EXPLOSIVE GAINS!!!

Hey,

Key Weekly Performance Stats:

- S&P 500: +4.75%

- Nasdaq 100: +5.48%

- Russel 2000: +8.74%

- Bitcoin: +10.22%

Last week, the stock market saw both new all-time highs and notable volatility driven by the presidential election. The S&P 500, Nasdaq 100, and Russell 200 surged as Donald Trump reclaimed the presidency, sparking "Trump Trades." Treasury yields also rose, which signals investors are optimistic about potential deregulation and tax cuts but wary of inflation risks from possible tariffs. Global sentiment was further shaped by the Federal Reserve's rate decision and expectations of a stimulus package from China.

Various economic data released showed a mixed picture: unemployment claims pointed to labor market resilience, supporting investor confidence, while the dollar strengthened, reaching 84.10, as policy shifts were anticipated. Bitcoin hit a record high, reflecting investor interest in alternative assets amid potential policy changes. It should also new noted that the president elect's commentary has been supportive surrounding cryptocurrencies.

Looking ahead, key focus areas include market reactions to election-related policy announcements and how interest rate-sensitive sectors respond to the Fed’s decisions. China's stimulus could impact commodity markets and trade, while inflation trends remain crucial for bond yields and stock valuations. As always, respect your risk. Godspeed.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, November 11th

ALL DAY Bond Market Closed (Veteran's Day)

Tuesday, November 12th

10:00 AM ET Fed Governor Waller Speakes

10:15 AM ET Richmond Fed President Barkin Speaks

05:00 PM ET Philadelphia Fed President Harker Speaks

Wednesday, November 13th

08:30 AM ET CPI YoY & MoM (Oct)

09:45 AM ET Dallas Fed President Logan Speaks

01:00 PM ET St. Louis Fed President Musalem Speaks

01:30 PM ET Kansas Fed President Schmid Speaks

Thursday, November 14th

08:30 AM ET Initial Jobless Claims

08:30 AM ET PPI YoY & MoM (Oct)

03:00 PM ET Fed Chair Powell Speaks

04:14 PM ET New York City Fed President Williams Speaks

Friday, November 15th

08:30 AM ET Retail Sales (Oct)

Upcoming Earnings

Monday

Evening: Live Nation

Tuesday

Morning: Home Depot & Shopify

Evening: Cava, Spotify & Occidental Petroleum

Wednesday

Morning: Hut 8

Evening: Cisco

Thursday

Morning: Disney & JD.com

Evening:

Friday

Morning: Alibaba

Seasonality Update

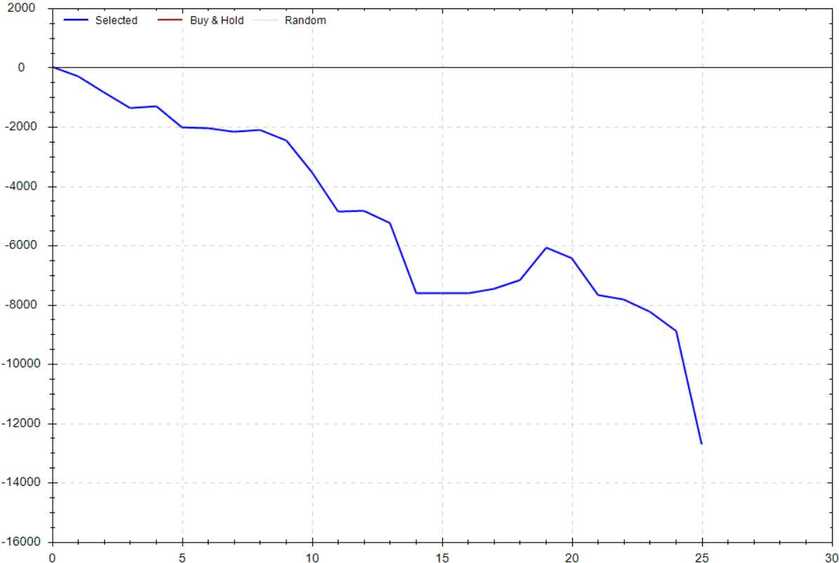

S&P 500 Seasonal Bias (Monday, November 11th)

