More Record Highs: Loading...

Key Weekly Performance Stats:

- S&P 500: +0.37%

- Nasdaq 100: +1.01%

- Russel 2000: +1.00%

- Bitcoin: +2.11%

Last week, markets kicked off the month quietly with markets closed for Labor Day on Monday. Things quickly heated up as labor data rolled in, painting a picture of a cooling economy. Stocks navigated the choppiness well overall. The S&P 500 climbed about 0.3% for the week, touching a fresh record high of on Friday before easing back, while the Nasdaq jumped 1.0% thanks to tech resilience. It was a mixed bag, with early-week dips on soft job openings data giving way to a mid-week rally fueled by hopes for Fed easing.

Key economic reads leaned soft, spotlighting a labor market that's losing steam but not spiraling. Wednesday's ISM services PMI surprised to the upside at 52.0, signaling modest expansion in the sector. But Thursday's ADP report showed just 54,000 private jobs added in August—well short of the 75,000 expected—and the trade deficit ballooned to $78.3 billion in July as imports surged. Friday's bombshell nonfarm payrolls capped it off with a meager 22,000 jobs gained, far below the 75,000 forecast, plus downward revisions to prior months and unemployment ticking up to 4.3%. Wage growth held steady at 3.7% year-over-year, offering a silver lining amid the slowdown.

All in all, the week's data screamed "rate cuts ahead," boosting bets on a September Fed move while keeping recession fears at bay. The economy's still chugging along, but these weaker prints suggest the post-pandemic boom is fading into something more sustainable. This was good news for inflation watchers, though it kept traders on their toes with volatile swings.

Looking ahead to next week, our focus should shift to inflation gauges, with August's CPI dropping on Wednesday. Analysts expect a tame 2.6% headline rise year-over-year, potentially sealing the deal for Fed action if it undershoots. Thursday follows with the PPI for more wholesale price insights. That's the main lineup, setting up anticipation for the FOMC powwow the week after. As always, stick to your trading plan and respect your risk.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, Sept 8th

None

Tuesday, Sept 9th

Evening: GameStop & Oracle

Wednesday, Sept 10th

Morning: Chewy

Thursday, Sept 11th

Morning: Kroger

Evening: Adobe

Friday, Sept 12th

None

Market Events

Monday, Sept 8th

03:00 PM ET Consumer Credit (July)

Tuesday, Sept 9th

None

Wednesday, Sept 10th

08:30 AM ET PPI MoM & YoY (Aug)

10:30 AM ET Crude Oil Inventories

01:00 PM ET 10-Year Note Auction

Thursday, Sept 11th

08:15 AM ET ECB Interest Rate Decision (Sep)

08:30 AM ET CPI MoM & YoY (Aug)

08:30 AM ET Initial Jobless Claims

08:45 AM ET ECB Press Conference

01:00 PM ET 30-Year Bond Auction

Friday, Sept 12th

10:00 AM ET Consumer Sentiment (Sep)

