Brother, Where Art Thou?!

Brother!

I'm fully aware I sound like a broken record, but I truly hope you got paid as the market once again grinded to new heights. Here are the key weekly performance stats:

- S&P 500: +0.32%

- Nasdaq 100: +0.21%

- Bitcoin: -2.85%

As always, the trend is your friend. It doesn't matter if the price seems illogical to you, your job is to make money. Traders make money by reacting to and riding the current trend. Investors make money by accurately predicting future situations. They seem similar but are wildly different. It's imperative to know which camp you're in.

With respect to last week, the market showed resilience. Price action was mainly driven by strong performance in technology and consumer sectors. There were also various favorable economic reports including declining interest rates and stable consumer spending. Please note that the final portion of June is seasonally bearish.

Overall, last week's action was a classic summer grind. Let's be honest -- It was very forgettable. This upcoming week will most likely contain more excitement. There are a myriad of reports, auctions, and speeches that should culminate to creating more tradable ranges. All the key details are highlighted below.

Godspeed,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, June 24th

08:30 AM ET Chicago Fed President Austan Goolsbee Speech

02:00 PM ET San Francisco Fed President Mary Daly Speech

Tuesday, June 25th

10:00 AM ET Consumer Confidence (Jun)

12:00 PM ET Fed Governor Lisa Cook Speech

01:00 PM ET 2-Year Bond Auction

Wednesday, June 26th

10:00 AM ET New Home Sales (May)

10:30 AM ET Crude Oil Inventories

01:00 PM ET 5-Year Bond Auction

Thursday, June 27th

08:30 AM ET GDP 2nd Read (QoQ) (Q1)

08:30 AM ET Durable Goods Orders (MoM) (May)

08:30 AM ET Initial Jobless Claims

10:00 AM ET Pending Home Sales (May)

01:00 PM ET 7-Year Bond Auction

Friday, June 28th

08:30 AM ET PCE Price Index (YoY)

08:30 AM ET PCE Price Index (MoM)

08:30 AM ET Personal Income (MoM)

08:30 AM ET Personal Spending (MoM)

09:45 AM ET Chicago PMI (Jun)

10:00 AM ET Consumer Sentiment (Jun)

12:00 PM ET Fed Governor Michelle Bowman Speech

Upcoming Earnings

Monday

None

Tuesday

Morning: Carnival

Evening: FedEx

Wednesday

Morning: General Mills

Evening: Blackberry, Levi's & Micron

Thursday

Morning: Walgreens

Evening: Nike

Friday

None

Seasonality Update

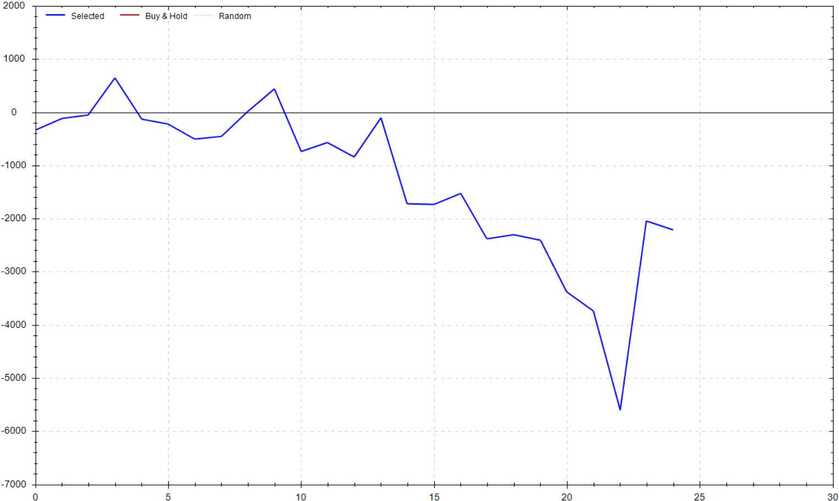

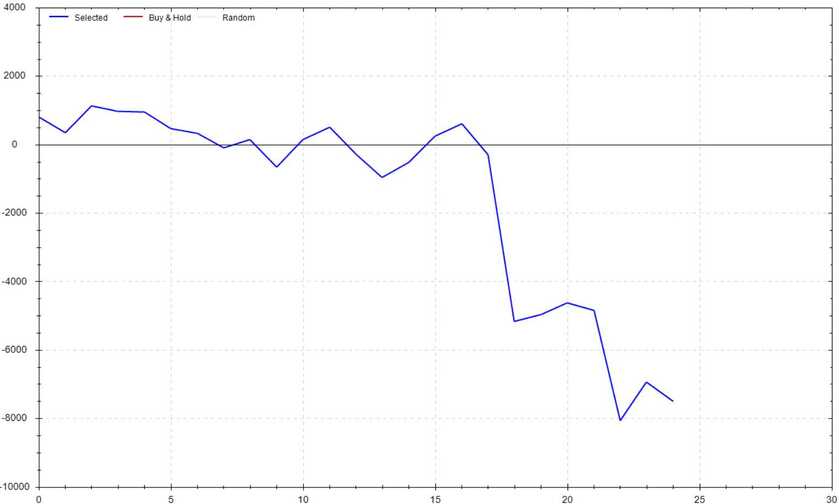

S&P 500 Seasonal Bias (Monday, June 24th)

