Explosive Gains

Hey,

Key Weekly Performance Stats:

- S&P 500: +1.72%

- Nasdaq 100: +1.61%

- Russel 2000: +2.14%

- Bitcoin: +0.85%

Last week, the stock market exploded higher during the shortened trading week. Stocks surged, with the S&P 500 and Nasdaq hitting fresh record highs multiple times. The Dow wasn’t far behind either—climbing 276 points on Monday and keeping that momentum going. The fuel behind the rally? A wave of optimism around trade deals—especially after Canada scrapped its digital services tax, reopening the door for negotiations with the U.S.

The fireworks weren’t just in the sky this week. On July 3, the June jobs report dropped and brought some heat: the U.S. added 147,000 jobs (beating expectation), and the unemployment rate dipped to 4.1%. But it wasn’t all straightforward. The ADP report told a different story, showing a loss of 33,000 private-sector jobs. Government hiring, especially at the state and local level (up 80,000), helped balance the scales. Even with mixed signals, investors liked what they saw. The bull camp cheered the resilience.

Looking ahead, investors are likely to focus on the July 9 deadline for US tariffs, which could increase rates on imports if no trade deals are secured, potentially causing market volatility. The July Investment Manager Index, expected to provide insights into equity market expectations and sector preferences, will also be closely watched. Additionally, updates on ongoing trade negotiations, especially with Canada, and other economic data releases are anticipated to influence market direction. As always, stick to your trading plan and repest your risk. Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, July 7th

