Hello, New All-Time Highs!

Hola Mi Amigo,

It's been a few weeks, but the market successfully locked in a new all-time high! The path to new heights was a strange one, but I hope you are printing regardless.

There are various things I think we should chat about. First, the macroeconomic situation is a confusing mess. There were two inflation reports last week. The PPI came in hot (high), while the CPI report came in cool (low). Beyond the obvious contradiction, the reports are continuing with the troubling trend we've seen since the start of the year. Inflation is persisting to quantifiably and qualitatively plague our lives. Does it make sense that the market is at a new high? Not really, but it doesn't matter. Money is made by riding the trend. As much as it might not make sense, the market can remain illogical longer than you can remain solvent.

The new chapter of Meme Mania is another example of illogical market behavior. Crazy things happen -- It's part of the game. When you stop trying to make sense of irrational actions, your life will be much easier. I do want to reiterate my words from early in the week. I deeply believe this is a tradable event. Money can be made by playing both the upside and the downside. I think the people who lose will be those who overstay their welcome. The traders who refuse to admit the trend has changed and transform into investors. The trend if your friend for a reason. I beg you to not let an amazing windfall disappear.

This upcoming week is bound to be an exciting one. We have various market/economy announcements. There are also a few "big" earnings reports coming out as we get close to the end of earnings season. As always, stick to your plan and respect your risk. Godspeed.

Ciao,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, May 20th

10:30 AM ET Fed Vice Chair Philip Jefferson Speaks

Tuesday, May 21st

09:00 AM ET Fed Governor Christopher Waller Speaks

11:45 AM ET Fed Vice Chair Michael Barr Speaks

07:00 PM ET Fed President Bostic, Collins & Mester Speak

Wednesday, May 22nd

10:00 AM ET Existing Home Sales (Apr)

10:30 AM ET Crude Oil Inventories

02:00 PM ET FOMC Meeting Minutes

Thursday, May 23rd

08:30 AM ET Initial Jobless Claims

09:45 AM ET S&P Global US Manufacturing PMI (May)

09:45 AM ET S&P Global Services PMI (May)

10:00 AM ET New Home Sales

03:00 PM ET Atlanta Fed President Raphael Bostic Speaks

Friday, May 24th

08:30 AM ET Durable Goods Orders (MoM) (Apr)

