One Small Stop For Man

Howdy,

Key Weekly Performance Stats:

- S&P 500: -0.83%

- Nasdaq 100: -2.58%

- Russel 2000: +3.40%

- Bitcoin: +1.82%

In a strange turn of events, I don't get to say, "we hit another new all-time high". It's interesting that a small pullback can feel like a disastrous bear market. When in doubt, zoom out -- The overall market is closer to its record high than anything else. Don't let a few red days confuse you about where we are in a larger sense.

There were two major macroeconomic events last week. The GDP reading came in way higher than expected (2.8% vs 2.0%), while the PCE inflation report was a bit hot to the tune of 0.1%. The net result of these updates is that a rate cut in September is all but guaranteed. In fact, the odds of a 50bps cut are starting the spike when most people were previously only focusing on 25bps. The upcoming week, which includes both an FOMC meeting and an unemployment report, will have a large influence on the Fed's decision in September. As always, stick to your trading plan, respect your risk, and don't be stupid. Godspeed.

Until Next Time,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, July 29th

None

Tuesday, July 30th

10:00 AM ET CB Consumer Confidence (Jul)

10:00 AM ET JOLTs Job Openings (Jun)

Wednesday, July 31st

05:00 AM ET Eurozone CPI (YoY) (Jul)

08:15 AM ET ADP Nonfarm Employment Chnage (Jul)

09:45 AM ET Chicago PMI (Jul)

10:30 AM ET Crude Oil Inventories

02:00 PM ET Fed Interest Rate Decision

02:30 PM ET FOMC Press Conference (Fed Chair Powell)

Thursday, August 1st

08:30 AM ET Initial Jobless Claims

08:30 AM ET S&P Global US Manufacturing PMI (Jul)

10:00 AM ET ISM Manufacturing PMI (Jul)

10:00 AM ET ISM Manufacturing Prices (Jul)

Friday, August 2nd

08:30 AM ET Unemployment Report (Jul)

08:30 AM ET Nonfarm Payrolls (Jul)

08:30 AM ET Average Hourly Earnings (MoM) (Jul)

