The Bulls Are Back!

Hey,

Key Weekly Performance Stats:

- S&P 500: +4.59%

- Nasdaq 100: +6.43%

- Russel 2000: +3.77%

- Bitcoin: +12.36%

Last week, the market staged a major relief rally, fueled by signs the administration was softening its stance on trade. The S&P 500 closed at 5,525, up 4.6% for the week, while the Dow added 2.5% to finish at 40,114, and the Nasdaq surged 6.7% to 17,383. Hopes for reduced tariffs on Chinese imports and progress in trade talks with South Korea and India helped drive the bounce, with the S&P 500 now up 10% from its April 9 low. Still, markets remain about 10% below their February highs, a reminder that volatility and uncertainty are far from over.

On the economic front, signs of slowing growth are starting to appear. Research suggests GDP could ease to 1.5%-1.7% if a broad 10% tariff on imports were implemented. Core inflation is expected to peak between 3.5% and 4% before pulling back as demand cools, amid worries about higher prices and weaker consumer spending. Trade negotiations gained some traction, with the U.S. weighing cuts to Chinese tariffs and China considering exemptions on some U.S. goods. Talks with South Korea were described as "very successful," but nothing is locked in yet. Meanwhile, the U.S. dollar slipped to a three-year low, and gold prices hit a new record above $3,440 per ounce, signaling rising investor caution.

Looking ahead, all eyes will be on upcoming economic data, especially PCE inflation and first-quarter GDP, for clues on inflation and growth trends. Progress—or setbacks—in U.S.-China trade talks will continue to move markets. The Fed’s next moves will also be key, with rate cuts of two to three times in 2025 possibly kicking off by midyear. Corporate earnings, particularly from tech giants, could reveal how tariffs are shaping forward guidance. As always, stick to your trading plan and respect your risk. Godspeed.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, April 28th

Morning: Domino's Pizza & MGM

Evening: Waste Management

Tuesday, April 29th

Morning: Coca Cola, JetBlue, PayPal, Pfizer, Sofi, Spotify & UPS

Evening: Snap, Starbucks & Visa

Wednesday, April 30th

Morning: Caterpillar

Evening: Microsoft, Meta & Robinhood, Qualcomm

Thursday, May 1st

Morning: CVS, Lily, Mastercard, McDonald's & Roblox

Evening: Airbnb, Apple, Amazon, Reddit & Riot

Friday, May 2nd

Morning: Chevron, Exxon Mobile, Fubo TV & Wendy's

Market Events

Monday, April 28th

None

Tuesday, April 29th

10:00 AM ET Consumer Confidence (Apr)

10:00 AM ET JOLTs Job Openings (Mar)

Wednesday, April 30th

08:15 AM ET ADP Nonfarm Employment Change (Apr)

08:30 AM ET GDP QoQ (Q1)

08:30 AM ET PCE YoY & MoM (Mar)

08:30 AM ET Personal Incoming & Spending (Mar)

09:45 AM ET Chicago PMI (Apr)

10:00 AM ET Pending Home Sales (Mar)

Thursday, May 1st

08:30 AM ET Initial Jobless Claims

10:00 AM ET S&P Global Manufacturing PMI (Apr)

10:00 AM ET ISM Manufacturing PMI & Prices (Apr)

Friday, May 2nd

05:00 AM ET Eurozone CPI MoM & YoY (Apr)

08:30 AM ET Unemployment Rate (Apr)

08:30 AM ET Avg. Hourly Earnings MoM & YoY (Apr)

