The Bulls Are Back In Town!

Hey,

Key Weekly Performance Stats:

- S&P 500: +5.70%

- Nasdaq 100: +7.49%

- Russel 2000: +1.82%

- Bitcoin: -0.57%

Last week, all markets experienced extreme volatility driven by President Donald Trump’s aggressive tariff policies. The week began with a sharp sell-off as markets reacted to escalating trade tensions, particularly after China imposed a 34% retaliatory tariff. Stocks were on track to have their worst week since March 2020. Midweek, a historic rally occurred when Trump announced a 90-day pause on most tariffs (except for China, which faced a 145% rate). However, renewed fears of a trade war with China’s counter-tariff of 125% and ongoing uncertainty caused stocks to slide again by week’s end, though Friday saw a partial recovery. High bond yields, with the 10-year Treasury nearing 4.6%, and an elevated VIX reflect investors current hesitation.

Economic data releases during the week added context but were overshadowed by trade policy chaos. The CPI & PPI reports, released on April 10 and 11, signaled cooling inflationary pressures. Fed Chair Jerome Powell noted that tariffs were “larger than expected,” likely leading to higher inflation and slower growth, yet he maintained a wait-and-see stance on rate changes. Strong March jobs data did little to ease recession fears, as consumer sentiment plummeted, with the University of Michigan’s index dropping to the lowest since June 2022, and inflation expectations surging to. Additionally, corporate earnings from banks like JPMorgan Chase and Morgan Stanley showed resilience but highlighted concerns about economic slowdown.

Looking ahead, you should monitor developments in U.S.-China trade negotiations, as any escalation or de-escalation could trigger sharp market swings. Key economic releases include March’s retail sales and industrial production data, which will offer insights into consumer and manufacturing health amid tariff disruptions. The Federal Reserve’s next moves remain critical, with markets looking for signals on whether it will adjust rates to counter tariff-induced inflation or hold steady. Prepare for large swings, respect your risk, and stick to your trading plan. Godspeed.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

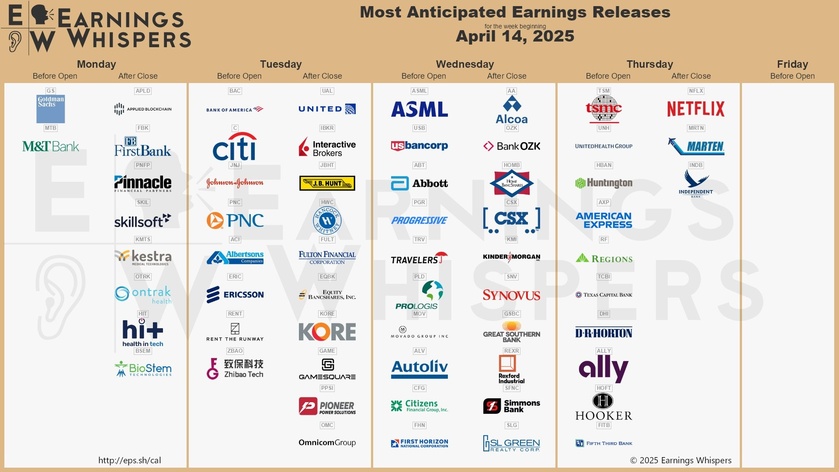

Earnings

Monday, April 14th

Morning: Goldman Sachs

Tuesday, April 15th

Morning: Bank of America, Citi, J&J & PNC

Evening: Interactive Brokers & United

Wednesday, April 16th

Morning: ASML

Thursday, April 17th

Morning: American Express, TSMC & UnitedHealth Group

Evening: Netflix

Friday, April 18th

None

Market Events

Monday, April 14th

06:00 PM ET Philadelphia Fed President Harker Speaks

07:40 PM ET Atlanta Fed President Bostic Speaks

Tuesday, April 15th

08:30 AM ET Empire State Manufacturing Survey (Apr)

Wednesday, April 16th

08:30 AM ET Retail Sales MoM &YoY (Mar)

12:00 PM ET Cleveland Fed President Hammack Speaks

01:15 PM ET Fed Chair Powell Speaks

Thursday, April 17th

08:30 AM ET Philadelphia Fed Manufacturing Survey (Apr)

08:30 AM ET Initial Jobless Claims

Friday, April 18th

ALL DAY Market Closed (Good Friday)