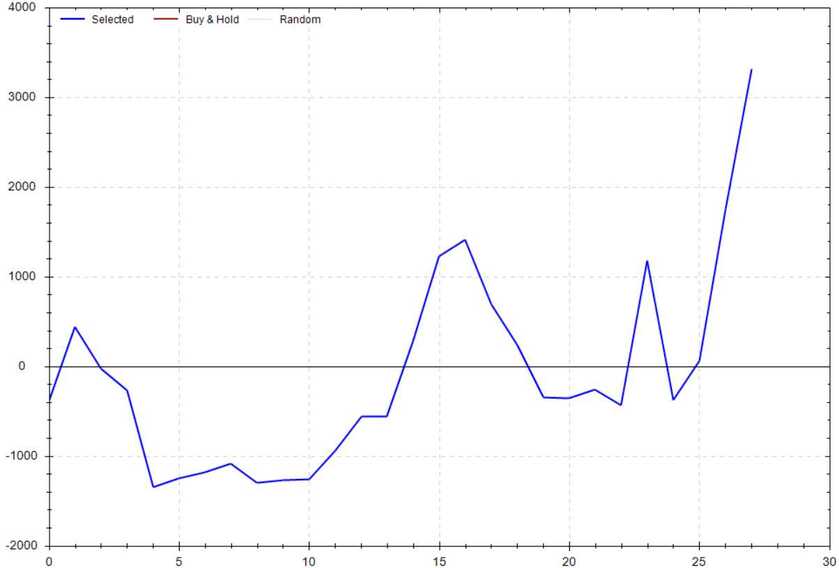

Seasonality Update

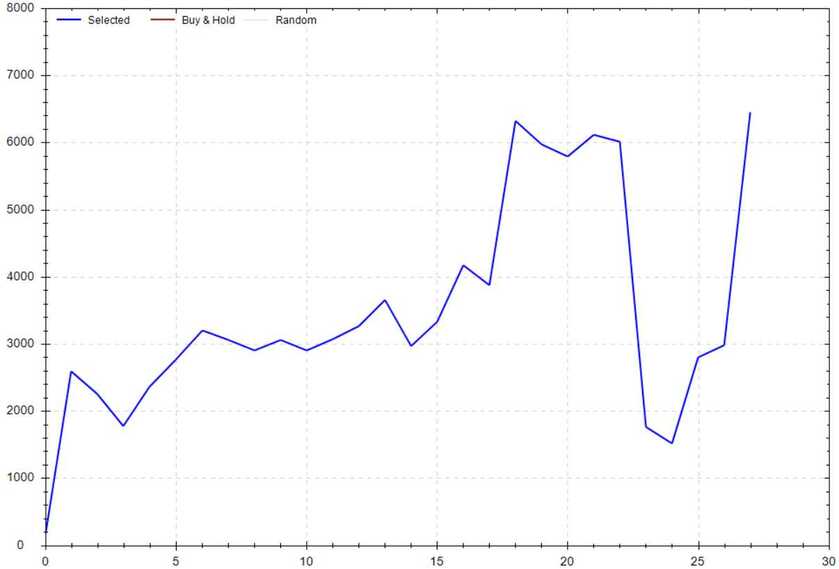

S&P 500 Seasonal Bias (Monday, Sept 8th)

- Bull Win Percentage: 57%

- Profit Factor: 1.87

- Bias: Leaning Bullish

Equity Curve -->

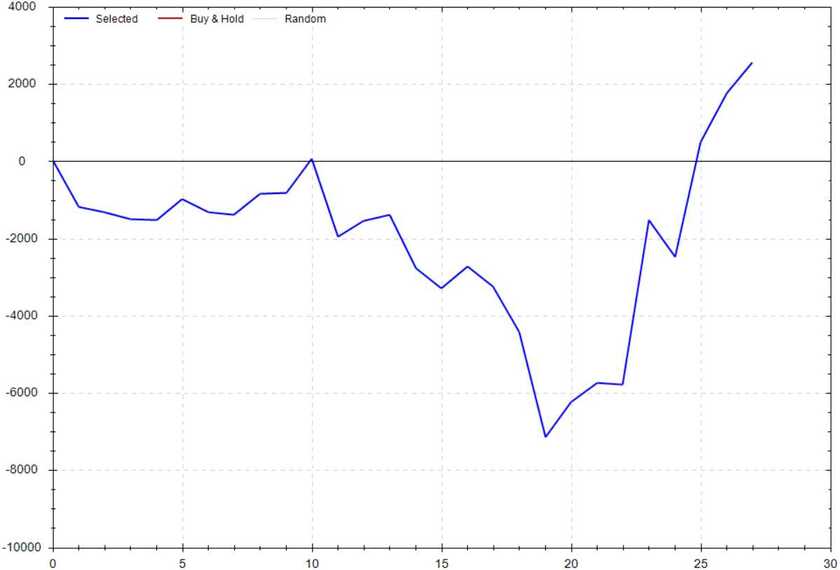

S&P 500 Seasonal Bias (Tuesday, Sept 9th)

- Bull Win Percentage: 50%

- Profit Factor: 1.23

- Bias: Neutral

Equity Curve -->

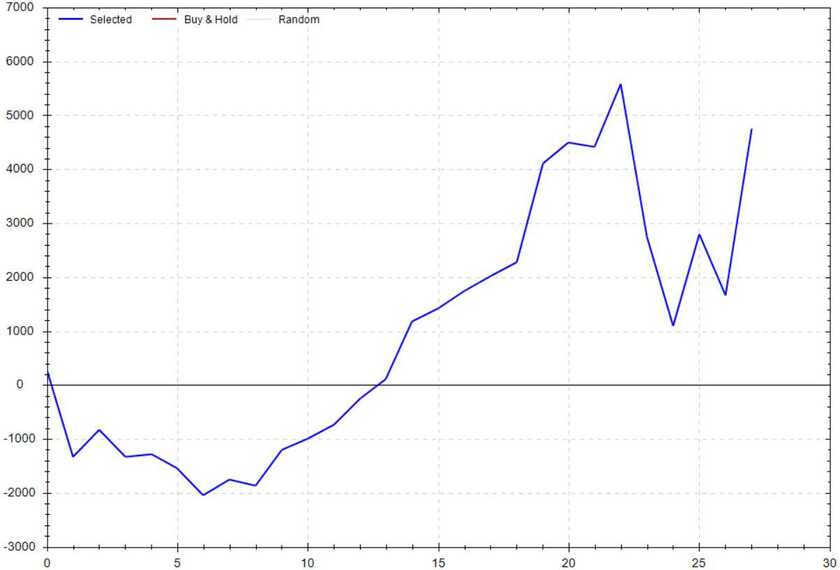

S&P 500 Seasonal Bias (Wednesday, Sept 10th)