Seasonality Update

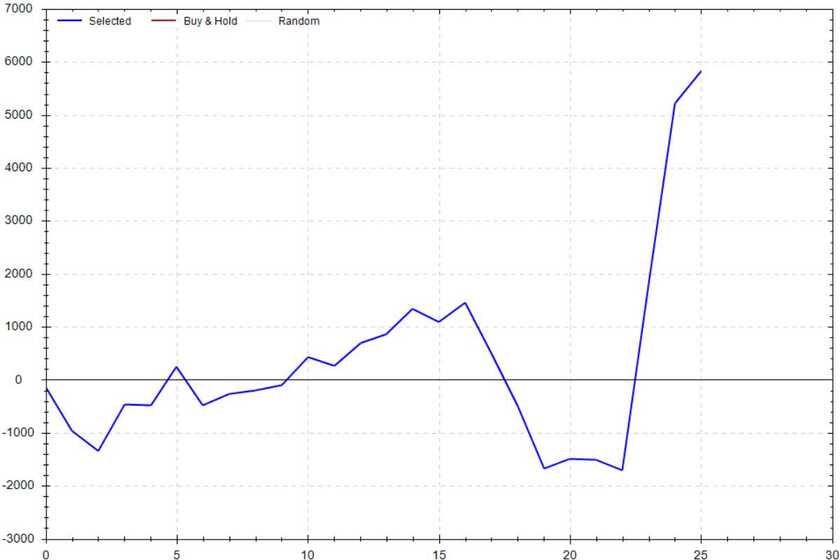

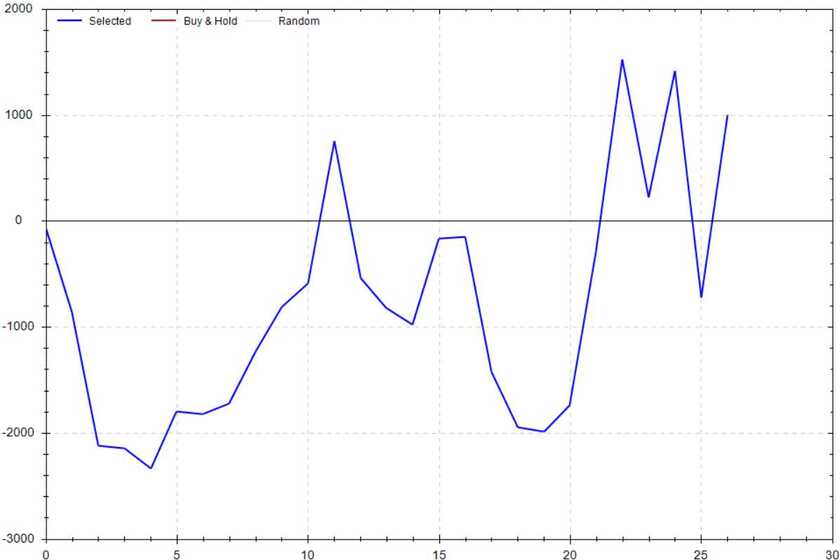

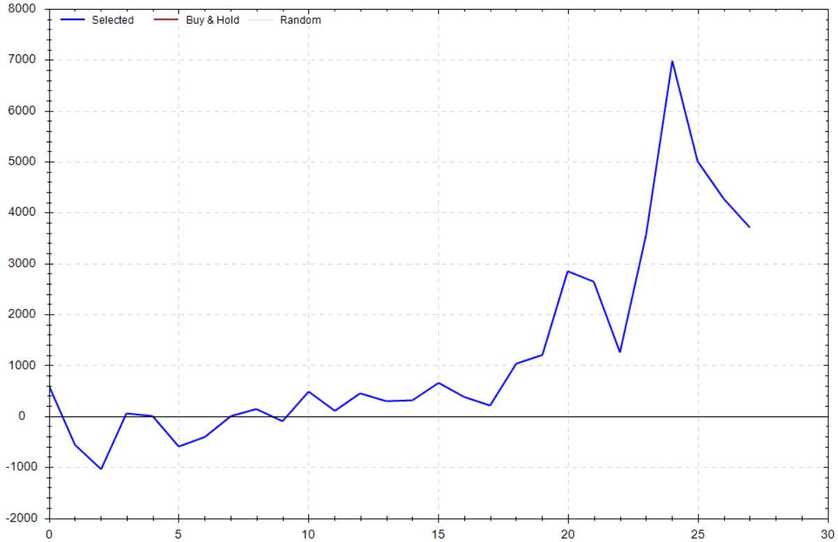

S&P 500 Seasonal Bias (Monday, April 28th)