Seasonality Update

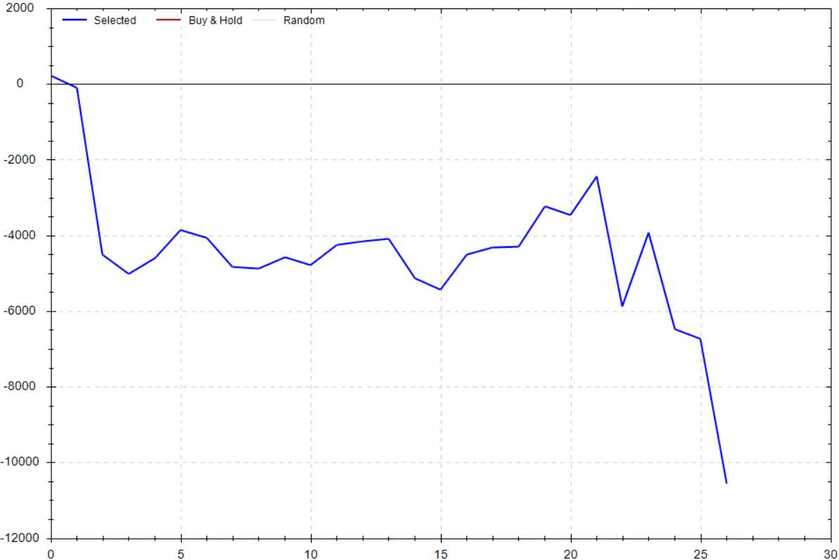

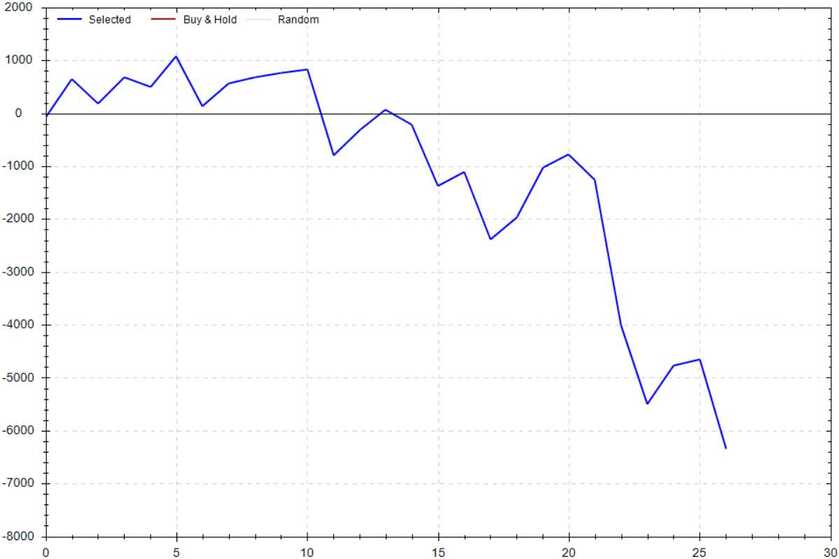

S&P 500 Seasonal Bias (Monday, April 14th)

- Bull Win Percentage: 48%

- Profit Factor: 0.42

- Bias: Bearish

Equity Curve -->

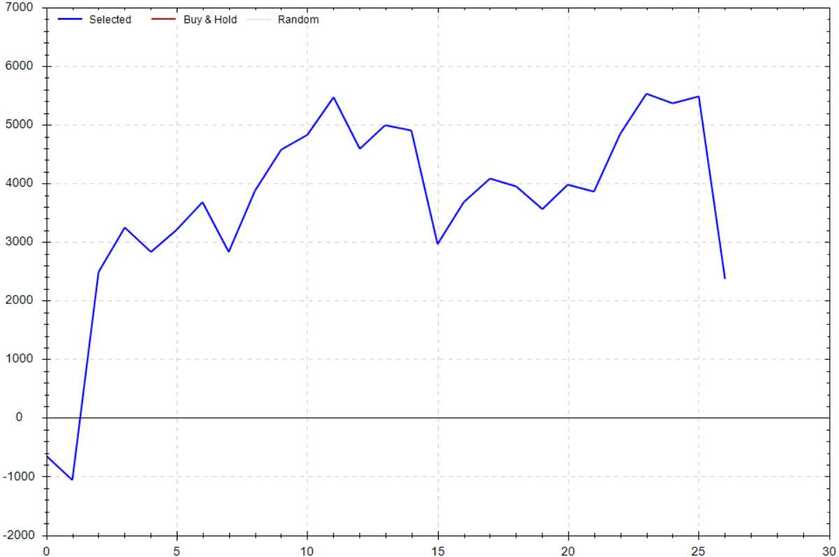

S&P 500 Seasonal Bias (Tuesday, April 15th)

- Bull Win Percentage: 56%

- Profit Factor: 1.26

- Bias: Neutral

Equity Curve -->

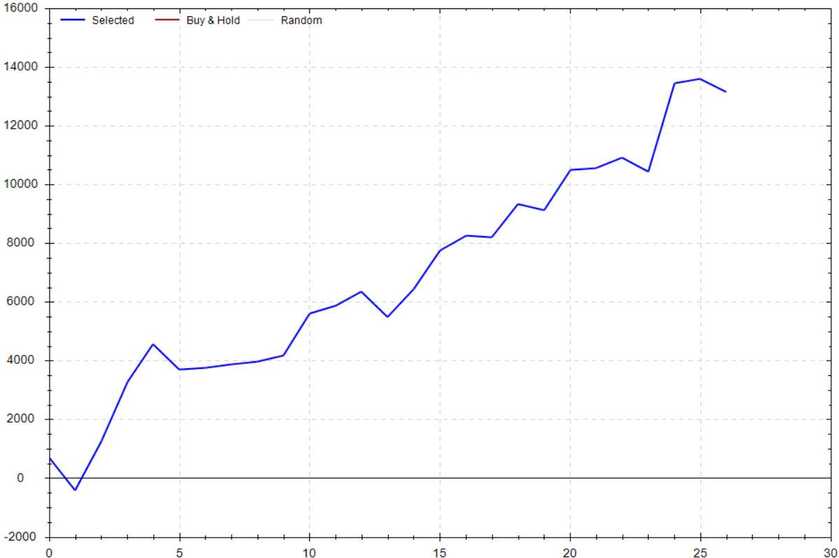

S&P 500 Seasonal Bias (Wednesday, April 16th)

- Bull Win Percentage: 74%

- Profit Factor: 4.29

- Bias: Very Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, April 17th)

- Bull Win Percentage: 56%

- Profit Factor: 0.49

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, April 18th)

- Market Closed All Day (Good Friday)

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 0 for 0 times (0 for 0 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 16 Trades

April Record: 6/6 Units

Monday, April 7th

No Signal Produced

Tuesday, April 8th

No Signal Produced

Wednesday, April 9th

No Signal Produced

Thursday, April 10th

No Signal Produced

Friday, April 11th

No Signal Produced

Times I Wanted To Quit Trading

69,420 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!