'Murica

Patriots,

Welcome to the land of the free and the home of the degens! I hope your Summer is off to a phenomenal start -- May your days be sunny and your tendies be plentiful. The market is cookin!

Key Weekly Performance Stats:

- S&P 500: 1.91% (New High)

- Nasdaq 100: 3.56% (New High)

- Bitcoin: -6.09%

For those of you who were too busy barbequing, the market hit another new all-time high. The theme this year has been a nonstop melt up to record heights. Obviously, I'm stupid and have no clue about anything, but I belive that the markets will continue to push higher all summer. Seasonality, macroeconomic reports, and an earnings season are all about to converge. My personal expectations are nothing less than fireworks.

As I've discussed numerous times on The MK Show, the historic performance of the S&P 500 in the month of July strongly favors the bulls. Is that a guarantee for this July? Absolutely not! However, I do like the odds of the current situation. The major macroeconomic report of last week was the Unemployment Report, which came in slightly higher the expected. This seems negative, but don't forget that the Fed is attempting to slow down demand to fight inflation. We are in the seemingly contradictory situation where bad economic news is good for the market -- This will not persist forever.

There is even more fun of the horizon! This upcoming week will contain various inflation reports, Fed Chair Powell will be testifying in front of Congress, and the next Earnings Season will officially commence. It would be silly to not admit that there are a decent number of "unknowns", but there is clearly excitement brewing. I'm biased towards the bull camp who I believe is about to show their strength at an even greater level. If I'm wrong, no worries! As an active trader, I attempt to trade with the current direction of the market. In the event that the markets take a nosedive, I'll happily switch my bias. Don't forget, respect your risk and take what the market gives you. Godspeed!

Onward & Upward,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, July 8th

03:00 PM ET Consumer Credit

Tuesday, July 9th

10:00 AM ET Fed Chair Powell Testifies (Senate)

01:00 PM ET 3-Year Note Auction

Wednesday, July 10th

10:00 AM ET Fed Chair Powell Testifies (House)

10:30 AM ET Crude Oil Inventories

01:00 PM ET 10-Year Note Auction

Thursday, July 11th

08:30 AM ET CPI (YoY) (Jun)

08:30 AM ET CPI (MoM) (Jun)

08:30 AM ET Initial Jobless Claims

01:00 PM ET 30-Year Note Auction

01:00 PM ET St. Louis Fed President Alberto Musalem Speaks

02:00 PM ET US Monthly Federal Budget

Friday, July 12th

08:30 AM ET PPI (YoY) (Jun)

08:30 AM ET PPI (MoM) (Jun)

10:00 AM ET Consumer Sentiment

Upcoming Earnings

Monday, July 8th

None

Tuesday, July 9th

None

Wednesday, July 10th

Morning: Manchester United

Evening: WD-40

Thursday, July 11th

Morning: Delta & PepsiCo

Friday, July 12th

Morning: Citi, BNY Mellon, JPMorgan & Wells Fargo

Seasonality Update

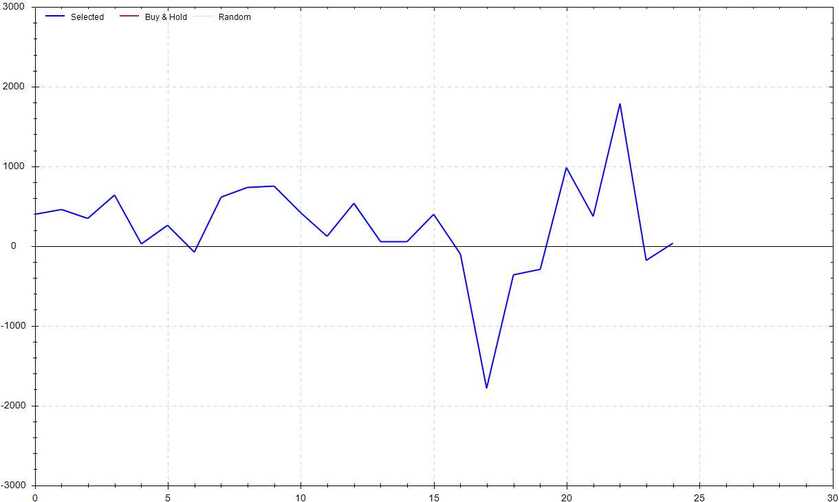

S&P 500 Seasonal Bias (Monday, July 8th)