- Bull Win Percentage: 54%

- Profit Factor: 2.00

- Bias: Leaning Bullish

Equity Curve -->

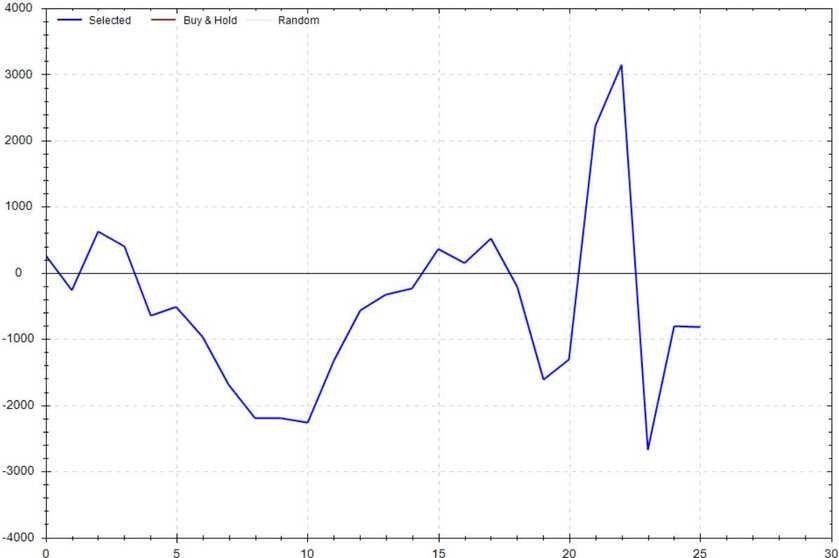

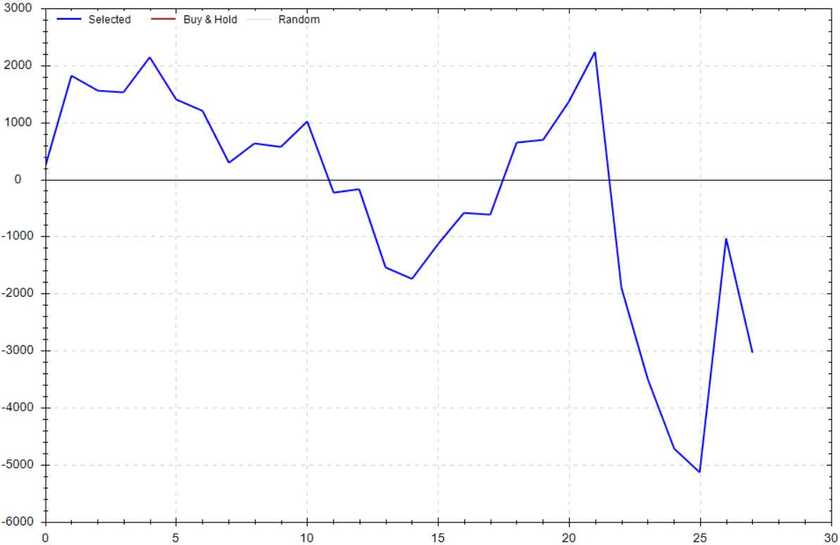

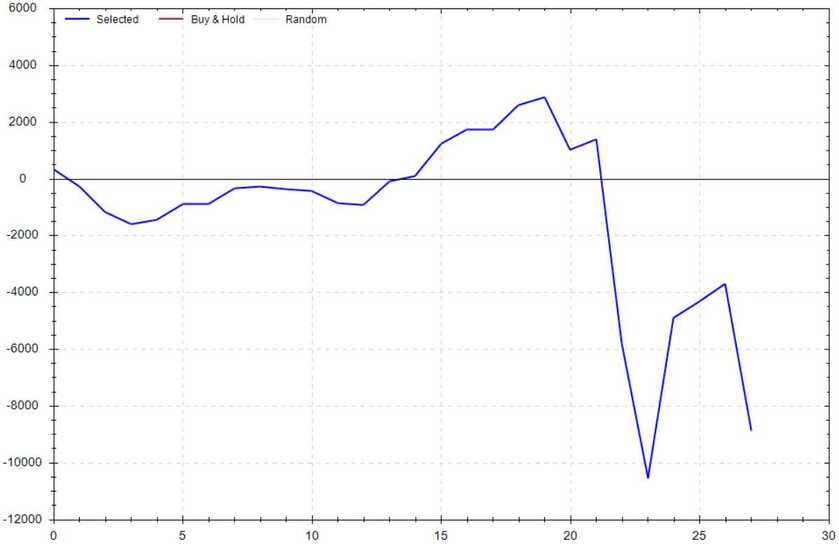

S&P 500 Seasonal Bias (Tuesday, April 29th)