- Bull Win Percentage: 68%

- Profit Factor: 1.55

- Bias: Bullish

Equity Curve -->

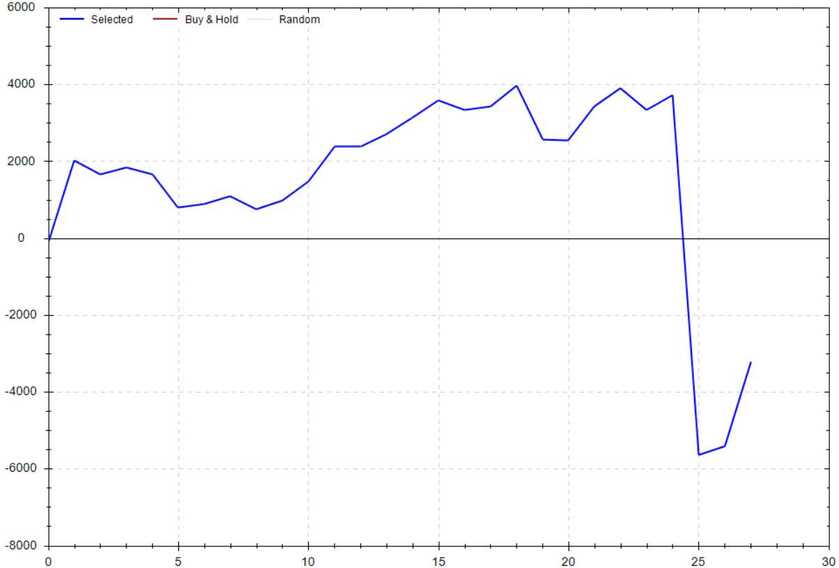

S&P 500 Seasonal Bias (Thursday, Sept 11th)

- Bull Win Percentage: 64%

- Profit Factor: 0.76

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Sept 12th)

- Bull Win Percentage: 57%

- Profit Factor: 1.56

- Bias: Leaning Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

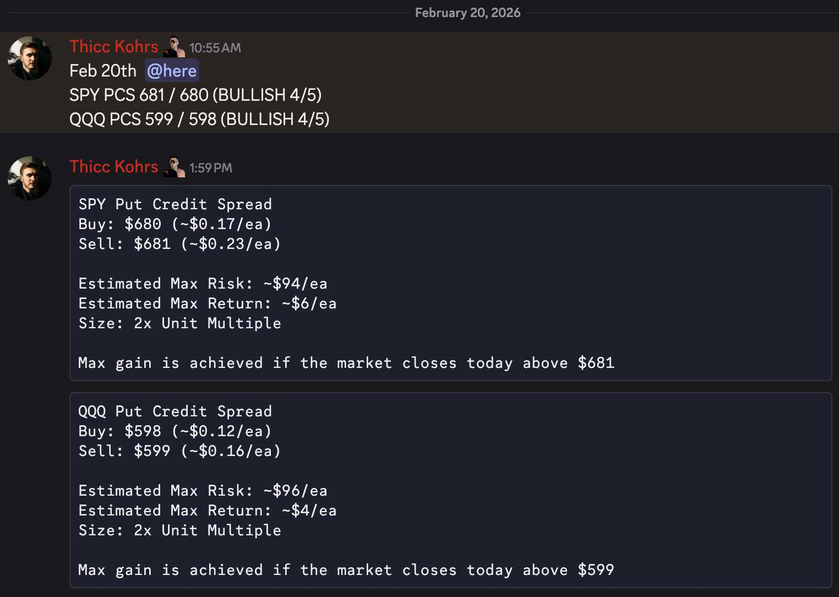

Options Strategy Update

The 0 DTE signal hit 8 for 8 times (16 for 16 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 15 Trades