None Scheduled

Tuesday, July 8th

03:00 PM ET Consumer Credit

Wednesday, July 9th

01:00 PM ET 10-Year Note Auction

02:00 PM ET FOMC Meeting Minutes

Thursday, July 10th

08:30 AM ET Initial Jobless Claims

01:00 PM ET 30-Year Bond Auction

Friday, July 11th

None Scheduled

Seasonality Update

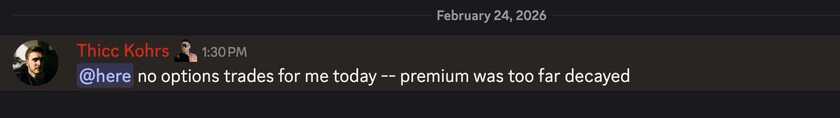

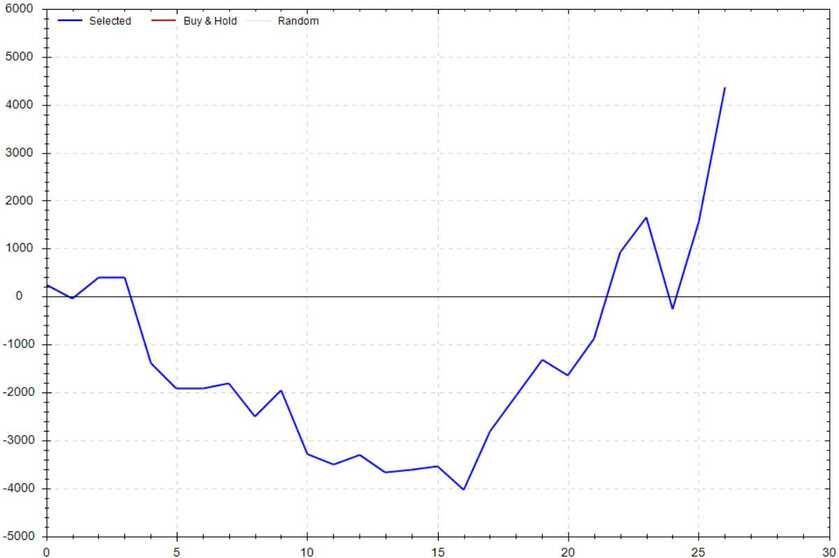

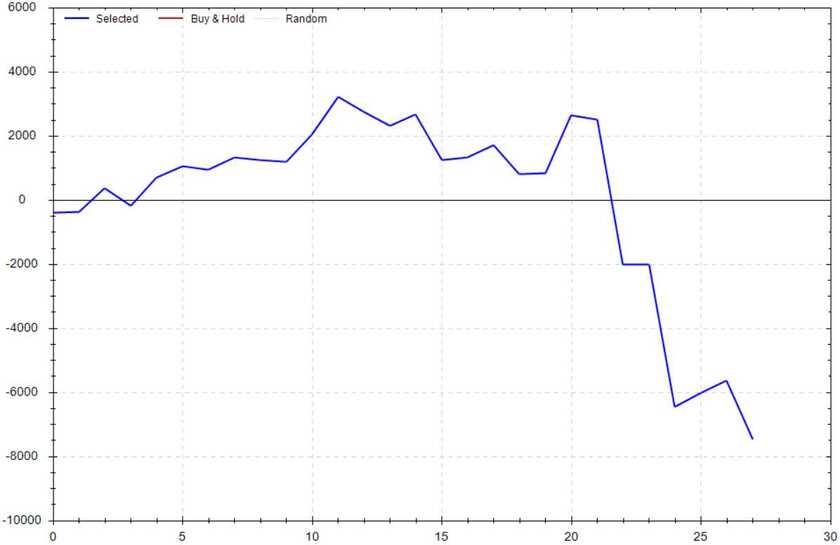

S&P 500 Seasonal Bias (Monday, July 7th)