- Bull Win Percentage: 50%

- Profit Factor: 0.93

- Bias: Neutral

Equity Curve -->

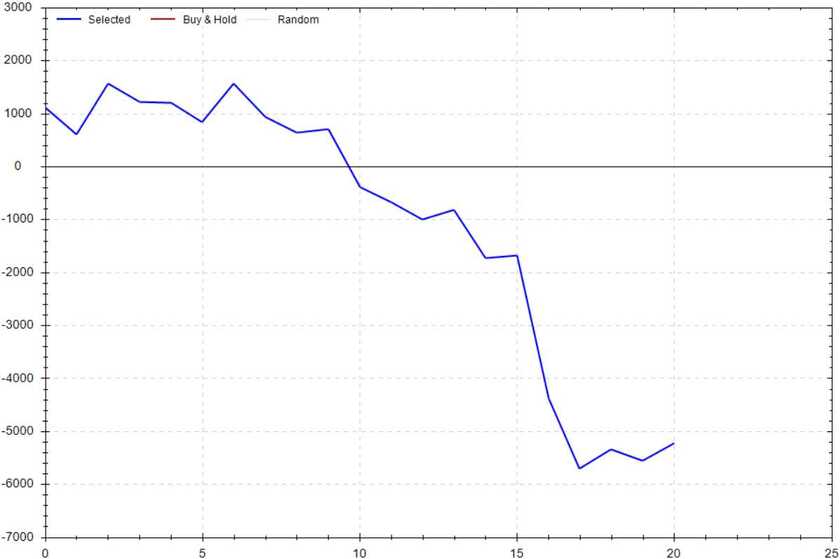

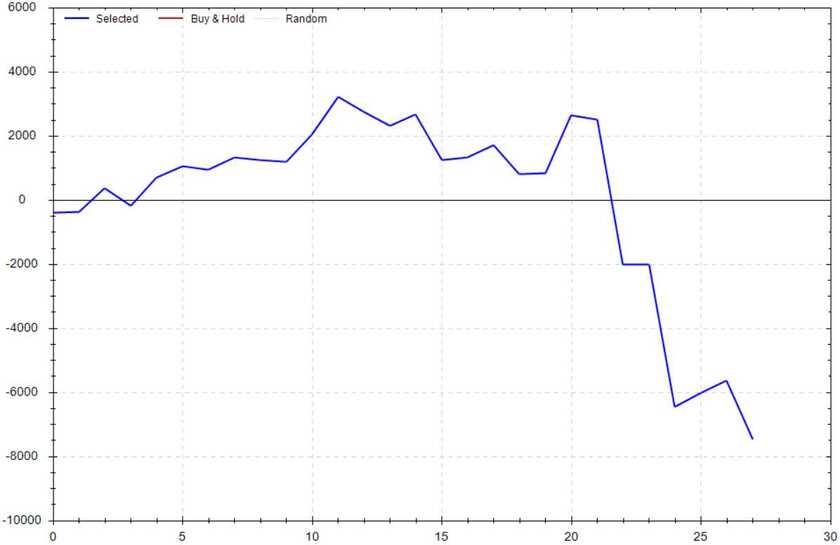

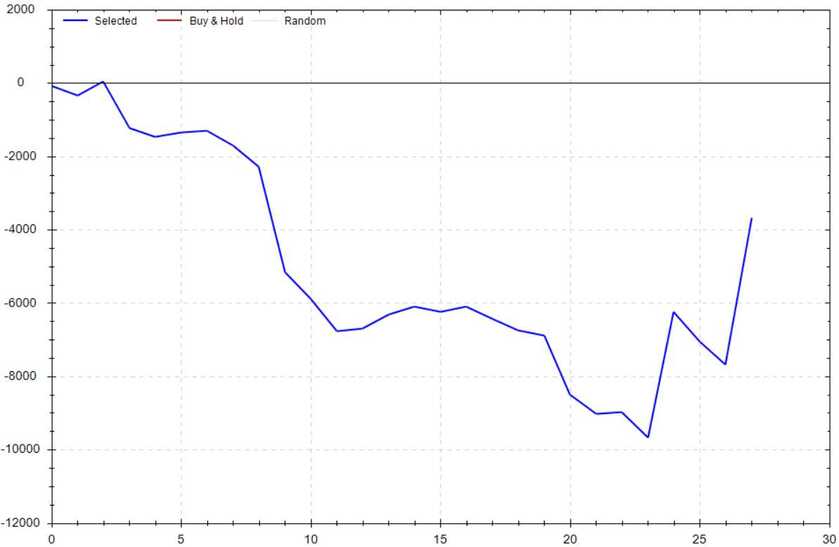

S&P 500 Seasonal Bias (Wednesday, April 30th)

