Trading Perfection

Hey!

Key Weekly Performance Stats:

- S&P 500: +4.00%

- Nasdaq 100: +5.47%

- Russel 2000: +2.97%

- Bitcoin: -3.24%

The bulls are back in town! The start of August was a bit rough, but it has been a green machine ever since. It has trully been nothing but bullish dominance for the past two weeks. To be clear, last week's gains were no fluke. The PPI inflation report came in less than expected. The CPI inflation report was also a bit cool. And to top it all off, the Retail Sales data ended up being way higher than expected. This trifecta of bullish updates sent the market to the moon.

Looking forward, the trend clearly favors the bulls. However, I would argue a cautionary mindset is paramount. Strong price action doesn't persist endlessly. Markets commonly move between periods of expansion and contraction. Eventually, there will be some consolidation. My crystal ball isn't telling me when that will happen, but it wouldn't be surprising to occur at major resistance. Oddly enough, that's exactly where both the SPY & QQQ's are currently sitting. Regardless of this plays out or not, it doesn't matter. What matters is that you react to price action. You're not trying to predict price action. React to optimal risk to reward situations and stick to your plan. Godspeed.

Ciao,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, August 19th

10:00 AM ET US Leading Economic Indicators (July)

Tuesday, August 20th

05:00 AM ET Eurozone CPI (YoY) (July)

01:35 PM ET Atlanta Fed President Raphael Bostic Speech

02:45 PM ET Fed Vice Chair Michael Barr Speech

Wednesday, August 21st

10:30 AM ET Crude Oil Inventories

01:00 PM ET 20-Year Bond Auction

02:00 PM ET Fed's FOMC Meeting Minutes (July)

Thursday, August 22nd

08:30 AM ET Initial Jobless Claims

09:45 AM ET S&P Global US Services PMI (Aug)

09:45 AM ET S&P Global US Manufacturing PMI (Aug)

10:00 AM ET Existing Home Sales (July)

01:00 PM ET 30-Year Bond Auction

Friday, August 23rd

10:00 AM ET Fed Chair Powell Jackson Hole Speech

10:00 AM ET Consumer Sentiment (Aug)

10:00 AM ET New Home Sales (July)

Upcoming Earnings

Monday, August 19th

Evening: Palo Alto Networks

Tuesday, August 20th

Morning: Lowe's

Wednesday, August 21st

Morning: Macy's & Target

Evening: Snowflake & Zoom

Thursday, August 22nd

Morning: Peloton & TD Bank

Evening: Cava

Friday, August 23rd

None

Seasonality Update

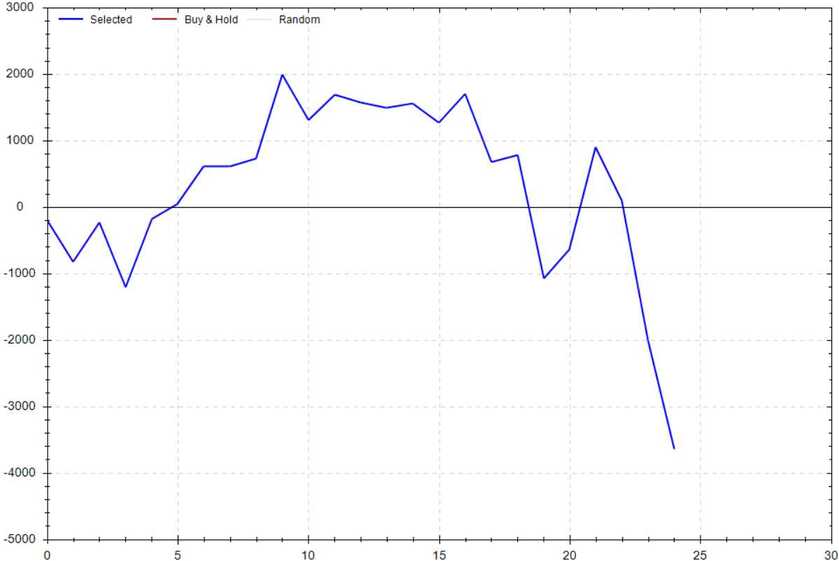

S&P 500 Seasonal Bias (Monday, August 19th)

- Bull Win Percentage: 48%

- Profit Factor: 0.65

- Bias: Leaning Bearish

Equity Curve -->

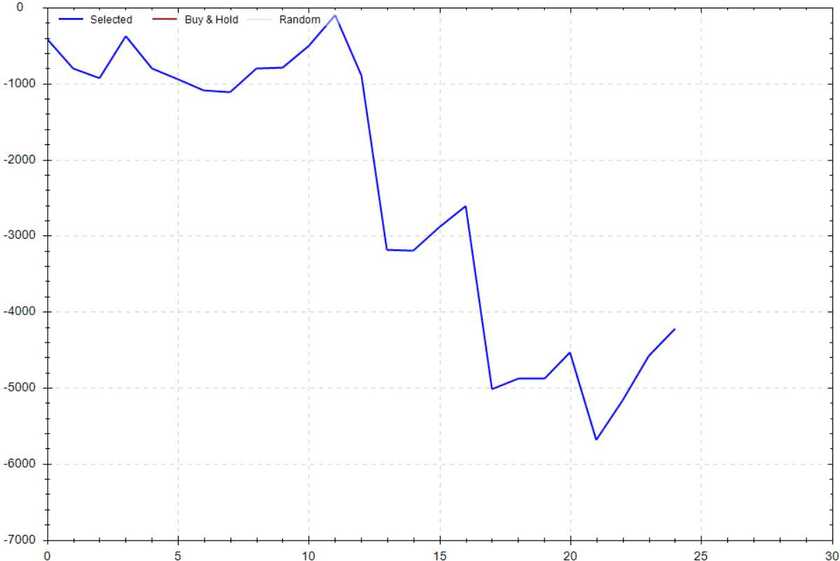

S&P 500 Seasonal Bias (Tuesday, August 20th)

