New Highs, New Me

Greetings Fellow Gambler,

I hope the Market Gods have been treating your positions well!

Both the S&P 500 and Nasdaq 100 hit another new all-time high. On the daily timeframe, the world's largest casino seems to be on easy mode. Apparently, all you have to do is buy and patiently wait. Will it always be like this? Absolutely not. It's also worthwhile to note that the intraday action has been considerably more complicated. There has been a ton of fake outs and whipsaw price action.

In my opinion, none of what we are seeing truly makes sense. Yes, you could argue that the cool inflation reports are bullish. I fully agree. But on the other hand, the Fed has raised their base inflation expectation. Simultaneously the FOMC has also officially lowered their predicted amount of rate cuts (again). The market was expecting 6 cuts at the start of the year. At the beginning of the week, the expectation was 3, but now it's dropped to 1. It's truly remarkable how much can change in half a year.

You might agree, you might disagree, but does it matter? Trading is about reaction -- Investing is about prediction. My thesis of the overall macroeconomic situation could be perfectly spot on or incredibly incorrect. It doesn't really matter. As a trader, price is king. You're either riding the current trend or fighting it. Leave your personal bias at the door. Trade what the market gives you, and more importantly, respect your risk.

Godspeed,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, June 17th

01:00 PM ET Philadelphia Fed President Patrick Harker Speech

09:00 PM ET Fed Governor Lisa Cook Speech

Tuesday, June 18th

05:00 AM ET Eurozone CPI (YoY) (May)

08:30 AM ET Retail Sales (MoM) (May)

01:00 PM ET Fed Governor Adriana Kugler Speech

01:00 PM ET Dalls Fed President Laurie Logan Speech

01:20 PM ET St. Louis Fed President Alberto Musalem Speech

02:00 PM ET Chicago Fed President Austan Goolsbee Speech

Wednesday, June 19th

ALL DAY Market Closed For Juneteenth

Thursday, June 20th

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Fed Manufacturing Index (Jun)

Friday, June 21st

09:45 AM ET S&P Global US Manufacturing PMI (Jun)

09:45 AM ET S&P Global Services PMI (Jun)

10:00 AM ET Existing Home Sales (May)

10:00 AM ET US Leading Economic Indicators

Upcoming Earnings

Monday

None

Tuesday

None

Wednesday

None

Thursday

Morning: Accenture, Darden & Kroger

Friday

Morning: CarMax

Seasonality Update

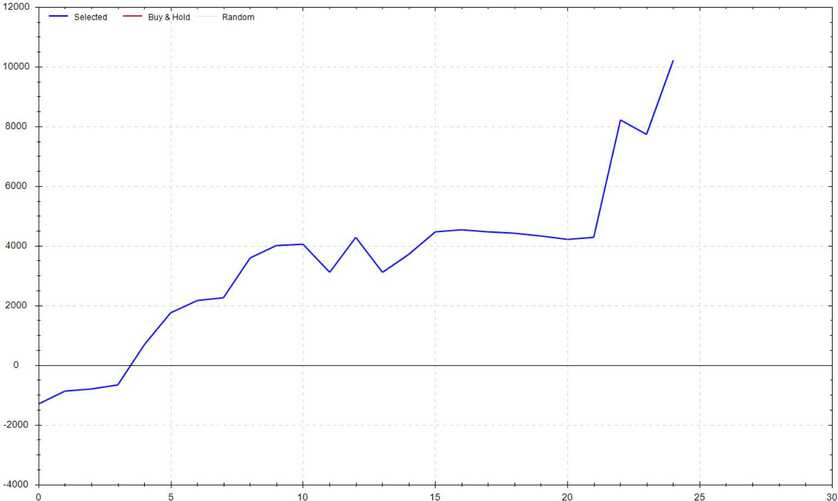

S&P 500 Seasonal Bias (Monday, June 17th)

