The Bears Are Back In Town

TODAY'S GAIN: +$9,320

My posted, REAL-TIME TRADES CRUSHED -- Today's trades would have paid for MORE EIGHTEEN YEARS OF GOONIE MEMBERSHIP!!!

Don't miss out! You can join the Goonie Trading Discord for FREE -- Lock in the cheaper rates before they increase next week! Let me teach what I do and how I do it. Join the Goonies!

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

Piper's Picks

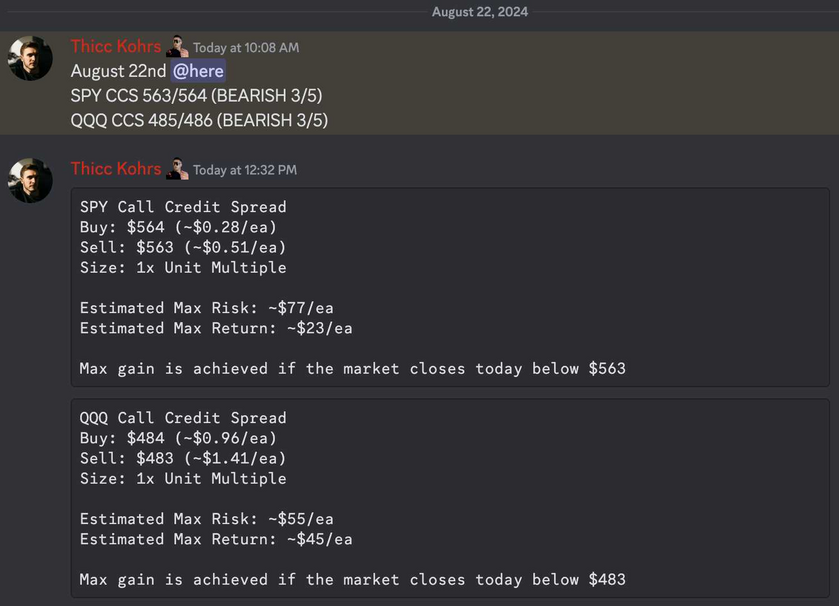

A BEARISH signal, 3/5 strength, was generated around 10:10am ET by Piper. The signal was used with various advanced options strategies to score (don't worry, I'll teach you every aspect of the strategy). Both of these trades hit if held until close -- 2 total units!

Both of these trades hit if held until close -- 2 total units!

SPY Return: +$23 (+100%) per $77 signal cost

QQQ Return: +$45 (+100%) per $55 signal cost

Total Return: +$68 (+100%) -- This could easily be scaled per $132 signal cost

Thicc Matt's Personal Trades

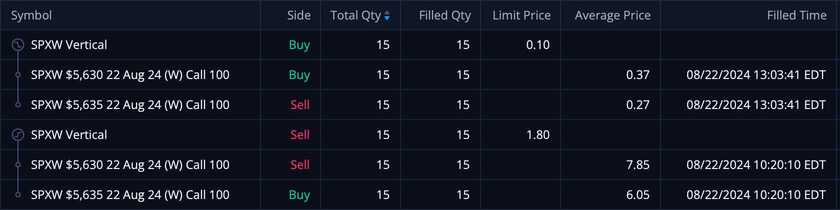

Trade One: 15 SPX 5630/5635 Put Credit Spreads (Piper Trade Strategy) Back at it again, Daniel! The market had enough downward momentum that Piper eventually fired off a bearish signal. I trust Piper with my life, so I also created a bearish/neutral position. To be fair, I was a bit aggressive with my selected strikes, but the risk paid off nicely. The call spreads were sold at $1.80/ea and were all bought back at $0.10 -- This means my REALIZED GAIN WAS $2,550.

Back at it again, Daniel! The market had enough downward momentum that Piper eventually fired off a bearish signal. I trust Piper with my life, so I also created a bearish/neutral position. To be fair, I was a bit aggressive with my selected strikes, but the risk paid off nicely. The call spreads were sold at $1.80/ea and were all bought back at $0.10 -- This means my REALIZED GAIN WAS $2,550.

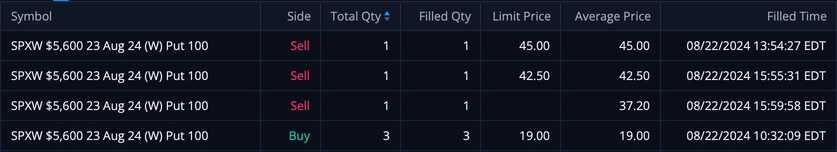

Trade Two: 3 SPX 5600 Puts (Scalp Strategy) Trade Two was a big risk, but the reward was worth it. The morning trend was clearly down. I got lucky that it persisted all day. I went long 3 SPX puts at $19.00/ea and took my profits at an average of $41.57 -- This means my REALIZED GAIN WAS $6,770.

Trade Two was a big risk, but the reward was worth it. The morning trend was clearly down. I got lucky that it persisted all day. I went long 3 SPX puts at $19.00/ea and took my profits at an average of $41.57 -- This means my REALIZED GAIN WAS $6,770.

Trade One Return: +$2,550

Trade Two Return: +$6,770

Total Return: $9,320 (before fees)

These trades would have paid for MORE THAN EIGHTEEN YEARS OF GOONIE DISCORD ACCESS!!!

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!