Goodbye August, Hello September

Yo yo yo,

August came in like a lion and left like a lamb. We went from massive tradable ranges to chop city in only a couple of weeks. Fortunately for us, the price compression seems to be coming to an end. Here are a few key things you should know as things progress.

Key Weekly Performance Stats:

- S&P 500: +0.28%

- Nasdaq 100: -0.78%

- Russel 2000: -0.14%

- Bitcoin: -7.76%

The final week of the month contained two major macroeconomic developments. The U.S. GDP was reported to have a steady growth rate of 2.8%, which was in line with expectations. This indicates that the U.S. economy continued to grow at a pace close to its long-term trend, supported by consumer spending despite a lower savings rate and a slowing labor market. The PCE inflation report was also a much-anticipated update. The reading came in slighlty cool. This is a postive sign that inflation is still trending in the right direction.

The S&P 500 managed to close about 5% higher by the end of the month. Stocks experienced significant volatility. There was a notable recovery after an initial drop, influenced by the Bank of Japan (BoJ) rate hike which led to a temporary unwind in the carry trade affecting markets globally. This eventual recovery was broad-based, suggesting widespread market participation beyond just the large-cap tech stocks.

Moving forward, the Fed's interest rate decision at the September 18th FOMC meeting will be the must-see event of the month. Price action has been compressed for effectively two weeks. I can't make any promises, but it feels as if there is a breakout, or breakdown, on the close horizon. As always, stick to your trading plan & respect your risk. Godspeed.

Peace,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, September 2nd

ALL DAY Market Closed (Labor Day)

Tuesday, September 3rd

09:45 AM ET S&P Global US Manufacturing PMI (Aug)

10:00 AM ET ISM Manufacturing PMI (Aug)

10:00 AM ET ISM Manufacturing Prices (Aug)

Wednesday, September 4th

10:00 AM ET JOLTs Job Openings (Jul)

02:00 PM ET Fed Beige Book

Thursday, September 5th

08:15 AM ET ADP Employment (Aug)

08:30 AM ET Initial Jobless Claims

09:45 AM ET S&P Global Services PMI (Aug)

10:00 AM ET ISM Non-Manufacturing PMI (Aug)

10:00 AM ET ISM Non-Manufacturing Prices (Aug)

11:00 AM ET Crude Oil Inventories

Friday, September 6th

08:30 AM ET US Unemployment Rate (Aug)

08:30 AM ET Avg. Hourly Earnings (MoM) (Aug)

08:45 AM ET New York Fed President Williams Speaks

11:00 AM ET Fed Governor Waller Speaks

Upcoming Earnings

Monday, September 2nd

None

Tuesday, September 3rd

Evening: GitLab

Wednesday, September 4th

Morning: Dick's

Evening: C3.AI

Thursday, September 5th

Morning: Nio

Evening: Broadcom & DocuSign

Friday, September 6th

None

Seasonality Update

S&P 500 Seasonal Bias (Monday, September 2nd)

- Market Closed (Labor Day)

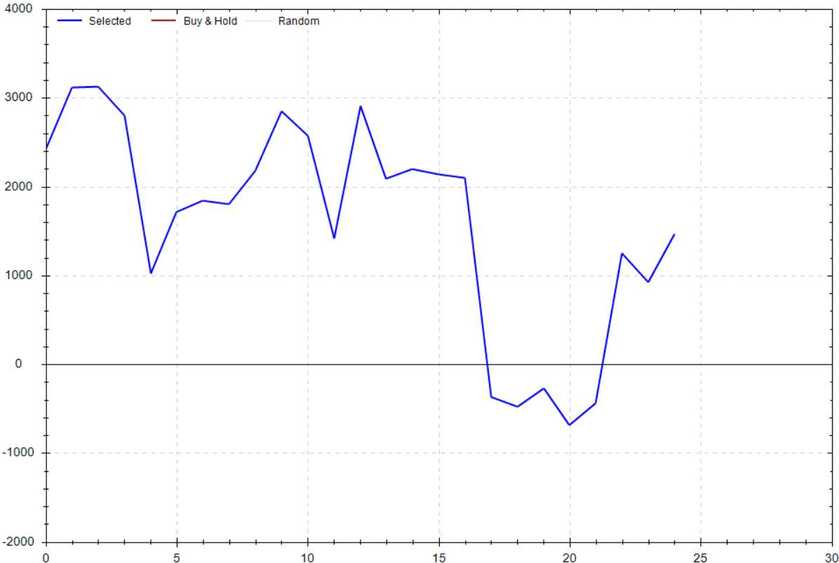

S&P 500 Seasonal Bias (Tuesday, September 3rd)

- Bull Win Percentage: 52%

- Profit Factor: 1.19

- Bias: Neutral

Equity Curve -->

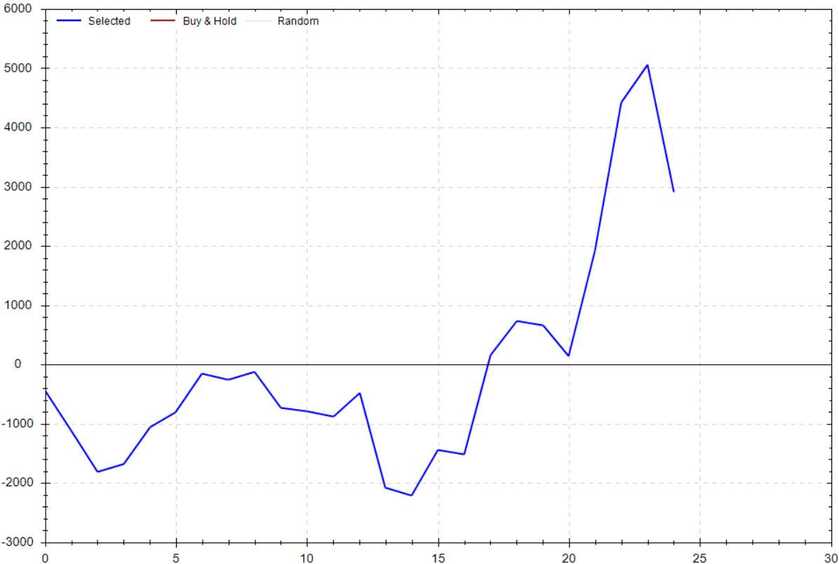

S&P 500 Seasonal Bias (Wednesday, September 4th)

