Happy (Actually Sad) Monday!

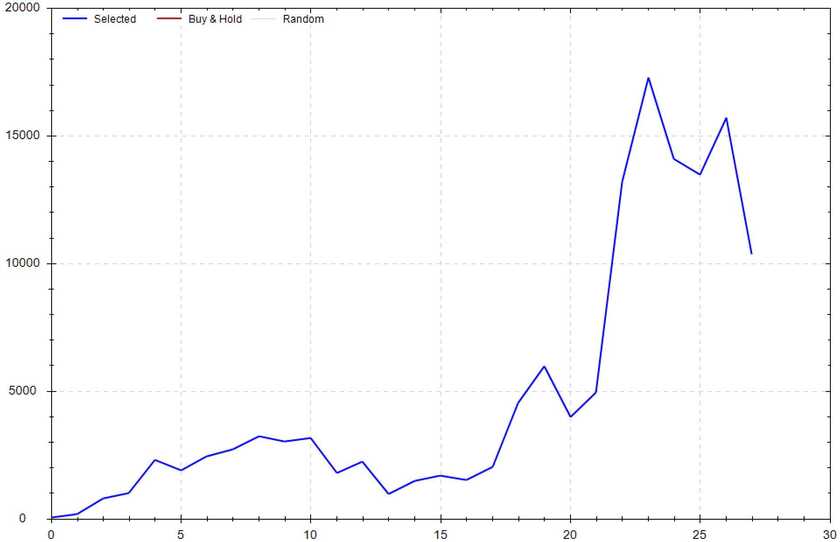

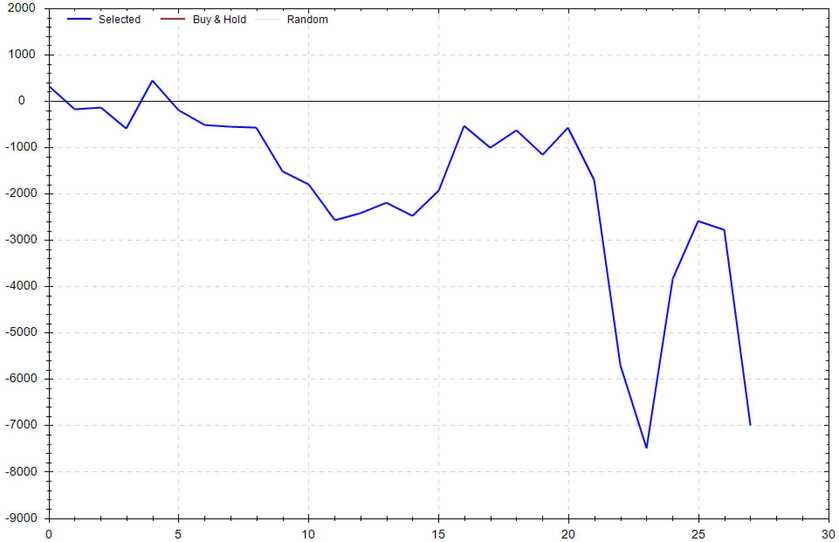

TODAY'S LOSS: -$14,805

My posted, REAL-TIME TRADES SUCKED! THE WORST TO EVER DO IT!

I was arrogant. I was cocky. I couldn't get out of my own way, and it cost me. If you enjoy watching the financial destruction of someone, the Discord is perfect for you.