- Bull Win Percentage: 59%

- Profit Factor: 2.55

- Bias: Bullish

Equity Curve -->

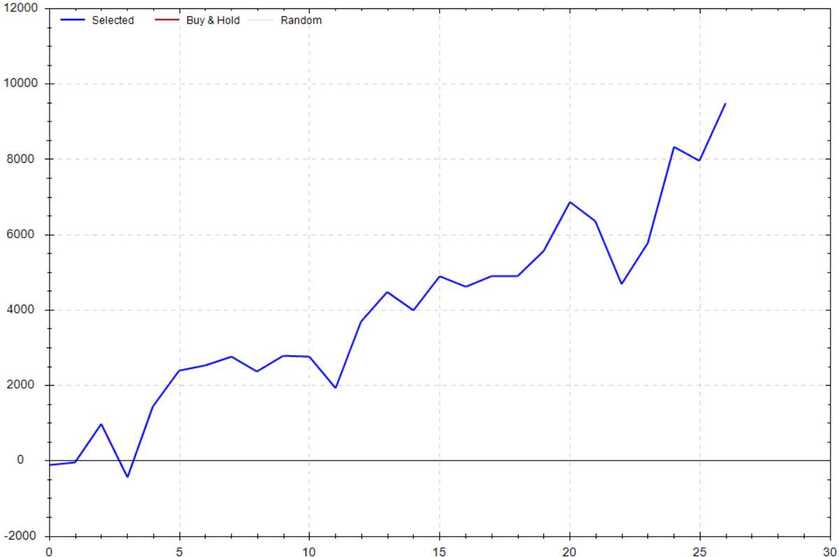

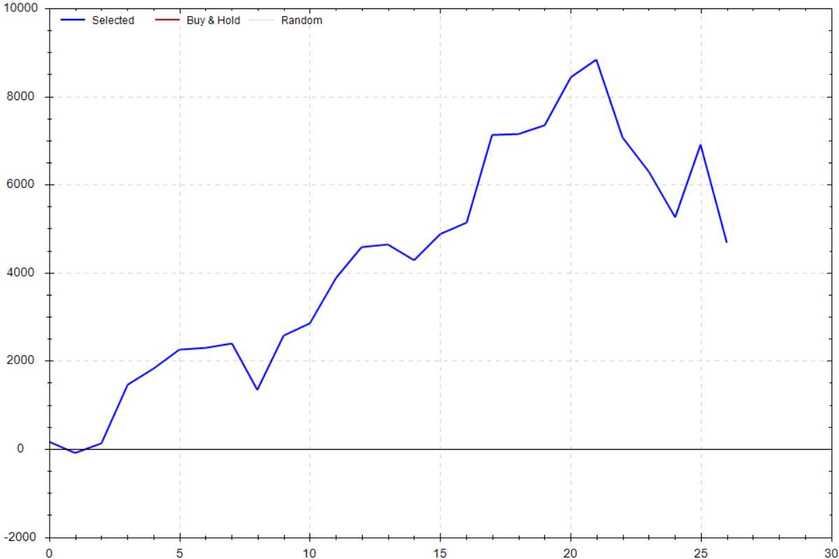

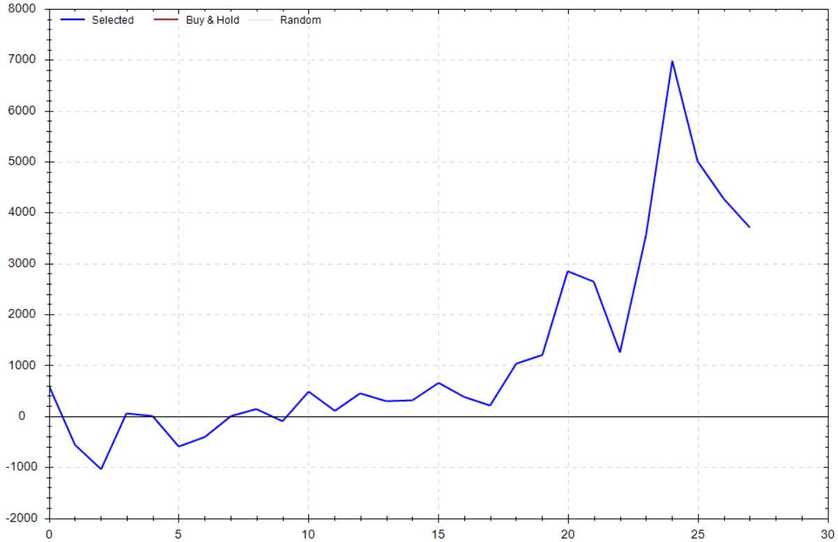

S&P 500 Seasonal Bias (Tuesday, July 8th)

- Bull Win Percentage: 59%

- Profit Factor: 1.15

- Bias: Neutral

Equity Curve -->

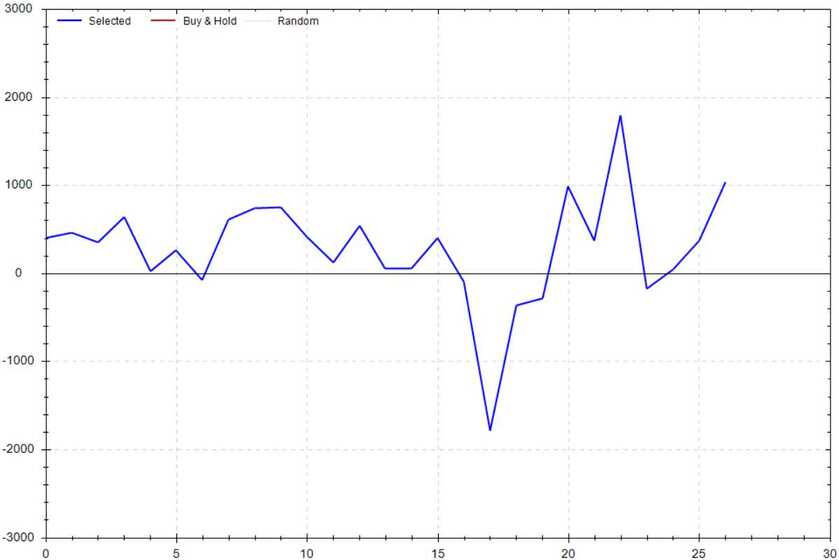

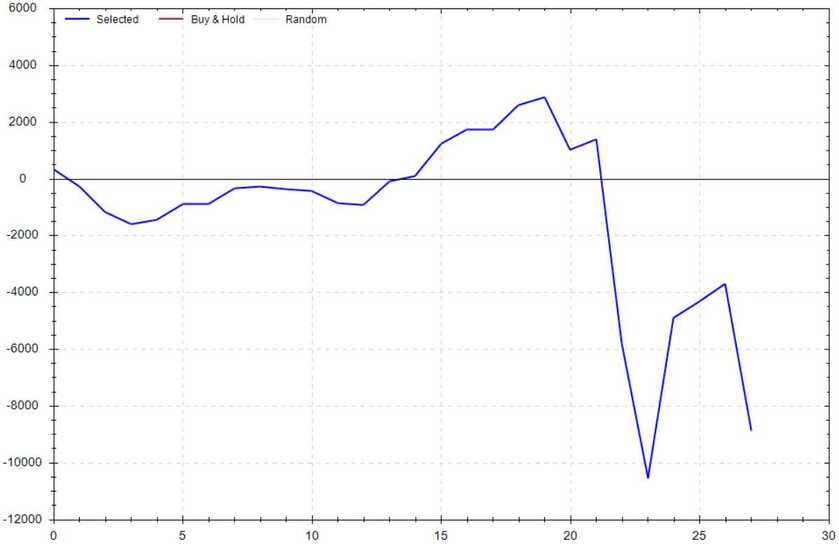

S&P 500 Seasonal Bias (Wednesday, July 9th)