- Bull Win Percentage: 38%

- Profit Factor: 0.42

- Bias: Bearish

Equity Curve -->

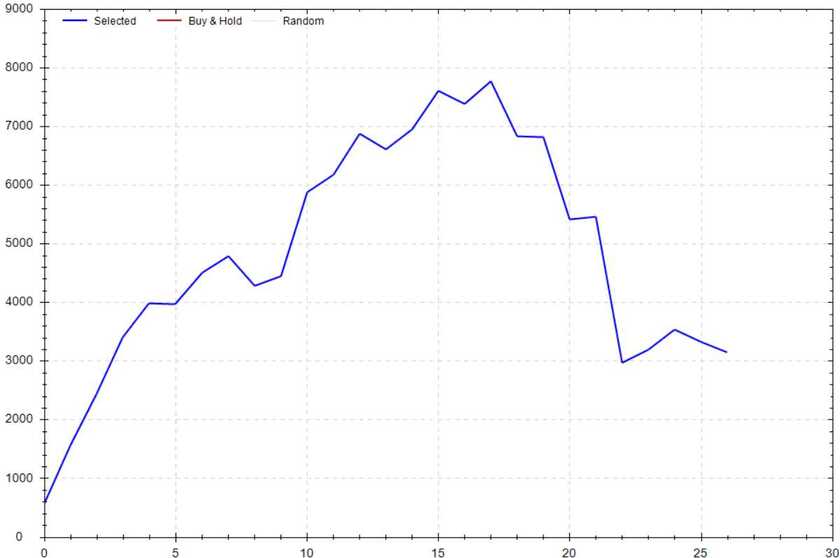

S&P 500 Seasonal Bias (Thursday, May 1st)

- Bull Win Percentage: 63%

- Profit Factor: 1.50

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, May 2nd)

- Bull Win Percentage: 48%

- Profit Factor: 1.11

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 10 times (22 for 28 total units) this past week.

Signal Accuracy: ~80%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 4 Trades