- Bull Win Percentage: 68%

- Profit Factor: 3.41

- Bias: Bullish

Equity Curve -->

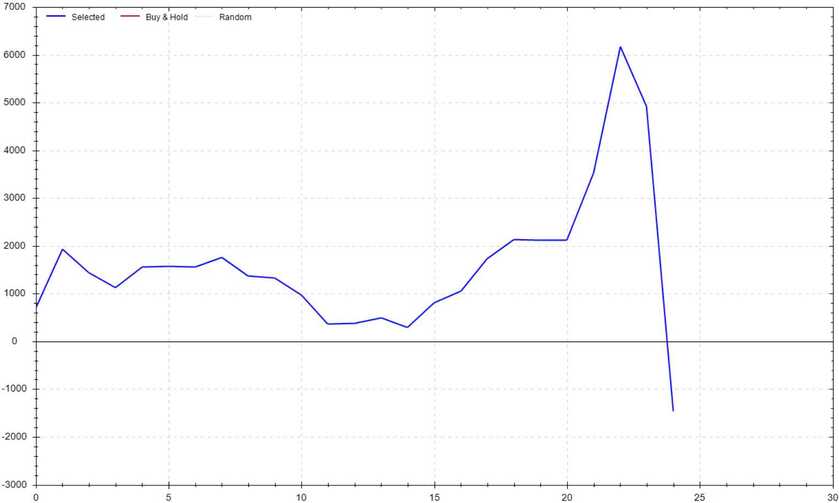

S&P 500 Seasonal Bias (Tuesday, June 18th)

- Bull Win Percentage: 52%

- Profit Factor: 0.86

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Wednesday, June 19th)

- MARKET CLOSED ALL DAY

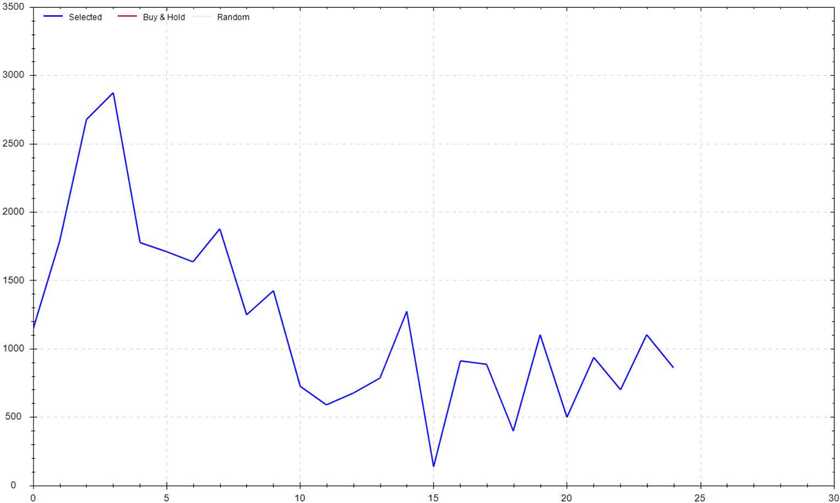

S&P 500 Seasonal Bias (Thursday, June 20th)

- Bull Win Percentage: 52%

- Profit Factor: 1.16

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, June 21st)

- Bull Win Percentage: 56%

- Profit Factor: 1.04

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 10 for 10 times (16 for 16 total units) this past week.

Signal Accuracy: ~100%

Another week of perfection -- Let's hope to good times keep rollin!

Piper's Current Signal Streak: 19 Trades

June Record: 32/32 Units

Monday June 10th

SPY Put Credit Spread (1x Multiple @ $532 / $531) 🟢

QQQ Put Credit Spread (1x Multiple @ $461 / $460) 🟢

Tuesday June 11th

SPY Put Credit Spread (1x Multiple @ $532 / $531) 🟢

QQQ Put Credit Spread (2x Multiple @ $462 / $461) 🟢

Wednesday June 12th

SPY Put Credit Spread (2x Multiple @ $541 / $540) 🟢

QQQ Put Credit Spread (2x Multiple @ $471 / $470) 🟢

Thursday June 13th

SPY Put Credit Spread (2x Multiple @ $539 / $538) 🟢

QQQ Put Credit Spread (2x Multiple @ $474 / $473) 🟢

Friday June 14th

SPY Put Credit Spread (1x Multiple @ $539 / $538) 🟢

QQQ Put Credit Spread (2x Multiple @ $476 / $475) 🟢

Times I Slipped & Fell Off The Stair Stepper

2.3 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!