September Record: 16/16 Units

Monday, Sept 1st

No Signal -- Market Closed

Tuesday, Sept 2nd

SPY Call Credit Spread (2x Multiple @ $641 / $642) 🟢

QQQ Call Credit Spread (2x Multiple @ $566 / $567) 🟢

Wednesday, Sept 3rd

SPY Put Credit Spread (2x Multiple @ $641 / $640) 🟢

QQQ Put Credit Spread (2x Multiple @ $567 / $566) 🟢

Thursday, Sept 4th

SPY Put Credit Spread (2x Multiple @ $643 / $642) 🟢

QQQ Put Credit Spread (2x Multiple @ $569 / $568) 🟢

Friday, Sept 5th

SPY Put Credit Spread (2x Multiple @ $642 / $641) 🟢

QQQ Put Credit Spread (2x Multiple @ $570 / $569) 🟢

Times I Got Chopped Up

196 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

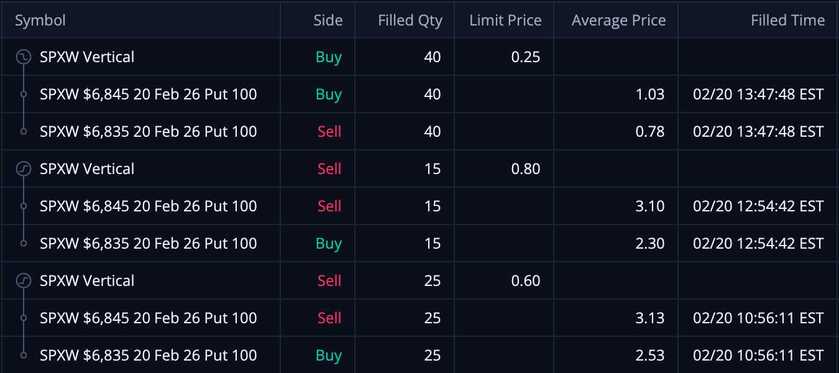

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

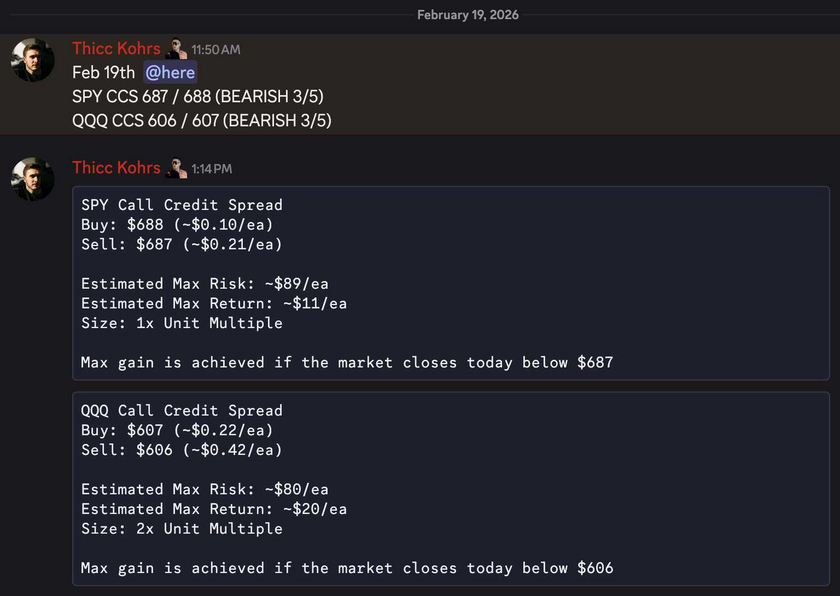

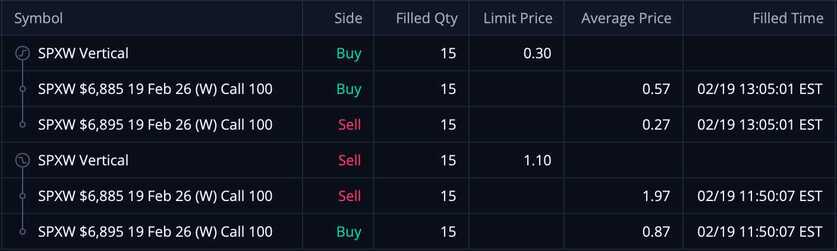

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

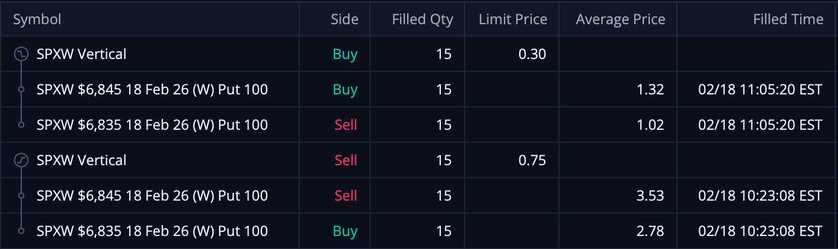

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!

These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!