- Bull Win Percentage: 44%

- Profit Factor: 0.75

- Bias: Bearish

Equity Curve -->

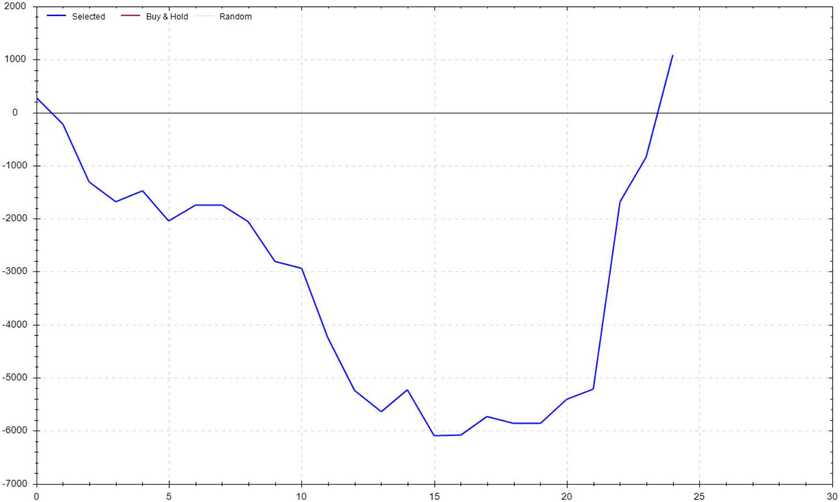

S&P 500 Seasonal Bias (Tuesday, June 25th)

- Bull Win Percentage: 44%

- Profit Factor: 1.15

- Bias: Leaning Bullish

Equity Curve -->

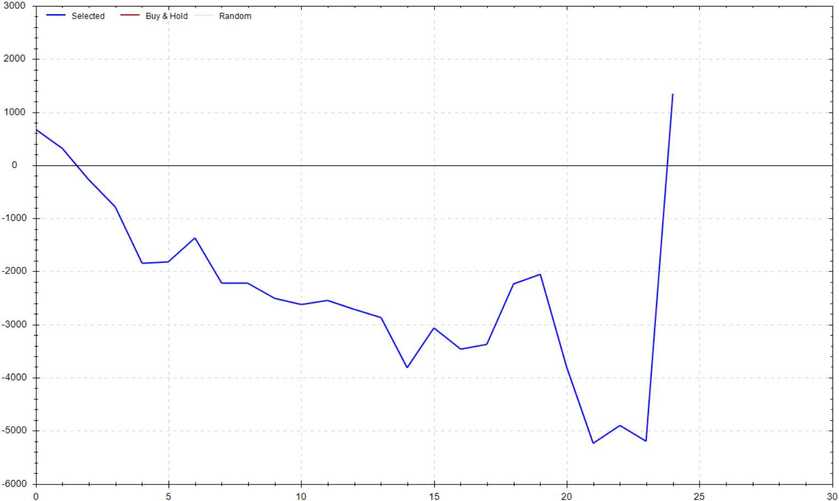

S&P 500 Seasonal Bias (Wednesday, June 26th)

- Bull Win Percentage: 40%

- Profit Factor: 1.15

- Bias: Leaning Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, June 27th)

- Bull Win Percentage: 44%

- Profit Factor: 0.45

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, June 28th)

- Bull Win Percentage: 48%

- Profit Factor: 0.68

- Bias: Leaning Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 7 for 8 times (10 for 12 total units) this past week.

Signal Accuracy: ~87.5%

Unfortunately, Piper lost her streak of perfection, but she is still crushing the market. Her overall performance has been phenomenal -- Let's sit back and see if she can push even higher in the next run!

Piper's Current Signal Streak: 3 Trades

June Record: 42/44 Units

Monday June 17th

SPY Put Credit Spread (1x Multiple @ $541 / $540) 🟢

QQQ Put Credit Spread (1x Multiple @ $478 / $477) 🟢

Tuesday June 18th

SPY Call Credit Spread (1x Multiple @ $549 / $550) 🟢

QQQ Call Credit Spread (1x Multiple @ $486 / $487) 🟢

Wednesday June 19th

Market Closed

Thursday June 20th

SPY Put Credit Spread (2x Multiple @ $547 / $546) 🟢

QQQ Put Credit Spread (2x Multiple @ $481 / $481) 🔴

Friday June 21st

SPY Put Credit Spread (2x Multiple @ $543 / $542) 🟢

QQQ Put Credit Spread (2x Multiple @ $478 / $477) 🟢

Success Rate Playing Chess Against The Homeless

0% *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!