The Trump Dump-Pump-Dump!

Hey,

Key Weekly Performance Stats:

- S&P 500: -0.17%

- Nasdaq 100: +0.12%

- Russel 2000: -0.21%

- Bitcoin: -5.70%

Last week, the markets could best be described as a rollercoaster. President Trump announced plans to introduce "reciprocal tariffs" on countries that impose tariffs on U.S. imports, aiming to ensure "reciprocal and fair trade." This move caused market jitters, sparking concerns about potential violations of World Trade Organization rules and the possibility of retaliatory tariffs from affected countries. If you've been watching the market closely, you know that a single tweet can trigger massive moves within seconds—I don’t expect this to change anytime soon.

All major indices saw extreme volatility but ultimately went nowhere due to trade tensions and mixed economic data. A weaker-than-expected jobs report added to the negative sentiment, with the economy adding 143,000 jobs in January—below the estimated 168,000—though the unemployment rate still dropped to 4.0%. Notably, the previous month's jobs number was revised significantly higher, a welcome shift after a trend of downward revisions in recent months.

Looking ahead to next week, we definitely need to stay sharp. The release of January's CPI will provide insights into inflation trends, while retail sales data will offer clues about consumer spending. Additionally, Federal Reserve Chair Jerome Powell’s congressional testimony is expected to shed light on interest rates and the broader economic outlook. He will be speaking before the Senate and the House on separate days, so make sure your notifications are on — You never know when a key news event will suddenly land in your lap. As always, stick to your trading plan and respect your risk.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, February 10th

Morning: McDonald's

Tuesday, February 11th

Morning: Coca Cola & Shopify

Evening: Lyft, SuperMicro & Upstart

Wednesday, February 12th

Morning: CVS

Evening: Reddit & Robinhood

Thursday, February 13th

Morning: Crocs, John Deere & Sony

Evening: Airbnb, Coinbase, Draft Kings & Roku

Friday, February 14th

Morning: Moderna

Market Events

Monday, February 10th

Tuesday, February 11th

08:50 AM ET Cleveland Fed President Hammack Speaks

10:00 AM ET Fed Chair Powell Testifies To The Senate

03:30 PM ET New York Fed President Williams Speaks

03:30 PM ET Fed Governor Bowman Speaks

Wednesday, February 12th

08:30 AM ET CPI MoM & YoY (Jan)

10:00 AM ET Fed Chair Powell Testifies To The House

01:00 PM ET 10-Year Note Auction

02:00 PM ET Atlanta Fed President Bostic Speaks

05:05 PM ET Fed Governor Waller Speaks

Thursday, February 13th

08:30 AM ET PPI MoM & YoY (Jan)

08:30 AM ET Initial Jobless Claims

01:00 PM ET 30-Year Bond Auction

Friday, February 14th

08:30 AM ET Retail Sales MoM & YoY (Jan)

Seasonality Update

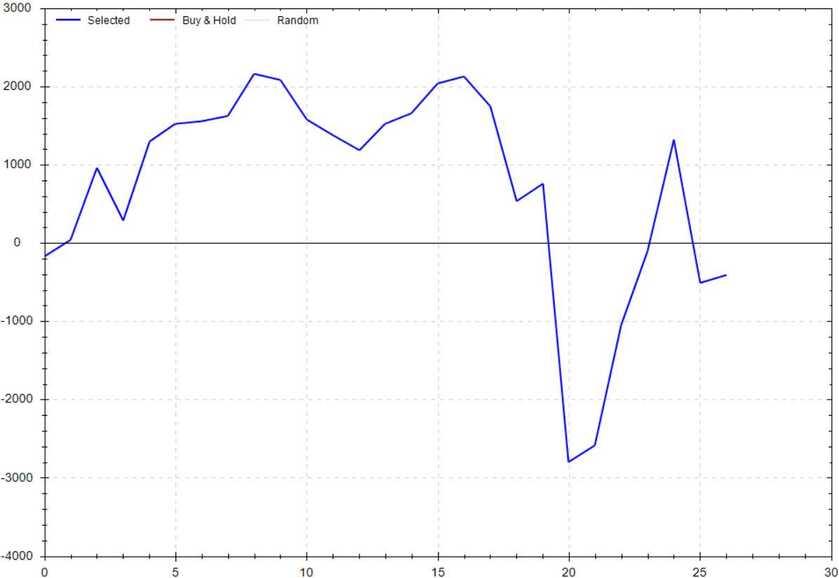

S&P 500 Seasonal Bias (Monday, February 10th)