April Record: 42/48 Units

Monday, April 22nd

SPY Call Credit Spread (3x Multiple @ $522 / $523) 🟢

QQQ Call Credit Spread (3x Multiple @ $440 / $441) 🟢

Tuesday, April 22nd

SPY Put Credit Spread (2x Multiple @ $519 / $518) 🟢

QQQ Put Credit Spread (2x Multiple @ $437 / $436) 🟢

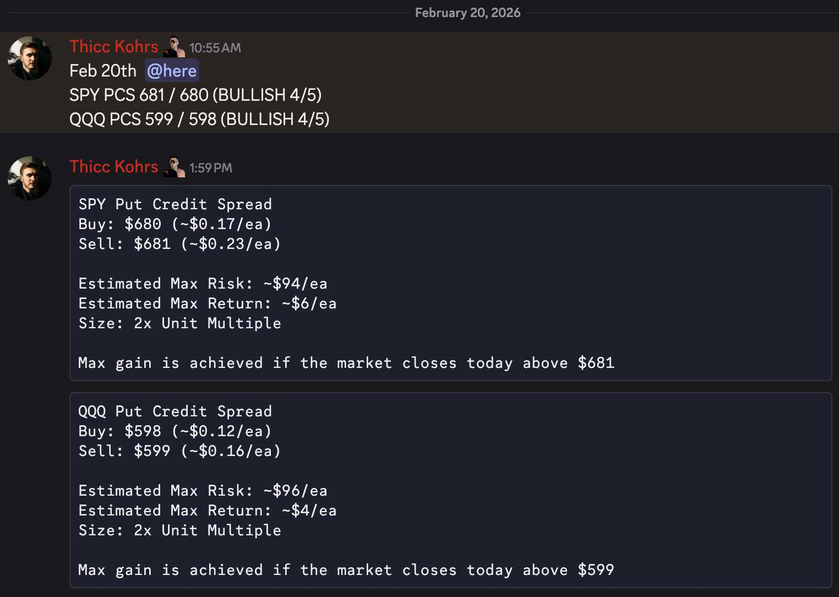

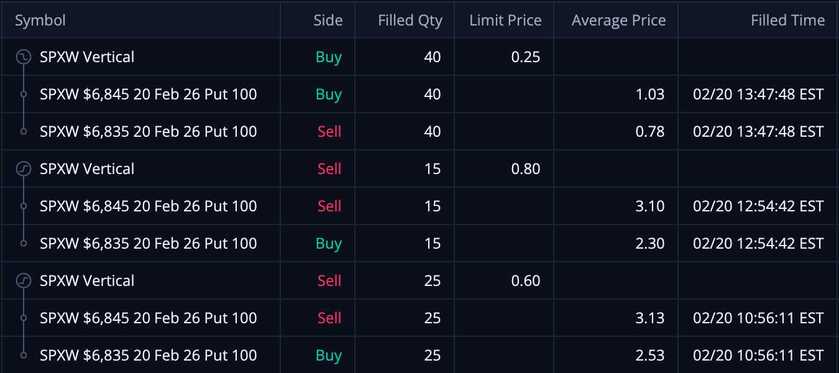

Wednesday, April 23rd

SPY Put Credit Spread (3x Multiple @ $538 / $537) 🔴

QQQ Put Credit Spread (3x Multiple @ $456 / $455) 🔴

Thursday, April 24th

SPY Put Credit Spread (3x Multiple @ $535 / $534) 🟢

QQQ Put Credit Spread (3x Multiple @ $455 / $454) 🟢

Friday, April 25th

SPY Put Credit Spread (3x Multiple @ $543 / $542) 🟢

QQQ Put Credit Spread (3x Multiple @ $465 / $464) 🟢

Count of Times I Wanted To Quit Trading

519 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

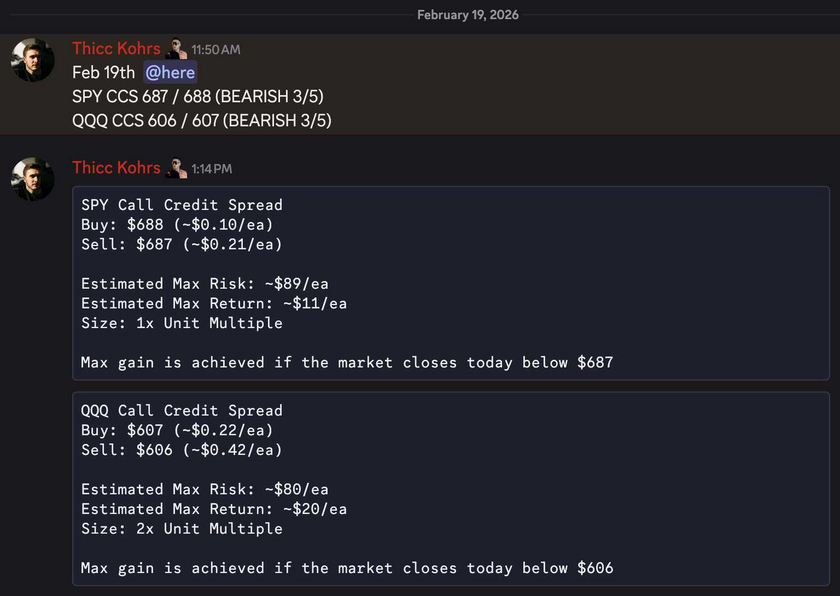

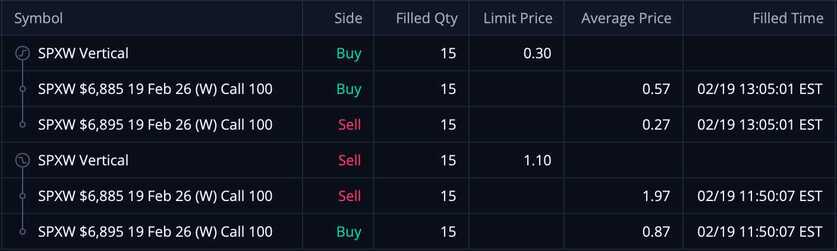

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!