¡Ay, Caramba!

Hey,

Key Weekly Performance Stats:

- S&P 500: +1.49%

- Nasdaq 100: +2.91%

- Russel 2000: -0.01%

- Bitcoin: +1.01%

Last week, the political landscape was marked by significant events. A Manhattan Federal Court judge extended a restraining order preventing the Department of Government Efficiency (DOGE) from accessing U.S. Treasury Department data, citing concerns over privacy violations and potential data breaches. Simultaneously, the Justice Department faced internal turmoil after acting Deputy Attorney-General Emil Bove ordered the dismissal of corruption charges against New York City Mayor Eric Adams, leading to multiple resignations within the Manhattan prosecutor's office. On the international front, Vice President JD Vance held a "fruitful" meeting with Ukrainian President Volodymyr Zelensky during the Munich Security Conference, aiming to advance peace efforts in Ukraine.

Additionally, the stocks experienced notable gains. This upward trend was influenced by a mix of corporate earnings reports and economic data. However, economic indicators presented a mixed picture; the CPI data indicated higher-than-expected inflation, raising concerns among investors, and retail sales in January fell by 0.9%, suggesting potential softness in consumer spending.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, February 17th

None

Tuesday, February 18th

Evening: Devon & OXY

Wednesday, February 19th

Morning: Etsy

Evening: Carvana

Thursday, February 20th

Morning: Alibaba, Unity, Walmart & Wayfair

Evening: Block, Rivian & Texas Roadhouse

Friday, February 21st

None

Market Events

Monday, February 17th

ALL DAY Market Closed (President's Day)

09:30 AM ET Philadelphia Fed President Harker Speaks

10:20 AM ET Fed Governor Bowman Speaks

06:00 PM ET Fed Governor Waller Speaks

Tuesday, February 18th

10:20 AM ET San Francisco Fed President Daly Speaks

Wednesday, February 19th

02:00 PM ET FOMC January Meeting Minutes

Thursday, February 20th

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Manufacturing Index (Feb)

10:00 AM ET US Leading Economic Indicators (Jan)

Friday, February 21st

08:30 AM ET S&P US PMI Services & Manufacturing (Feb)

10:00 AM ET Consumer Sentiment (Feb)

10:00 AM ET Existing Home Sales (Jan)

Seasonality Update

S&P 500 Seasonal Bias (Monday, February 17th)

- MARKET CLOSED (President's Day)

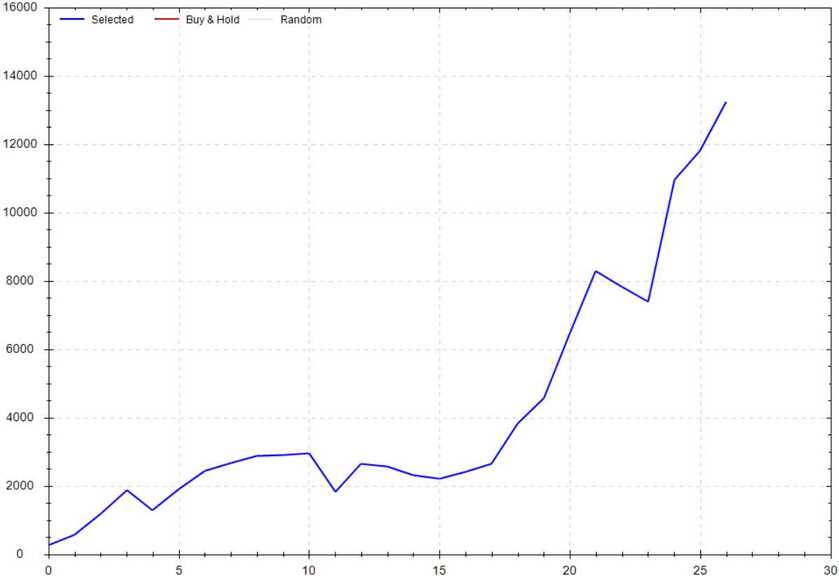

S&P 500 Seasonal Bias (Tuesday, February 18th)

- Bull Win Percentage: 74%

- Profit Factor: 5.33

- Bias: Bullish

Equity Curve -->

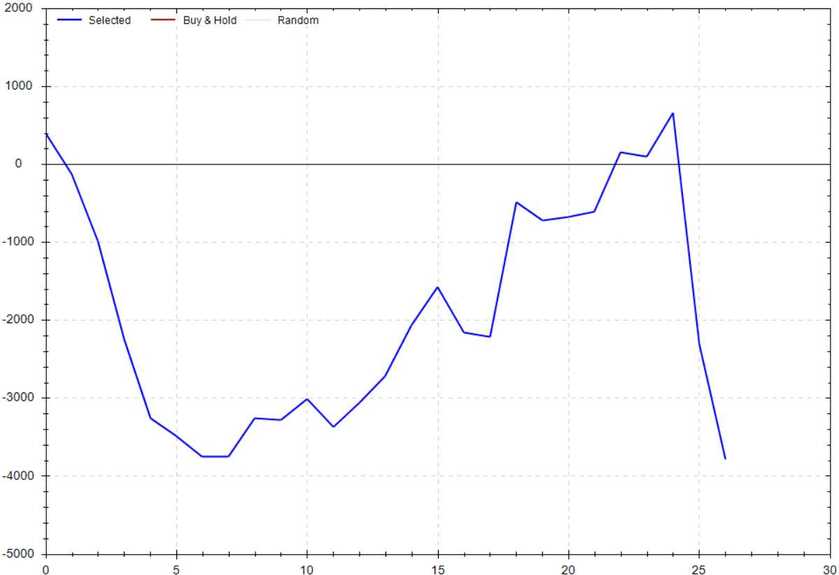

S&P 500 Seasonal Bias (Wednesday, February 19th)