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

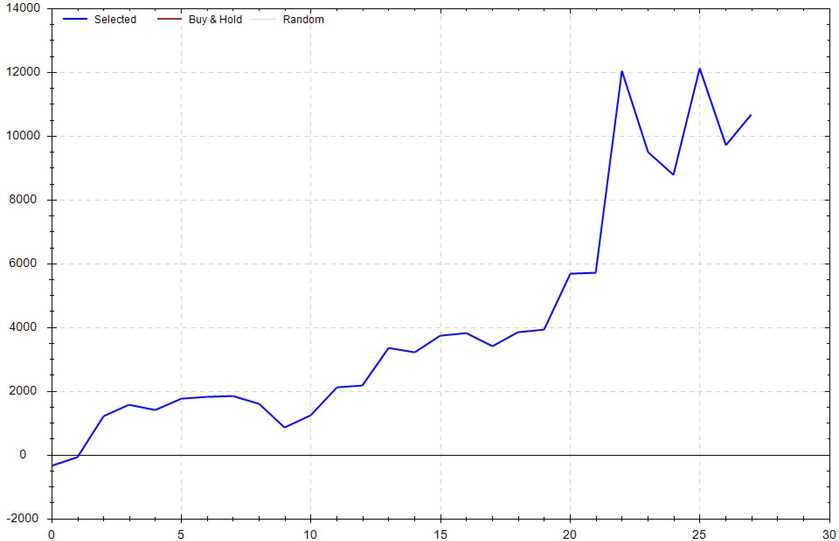

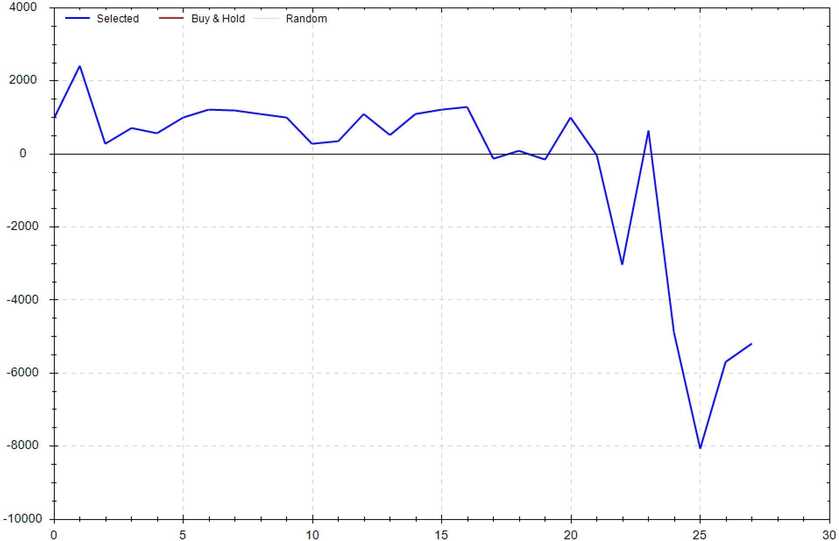

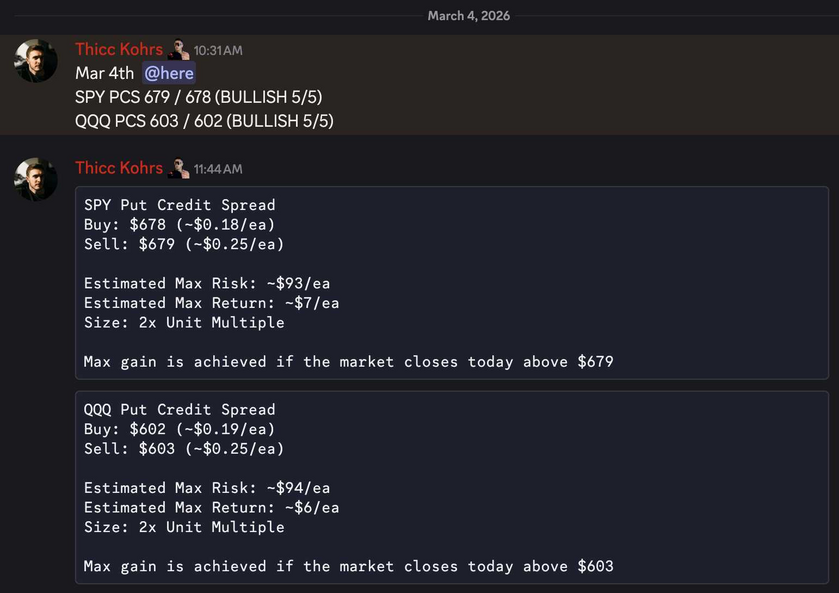

Piper's Picks

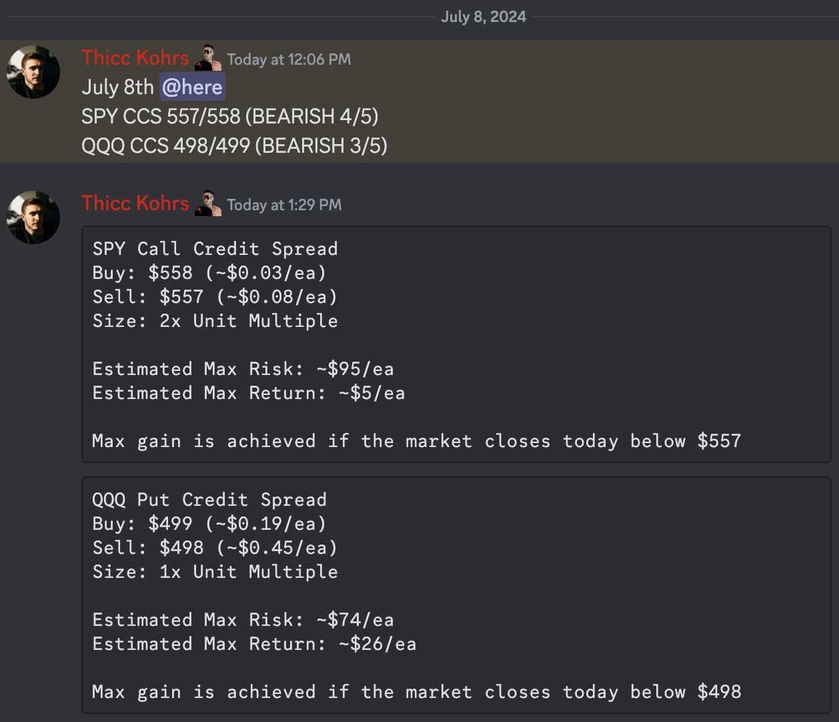

A BEARISH signal, 4/5 strength, was generated at 12:05pm ET by Piper. The signal was used with various advanced options strategies to score (don't worry, I'll teach you every aspect of the strategy).

Both of these trades hit if held until close -- 3 total units!

SPY Return: +$10 (+100%) per $190 signal cost

QQQ Return: +$26 (+100%) per $74 signal cost

Total Return: +$36 (+100%) -- This could easily be scaled per $264 signal