- Bull Win Percentage: 63%

- Profit Factor: 0.95

- Bias: Neutral

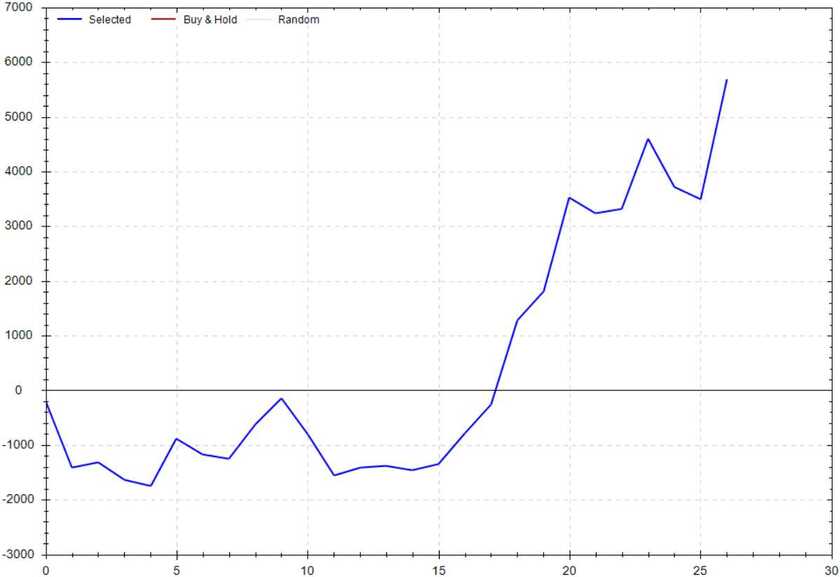

Equity Curve -->

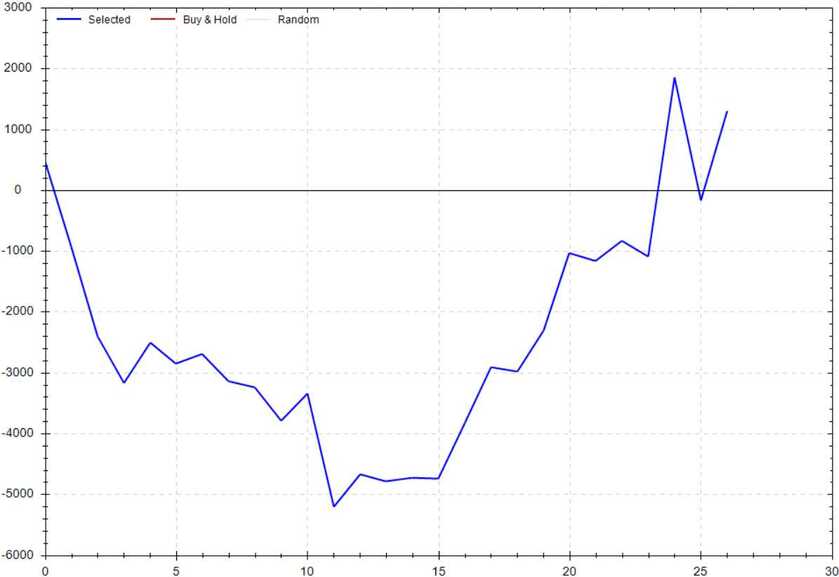

S&P 500 Seasonal Bias (Tuesday, February 11th)