Upcoming Earnings

Monday, July 29th

Morning: McDonalds

Evening: Tilray

Tuesday, July 30th

Morning: BP, P&G, PayPal, Pfizer & Sofi

Evening: AMD, Microsoft, Pinterest & Starbucks

Wednesday, July 31st

Morning: Boeing, Mastercard & Norwegian

Evening: Arm, Meta, Qualcomm & Riot

Thursday, August 1st

Morning: Moderna

Evening: Apple, Amazon, Coinbase, Draft Kings, Intel & Roku

Friday, August 2nd

Morning: Chevron & ExxonMobil

Seasonality Update

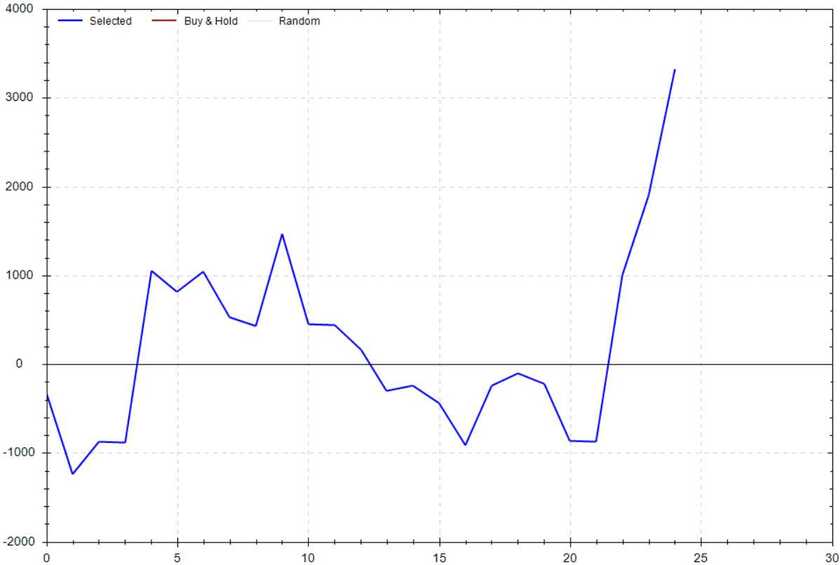

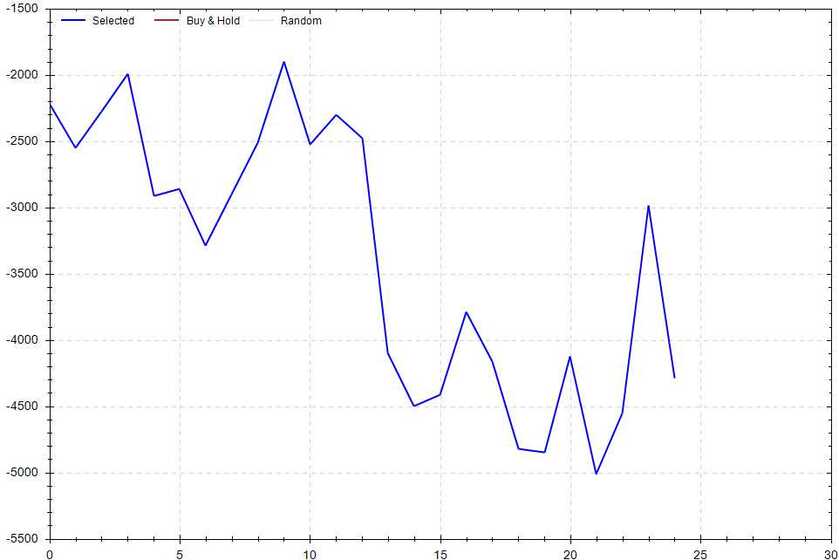

S&P 500 Seasonal Bias (Monday, July 29th)

- Bull Win Percentage: 40%

- Profit Factor: 1.63

- Bias: Leaning Bullish

Equity Curve -->

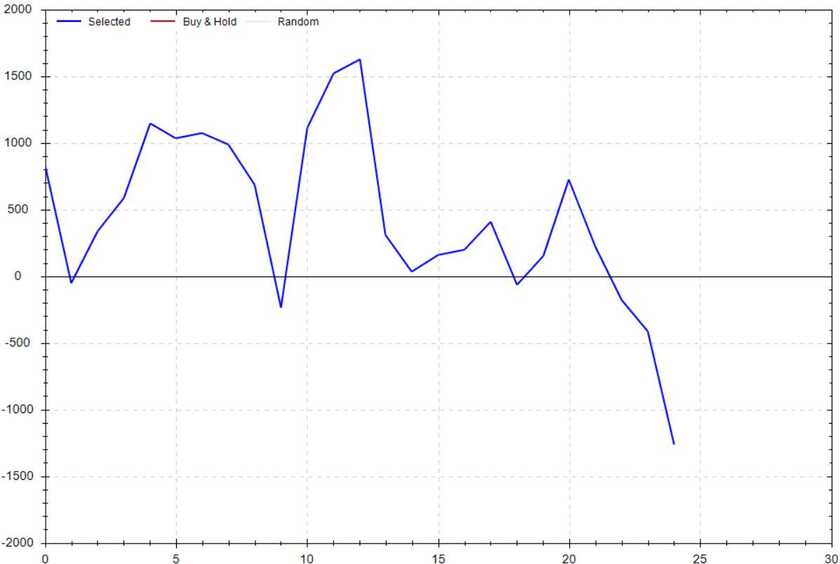

S&P 500 Seasonal Bias (Tuesday, July 30th)