- Bull Win Percentage: 67%

- Profit Factor: 1.02

- Bias: Neutral

Equity Curve -->

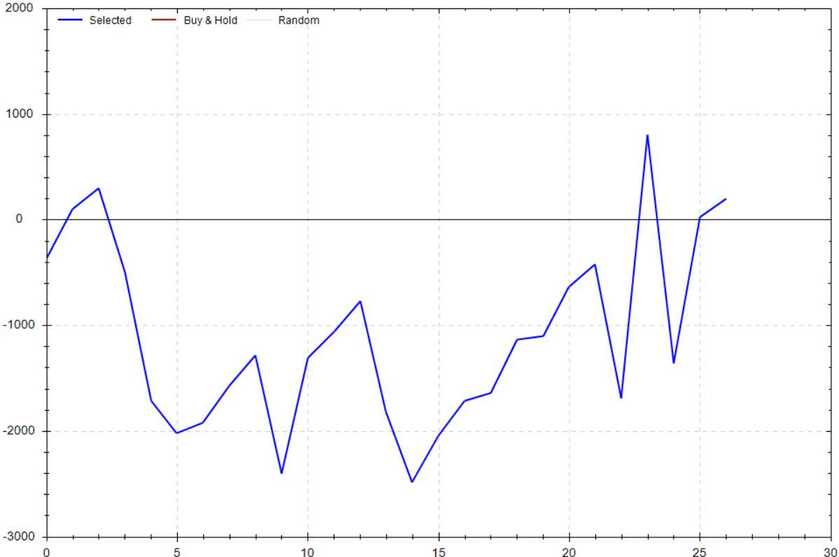

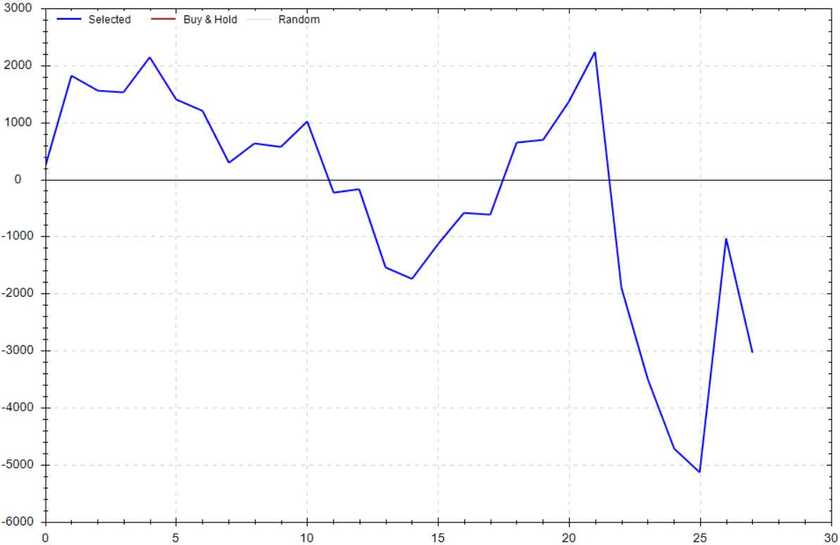

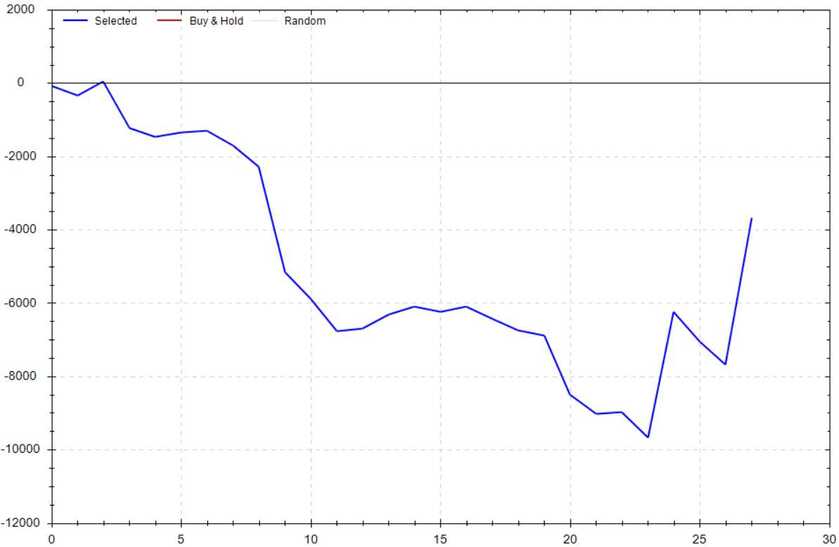

S&P 500 Seasonal Bias (Thursday, July 10th)

- Bull Win Percentage: 56%

- Profit Factor: 1.55

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, July 11th)

- Bull Win Percentage: 74%

- Profit Factor: 1.63

- Bias: Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

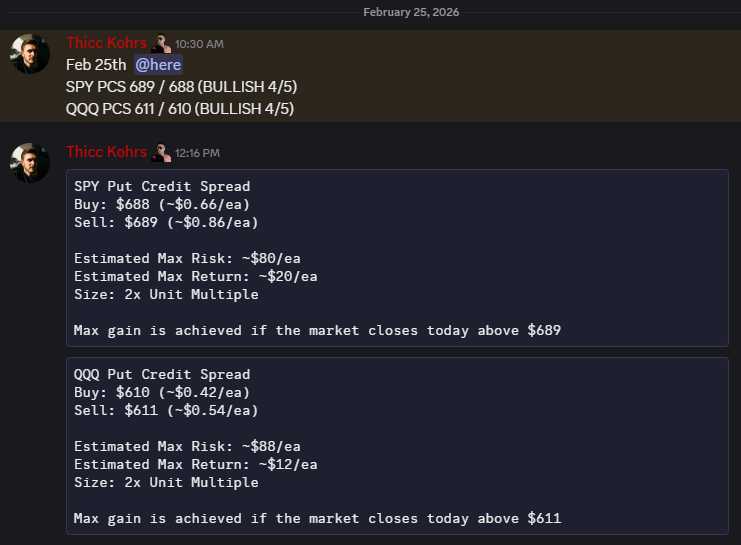

Options Strategy Update

The 0 DTE signal hit 5 for 6 times (9 for 10 total units) this past week.

Signal Accuracy: ~83%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 3 Trade

June Record: 52/60 Units

July Record: 7/8 Units