- Bull Win Percentage: 31%

- Profit Factor: 0.12

- Bias: Very Bearish

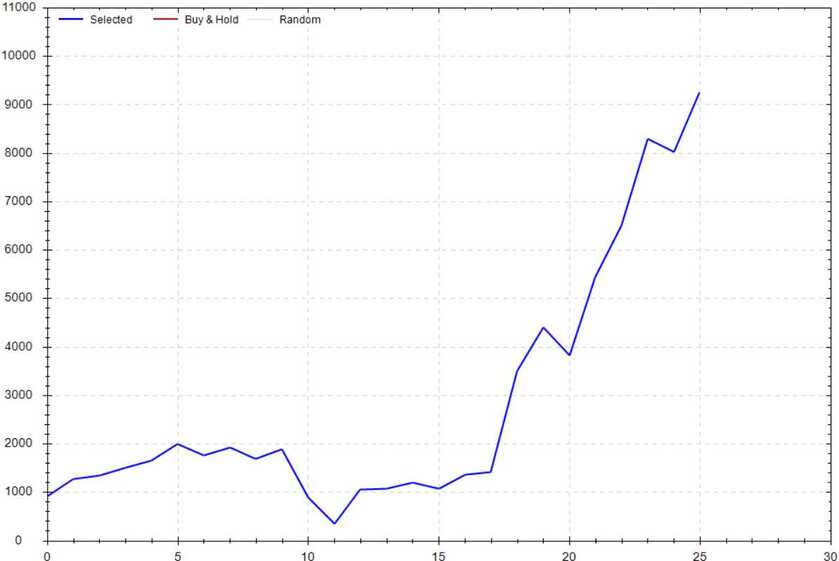

Equity Curve -->

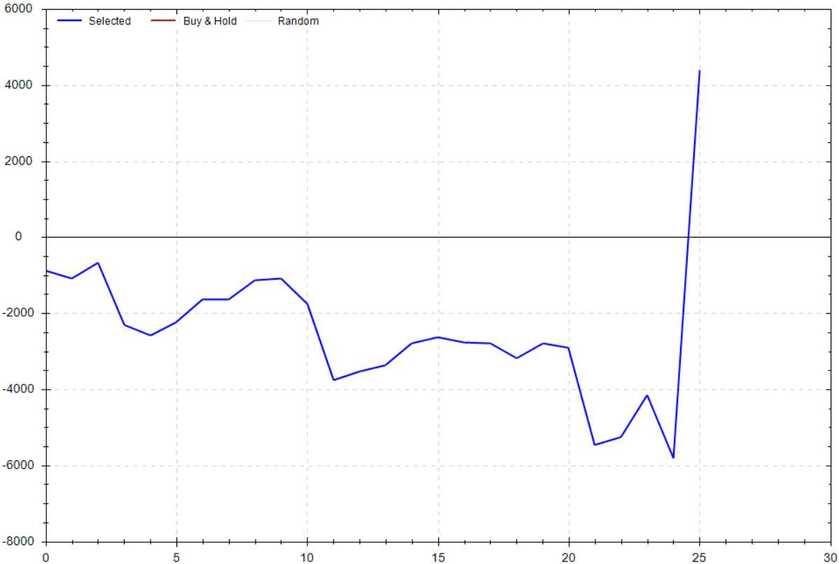

S&P 500 Seasonal Bias (Tuesday, November 12th)