- Bull Win Percentage: 44%

- Profit Factor: 0.62

- Bias: Leaning Bearish

Equity Curve -->

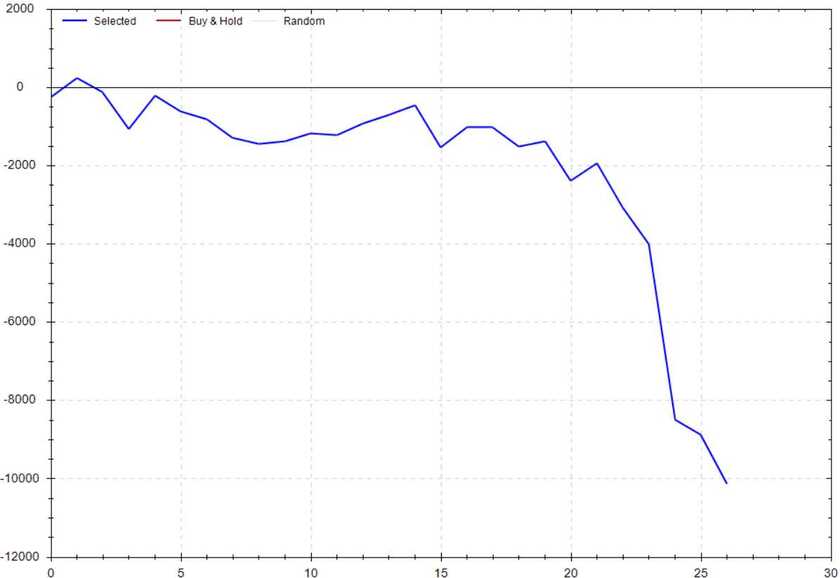

S&P 500 Seasonal Bias (Thursday, February 20th)

- Bull Win Percentage: 37%

- Profit Factor: 0.26

- Bias: Bearish

Equity Curve -->

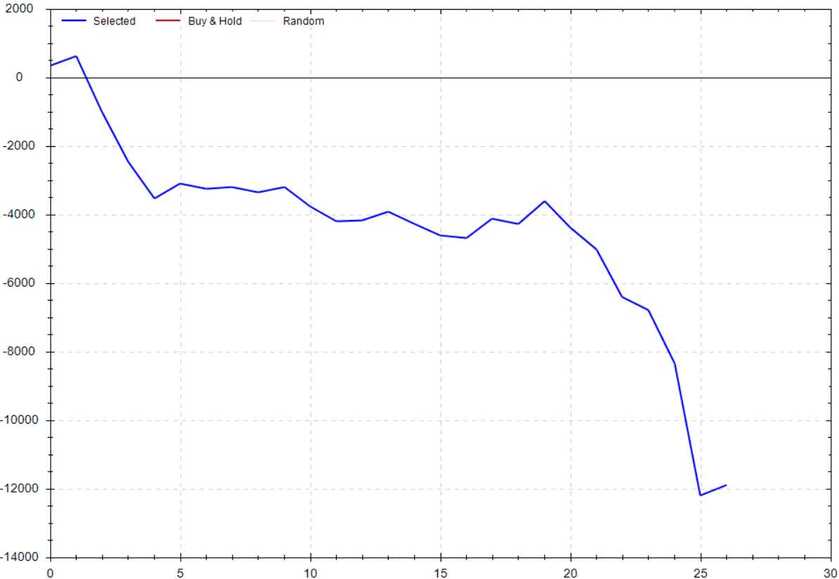

S&P 500 Seasonal Bias (Friday, February 21st)

- Bull Win Percentage: 37%

- Profit Factor: 0.21

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 9 for 10 times (19 for 20 total units) this past week.

Signal Accuracy: ~90%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 5 Trades

February Record: 31/36 Units

Monday, February 10th

SPY Call Credit Spread (2x Multiple @ $607/$608) 🟢

QQQ Call Credit Spread (2x Multiple @ $532/$533) 🟢

Tuesday, February 11th

SPY Call Credit Spread (2x Multiple @ $606/$607) 🟢

QQQ Call Credit Spread (2x Multiple @ $531/$532) 🟢

Wednesday, February 12th

SPY Call Credit Spread (1x Multiple @ $604/$605) 🟢

QQQ Call Credit Spread (1x Multiple @ $528/$529) 🔴

Thursday, February 13th

SPY Put Credit Spread (2x Multiple @ $603/$602) 🟢

QQQ Put Credit Spread (2x Multiple @ $528/$527) 🟢

Friday, February 14th

SPY Put Credit Spread (3x Multiple @ $609/ $608) 🟢

QQQ Put Credit Spread (3x Multiple @ $534/$527) 🟢

Sangria Consumed

All of it *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!