- Bull Win Percentage: 56%

- Profit Factor: 1.01

- Bias: Neutral

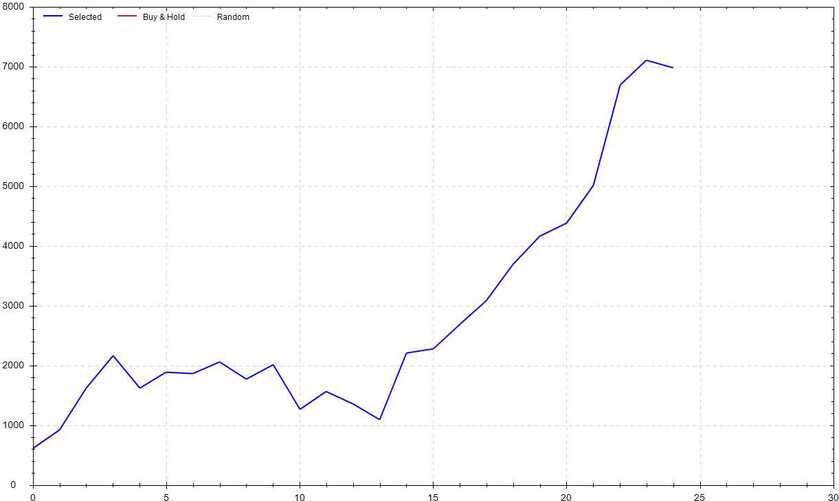

Equity Curve -->

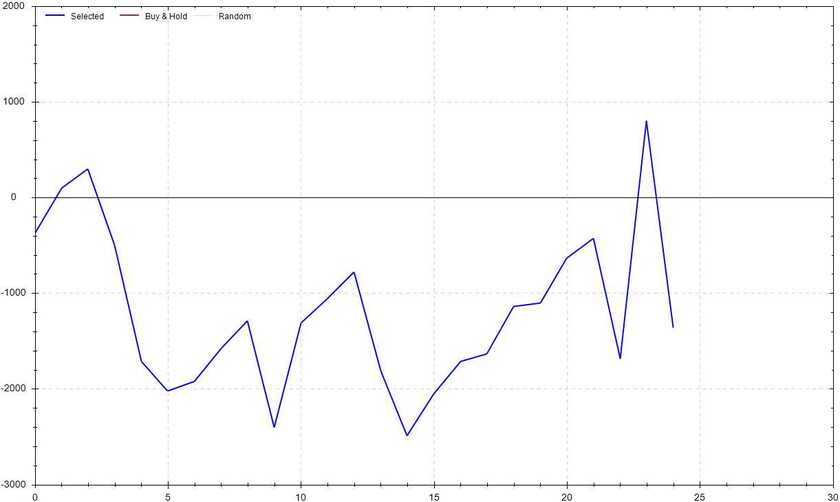

S&P 500 Seasonal Bias (Tuesday, July 9th)