09:35 AM ET Fed Governor Christopher Waller Speaks

10:00 AM ET Consumer Sentiment

Upcoming Earnings

Monday

Evening: Zoom

Tuesday

Morning: AutoZone, Lowe's & Macy's

Evening: Urban Outfitters

Wednesday

Morning: Target & TJX

Evening: Nvidia & Snowflake

Thursday

Morning: BJs, Ralph Lauren & TD Bank

Evening: Intuit

Friday

None

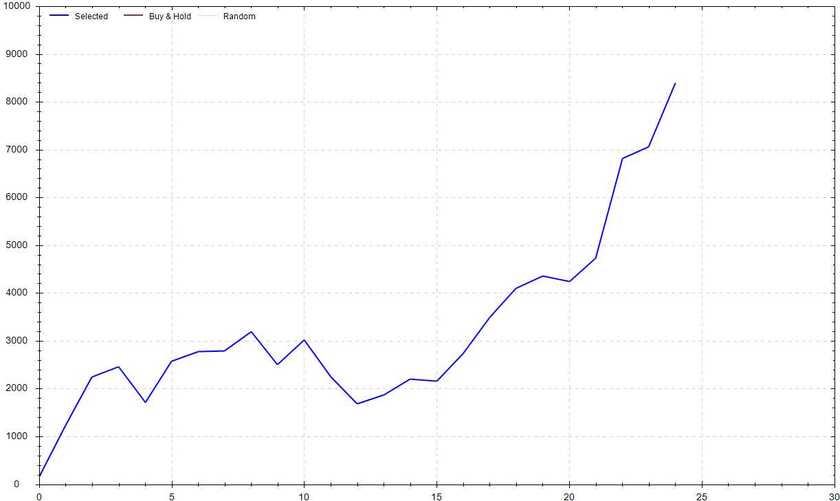

Seasonality Update

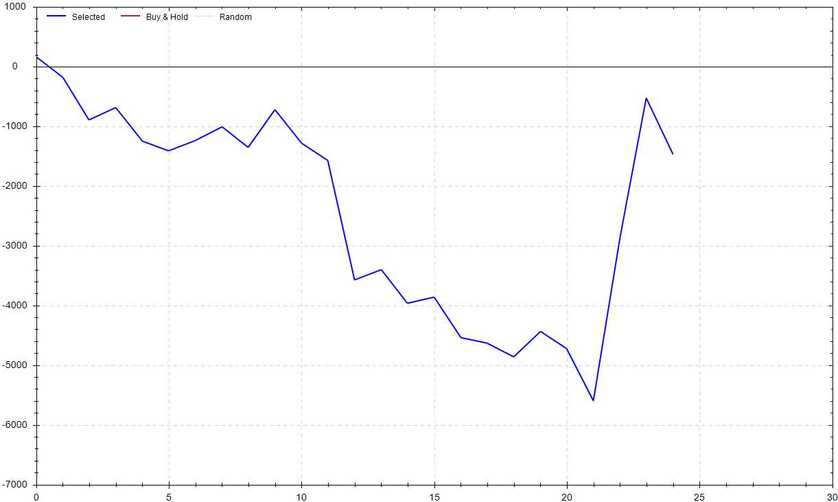

S&P 500 Seasonal Bias (Monday, May 20th)

- Bull Win Percentage: 40%

- Profit Factor: 0.83

- Bias: Leaning Bearish

Equity Curve -->

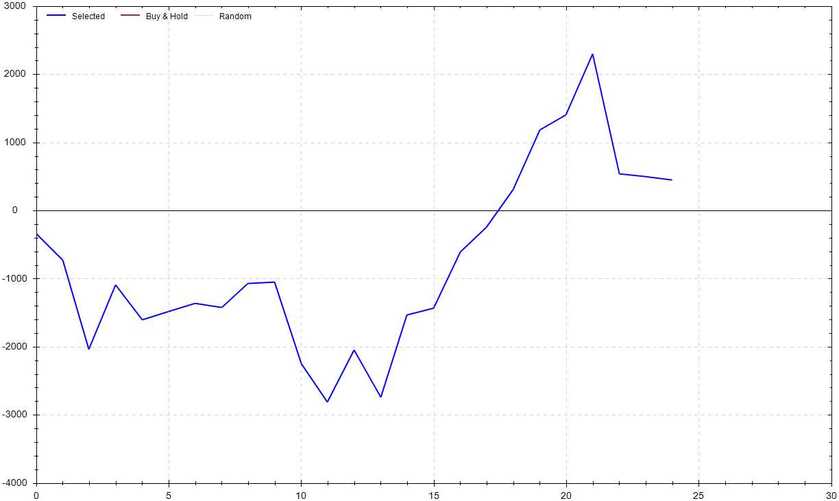

S&P 500 Seasonal Bias (Tuesday, May 21st)