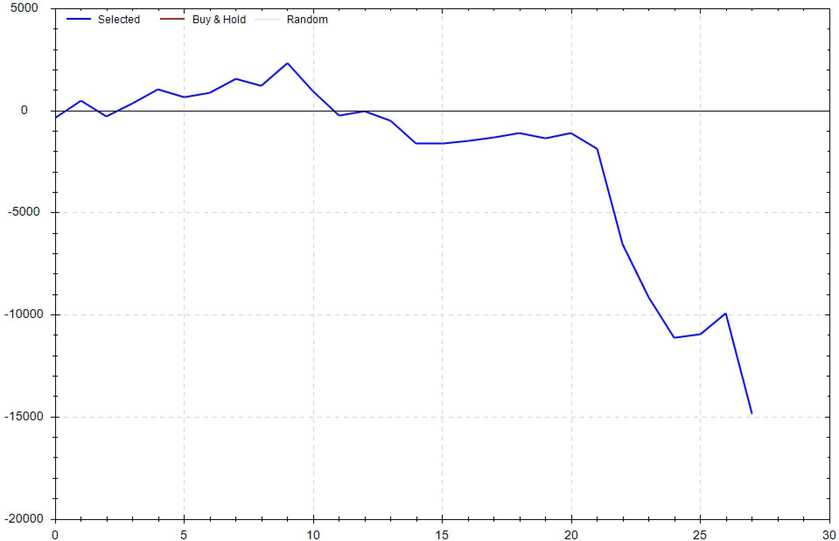

Thicc Matt's Personal Trades

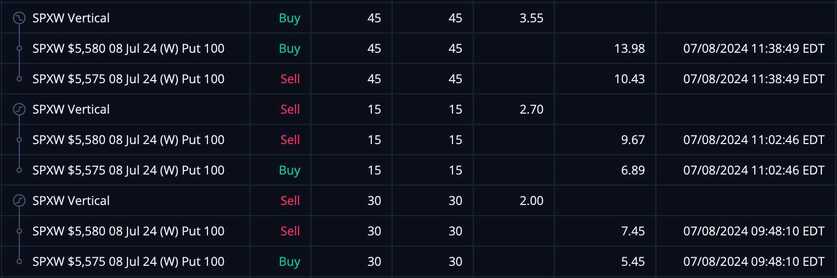

Trade One: 45 x SPX 5580/5575 Put Credit Spread (Scalp Strategy Trade) I think I got a little too arrogant due to my success last week -- I wasn't able to control my own hubris. I inexplicably threw on a position before any of my signals or indicators fired. I was overly confident for no reason, and I paid the price. Trade One was a bullish put credit spread that had an average entry of $2.26/ea and an average exit of $3.55 -- This means Trade One was a realized loss of $5,805.