- Bull Win Percentage: 64%

- Profit Factor: 0.85

- Bias: Neutral

Equity Curve -->

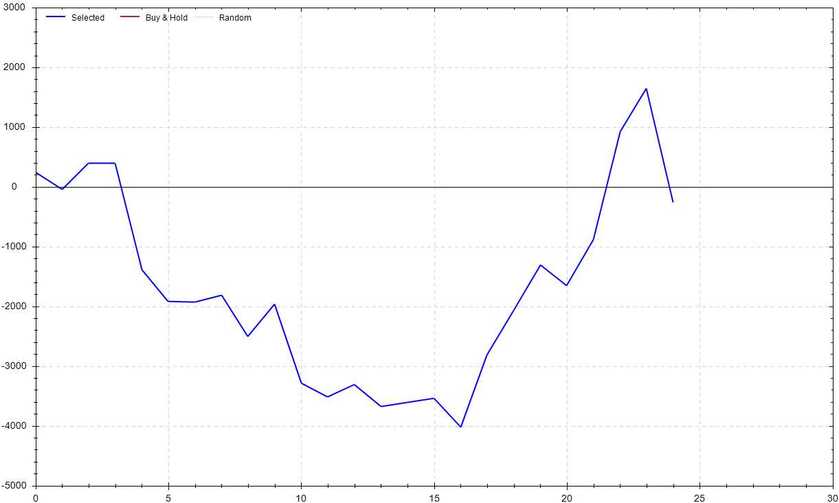

S&P 500 Seasonal Bias (Wednesday, July 10th)

- Bull Win Percentage: 52%

- Profit Factor: 0.97

- Bias: Leaning Bullish

Equity Curve -->

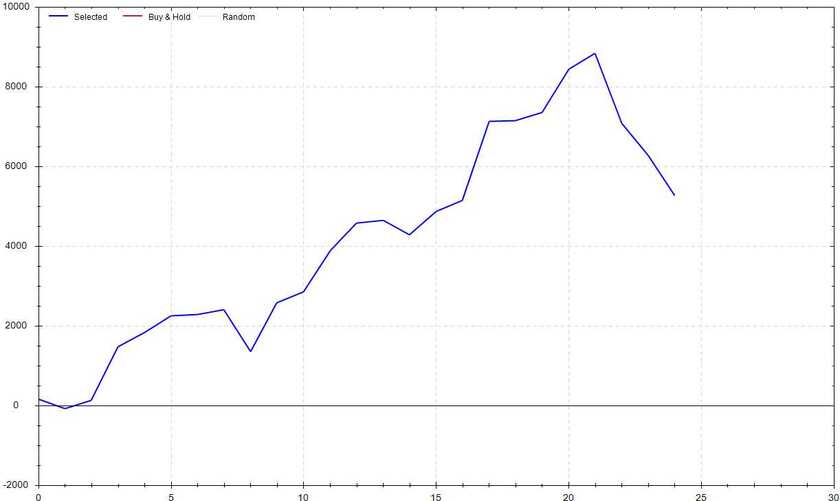

S&P 500 Seasonal Bias (Thursday, July 11th)

- Bull Win Percentage: 76%

- Profit Factor: 2.00

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, July 12th)

- Bull Win Percentage: 72%

- Profit Factor: 4.18

- Bias: Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 7 for 8 times (14 for 16 total units) this past week.

Signal Accuracy: ~87.5%

Piper is continuing to showcase why she is the best trader on this side of the Mississippi. I hope you've found her insights helpful -- I have a feeling she's going to have a great summer!

Piper's Current Signal Streak: 6 Trades

July Record: 14/16 Units

Monday July 1st

SPY Call Credit Spread (2x Multiple @ $546 / $547) 🟢

QQQ Call Credit Spread (2x Multiple @ $481 / $482) 🔴

Tuesday July 2nd

SPY Put Credit Spread (2x Multiple @ $543 / $542) 🟢

QQQ Put Credit Spread (2x Multiple @ $480 / $479) 🟢

Wednesday July 3rd

SPY Put Credit Spread (2x Multiple @ $548 / $547) 🟢

QQQ Put Credit Spread (2x Multiple @ $486 / $485) 🟢

Thursday July 4th

No Signal -- Market Closed All Day

Friday July 5th

SPY Put Credit Spread (2x Multiple @ $550 / $549) 🟢

QQQ Put Credit Spread (2x Multiple @ $491 / $490) 🟢

Total Fall Count While Wakeboarding

18.4*

This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!