- Bull Win Percentage: 56%

- Profit Factor: 1.07

- Bias: Neutral

Equity Curve -->

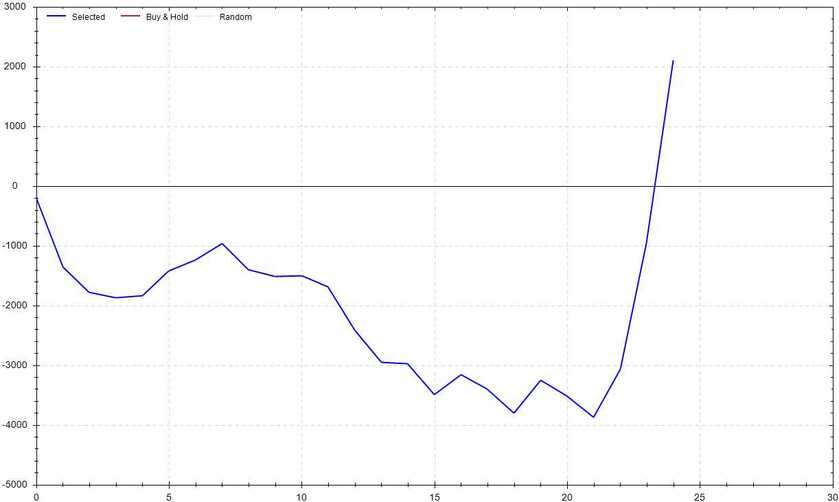

S&P 500 Seasonal Bias (Wednesday, May 22nd)

- Bull Win Percentage: 40%

- Profit Factor: 1.37

- Bias: Leaning Bullish

Equity Curve -->

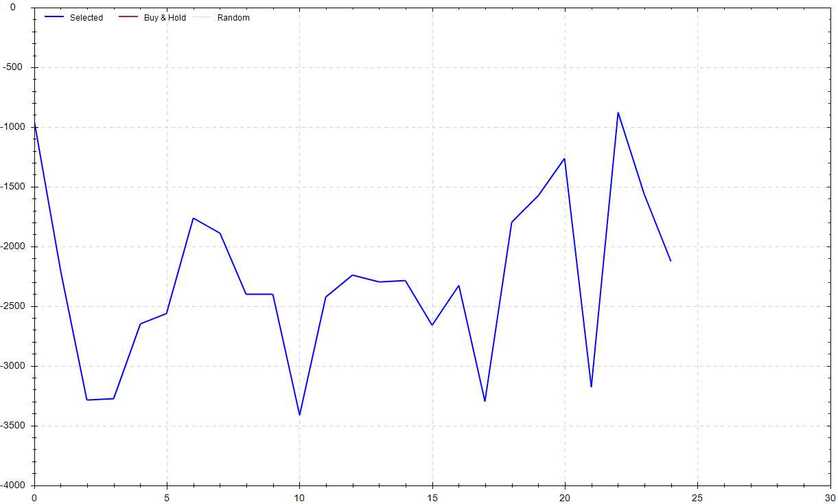

S&P 500 Seasonal Bias (Thursday, May 23rd)

- Bull Win Percentage: 48%

- Profit Factor: 0.78

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, May 24th)

- Bull Win Percentage: 76%

- Profit Factor: 3.87

- Bias: VERY Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 9 for 10 times (16 for 17 total units) this past week.

Signal Accuracy: ~90%

Piper is back to her MARKET-DOMINATING ways -- I love to see it! I'm going to let her continue to cook. While she's in the kitchen, I want to let you know we have multiple new systems that will be going live soon. Stay tuned!!!

Piper's Current Signal Streak: 3 Trades

May Record: 25/27 Units

Monday May 13th

SPY Call Credit Spread (2x Multiple @ $523 / $524) 🟢

QQQ Call Credit Spread (1x Multiple @ $445 / $446) 🟢

Tuesday May 14th

SPY Call Credit Spread (2x Multiple @ $520 / $519) 🟢

QQQ Call Credit Spread (2x Multiple @ $441 / $440) 🟢

Wednesday May 15th

SPY Put Credit Spread (2x Multiple @ $525 / $524) 🟢

QQQ Put Credit Spread (2x Multiple @ $446 / $445) 🟢

Thursday May 16th

SPY Put Credit Spread (1x Multiple @ $529 / $528) 🔴

QQQ Put Credit Spread (1x Multiple @ $452 / $451) 🟢

Friday May 17th

SPY Call Credit Spread (2x Multiple @ $530 / $531) 🟢

QQQ Call Credit Spread (2x Multiple @ $453 / $454) 🟢

Times I Cried on The Stair Stepper

8.4 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!