I think I got a little too arrogant due to my success last week -- I wasn't able to control my own hubris. I inexplicably threw on a position before any of my signals or indicators fired. I was overly confident for no reason, and I paid the price. Trade One was a bullish put credit spread that had an average entry of $2.26/ea and an average exit of $3.55 -- This means Trade One was a realized loss of $5,805.

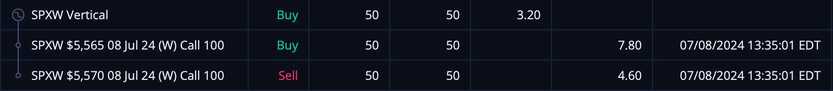

Trade Two: 50 x SPX 5565/5570 Call Credit Spread (Revenge Trade)

Instead of being calm and reasonable, I made the stupid decision to revenge trade. I made the fatal error of sizing up and quickly switching directions after my first trade. Trade Two was a bearish call credit spread that had an average entry of $2.90/ea and an average exit of $3.20 -- This means Trade Two was a realized loss of $1,500.

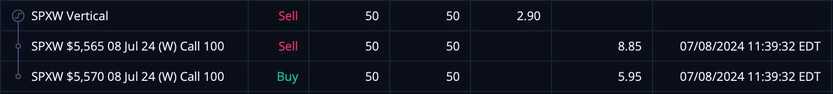

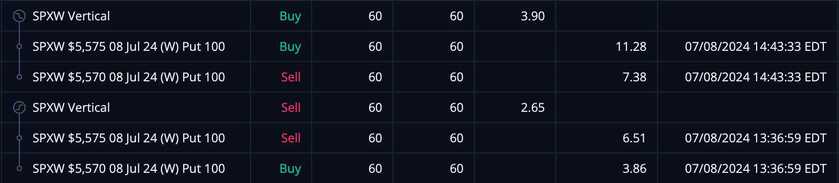

Trade Three: 60 x SPX 5575/5570 Put Credit Spread (Fully on Tilt Trade)

Trade Three was a perfect example of me going fully on tilt and getting whipped (again) by the Market Gods. This trade was a bullish put credit spread that had an average entry of $2.65/ea and an average exit of $3.90 -- This means Trade Three was a realized loss of $7,500.

Trade One Return: -$5,805

Trade Two Return: -$1,500

Trade Three Return: -$7,500

Total Return: -$14,805 (before fees)

How To Join The Goonie Discord (For FREE)

Join the Goonie Discord if you want access to any of the following:

- My Live Trades & Thoughts

- Weekly Teaching Sessions

- Weekly Newsletter

- Trading Competitions

- Texas Roadhouse Talk

Remember you can join the Discord for FREE with the code GOONIE (Click Here!). This code will allow to become a Locals "supporter". Supporters get full access to the entire Locals Community & Goonie Discord server.

Discord Link: https://discord.gg/3dxBRVrgGG

(Allow up to 24hrs to process after you've become a "supporter". If you have any issues, don't hesitate to reach out -- Feel free to DM on Discord or Twitter.)

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

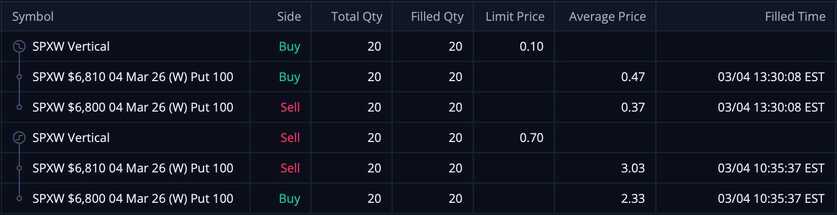

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!