- Bull Win Percentage: 54%

- Profit Factor: 1.42

- Bias: Neutral

Equity Curve -->

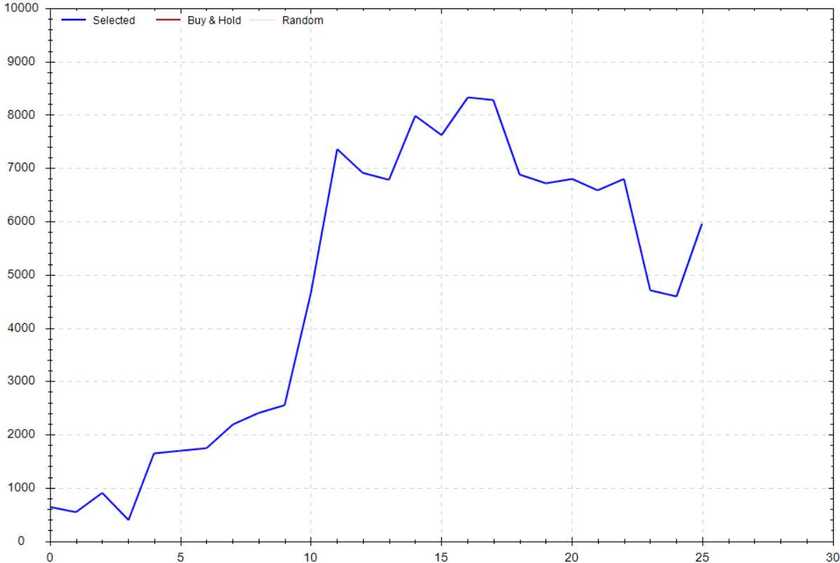

S&P 500 Seasonal Bias (Wednesday, November 13th)

- Bull Win Percentage: 58%

- Profit Factor: 2.07

- Bias: Bullish

Equity Curve -->

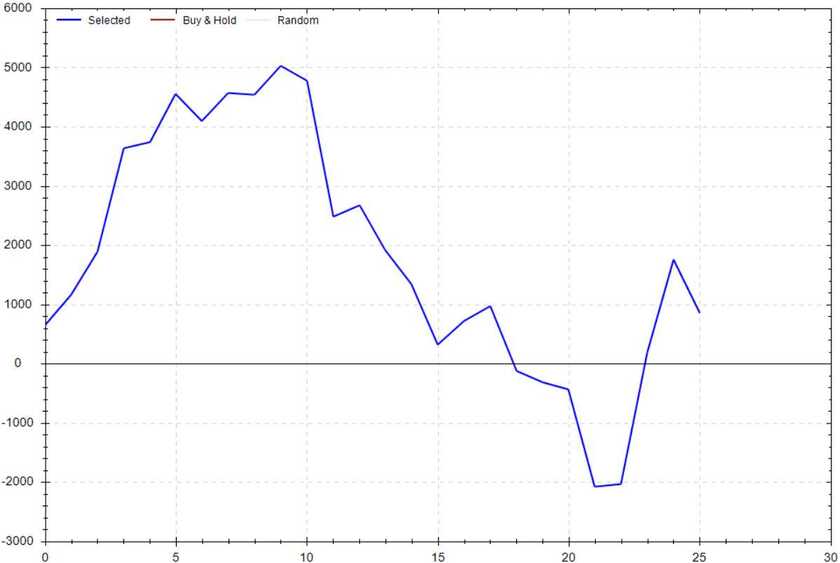

S&P 500 Seasonal Bias (Thursday, November 14th)

- Bull Win Percentage: 54%

- Profit Factor: 1.09

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, November 15th)

- Bull Win Percentage: 73%

- Profit Factor: 4.08

- Bias: Very Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 8 times (15 for 15 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 16 Trades

November Record: 15/15 Units

Monday, November 4th

SPY Put Credit Spread (1x Multiple @ $569 / $568) 🟢

QQQ Put Credit Spread (1x Multiple @ $484 / $483) 🟢

Tuesday, November 5th

SPY Put Credit Spread (2x Multiple @ $570 / $569) 🟢

QQQ Put Credit Spread (2x Multiple @ $487 / $486) 🟢

Wednesday, November 6th

SPY Put Credit Spread (2x Multiple @ $585 / $584) 🟢

QQQ Put Credit Spread (2x Multiple @ $499 / $498) 🟢

Thursday, November 7th

No Signal (FOMC Decision)

Friday, November 8th

SPY Put Credit Spread (3x Multiple @ $596 / $595) 🟢

QQQ Put Credit Spread (2x Multiple @ $512 / $511) 🟢

Times Donald Trump Has Been Elected President

2 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!