Monday, June 30th

SPY Put Credit Spread (1x Multiple @ $614 / $613) 🟢

QQQ Put Credit Spread (1x Multiple @ $547 / $546) 🟢

Tuesday, July 1st

SPY Put Credit Spread (1x Multiple @ $615 / $614) 🟢

QQQ Put Credit Spread (1x Multiple @ $548 / $547) 🔴

Wednesday, July 2nd

SPY Put Credit Spread (3x Multiple @ $616 / $615) 🟢

QQQ Put Credit Spread (3x Multiple @ $545 / $544) 🟢

Thursday, July 3rd

No Signal: Market Half Day (Independence Day)

Friday, July 4th

No Signal: Market Closed (Independence Day)

Hugo Spritzes Consumed

All of them *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

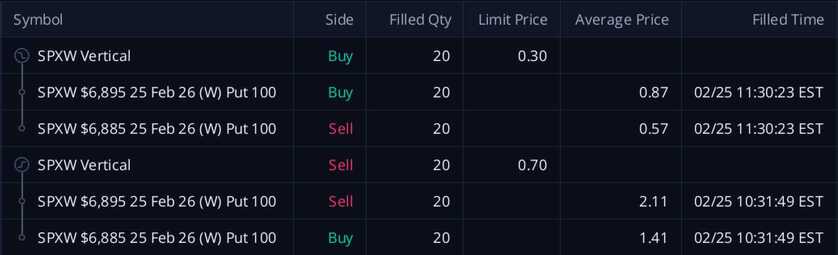

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!

These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!