- Bull Win Percentage: 48%

- Profit Factor: 1.40

- Bias: Leaning Bullish

Equity Curve -->

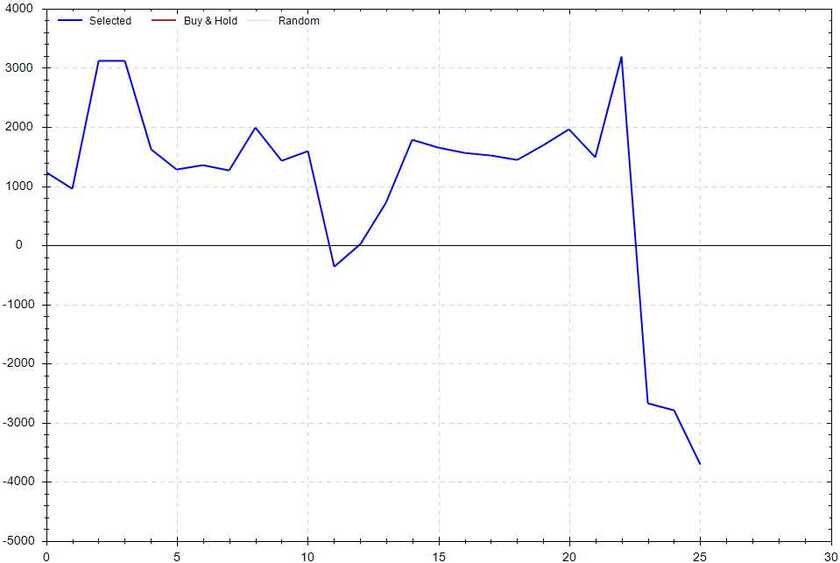

S&P 500 Seasonal Bias (Thursday, September 5th)

- Bull Win Percentage: 42%

- Profit Factor: 0.70

- Bias: Leaning Bearish

Equity Curve -->

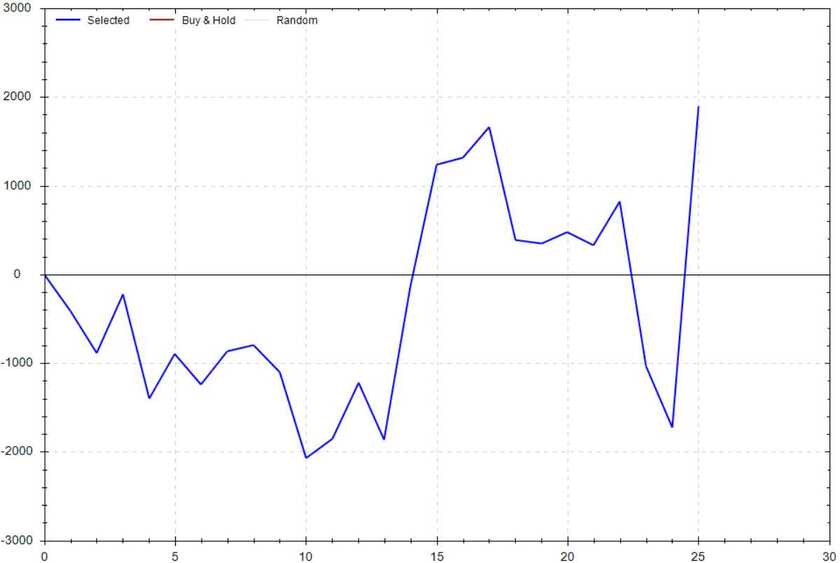

S&P 500 Seasonal Bias (Friday, September 6th)

- Bull Win Percentage: 50%

- Profit Factor: 1.23

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 10 times (16 for 20 total units) this past week.

Signal Accuracy: ~80%

Piper's historic streak has come to an end. After 28 glorious trades, her perfection has come to an end. Here's to her next run of dominance!

Piper's Current Signal Streak: 2 Trades

August Record: 72/80 Units

Monday, August 26th

SPY Call Credit Spread (2x Multiple @ $563 / $564) 🟢

QQQ Call Credit Spread (2x Multiple @ $480 / $481) 🟢

Tuesday, August 27th

SPY Put Credit Spread (2x Multiple @ $558 / $557) 🟢

QQQ Put Credit Spread (2x Multiple @ $472 / $471) 🟢

Wednesday, August 28th

SPY Call Credit Spread (2x Multiple @ $562 / $563) 🟢

QQQ Call Credit Spread (2x Multiple @ $477 / $478) 🟢

Thursday, August 29th

SPY Put Credit Spread (2x Multiple @ $559 / $558) 🔴

QQQ Put Credit Spread (2x Multiple @ $472 / $471) 🔴

Friday, August 30th

SPY Put Credit Spread (2x Multiple @ $560 / $559) 🟢

QQQ Put Credit Spread (2x Multiple @ $474 / $473) 🟢

Times Piper Puked On Me

1 -- Low count, but horrible*

This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!