- Bull Win Percentage: 48%

- Profit Factor: 0.49

- Bias: Bearish

Equity Curve -->

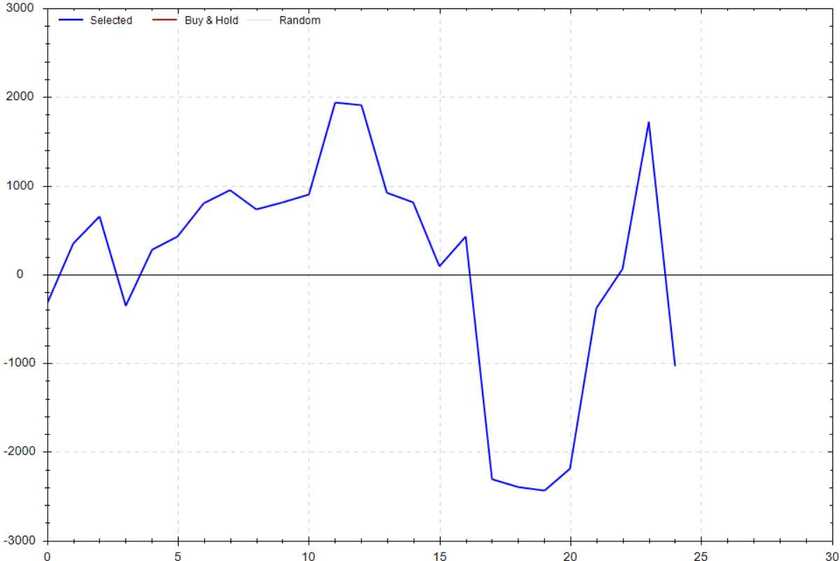

S&P 500 Seasonal Bias (Wednesday, August 21st)

- Bull Win Percentage: 56%

- Profit Factor: 0.89

- Bias: Neutral

Equity Curve -->

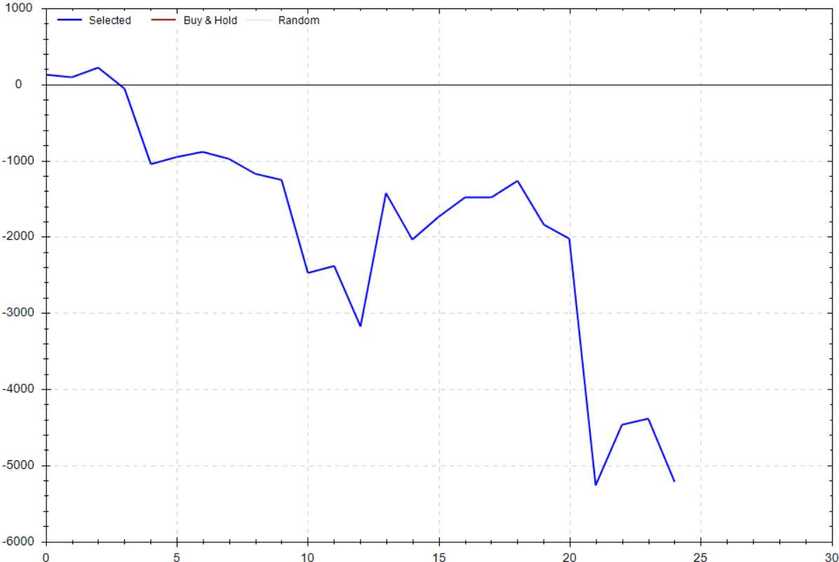

S&P 500 Seasonal Bias (Thursday, August 22nd)

- Bull Win Percentage: 60%

- Profit Factor: 1.05

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, August 23rd)

- Bull Win Percentage: 44%

- Profit Factor: 0.43

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 10 for 10 times (24 for 24 total units) this past week.

Signal Accuracy: ~100%

Same story, different week. Piper is as trading monster -- I hope you're enjoying the ride!

Piper's Current Signal Streak: 14 Trades

August Record: 44/48 Units

Monday, August 12th

SPY Put Credit Spread (2x Multiple @ $531 / $530) 🟢

QQQ Put Credit Spread (2x Multiple @ $448 / $447) 🟢

Tuesday, August 13th

SPY Put Credit Spread (3x Multiple @ $536 / $535) 🟢

QQQ Put Credit Spread (3x Multiple @ $455 / $454) 🟢

Wednesday, August 14th

SPY Call Credit Spread (2x Multiple @ $544 / $545) 🟢

QQQ Call Credit Spread (2x Multiple @ $465 / $466) 🟢

Thursday, August 15th

SPY Put Credit Spread (3x Multiple @ $548 / $547) 🟢

QQQ Put Credit Spread (3x Multiple @ $468 / $467) 🟢

Friday, August 16th

SPY Put Credit Spread (2x Multiple @ $551 / $550) 🟢

QQQ Put Credit Spread (2x Multiple @ $471 / $470) 🟢

Tarot Card Market Prediction Accuracy

100% (Absolutely perfect) *

This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!