

- Profit Factor: 0.20

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 8 times (15 for 15 total units) this past week.

Signal Accuracy: ~100%

Piper is back to crushing it! I'm very happy to see variance is starting to return to our favor. In the coming weeks, I'll start incorporating the results and related information of the new premium scalping strategy. We ride at dawn!

Piper's Current Signal Streak: 11 Trades

May Record: 25/27 Units

Monday May 6th

SPY Put Credit Spread (3x Multiple @ $513 / $512) 🟢

QQQ Put Credit Spread (3x Multiple @ $436 / $435) 🟢

Tuesday May 7th

SPY Put Credit Spread (2x Multiple @ $516 / $515) 🟢

QQQ Put Credit Spread (2x Multiple @ $439 / $438) 🟢

Wednesday May 8th

SPY Call Credit Spread (1x Multiple @ $518 / $519) 🟢

QQQ Call Credit Spread (1x Multiple @ $442 / $443) 🟢

Thursday May 9th

SPY Put Credit Spread (2x Multiple @ $516 / $515) 🟢

QQQ Put Credit Spread (1x Multiple @ $438 / $437) 🟢

Friday May 10th

No Signal

Piper's Feet Attack While I'm Sleeping

88 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!