- Bull Win Percentage: 52%

- Profit Factor: 0.80

- Bias: Leaning Bearish

Equity Curve -->

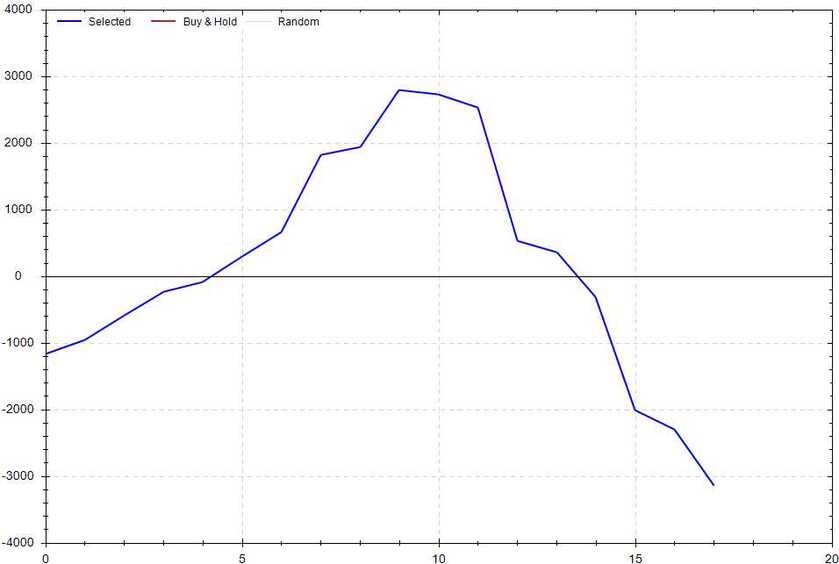

S&P 500 Seasonal Bias (Wednesday, July 31st)

- Bull Win Percentage: 50%

- Profit Factor: 0.56

- Bias: Leaning Bearish

Equity Curve -->

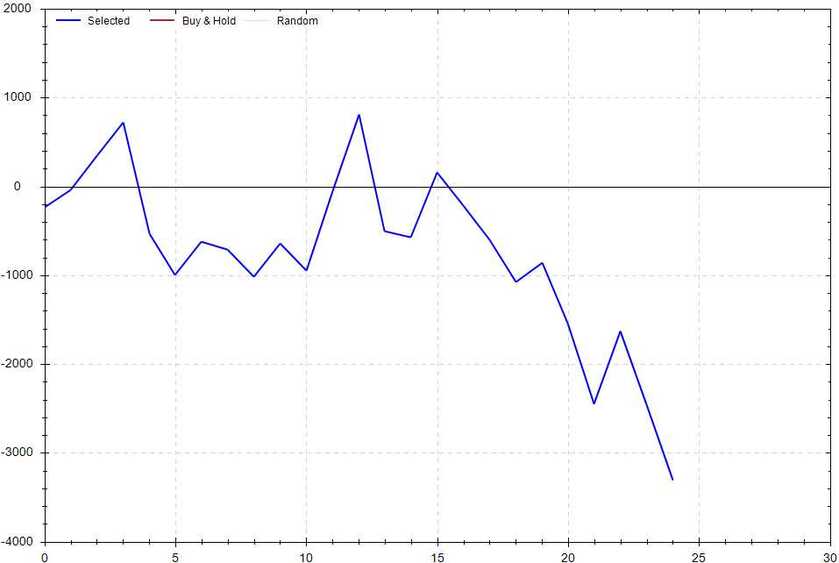

S&P 500 Seasonal Bias (Thursday, August 1st)

- Bull Win Percentage: 40%

- Profit Factor: 0.61

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, August 2nd)

- Bull Win Percentage: 48%

- Profit Factor: 0.57

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 9 for 10 times (20 for 22 total units) this past week.

Signal Accuracy: ~90%

Piper's Current Signal Streak: 7 Trades

July Record: 69/83 Units

Monday July 22nd

SPY Put Credit Spread (2x Multiple @ $550 / $549) 🟢

QQQ Put Credit Spread (2x Multiple @ $478 / $477) 🟢

Tuesday July 23rd

SPY Put Credit Spread (2x Multiple @ $554 / $553) 🔴

QQQ Put Credit Spread (2x Multiple @ $480 / $479) 🟢

Wednesday July 24th

SPY Call Credit Spread (3x Multiple @ $549 / $550) 🟢

QQQ Call Credit Spread (3x Multiple @ $474 / $475) 🟢

Thursday July 25th

SPY Call Credit Spread (2x Multiple @ $543 / $544) 🟢

QQQ Call Credit Spread (2x Multiple @ $464 / $465) 🟢

Friday July 26th

SPY Put Credit Spread (2x Multiple @ $541 / $540) 🟢

QQQ Put Credit Spread (2x Multiple @ $459 / $458) 🟢

Count of Saying "Oh Brother!"

184 *

This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!