- Bull Win Percentage: 48%

- Profit Factor: 1.14

- Bias: Leaning Bullish

Equity Curve -->

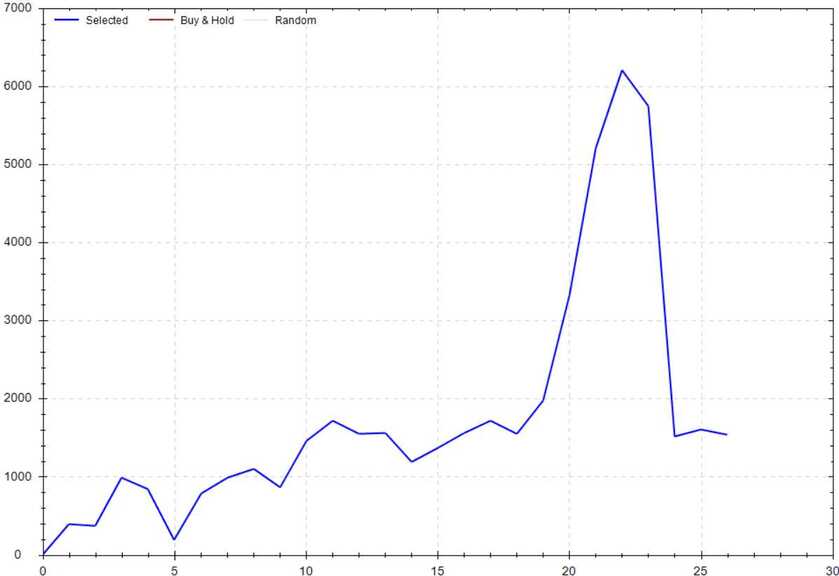

S&P 500 Seasonal Bias (Wednesday, February 12th)

- Bull Win Percentage: 59%

- Profit Factor: 1.24

- Bias: Leaning Bullish

Equity Curve -->

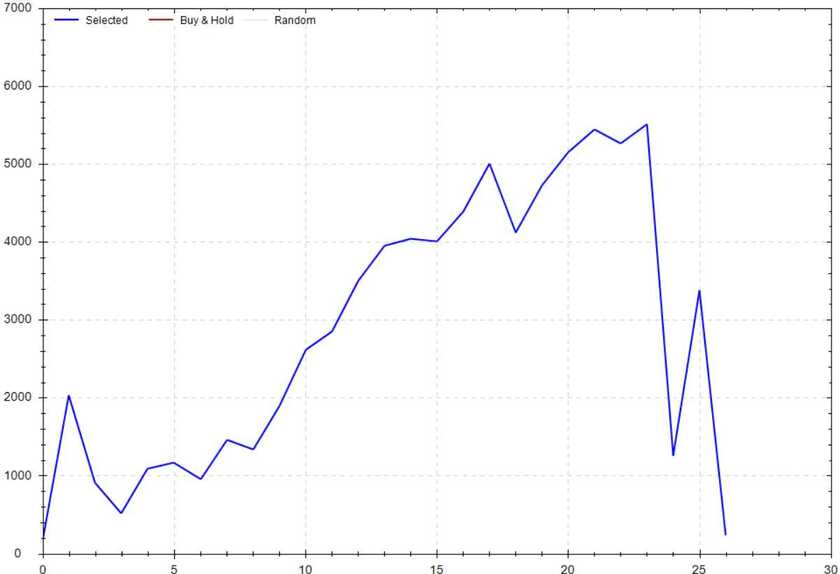

S&P 500 Seasonal Bias (Thursday, February 13th)

- Bull Win Percentage: 67%

- Profit Factor: 1.02

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, February 14th)

- Bull Win Percentage: 56%

- Profit Factor: 2.12

- Bias: Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 6 for 8 times (12 for 16 total units) this past week.

Signal Accuracy: ~75%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 6 Trades

February Record: 12/16 Units

Monday, February 3rd

SPY Call Credit Spread (2x Multiple @ $595/ $596) 🔴

QQQ Call Credit Spread (2x Multiple @ $516 / $517) 🔴

Tuesday, February 4th

SPY Put Credit Spread (2x Multiple @ $597/ $596) 🟢

QQQ Put Credit Spread (2x Multiple @ $518 / $517) 🟢

Wednesday, February 5th

SPY Put Credit Spread (2x Multiple @ $598/ $597) 🟢

QQQ Put Credit Spread (2x Multiple @ $520 / $519) 🟢

Thursday, February 6th

SPY Put Credit Spread (2x Multiple @ $604/ $603) 🟢

QQQ Put Credit Spread (2x Multiple @ $526 / $525) 🟢

Friday, February 7th

No signal produced

Total Number of Stream Rants

88,404 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!